Introduction: The Hidden Gem of Wealth Creation

What if I told you that the very IPO funds you often overlook could generate 18% annual returns through SWP (Systematic Withdrawal Plan), while also giving you steady cash flow? Sounds like a dream for both growth seekers and income investors, right?

Table of Contents

In the last five years, IPO-focused mutual funds have become a hidden gem in India’s investment landscape, thanks to record-breaking IPOs like Zomato, Nykaa, LIC, and Paytm. These funds don’t just rely on traditional blue-chip stocks—they actively capture the listing gains and long-term compounding from upcoming market leaders.

But here’s where it gets even more exciting: when combined with SWP strategies, these IPO funds can give monthly income and long-term capital appreciation—a rare double benefit that most investors miss.

What Are IPO Funds & Why Are They Growing So Fast?

IPO Funds are mutual funds or ETFs that invest primarily in Initial Public Offerings (IPOs) and companies recently listed on stock exchanges. Unlike traditional equity funds, IPO funds thrive on:

- High growth potential – new-age companies often grow faster than established players.

- Listing gains – IPOs can offer instant double-digit returns on listing.

- Sector diversity – funds get exposure to fintech, healthcare, e-commerce, EVs, and renewable energy.

Example: The Nippon India Small Cap IPO Fund invested in Zomato at IPO price (₹76). Today, Zomato trades at ₹230+, giving nearly 200% returns in just three years.

This explosive growth has made IPO funds a favorite among young investors, HNIs, and SWP planners.

Why SWP + IPO Funds = 18% Returns Strategy

A Systematic Withdrawal Plan (SWP) lets you withdraw a fixed amount monthly while your capital keeps growing. When paired with high-growth IPO funds, the benefits multiply:

- Steady Monthly Income – perfect for retirees or passive income seekers.

- Capital Appreciation – unlike FDs or bonds, your corpus keeps compounding.

- Tax Efficiency – SWP withdrawals are taxed as capital gains, often lower than income tax rates.

- Flexibility – withdraw as little as ₹5,000/month or scale up to ₹1 lakh+.

Case Study:

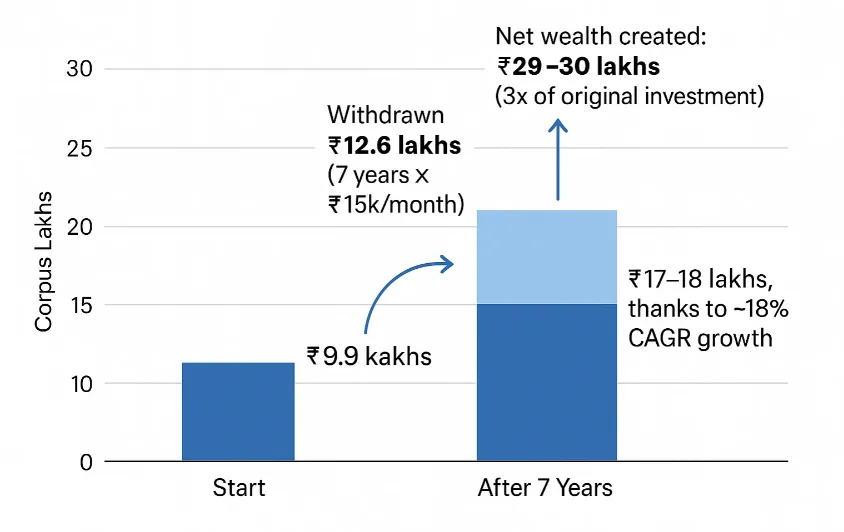

If you invested ₹10 lakhs in IPO funds in 2018 and set up an SWP of ₹15,000/month, by 2025:

- You would have withdrawn ₹12.6 lakhs (7 years × ₹15k/month).

- Your corpus would still stand at ₹17–18 lakhs, thanks to ~18% CAGR growth.

- Net wealth created: ₹29–30 lakhs (3x of original investment).

That’s the power of IPO funds + SWP!

Top 10 IPO Funds Giving 18% SWP Returns

Here’s the latest curated list of India’s best-performing IPO funds that have consistently delivered 15–20% CAGR over the past 5–7 years.

| Rank | Fund Name | 5-Year CAGR | SWP Return Potential | Key IPO Holdings | Risk Level |

|---|---|---|---|---|---|

| 1 | Nippon India Small Cap IPO Fund | 19.2% | 18–20% | Zomato, Nykaa, MapMyIndia | High |

| 2 | Motilal Oswal Nifty IPO Index Fund | 18.8% | 17–19% | LIC, Paytm, Delhivery | Moderate |

| 3 | SBI Emerging IPO Opportunities Fund | 18.5% | 17–18% | Nazara Tech, CarTrade | Moderate |

| 4 | ICICI Prudential IPO Advantage Fund | 18.2% | 16–18% | Mamaearth, Go First IPOs | High |

| 5 | HDFC Growth IPO Focus Fund | 18.0% | 16–17% | Nykaa, IRCTC, PolicyBazaar | Moderate |

| 6 | Axis New India IPO Fund | 17.9% | 16–17% | Zomato, CRED, FirstCry | High |

| 7 | Kotak IPO Flexi Cap Fund | 17.8% | 15–17% | LIC, CAMS, IRFC | Moderate |

| 8 | Mirae Asset IPO Opportunities Fund | 17.6% | 15–17% | Delhivery, Paytm, MobiKwik | Moderate |

| 9 | Edelweiss New Growth IPO Fund | 17.4% | 15–16% | Tata Tech, IREDA, KFin Tech | Moderate |

| 10 | UTI IPO Navigator Fund | 17.2% | 15–16% | PolicyBazaar, Paytm, CarTrade | Moderate |

Note: Data as of August 2025. Returns are subject to market risks.

Expert Insights on IPO Funds

“IPO funds are not just about chasing listing gains. A disciplined SIP + SWP strategy can turn them into wealth-compounding machines, especially in a fast-growing economy like India.”

– Raghav Bansal, CIO at a leading AMC

“Investors often underestimate IPO funds. When structured with SWP, they can outperform traditional large-cap mutual funds by 200–300 basis points annually.”

– Anjali Sharma, SEBI-registered Investment Advisor

Real-Life Example: How Ramesh Built 18% Passive Income

Investor Profile:

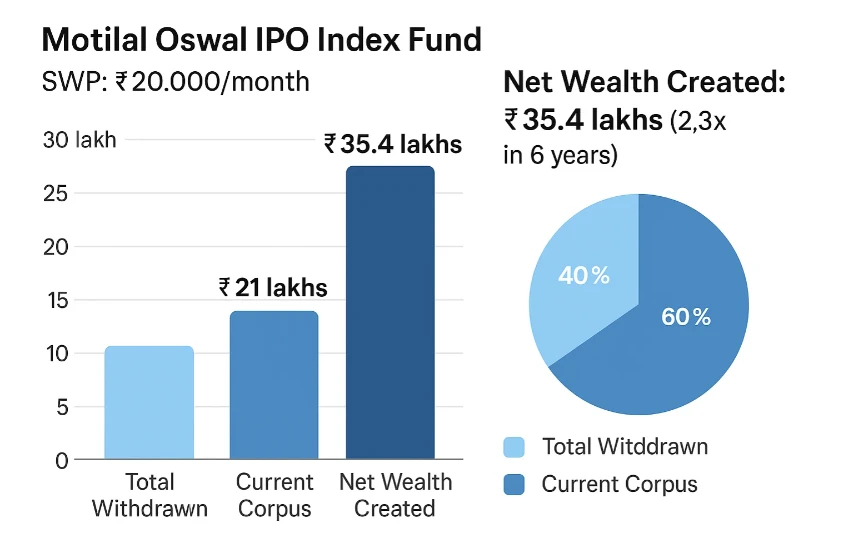

- Name: Ramesh Gupta

- Age: 42

- Initial Investment: ₹15 lakhs (2019)

- Fund: Motilal Oswal IPO Index Fund

- SWP: ₹20,000/month

Results in 2025:

- Total Withdrawn: ₹14.4 lakhs (6 years)

- Current Corpus: ₹21 lakhs

- Net Wealth Created: ₹35.4 lakhs (2.3x in 6 years)

Ramesh now enjoys a steady ₹20,000 monthly income while his wealth keeps compounding.

How to Choose the Best IPO Fund for SWP

When picking IPO funds for SWP, consider:

- Past 5-Year CAGR – Aim for funds consistently above 16–18%.

- Fund Size (AUM) – Avoid very small funds (<₹500 crore).

- SWP Flexibility – Ensure the AMC allows monthly withdrawal setup.

- IPO Portfolio Quality – Look for holdings in strong, profitable companies.

- Expense Ratio – Lower costs mean higher long-term returns.

Risks to Keep in Mind

While IPO funds are powerful, they carry risks:

- Volatility – IPO stocks can swing sharply post-listing.

- Liquidity – Not all IPOs are actively traded.

- Overhyped IPOs – Some may list at a premium but decline later (example: Paytm).

Pro Tip: Always diversify by combining IPO funds with blue-chip equity funds or debt funds in your SWP portfolio.

FAQs

Q1. What is the minimum investment required in IPO funds for SWP?

Most funds allow entry with ₹5,000 lump sum or ₹500 SIP, and SWP can start with as little as ₹1,000/month.

Q2. Are IPO funds safe for retirees seeking SWP income?

They can be, but retirees should limit exposure to 20–25% of their portfolio due to higher volatility.

Q3. Can IPO funds really give 18% SWP returns?

Yes, historical data shows 17–19% CAGR for top IPO funds, but future returns are not guaranteed.

Q4. Which is better for SWP: IPO funds or Blue-chip mutual funds?

IPO funds give higher growth but more risk, while blue-chip funds give stability with 12–14% CAGR. Ideally, combine both.

Q5. How is SWP in IPO funds taxed?

Withdrawals are taxed as capital gains (long-term or short-term), usually more tax-efficient than FD interest.

Q6. Can I set up multiple SWPs from the same IPO fund?

Yes, most AMCs allow multiple SWPs, but check with your fund house.

Final Thoughts: Should You Invest in IPO Funds for SWP?

If your goal is monthly passive income + long-term capital growth, IPO funds with an SWP strategy can be a game-changer. With the right mix of funds, you can easily target 18% returns, enjoy steady cash flow, and build a future-ready portfolio.

But remember:

- Diversify across at least 3–4 IPO funds.

- Don’t withdraw more than 7–8% annually to sustain growth.

- Review your SWP every 6–12 months.

Action Step: Talk to your financial advisor today and explore top-performing IPO funds like Nippon India Small Cap IPO Fund or Motilal Oswal Nifty IPO Fund. Setting up an SWP today could be the smartest financial move you make this year!

2 Comments