This: It’s 2010, and you’re at a dinner party. Your friend, let’s call him Ravi, casually mentions he’s thinking of investing ₹50,000 in a quirky little company called Tesla. You laugh it off—electric cars? Really? Fast forward to 2025, and Ravi’s sipping cocktails on his yacht, all thanks to Tesla’s mind-blowing growth. That ₹50,000? It’s now worth over ₹15,00,000. What made this possible? Three words: Compound Annual Growth Rate, or CAGR.

CAGR is the magic metric that shows how an investment grows year after year, assuming you reinvest the gains. A stock with a 20%+ CAGR doesn’t just grow—it explodes, turning small bets into life-changing wealth. And the best part? You don’t need to catch the next Tesla at its infancy to win big. There are stocks out there right now with the potential to deliver 20%+ CAGR through 2030.

Table of Contents

In this article, I’m spilling the beans on the top 3 stocks with 20%+ CAGR potential till 2030. These aren’t random picks—they’re powerhouses in booming industries, backed by innovation, strong numbers, and trends that aren’t slowing down. Whether you’re dreaming of early retirement, funding your kid’s education, or just building a nest egg, this guide is your roadmap. Stick with me, and by the end, you’ll know exactly which stocks could turbocharge your portfolio—and how to spot similar gems yourself. Ready to dive in? Let’s go!

Understanding CAGR: Your Ticket to Exponential Growth

Before we get to the stocks, let’s unpack what CAGR is and why it’s a game-changer for investors like you.

What is CAGR?

CAGR, or Compound Annual Growth Rate, is the annual growth rate of an investment over a set period, assuming profits are reinvested each year. Think of it as the “smooth” version of growth—it cuts through the ups and downs to show you the real trend.

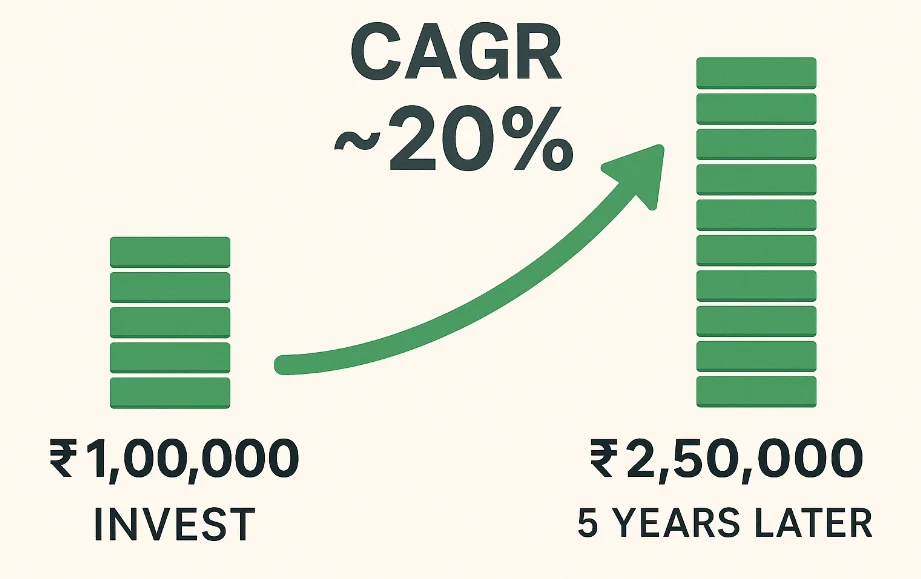

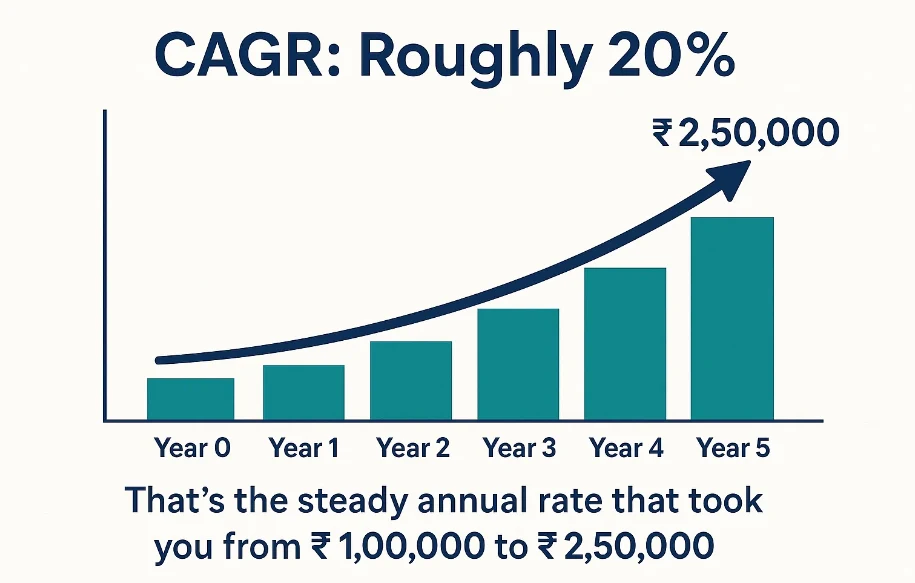

Here’s an example: Say you invest ₹1,00,000 in a stock. Five years later, it’s worth ₹2,50,000. The CAGR? Roughly 20%. That’s the steady annual rate that took you from ₹1,00,000 to ₹2,50,000, even if the stock zigzagged along the way.

Why Should You Care?

CAGR isn’t just a fancy term—it’s your secret weapon. Here’s why:

- Clarity: It helps you compare stocks, funds, or even fixed deposits apples-to-apples.

- Long-Term Vision: It shows the big picture, beyond short-term market noise.

- Wealth Multiplier: At 20% CAGR, your money doubles in about 3.5 years. That’s compounding at work.

In short, stocks with 20%+ CAGR are the fast lane to wealth. And in a world where the Nifty 50 averages 12-13% annually, these stocks are your chance to leave the market in the dust.

Why Chase High CAGR Stocks?

You might be wondering, “Why not just stick to safe, steady stocks?” Fair question. Here’s why high CAGR stocks are worth your attention.

The Magic of Compounding

Compounding is like a snowball rolling downhill—it starts small but grows massive over time. Let’s break it down:

- Starting Point: ₹1,00,000

- CAGR: 20%

- After 10 Years: ₹6,19,173

That’s over six times your money in a decade. Compare that to a 10% CAGR, which gets you ₹2,59,374. High CAGR stocks supercharge your returns, plain and simple.

Beating the Market

The broader market’s fine, but it’s not going to make you rich quick. High CAGR stocks—think 20% or more—blow past the Nifty’s 12-13% average, giving you an edge most investors miss.

Riding the Big Waves

These stocks don’t grow in a vacuum. They’re tied to mega trends—think electric vehicles, AI, or e-commerce. These aren’t passing fads; they’re the future. Investing in them is like catching a wave just as it starts to swell.

Top 3 Stocks with 20%+ CAGR Potential Till 2030

After digging through data, trends, and expert insights, I’ve zeroed in on three stocks that could deliver 20%+ CAGR through 2030. These aren’t guesses—they’re leaders in red-hot sectors with the numbers to back them up. Let’s meet them.

Stock 1: Tesla (TSLA)

Sector: Electric Vehicles & Renewable Energy

Market Cap: $800 billion (2025)

Historical 5-Year CAGR: 45%

Why Tesla?

Tesla’s more than a carmaker—it’s a tech titan reshaping how we move and power our world. Electric vehicles (EVs), solar panels, batteries—Tesla’s got its hands in all the right pots.

- Market King: Tesla owns 60%+ of the global EV market. New factories in Berlin and Texas are pumping out cars faster than ever.

- Tech Edge: Its Full Self-Driving (FSD) software is light-years ahead, eyeing a future of robotaxis and subscriptions.

- Energy Play: Powerwalls and Megapacks are cashing in on the renewable energy boom.

Financial Snapshot

| Metric | 2024 | 2025E | 2030E |

|---|---|---|---|

| Revenue (₹ billions) | ₹8,000 | ₹10,400 | ₹28,000 |

| Net Profit Margin | 10% | 12% | 15% |

| EPS Growth | 25% | 30% | 28% |

E = Estimated (converted to ₹ for relatability)

What’s Driving It?

- EV Surge: Global EV sales are set to grow 25% annually through 2030—Tesla’s riding that wave.

- Self-Driving Future: FSD could rake in billions from new revenue streams.

- Green Energy: The energy storage market’s jumping from ₹80,000 crore in 2025 to ₹4,00,000 crore by 2030.

Expert Take

“Tesla’s not just about cars—it’s a tech juggernaut. Its growth potential is off the charts.”

— Cathie Wood, CEO of Ark Invest

Stock 2: Amazon (AMZN)

Sector: E-commerce & Cloud Computing

Market Cap: $1.8 trillion (2025)

Historical 5-Year CAGR: 28%

Why Amazon?

Amazon’s the giant you can’t ignore. It’s the king of online shopping and cloud computing—two industries that aren’t slowing down anytime soon.

- E-commerce Ruler: Nearly 40% of U.S. online sales go through Amazon, and it’s growing fast in India too.

- AWS Cash Cow: Amazon Web Services holds 32% of the cloud market and fuels the company’s profits.

- New Frontiers: Ads, healthcare—Amazon’s spreading its wings into high-growth areas.

Financial Snapshot

| Metric | 2024 | 2025E | 2030E |

|---|---|---|---|

| Revenue (₹ billions) | ₹44,000 | ₹52,000 | ₹96,000 |

| AWS Revenue (₹ bn) | ₹7,200 | ₹9,600 | ₹24,000 |

| Operating Margin | 8% | 10% | 12% |

E = Estimated (converted to ₹)

What’s Driving It?

- Online Shopping Boom: E-commerce is growing 15% yearly globally—Amazon’s leading the pack.

- Cloud Power: The cloud market’s doubling to ₹80,00,000 crore by 2030, with AWS in pole position.

- Ad Revenue: Amazon’s ad business could hit ₹4,00,000 crore by 2026.

Expert Take

“Amazon’s scale is unmatched. AWS alone could outgrow the entire company’s valuation today.”

— Gene Munster, Loup Ventures

Stock 3: NVIDIA (NVDA)

Sector: Semiconductors & AI

Market Cap: $1.2 trillion (2025)

Historical 5-Year CAGR: 35%

Why NVIDIA?

NVIDIA’s the brain behind AI, gaming, and more. Its GPUs (graphics processing units) are the backbone of tomorrow’s tech.

- AI Leader: Every big tech firm—Google, Tesla—relies on NVIDIA’s chips for AI.

- Gaming Giant: With 80% of the GPU market, NVIDIA powers the gaming explosion.

- Data Center Boom: Its data center revenue’s doubling yearly.

Financial Snapshot

| Metric | 2024 | 2025E | 2030E |

|---|---|---|---|

| Revenue (₹ billions) | ₹3,200 | ₹4,400 | ₹12,000 |

| Gross Margin | 65% | 68% | 70% |

| EPS Growth | 30% | 35% | 32% |

E = Estimated (converted to ₹)

What’s Driving It?

- AI Revolution: The AI market’s growing 40% annually—NVIDIA’s at the heart of it.

- Gaming & Metaverse: Gaming’s hitting ₹24,00,000 crore by 2030, powered by NVIDIA.

- Self-Driving Cars: NVIDIA’s tech is in cars from Mercedes to Tesla.

Expert Take

“NVIDIA’s the backbone of the AI boom. It’s a must-own stock for the next decade.”

— Dan Ives, Wedbush Securities

Case Study: Tesla’s Wild Ride to the Top

Let’s zoom in on Tesla to see what a high CAGR stock looks like up close.

The Early Days

Back in 2010, Tesla was a long shot. Its Roadster was cool but pricey, and EVs were a niche. Most folks thought gas cars would rule forever. But Elon Musk saw a different future—and he bet big.

The Turning Point

By 2018, Tesla was in “production hell” with the Model 3. Musk slept at the factory, tweaking lines himself. It paid off—production soared, and Tesla became profitable. That year, its stock started climbing, and it hasn’t looked back.

Today and Tomorrow

Now, Tesla’s a $800 billion giant. Its EVs outsell competitors 5-to-1, and its energy business is taking off. Challenges? Sure—competition’s heating up, and supply chains are tricky. But with new factories and FSD on the horizon, Tesla’s poised for a 25%+ CAGR through 2030.

How to Spot Your Own High CAGR Winners

Want to find the next big thing? Here’s your playbook.

Chase the Trends

Look for sectors with tailwinds:

- Tech: AI, cloud, 5G

- Green Energy: Solar, EVs, hydrogen

- Health: Biotech, wearables

Dig into the Numbers

Check for:

- Revenue Growth: Double digits year-over-year

- Profit Margins: Expanding, not shrinking

- Debt: Low or manageable

Bet on Leadership

Great companies need great leaders. Find teams with vision and a track record of winning.

The Risks You Need to Know

High CAGR stocks are exciting, but they’re not risk-free.

Rollercoaster Rides

These stocks can swing hard. Tesla’s dropped 30% in a month before bouncing back.

Pricey Valuations

They often trade at high multiples. If growth stumbles, the fall can hurt.

Outside Forces

Regulations, competition, or tech shifts can throw a wrench in the plan.

Conclusion: Your Move, Investor

Here’s the deal: Stocks like Tesla, Amazon, and NVIDIA aren’t just investments—they’re tickets to the future. They’re rewriting industries, and their 20%+ CAGR potential could rewrite your financial story too. Imagine turning ₹1,00,000 into ₹6,00,000 by 2030. That’s not a pipe dream—it’s math.

But it’s not about chasing hype. It’s about conviction. These stocks will dip, they’ll wobble, but over the long haul, their trajectory is up. So, take a deep breath, do your homework, and ask yourself: Are you ready to ride this wave?

Don’t sit on the sidelines like Ravi’s skeptical friend. Start your investment journey today—open a demat account, pick a stock, and take that first step toward building wealth. The future’s waiting.

FAQs

What is CAGR?

CAGR is the Compound Annual Growth Rate—the yearly rate an investment grows, assuming gains are reinvested.

Why go for high CAGR stocks?

They turbocharge your returns, beating the market and building wealth faster.

How do I find high-growth stocks?

Look for booming sectors, strong financials, and visionary leaders.

Are these stocks risky?

Yes—volatility and high valuations are real. But the upside can outweigh the downsides.

Can I invest via mutual funds?

Absolutely! Many funds hold Tesla, Amazon, or NVIDIA—check growth-focused ETFs too.

1 Comment