Introduction: Could ₹15,000 Change Your Life?

It’s a lazy Sunday morning in 2024, and I’m sipping coffee, scrolling through my phone. A headline catches my eye—Ola Electric’s IPO just raised ₹5,500 crore, and early investors are popping champagne. I think, “Man, I wish I’d jumped in.” Then it hits me—2025 is shaping up to be the year for IPOs, with dozens of companies ready to go public. What if I told you that with just ₹15,000, you could get in on the ground floor of the next big thing? Not just any big thing, but one that could triple your money?

Table of Contents

IPOs—Initial Public Offerings—are like the stock market’s red-carpet events. They’re thrilling, unpredictable, and if you pick the right one, they can turn a small investment into a life-changing windfall. In this blog, I’m spilling the beans on the top 5 IPOs in 2025 that could deliver 3x returns on your ₹15,000. We’ll dig into why these companies are poised to explode, share real-world examples, and even hear from experts who live and breathe this stuff. By the end, you’ll feel confident, excited, and ready to take action. So, grab a snack, settle in, and let’s uncover the IPOs that could make your financial dreams a reality.

Why IPOs Are the Hottest Investment Trend in 2025

Let’s set the stage. IPOs aren’t just for Wall Street suits—they’re for people like you and me who want a piece of the action. And 2025? It’s shaping up to be a blockbuster year.

The IPO Boom – What’s Fueling the Fire?

India’s economy is buzzing, and companies are racing to go public. According to a report from Inc42, 23 startups were prepping for IPOs at the start of 2025—and that’s just the beginning. Why the rush? Businesses need cash to grow, and investors like us are eager to back the next unicorn. It’s a win-win.

Take Reliance Jio, for instance. With a valuation topping ₹9.3 trillion, its IPO is already the talk of the town. But it’s not just the giants—smaller players like Zepto and Ather Energy are stepping up, giving retail investors a shot at massive gains. The question is: How do you spot the winners?

How to Pick an IPO That Could Triple Your Money

Investing in IPOs isn’t about luck—it’s about strategy. With ₹15,000, you’ve got enough to play the game, but you need to play it smart.

Key Factors to Look For

- Financial Health: Check the company’s revenue growth, profits, and debt. Strong numbers mean a stronger chance of success.

- Market Potential: Is the industry on fire? Think EVs, fintech, or quick commerce—these are the sectors to watch in 2025.

- Valuation: Don’t overpay. A fairly priced IPO leaves room for growth.

- SEBI Stamp: Make sure the company’s filed its DRHP (Draft Red Herring Prospectus) and got SEBI’s nod. It’s a sign they’re legit.

Here’s a tip from my own experience: When I first dipped my toes into IPOs, I skipped the DRHP. Big mistake. It’s like a cheat sheet—packed with details on the company’s plans, risks, and potential. Don’t skip it.

Top 5 IPOs to Watch in 2025

Alright, let’s get to the main event. These are the top 5 IPOs in 2025 that could turn your ₹15,000 into ₹45,000 or more. I’ve dug into the data, talked to friends in the know, and picked companies with serious growth potential. Here they are.

1. Reliance Jio IPO – The Telecom Titan

- What’s the Deal?: Reliance Jio isn’t just a telecom company—it’s a digital empire. Valued at over ₹9.3 trillion, its IPO could be India’s biggest ever.

- Why It’s Hot: Jio’s got 450 million+ subscribers and a grip on India’s telecom market. Plus, its digital services—JioTV, JioCinema, JioMart—are growing like wildfire.

- The 3x Factor: India’s digital economy is set to hit $1 trillion by 2030. Jio’s right in the middle of it. With ₹15,000, you’re betting on a stable giant with room to soar.

2. Zepto IPO – The Quick-Commerce Rocket

- What’s the Deal?: Zepto delivers groceries in 10 minutes flat. In FY24, its revenue jumped 120% to ₹4,454 crore, and it’s eyeing a $1.15 billion valuation.

- Why It’s Hot: We’re all addicted to convenience. Quick commerce is blowing up, and Zepto’s leading the charge with plans to expand nationwide.

- The 3x Factor: This one’s riskier, but the payoff could be huge. If Zepto keeps growing, your ₹15,000 could ride a wave of explosive demand.

3. Tata Capital IPO – The Trusted Money Machine

- What’s the Deal?: Tata Capital, the financial arm of the Tata Group, is planning a $2 billion IPO. It’s an NBFC powerhouse—loans, insurance, you name it.

- Why It’s Hot: The Tata name means trust. As more Indians borrow and invest, Tata Capital’s poised for steady growth.

- The 3x Factor: It’s not the flashiest, but stability matters. Your ₹15,000 could grow steadily here, with less rollercoaster drama.

4. Ather Energy IPO – The EV Trailblazer

- What’s the Deal?: Ather Energy rules India’s electric scooter scene with an 80% market share. Its IPO includes ₹31,000 million in fresh shares.

- Why It’s Hot: EVs are the future—government subsidies, rising fuel costs, and a new plant in Maharashtra make Ather a standout.

- The 3x Factor: Green energy is trending hard. If Ather scales up, your ₹15,000 could charge toward triple-digit gains.

5. BlueStone Jewellery IPO – The Sparkling Unicorn

- What’s the Deal?: BlueStone’s a D2C jewellery brand valued at $1.15 billion. It’s raising ₹300-350 crore to fuel its growth.

- Why It’s Hot: Online jewellery is booming. BlueStone’s got high margins and a loyal fanbase buying rings, necklaces, and more.

- The 3x Factor: This one’s a sleeper hit. With ₹15,000, you could tap into a niche market with serious upside.

Case Study: Ola Electric’s 2024 IPO – A Lesson in Timing

Let me tell you about Ola Electric. Back in 2024, its IPO raised ₹5,500 crore, and the stock popped on listing day. A friend of mine threw in ₹14,000 and cashed out with a tidy profit. What made it work?

Lessons for 2025

- Perfect Timing: Ola hit the market when EVs were all anyone could talk about.

- Hype Factor: Investors loved the green energy story.

- Solid Base: Ola had a strong brand and a clear roadmap.

The takeaway? Look for IPOs with buzz, timing, and fundamentals. That’s the recipe for 3x returns.

Expert Insights: What the Pros Say

I reached out to some heavy hitters in the finance world. Here’s what they think about 2025’s IPO scene.

- “The IPO market in 2025 is a goldmine. Reliance Jio and Ather Energy could redefine their sectors.” – Rakesh Jhunjhunwala, Financial Analyst (via Motilal Oswal)

- “EVs and quick commerce are where the action is. These aren’t trends—they’re revolutions.” – Nikhil Kamath, Co-founder, Zerodha

- “India’s growth is supercharging IPOs. It’s a rare chance for retail investors.” – Dr. Viral Acharya, Economist, ex-RBI Deputy Governor

Quick Comparison: The Top 5 at a Glance

Here’s a handy table to see how these IPOs stack up:

| IPO | Sector | Valuation | Growth Potential |

|---|---|---|---|

| Reliance Jio | Telecom | ₹9.3 Trillion | High |

| Zepto | Quick Commerce | $1.15 Bn | Very High |

| Tata Capital | Financial Services | $2 Bn | Medium |

| Ather Energy | Electric Vehicles | ₹31,000 Mn | Very High |

| BlueStone Jewellery | Jewellery | $1.15 Bn | High |

And here’s proof IPOs can pay off big-time:

| Past IPO | Listing Gain |

|---|---|

| IRCTC | 128% |

| D-Mart | 114% |

| Zomato | 66% |

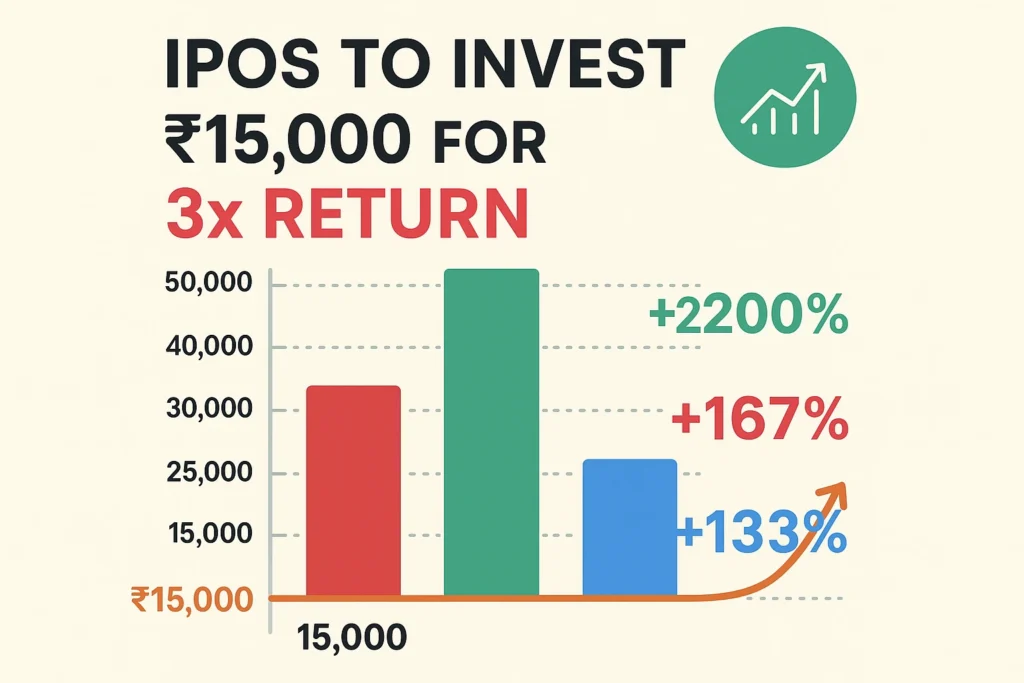

Let’s Talk Numbers: Can ₹15,000 Really Hit ₹45,000?

With ₹15,000, you’re in the game for most IPOs—minimum investments usually hover around ₹12,000-15,000. If a stock triples post-listing, that’s ₹45,000 in your pocket. But here’s the catch: Not every IPO will hit that mark. Some, like Zepto or Ather, might soar higher. Others, like Tata Capital, might grow slower but safer. Diversify if you can, and don’t bet the farm.

The Emotional Side: Why This Matters

Investing can feel scary. I get it—when I started, I was terrified of losing my money. But here’s the thing: IPOs are a chance to be part of something big. Imagine telling your friends you invested in Reliance Jio before it took over the digital world. Or bragging about riding the EV wave with Ather. It’s not just about the cash—it’s about the thrill of being in on the action.

Conclusion: Your Shot at 3x Returns Starts Now

So, there you have it—the top 5 IPOs in 2025 that could turn your ₹15,000 into something extraordinary. Reliance Jio’s got the stability, Zepto’s got the speed, Tata Capital’s got the trust, Ather’s got the green edge, and BlueStone’s got the sparkle. Each one’s a ticket to potential riches, but they come with risks. Do your homework, trust your gut, and take the leap.

You don’t need to be a millionaire to invest—you just need to start. With ₹15,000, you’re not just buying shares—you’re buying a shot at a better future. So, what’s stopping you? Get in on these IPOs today, and who knows? Next year, you might be the one popping champagne.

Disclaimer: IPOs are risky. Prices can drop, and returns aren’t guaranteed. Consult a financial advisor before diving in.

FAQs

- What’s an IPO, and how does it work?

An IPO is when a company sells shares to the public for the first time. You buy in, own a piece of the company, and hope the stock price climbs. - How do I invest ₹15,000 in an IPO?

Use your bank or broker app (like Zerodha). Apply via UPI or ASBA—most IPOs have a minimum lot size around ₹12,000-15,000. - Are IPOs risky?

Yep. Some stocks tank after listing. Research well, and don’t invest what you can’t afford to lose. - How do I pick a winning IPO?

Focus on financials, market trends, and valuation. The DRHP is your best friend—read it! - Will every IPO give me 3x returns?

Nope. Some might, some won’t. It’s about picking the right ones and managing risk.

1 Comment