Are you searching for a smart, reliable way to generate monthly income from your investments? Imagine having a steady cash flow to cover your living expenses, fund your dreams, or simply enjoy financial freedom—without the hassle of selling off your entire portfolio. If this sounds appealing, a Systematic Withdrawal Plan (SWP) might just be your golden ticket. SWPs and unveil the top 5 SWP plans for 2025 that can help you earn consistent monthly income.

What is a Systematic Withdrawal Plan (SWP)?

Before we jump into the best plans, let’s break down what an SWP actually is. A Systematic Withdrawal Plan (SWP) is a feature offered by mutual funds that lets you withdraw a fixed amount of money at regular intervals—usually monthly, quarterly, or annually—from your investment. Think of it as a reverse Systematic Investment Plan (SIP): instead of putting money in, you’re taking money out in a disciplined, predictable way.

Here’s how it works in simple terms:

- You invest a lump sum in a mutual fund of your choice.

- You decide how much you want to withdraw (e.g., ₹10,000) and how often (e.g., monthly).

- The mutual fund redeems a portion of your units each time to pay you that amount.

- The rest of your investment stays in the fund, potentially growing over time.

For example, if you invest ₹5,00,000 and set an SWP for ₹20,000 per month, the fund sells enough units each month to give you that ₹20,000. Meanwhile, your remaining investment keeps working for you.

“SWP is like setting up a paycheck from your investments—it’s predictable, flexible, and lets your money keep growing.” – Financial Expert, Groww.in

SWPs are especially popular among retirees, investors seeking passive income, and anyone who wants to avoid the stress of timing the market. But why should you consider it? Let’s explore the benefits.

Why SWP is a Game-Changer for Monthly Income

SWPs aren’t just a fancy financial tool—they’re a practical solution for generating steady income. Here’s why they’re worth your attention:

- Consistent Cash Flow: You get a regular income stream, whether it’s monthly, quarterly, or annually—your choice!

- Customizable Withdrawals: Adjust the amount and frequency to suit your lifestyle or financial needs.

- Tax Advantages: Only the capital gains portion of your withdrawal is taxed, often making it more efficient than traditional income sources like fixed deposits.

- Growth Potential: Unlike fully liquidating your investment, the remaining units stay invested and can grow with the market.

- No Market Timing Stress: You don’t need to worry about selling at the wrong time—SWP handles it systematically.

But it’s not all sunshine and rainbows. There are risks to consider:

- Market Volatility: If the market dips, your fund’s value could drop, and frequent withdrawals might eat into your capital.

- Sustainability: Withdraw too much too fast, and you could deplete your investment over time.

That’s why picking the right SWP plan is critical. Let’s move on to the main event: the top 5 SWP plans for 2025.

Top 5 SWP Plans for Monthly Income in 2025

After digging into mutual fund performance, features, and suitability for regular withdrawals, we’ve handpicked the top 5 SWP plans for 2025. These funds cater to different risk levels and income goals, ensuring there’s something for everyone. Let’s dive into each one.

1. Quant Flexi Cap Fund

- Fund House: Quant Mutual Fund

- Type: Flexi Cap (Equity)

- Minimum Investment: ₹5,000

- Withdrawal Frequency: Monthly, Quarterly, Annually

- Expected Returns: 12-15% p.a. (based on historical data)

- Risk Level: High

- Why It Stands Out: This fund invests across large, mid, and small-cap stocks, offering a dynamic mix of growth and diversification. It’s perfect for investors with a higher risk appetite who want substantial returns alongside their monthly income.

“Quant Flexi Cap’s flexibility and strong performance make it a top pick for SWP in 2025.” – Angel One

If you’re someone who can stomach market ups and downs, this fund’s growth potential could keep your SWP running for years.

2. ICICI Prudential Equity & Debt Fund

- Fund House: ICICI Prudential Mutual Fund

- Type: Hybrid (Aggressive)

- Minimum Investment: ₹5,000

- Withdrawal Frequency: Monthly, Quarterly

- Expected Returns: 10-12% p.a.

- Risk Level: Moderate

- Why It Stands Out: This hybrid fund blends equity (for growth) and debt (for stability), striking a balance that suits conservative investors who still want decent returns.

“The equity-debt mix in ICICI Prudential’s fund ensures steady income with controlled risk.” – ClearTax

It’s an excellent middle-ground option if you want income without exposing yourself fully to equity market swings.

3. Mirae Asset Large Cap Fund

- Fund House: Mirae Asset Mutual Fund

- Type: Large Cap (Equity)

- Minimum Investment: ₹5,000

- Withdrawal Frequency: Monthly, Quarterly, Annually

- Expected Returns: 10-12% p.a.

- Risk Level: Moderate

- Why It Stands Out: Focused on large-cap companies, this fund offers stability and consistent returns—ideal for SWP investors who prioritize reliability over high risk.

“Mirae Asset Large Cap delivers dependable performance, making it a solid SWP choice.” – SBI MF

If you’re after peace of mind with your monthly income, this fund’s a strong contender.

4. HDFC Balanced Advantage Fund

- Fund House: HDFC Mutual Fund

- Type: Hybrid (Balanced Advantage)

- Minimum Investment: ₹5,000

- Withdrawal Frequency: Monthly, Quarterly

- Expected Returns: 9-11% p.a.

- Risk Level: Low to Moderate

- Why It Stands Out: This fund dynamically shifts between equity and debt based on market conditions, offering a safety net with growth potential.

“HDFC Balanced Advantage adapts to the market, making it a smart SWP option for cautious investors.” – Groww.in

It’s perfect if you want a hands-off approach with balanced risk and reward.

5. SBI Magnum Medium Duration Fund

- Fund House: SBI Mutual Fund

- Type: Debt (Medium Duration)

- Minimum Investment: ₹5,000

- Withdrawal Frequency: Monthly, Quarterly

- Expected Returns: 7-8% p.a.

- Risk Level: Low

- Why It Stands Out: As a debt fund, it prioritizes safety and stability, making it ideal for risk-averse investors or those nearing retirement.

“SBI Magnum Medium Duration is a low-risk haven for SWP investors seeking steady income.” – PolicyBazaar

If capital preservation is your top priority, this fund’s got you covered.

Comparison Table: Top 5 SWP Plans at a Glance

To help you pick the best plan, here’s a handy table comparing the key features of these SWP options:

| Fund Name | Type | Min. Investment | Withdrawal Frequency | Expected Returns | Risk Level |

|---|---|---|---|---|---|

| Quant Flexi Cap Fund | Equity (Flexi) | ₹5,000 | Monthly, Quarterly, Annually | 12-15% p.a. | High |

| ICICI Prudential Equity & Debt | Hybrid (Aggressive) | ₹5,000 | Monthly, Quarterly | 10-12% p.a. | Moderate |

| Mirae Asset Large Cap Fund | Equity (Large Cap) | ₹5,000 | Monthly, Quarterly, Annually | 10-12% p.a. | Moderate |

| HDFC Balanced Advantage Fund | Hybrid (Balanced) | ₹5,000 | Monthly, Quarterly | 9-11% p.a. | Low to Moderate |

| SBI Magnum Medium Duration Fund | Debt (Medium Duration) | ₹5,000 | Monthly, Quarterly | 7-8% p.a. | Low |

This table makes it easy to see which fund aligns with your risk tolerance and income goals. High returns come with higher risk (Quant Flexi Cap), while lower risk offers modest gains (SBI Magnum).

How to Choose the Perfect SWP Plan for You

With five stellar options, how do you decide? The best SWP plan depends on your unique situation. Here are the key factors to weigh:

- Risk Tolerance:

- High risk? Go for equity funds like Quant Flexi Cap or Mirae Asset Large Cap.

- Moderate risk? Hybrid funds like ICICI Prudential or HDFC Balanced Advantage are great.

- Low risk? Stick with debt funds like SBI Magnum Medium Duration.

- Income Needs: Calculate how much monthly income you need. Higher withdrawals may require funds with better growth potential.

- Investment Horizon: Planning for 10+ years? Equity or hybrid funds can sustain growth. Short-term needs? Debt funds are safer.

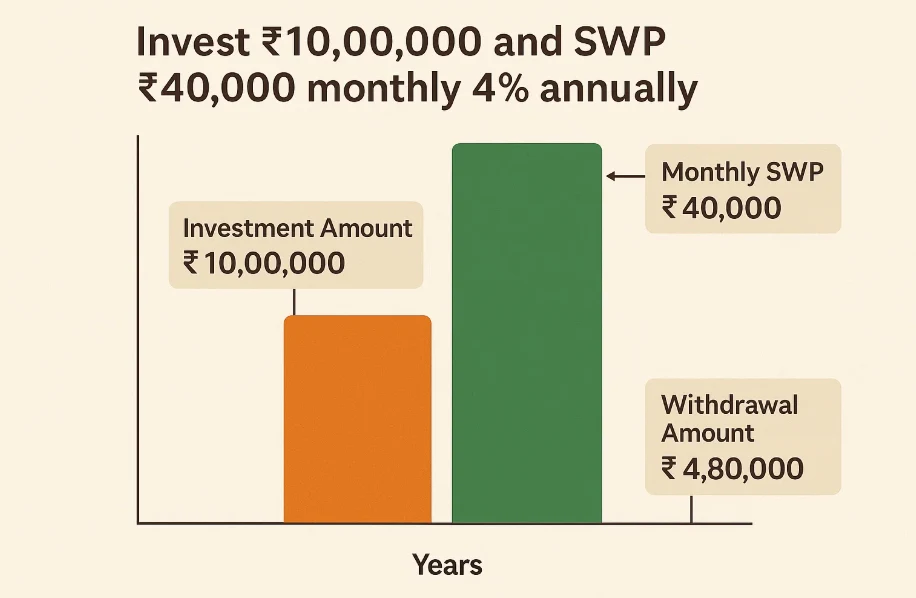

- Withdrawal Rate: Aim for a sustainable rate (4-5% of your corpus annually) to avoid running out of money too soon.

“Match your SWP to your risk profile and timeline—it’s the key to long-term success.” – Financial Advisor, ClearTax

For example, if you invest ₹10,00,000 and want ₹40,000 monthly (4% annually), a fund with 10% returns (like Mirae Asset Large Cap) could keep your capital growing while meeting your needs.

Step-by-Step: How to Start Your SWP

Ready to set up your SWP? It’s easier than you think. Follow these steps:

- Pick Your Fund: Choose one of the top 5 based on your goals (e.g., HDFC Balanced Advantage for balance).

- Invest a Lump Sum: Deposit your initial amount (e.g., ₹5,00,000) into the fund.

- Set Your SWP: Decide your withdrawal amount (e.g., ₹20,000) and frequency (e.g., monthly).

- Submit the Request: Use your mutual fund platform (like Groww or SBI MF) or contact your advisor.

- Monitor and Adjust: Check your fund’s performance periodically and tweak your withdrawals if needed.

Most platforms offer online SWP setups, so you can get started in minutes!

Understanding SWP Tax Implications

Taxes can eat into your returns, so let’s clarify how SWP withdrawals are taxed:

- Equity Funds (e.g., Quant Flexi Cap, Mirae Asset Large Cap):

- Short-Term Capital Gains (STCG) (<12 months): 20%

- Long-Term Capital Gains (LTCG) (>12 months): 12.5% on gains over ₹1 lakh

- Debt Funds (e.g., SBI Magnum Medium Duration):

- STCG (<36 months): Taxed as per your income slab

- LTCG (>36 months): 20% with indexation

- Hybrid Funds: Taxed based on their equity-debt split (e.g., ICICI Prudential follows equity rules if >65% equity).

“SWP’s tax efficiency is a big win—only the gains get taxed, not the whole withdrawal.” – Tax Expert, PolicyBazaar

For example, if you withdraw ₹10,000 from an equity fund and ₹2,000 is capital gains, only that ₹2,000 is taxable.

Pros and Cons of SWP: Is It Right for You?

Let’s weigh the good and the bad:

Pros

- Predictable income stream

- Flexibility to adjust withdrawals

- Potential for capital growth

- Tax-efficient compared to fixed income options

Cons

- Market risk can reduce your corpus

- High withdrawals may deplete funds faster

- Requires careful fund selection

SWP shines for retirees or those needing regular income, but it’s less ideal if your focus is aggressive wealth-building.

Real-Life SWP Scenarios

To bring this to life, here are two examples:

- Retiree Rajesh:

- Invests ₹20,00,000 in HDFC Balanced Advantage Fund (9-11% returns).

- Sets SWP for ₹80,000 monthly (4% annually).

- Enjoys steady income while his capital grows over 10+ years.

- Working Professional Priya:

- Invests ₹10,00,000 in Quant Flexi Cap Fund (12-15% returns).

- Withdraws ₹40,000 monthly to fund her child’s education.

- Benefits from high growth potential for long-term sustainability.

Frequently Asked Questions (FAQs)

1. What’s the difference between SWP and SIP?

- SIP: You invest a fixed amount regularly to build wealth.

- SWP: You withdraw a fixed amount regularly from your investment.

2. Who should use SWP?

- Retirees, passive income seekers, or anyone needing regular cash flow. It’s less suited for young investors focused on growth.

3. Can I change or stop my SWP?

- Yes! Most funds let you modify or pause your SWP anytime, penalty-free.

4. What if the market crashes during my SWP?

- Your fund value may drop, and withdrawals could shrink your corpus faster. A lower withdrawal rate or pausing during downturns can help.

5. How much can I safely withdraw?

- Stick to 4-5% of your corpus annually (e.g., ₹3,333 monthly from ₹10,00,000) to balance income and longevity.

Conclusion: Your Path to Monthly Income Starts Here

A Systematic Withdrawal Plan (SWP) is a powerful way to turn your investments into a reliable monthly income stream. Whether you’re drawn to the high-growth potential of Quant Flexi Cap, the balanced approach of HDFC Balanced Advantage, or the safety of SBI Magnum Medium Duration, there’s a plan here for you. The top 5 SWP plans for 2025 offer flexibility, tax efficiency, and the chance to keep your money growing—all tailored to different risk levels and goals.

Before you dive in, assess your needs, risk tolerance, and withdrawal rate. A quick chat with a financial advisor can seal the deal. Ready to take control of your finances? Explore these funds today and start your SWP journey!

Call to Action: Unsure where to begin? Visit platforms like Groww, ClearTax, or SBI MF to set up your SWP—or consult an advisor to find your perfect fit. Your financial freedom awaits!

Leave a Reply