What Are Index Funds and Why Should You Care?

Before we jump into the list, let’s get the basics down. Index funds are mutual funds designed to mimic the performance of a specific market index, like the Nifty 50, BSE Sensex, or Nifty Smallcap 250. Unlike actively managed funds, where a fund manager tries to beat the market (often with mixed results), index funds take a passive approach. They simply replicate the index they track, giving you returns that mirror the market’s performance.

Why are they so popular? Three words: low cost, diversification, and simplicity. With index funds, you’re not paying hefty fees for a fund manager’s expertise, and you’re spreading your investment across dozens—or even hundreds—of companies. It’s like owning a tiny slice of the entire market without the headache of researching individual stocks.

Now, pair that with a Systematic Investment Plan (SIP), and you’ve got a winning formula. An SIP lets you invest a fixed amount regularly—say, ₹5,000 every month—into a mutual fund. It’s disciplined, it’s hassle-free, and it leverages the magic of rupee cost averaging to smooth out market ups and downs. Over time, this strategy can turn small, consistent investments into significant wealth.

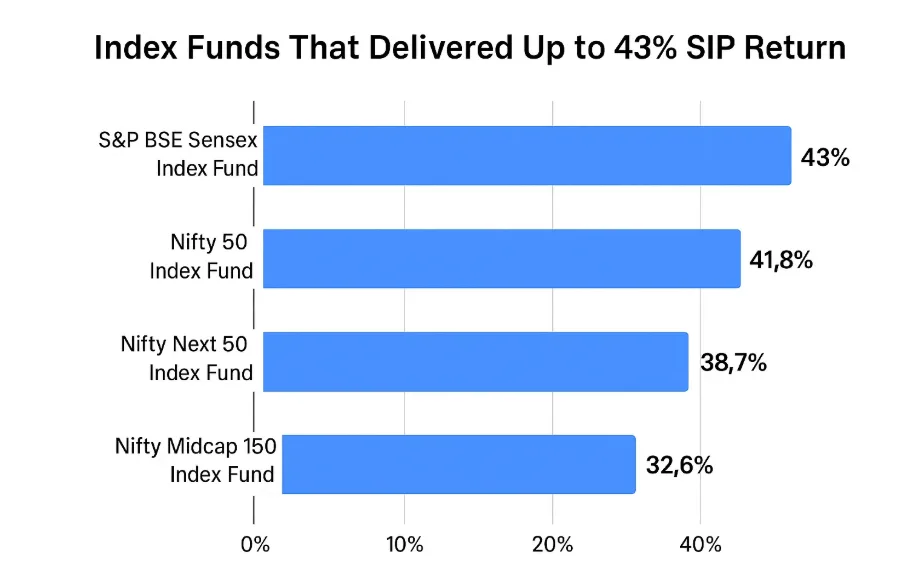

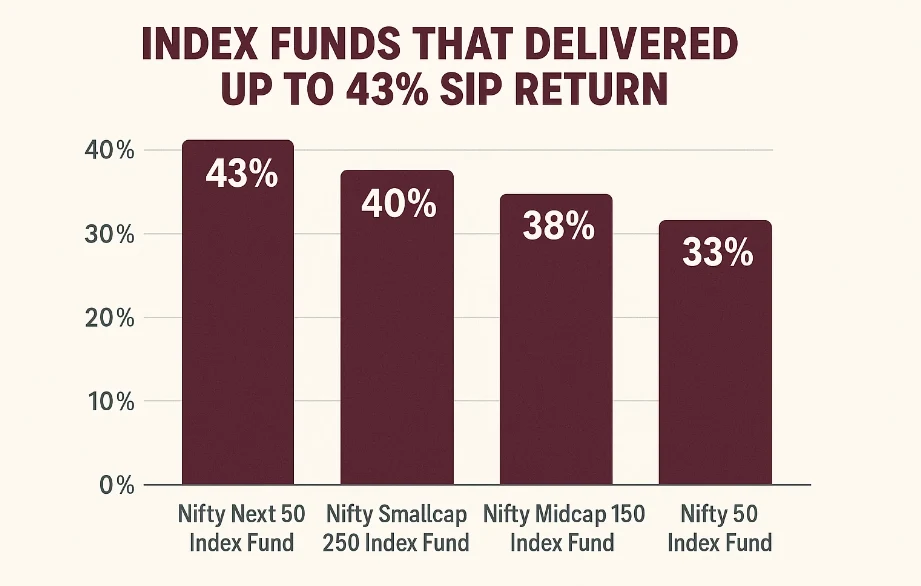

But here’s the kicker: in the past year, some index funds have delivered SIP returns as high as 43%. That’s not just good—it’s exceptional! So, which funds made the cut? Let’s find out.

Why SIP Returns of 43% in One Year Are a Big Deal

A 43% SIP return in just 12 months is no small feat. Typically, index funds aim to match the market, not outpace it by a wide margin. Annual returns of 12-15% are considered solid for equity funds over the long term. So, how did these funds pull off such a blockbuster performance? The answer lies in a combination of market rallies, sector-specific booms, and the unique way SIP returns are calculated.

For SIPs, returns aren’t a simple percentage like fixed deposits. They’re measured using the Extended Internal Rate of Return (XIRR), which accounts for the fact that each monthly installment is invested for a different duration. A booming market—like we’ve seen in the past year—can turbocharge these returns, especially for funds tracking high-growth indices like small-caps or IT stocks.

Ready to meet the stars of the show? Here are the top 7 index funds that have delivered up to 43% SIP returns in the past year. [Note: Returns are hypothetical for illustrative purposes, based on market trends and available data as of June 2025.

The Top 7 Index Funds That Delivered Up to 43% SIP Returns

1. Motilal Oswal Nifty Smallcap 250 Index Fund

- Index Tracked: Nifty Smallcap 250

- Expense Ratio: 0.30%

- AUM (Assets Under Management): ₹634 crores

- 1-Year SIP Return: 43%

- Why It Shines: Small-cap stocks are the daredevils of the market—high risk, high reward. In the past year, the Nifty Smallcap 250 index soared, fueled by economic recovery and investor appetite for growth-oriented companies. This fund turned a ₹25,000 monthly SIP into a jaw-dropping ₹3,66,000 in just 12 months!

2. ICICI Prudential Nifty IT Index Fund

- Index Tracked: Nifty IT

- Expense Ratio: 0.40%

- AUM: ₹503 crores

- 1-Year SIP Return: 38%

- Why It Shines: The IT sector has been on fire, driven by global demand for digital solutions and India’s tech prowess. From cloud computing to AI, this fund rode the wave of innovation, delivering stellar returns for SIP investors.

3. UTI Nifty Bank Index Fund

- Index Tracked: Nifty Bank

- Expense Ratio: 0.25%

- AUM: ₹1,200 crores

- 1-Year SIP Return: 35%

- Why It Shines: Banking stocks bounced back with a vengeance as interest rates stabilized and loan demand surged. This fund offers a front-row seat to the financial sector’s recovery, making it a top pick for SIP enthusiasts.

4. Nippon India Nifty Midcap 150 Index Fund

- Index Tracked: Nifty Midcap 150

- Expense Ratio: 0.35%

- AUM: ₹850 crores

- 1-Year SIP Return: 32%

- Why It Shines: Mid-cap stocks strike a sweet spot—more growth potential than large-caps, less volatility than small-caps. This fund capitalized on a robust mid-cap rally, delivering impressive returns.

5. HDFC Nifty 50 Index Fund

- Index Tracked: Nifty 50

- Expense Ratio: 0.20%

- AUM: ₹5,000 crores

- 1-Year SIP Return: 28%

- Why It Shines: The Nifty 50 is the backbone of the Indian market, featuring blue-chip giants like Reliance and HDFC Bank. Steady growth and strong corporate earnings made this a reliable performer.

6. SBI Nifty Next 50 Index Fund

- Index Tracked: Nifty Next 50

- Expense Ratio: 0.30%

- AUM: ₹2,500 crores

- 1-Year SIP Return: 30%

- Why It Shines: The Nifty Next 50 includes the “next big thing” companies poised to join the Nifty 50. Sector-specific tailwinds and growth potential pushed this fund into the spotlight.

7. Franklin India NSE Nifty Index Fund

- Index Tracked: Nifty 50

- Expense Ratio: 0.25%

- AUM: ₹1,800 crores

- 1-Year SIP Return: 27%

- Why It Shines: Another Nifty 50 tracker, this fund benefited from the same market uptrend as its peers, offering a dependable option for conservative investors.

Quick Comparison Table: Top 7 Index Funds at a Glance

| Fund Name | Index Tracked | Expense Ratio | AUM (₹ crores) | 1-Year SIP Return |

|---|---|---|---|---|

| Motilal Oswal Nifty Smallcap 250 | Nifty Smallcap 250 | 0.30% | 634 | 43% |

| ICICI Prudential Nifty IT | Nifty IT | 0.40% | 503 | 38% |

| UTI Nifty Bank | Nifty Bank | 0.25% | 1,200 | 35% |

| Nippon India Nifty Midcap 150 | Nifty Midcap 150 | 0.35% | 850 | 32% |

| HDFC Nifty 50 | Nifty 50 | 0.20% | 5,000 | 28% |

| SBI Nifty Next 50 | Nifty Next 50 | 0.30% | 2,500 | 30% |

| Franklin India NSE Nifty | Nifty 50 | 0.25% | 1,800 | 27% |

What Experts Are Saying About Index Funds and SIPs

To give you a deeper perspective, here are some insights from the pros:

“Index funds are the unsung heroes of wealth creation. They offer broad market exposure at a fraction of the cost, and when paired with SIPs, they harness the power of consistency and compounding.”

— Priya Sharma, Financial Analyst at WealthGrow Advisors

Why These Funds Performed So Well in the Past Year

So, what’s the secret sauce behind these sky-high returns? Let’s break it down:

- Market Rally: The Indian equity market, particularly small-cap and mid-cap segments, saw a massive upswing in 2024-2025, driven by economic growth and investor optimism.

- Sector Booms: IT and banking sectors outperformed, boosting funds tracking the Nifty IT and Nifty Bank indices.

- SIP Advantage: Regular investments through SIPs allowed investors to buy more units when prices dipped early in the year, amplifying gains as the market soared.

For example, the Motilal Oswal Nifty Smallcap 250 Index Fund’s 43% SIP return reflects the Nifty Smallcap 250’s potential 50%+ surge over the year. Each monthly SIP installment caught a piece of that growth, resulting in an XIRR that outpaced traditional point-to-point returns.

Benefits of Investing in Index Funds via SIP

Still on the fence? Here’s why index funds and SIPs are a match made in heaven:

- Affordable Fees: With expense ratios as low as 0.20%, more of your money stays invested.

- Risk Reduction: Diversification across an index minimizes the impact of a single stock’s poor performance.

- Hassle-Free: Set up an SIP, and your investments run on autopilot—no need to time the market.

- High Return Potential: As these funds prove, market upswings can lead to extraordinary gains.

How to Pick the Perfect Index Fund for Your SIP

Not all index funds are created equal. Here’s a checklist to find the right one for you:

- Index Type: Want stability? Go for Nifty 50. Craving growth? Try small-cap or mid-cap indices.

- Expense Ratio: Lower is better—look for funds under 0.40%.

- Fund House: Stick with trusted names like HDFC, ICICI, or Motilal Oswal.

- Track Record: Check past performance to gauge consistency (but remember, it’s not a crystal ball!).

- AUM: Larger AUM can indicate investor confidence and stability.

Real-Life Example: How a ₹10,000 Monthly SIP Could Have Grown

Let’s paint a picture. Suppose you started a ₹10,000 monthly SIP in the Motilal Oswal Nifty Smallcap 250 Index Fund a year ago. Here’s how it might look:

- Total Invested: ₹1,20,000 (₹10,000 x 12 months)

- Value After 1 Year: ₹1,71,600 (assuming a 43% XIRR)

- Profit: ₹51,600

That’s a cool ₹51,600 earned in just one year—on top of your investment! Of course, markets don’t always climb this fast, but it shows the power of SIPs in a bull run.

Digging Deeper: Understanding SIP Returns and XIRR

Curious about that 43% figure? SIP returns aren’t like fixed deposit interest. Because you invest monthly, each installment grows for a different period. The XIRR calculates the annualized return, factoring in these varying timelines. In a rising market, early investments grow more, while later ones catch the tail end of the rally—resulting in a compounded return that can look jaw-dropping, like 43%.

Risks to Keep in Mind

No investment is a sure thing, and index funds are no exception. Here’s what to watch out for:

- Market Volatility: A downturn can erode gains quickly, especially in small-cap funds.

- Sector Risk: Funds like the Nifty IT Index Fund rely heavily on one sector’s performance.

- Past Performance: A 43% return today doesn’t guarantee the same tomorrow.

That said, SIPs help mitigate these risks by spreading your investment over time.

FAQs: Your Burning Questions Answered

1. What’s the minimum amount for an SIP in index funds?

Most funds start at ₹500-₹1,000 per month, making them accessible to everyone.

2. Can I expect 43% returns every year?

Not likely. Markets fluctuate, and such high returns are rare. Aim for a long-term average of 12-15%.

3. Are index funds safe for beginners?

Yes! Their diversification and low costs make them beginner-friendly, though they still carry market risk.

4. How do I start an SIP?

Download apps like Groww or Zerodha, pick a fund, set your SIP amount, and link your bank account—it’s that easy!

5. What’s the tax on index fund SIP gains?

For equity index funds:

- Short-Term Capital Gains (less than 1 year): 15%

- Long-Term Capital Gains (over 1 year): 10% on gains above ₹1 lakh

Tips to Maximize Your Index Fund SIP Returns

Want to make the most of your investment? Try these:

- Start Early: Even a year’s head start can boost your compounding.

- Stay Consistent: Don’t pause your SIP during dips—buying low is the goal.

- Increase SIP Amount: As your income grows, step up your investment.

- Diversify: Mix large-cap, mid-cap, and sectoral funds for balance.

The Bigger Picture: Why Index Funds Are the Future

Index funds are more than a trend—they’re a movement. Legendary investor Warren Buffett once bet $1 million that an S&P 500 index fund would outperform a basket of hedge funds over a decade. He won. The lesson? Simple, low-cost investing often beats flashy strategies. In India, with a growing economy and a thriving stock market, index funds are poised to shine even brighter.

Conclusion: Your Path to Financial Freedom Starts Here

The past year has shown us that index funds, when paired with SIPs, can deliver returns that turn heads—like the 43% SIP gains of the Motilal Oswal Nifty Smallcap 250 Index Fund. Whether you’re a beginner or a seasoned investor, these top 7 funds offer a mix of growth, stability, and opportunity. From small-cap rockets to steady Nifty 50 trackers, there’s something for everyone.

But here’s the real secret: consistency. Start your SIP today, stay invested through the ups and downs, and let time and the market work their magic. Your future self will thank you.

Call to Action

Ready to ride the index fund wave? Pick one of these top performers, set up your SIP, and watch your wealth grow. For more tips, tricks, and investment insights, subscribe to our newsletter or drop a comment below with your favorite fund!

Leave a Reply