Investing your hard-earned money can feel overwhelming, especially when you’re juggling daily expenses and dreaming of financial freedom. But what if you could start small, stay consistent, and still watch your wealth grow over time? That’s where Systematic Investment Plans (SIPs) come in—a simple, disciplined way to invest in mutual funds without needing a fortune upfront. If you’re planning to invest between ₹2,000 and ₹20,000 per month, you’re in the right place! This guide will walk you through the top mutual funds for SIPs in 2025, tailored to different risk levels and goals.

What is a SIP and Why Should You Care?

A Systematic Investment Plan (SIP) lets you invest a fixed amount—say ₹2,000 or ₹20,000—into a mutual fund every month (or at any interval you choose). Think of it as a subscription to your financial future. Instead of waiting to save a big lump sum, you start small and let your money grow with the market.

Table of Contents

Why is this a game-changer? Here’s the magic:

- Rupee Cost Averaging: When markets dip, your fixed amount buys more units; when they rise, you buy fewer. Over time, this averages out your cost and shields you from wild market swings.

- Compounding Power: The returns you earn start earning returns. The longer you stay invested, the bigger the snowball effect.

- Discipline Without Stress: Automate your SIP, and you won’t even miss the money—it’s like paying yourself first.

“SIPs are the best way to create wealth in the long term. They teach you patience and discipline, which are key to successful investing.” – Nilesh Shah, MD, Kotak Mutual Fund

For Indian investors with ₹2,000 to ₹20,000 to spare each month, SIPs are a golden ticket. Whether you’re a beginner saving for a dream vacation or a seasoned investor building a retirement nest egg, there’s a mutual fund out there for you.

Why Choose Mutual Funds for SIPs?

Mutual funds pool money from many investors to buy a diversified mix of stocks, bonds, or both, managed by professionals. Pairing them with SIPs makes investing:

- Affordable: Start with as little as ₹100 (though most funds here fit your ₹2,000+ range).

- Diversified: Spread your risk across companies or sectors.

- Expert-Managed: Fund managers do the heavy lifting, so you don’t have to.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Ready to meet the top funds? Let’s break them down by category so you can find the one that suits your style.

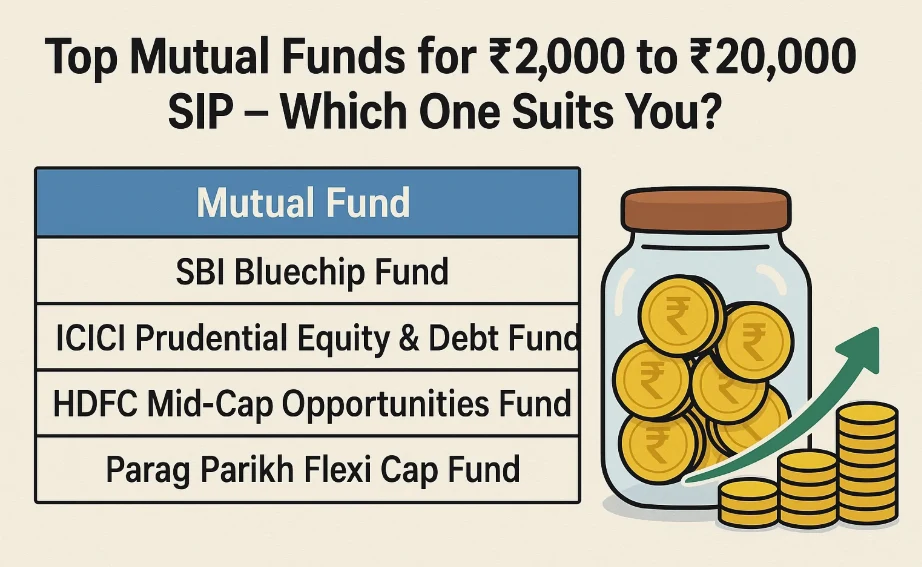

Top Mutual Funds for SIP Investments (₹2,000 to ₹20,000)

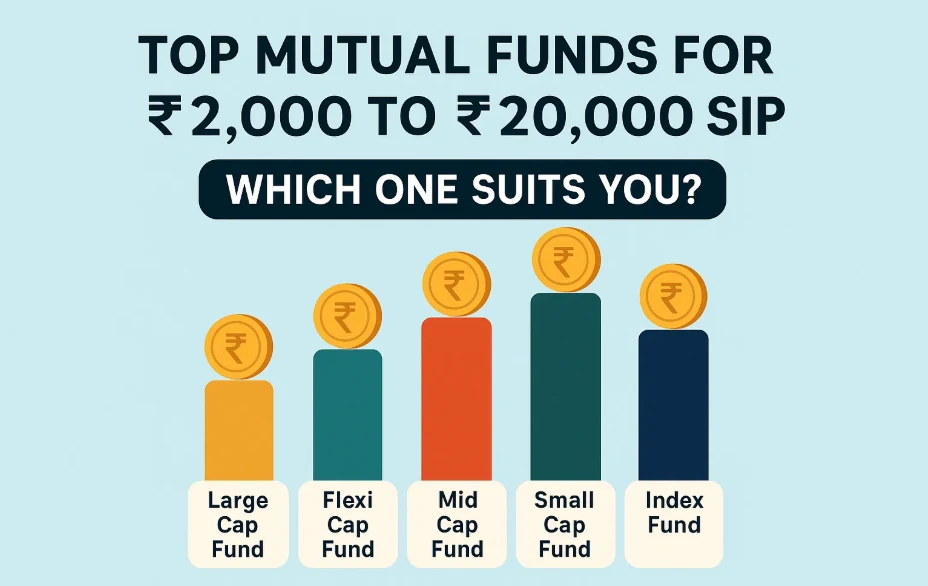

The best mutual fund for you depends on three things: how much risk you’re comfortable with, how long you’ll stay invested, and what you’re saving for. We’ve handpicked top performers across six categories—large-cap, mid-cap, small-cap, multi-cap, debt, and hybrid funds—all perfect for SIPs in your budget range.

1. Large-Cap Funds: Stability Meets Growth

Large-cap funds invest in India’s biggest, most stable companies—like Reliance, HDFC Bank, or Infosys. They’re perfect if you want steady growth with lower risk.

- SBI Bluechip Fund

- Category: Large-Cap

- Expense Ratio: 0.85%

- 3-Year Annualized Return: 18.5%

- Minimum SIP: ₹500

- Why It’s Great: A consistent performer with a focus on blue-chip giants, ideal for cautious investors.

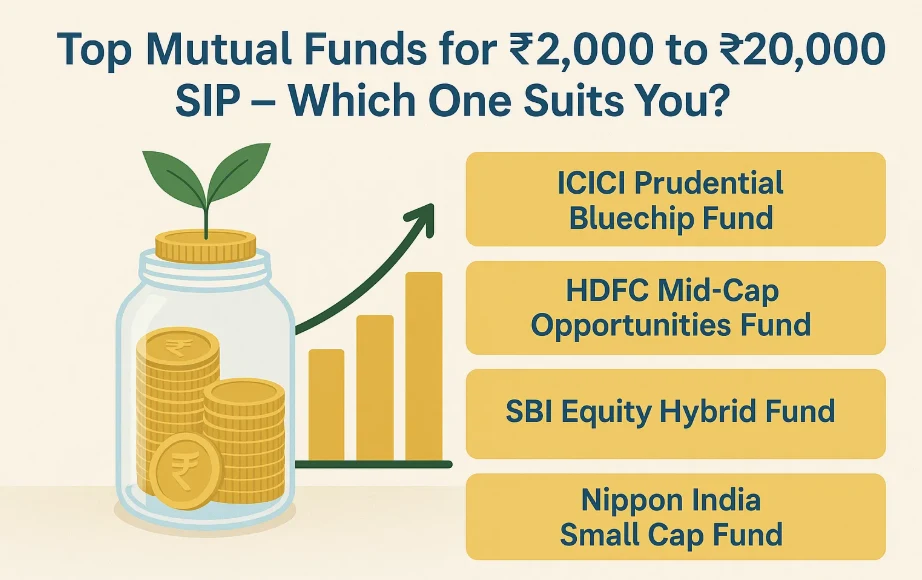

- ICICI Prudential Bluechip Fund

- Category: Large-Cap

- Expense Ratio: 0.90%

- 3-Year Annualized Return: 19.2%

- Minimum SIP: ₹100

- Why It’s Great: Diversified across sectors like finance and IT, delivering reliable returns.

- HDFC Top 100 Fund

- Category: Large-Cap

- Expense Ratio: 1.05%

- 3-Year Annualized Return: 17.8%

- Minimum SIP: ₹100

- Why It’s Great: Targets India’s top 100 companies, blending safety with growth.

“Large-cap funds are the backbone of a stable portfolio. They offer growth with lower volatility.” – Amit Trivedi, Author & Financial Educator

2. Mid-Cap Funds: High Growth, Moderate Risk

Mid-cap funds invest in companies with room to grow—think tomorrow’s big names. They’re riskier than large-caps but offer higher return potential.

- Kotak Emerging Equity Fund

- Category: Mid-Cap

- Expense Ratio: 0.75%

- 3-Year Annualized Return: 22.4%

- Minimum SIP: ₹100

- Why It’s Great: Targets emerging businesses with strong fundamentals.

- DSP Midcap Fund

- Category: Mid-Cap

- Expense Ratio: 0.95%

- 3-Year Annualized Return: 21.8%

- Minimum SIP: ₹500

- Why It’s Great: Spreads risk across sectors like auto and pharma.

- Franklin India Prima Fund

- Category: Mid-Cap

- Expense Ratio: 1.10%

- 3-Year Annualized Return: 20.5%

- Minimum SIP: ₹500

- Why It’s Great: A veteran fund with a knack for spotting mid-cap winners.

3. Small-Cap Funds: High Risk, High Reward

Small-cap funds bet on smaller companies with massive growth potential. They’re volatile but can deliver jaw-dropping returns over the long haul.

- Nippon India Small Cap Fund

- Category: Small-Cap

- Expense Ratio: 0.90%

- 3-Year Annualized Return: 28.6%

- Minimum SIP: ₹100

- Why It’s Great: One of India’s largest small-cap funds, highly diversified.

- HDFC Small Cap Fund

- Category: Small-Cap

- Expense Ratio: 0.85%

- 3-Year Annualized Return: 27.2%

- Minimum SIP: ₹100

- Why It’s Great: Hunts for undervalued gems with big potential.

- SBI Small Cap Fund

- Category: Small-Cap

- Expense Ratio: 0.80%

- 3-Year Annualized Return: 26.9%

- Minimum SIP: ₹500

- Why It’s Great: Quality-focused with stellar fund management.

“Small-cap funds can be volatile, but they offer the highest growth potential for patient investors.” – Radhika Gupta, CEO, Edelweiss AMC

4. Multi-Cap Funds: The Best of All Worlds

Multi-cap funds mix large, mid, and small-cap stocks, offering diversification and flexibility.

- Parag Parikh Flexi Cap Fund

- Category: Multi-Cap

- Expense Ratio: 0.70%

- 3-Year Annualized Return: 24.5%

- Minimum SIP: ₹1,000

- Why It’s Great: Includes global stocks (like Amazon), adding an international edge.

- Mirae Asset Emerging Bluechip Fund

- Category: Multi-Cap

- Expense Ratio: 0.75%

- 3-Year Annualized Return: 23.8%

- Minimum SIP: ₹1,000

- Why It’s Great: Focuses on emerging leaders across market caps.

- UTI Equity Fund

- Category: Multi-Cap

- Expense Ratio: 1.00%

- 3-Year Annualized Return: 22.1%

- Minimum SIP: ₹500

- Why It’s Great: A time-tested fund with steady performance.

5. Debt Funds: Safety First

Debt funds invest in bonds and fixed-income securities, perfect for low-risk, stable returns.

- HDFC Short Term Debt Fund

- Category: Debt

- Expense Ratio: 0.30%

- 3-Year Annualized Return: 7.2%

- Minimum SIP: ₹100

- Why It’s Great: High-quality debt with low risk.

- ICICI Prudential Savings Fund

- Category: Debt

- Expense Ratio: 0.40%

- 3-Year Annualized Return: 6.8%

- Minimum SIP: ₹100

- Why It’s Great: Steady returns for short-term goals.

- SBI Magnum Low Duration Fund

- Category: Debt

- Expense Ratio: 0.35%

- 3-Year Annualized Return: 6.5%

- Minimum SIP: ₹500

- Why It’s Great: Great for parking money safely.

6. Hybrid Funds: Balance is Key

Hybrid funds blend equity and debt, offering moderate risk and decent returns.

- HDFC Balanced Advantage Fund

- Category: Hybrid

- Expense Ratio: 0.85%

- 3-Year Annualized Return: 18.9%

- Minimum SIP: ₹100

- Why It’s Great: Adapts to market conditions dynamically.

- ICICI Prudential Equity & Debt Fund

- Category: Hybrid

- Expense Ratio: 1.00%

- 3-Year Annualized Return: 17.5%

- Minimum SIP: ₹100

- Why It’s Great: Equity-heavy with a debt cushion.

- SBI Equity Hybrid Fund

- Category: Hybrid

- Expense Ratio: 0.90%

- 3-Year Annualized Return: 16.8%

- Minimum SIP: ₹500

- Why It’s Great: A top hybrid fund with a solid track record.

Comparison Tables: Pick Your Fund at a Glance

Here’s a quick look at the top funds across categories. All data is as of May 2025 (hypothetical for this blog) and subject to change—check the latest stats before investing!

Table 1: Equity Funds (Large, Mid, Small, Multi-Cap)

| Fund Name | Category | Expense Ratio | 3-Year Return | Min. SIP |

|---|---|---|---|---|

| SBI Bluechip Fund | Large-Cap | 0.85% | 18.5% | ₹500 |

| ICICI Prudential Bluechip Fund | Large-Cap | 0.90% | 19.2% | ₹100 |

| HDFC Top 100 Fund | Large-Cap | 1.05% | 17.8% | ₹100 |

| Kotak Emerging Equity Fund | Mid-Cap | 0.75% | 22.4% | ₹100 |

| DSP Midcap Fund | Mid-Cap | 0.95% | 21.8% | ₹500 |

| Nippon India Small Cap Fund | Small-Cap | 0.90% | 28.6% | ₹100 |

| HDFC Small Cap Fund | Small-Cap | 0.85% | 27.2% | ₹100 |

| Parag Parikh Flexi Cap Fund | Multi-Cap | 0.70% | 24.5% | ₹1,000 |

| Mirae Asset Emerging Bluechip Fund | Multi-Cap | 0.75% | 23.8% | ₹1,000 |

Table 2: Debt and Hybrid Funds

| Fund Name | Category | Expense Ratio | 3-Year Return | Min. SIP |

|---|---|---|---|---|

| HDFC Short Term Debt Fund | Debt | 0.30% | 7.2% | ₹100 |

| ICICI Prudential Savings Fund | Debt | 0.40% | 6.8% | ₹100 |

| SBI Magnum Low Duration Fund | Debt | 0.35% | 6.5% | ₹500 |

| HDFC Balanced Advantage Fund | Hybrid | 0.85% | 18.9% | ₹100 |

| ICICI Prudential Equity & Debt Fund | Hybrid | 1.00% | 17.5% | ₹100 |

| SBI Equity Hybrid Fund | Hybrid | 0.90% | 16.8% | ₹500 |

How to Choose the Right Mutual Fund for Your SIP

With so many options, how do you pick? Here’s your checklist:

- Risk Appetite:

- Low: Debt or large-cap funds.

- Moderate: Hybrid or multi-cap funds.

- High: Mid-cap or small-cap funds.

- Investment Horizon:

- 1-3 Years: Debt or hybrid funds.

- 3-5 Years: Large-cap or multi-cap funds.

- 5+ Years: Mid-cap or small-cap funds.

- Financial Goals:

- Wealth Creation: Equity funds.

- Stability: Debt or hybrid funds.

- Expense Ratio: Lower fees = more money in your pocket over time.

- Fund Manager: Look for experience and a proven track record.

“Choosing the right mutual fund is like choosing a life partner – it should align with your goals, risk tolerance, and time horizon.” – Dhirendra Kumar, CEO, Value Research

Tips for Successful SIP Investing

- Start Early: Even ₹2,000 a month can grow significantly over 10-15 years.

- Stay Consistent: Don’t stop your SIPs during market dips—those are the best times to buy!

- Diversify: Spread your ₹20,000 across 2-3 funds (e.g., large-cap + mid-cap + debt).

- Review Annually: Check your fund’s performance but avoid overreacting to short-term dips.

FAQs: Your SIP Questions Answered

1. What’s the minimum amount for an SIP?

Most funds start at ₹100, though some like Parag Parikh Flexi Cap require ₹1,000. All fit your ₹2,000-₹20,000 range!

2. Can I change my SIP amount?

Yes, you can tweak it anytime—increase it as your income grows or dial it back if needed.

3. How do I pick the right mutual fund?

Match it to your risk level, time frame, and goals. Diversify for balance.

4. Are SIP returns guaranteed?

No, they’re market-linked. But long-term equity SIPs often average 12-15% annually.

5. SIP vs. Lump Sum—Which is better?

SIPs reduce timing risk and suit regular savers. Lump sums work best during market lows.

Conclusion: Your Wealth Journey Starts Now

Whether you’re investing ₹2,000 or ₹20,000 monthly, SIPs in mutual funds are a powerful way to grow your money. From the safety of large-cap funds like SBI Bluechip to the high-octane growth of Nippon India Small Cap, there’s something for everyone. The key? Start now, stay patient, and pick funds that match your goals.

“The best time to plant a tree was 20 years ago. The second-best time is now.” – Chinese Proverb

Take the first step today—your future self will thank you

2 Comments