Intel Corporation (INTC) has been a semiconductor industry giant for decades, but its stock has not reflected its position in recent years. The company’s stock has been down 4% over the last five years compared to a market-trouncing 176% return for the S&P 500. Despite its recent improvements in business performance and the potential for growth in its foundry business, Intel’s stock is still considered cheap by some investors. In this article, we will explore the reasons behind Intel’s low stock price and discuss whether it is a good investment opportunity.

Reasons for Intel‘s Low Stock Price

- Aggressive Manufacturing Expansion: Intel is investing heavily in new and expanded fabrication operations, which has led to negative free cash flow in the short term. This aggressive expansion has increased the company’s capital expenditures, which may have contributed to the low stock price.

- Geopolitical Factors: The geopolitical situation has been favoring Intel, as governments and private investors are willing to invest in the company’s foundry business. However, the market has not fully recognized this potential growth, leading to an undervalued stock price.

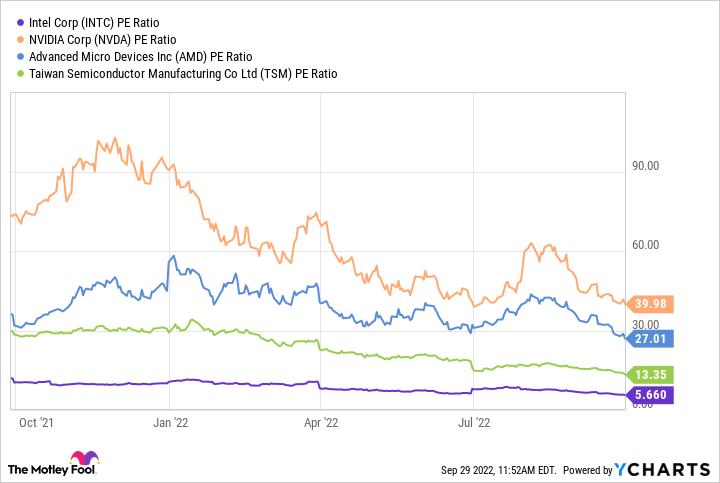

- Competition: Intel faces increased competition from companies like AMD, which has gained market share in the data center chip market. This competition has led to a higher forward price-to-earnings ratio for Intel, making it appear more expensive than it might be.

Intel’s Potential for Growth

Despite the challenges, Intel has been making progress and is expected to grow its bottom line at a faster pace than industry peers. The company’s foundry business is gaining traction, with 80% of the world’s semiconductor manufacturing based in Asia, and many chip designers looking for more options to diversify their supply chains. Intel’s new processors for the data center market could support further gains in 2024.

Risks and Considerations

While Intel’s stock may appear cheap, there are still risks and considerations to take into account. The company’s aggressive manufacturing expansion has led to negative free cash flow, which may continue for some time. Additionally, the geopolitical situation could change, potentially impacting Intel’s growth prospects. Finally, the competition from companies like AMD remains a significant challenge for Intel.

Why Intel Stock Is Now Too Cheap To Ignore

Intel Corporation (INTC) has been a leading player in the semiconductor industry for decades, but its stock has not reflected its position in recent years. Despite its recent improvements in business performance and the potential for growth in its foundry business, Intel’s stock is still considered cheap by some investors. In this article, we will explore the reasons behind Intel’s low stock price and discuss why it may be too cheap to ignore.

Reasons for Intel’s Low Stock Price

- Aggressive Manufacturing Expansion: Intel is investing heavily in new and expanded fabrication operations, which has led to negative free cash flow in the short term. This aggressive expansion has increased the company’s capital expenditures, which may have contributed to the low stock price.

- Geopolitical Factors: The geopolitical situation has been favoring Intel, as governments and private investors are willing to invest in the company’s foundry business. However, the market has not fully recognized this potential growth, leading to an undervalued stock price.

- Competition: Intel faces increased competition from companies like AMD, which has gained market share in the data center chip market. This competition has led to a higher forward price-to-earnings ratio for Intel, making it appear more expensive than it might be.

Intel’s Potential for Growth

Despite the challenges, Intel has been making progress and is expected to grow its bottom line at a faster pace than industry peers. The company’s foundry business is gaining traction, with 80% of the world’s semiconductor manufacturing based in Asia, and many chip designers looking for more options to diversify their supply chains. Intel’s new processors for the data center market could support further gains in 2024.

Why Intel Stock Is Too Cheap To Ignore

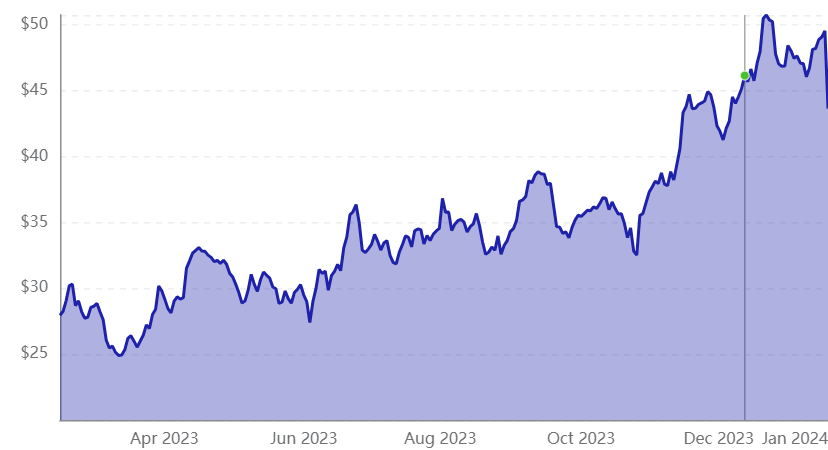

Despite the challenges and competition, Intel’s stock is now considered too cheap to ignore by some investors. The company’s current valuation is sitting well below its normal price-to-earnings ratio of 11.9 over the past decade. Morningstar has a fair value estimate of $50, and sell-side analysts have an average price target of $55, translating to a potential one-year 34% total return based on the lower of the two estimates. Intel’s current valuation reflects an excessively pessimistic outlook, and the market has not fully recognized the potential growth in the company’s foundry business.

Furthermore, Intel’s new CEO, Pat Gelsinger, has been making significant changes to the company’s strategy, including investing in new technologies and expanding its foundry business. Gelsinger’s leadership and the company’s potential for growth make Intel an attractive investment opportunity for some investors.

Risks and Considerations

While Intel’s stock may appear cheap, there are still risks and considerations to take into account. The company’s aggressive manufacturing expansion has led to negative free cash flow, which may continue for some time. Additionally, the geopolitical situation could change, potentially impacting Intel’s growth prospects. Finally, the competition from companies like AMD remains a significant challenge for Intel.

Frequently Asked Questions

What is Intel Corporation (INTC)?

Intel Corporation (INTC) is a technology company that designs, manufactures, and sells computer processors, motherboard chipsets, and other semiconductor products.

What is the current stock price of Intel Corporation (INTC)?

The current stock price of Intel Corporation (INTC) can be found on financial websites like Yahoo Finance[.

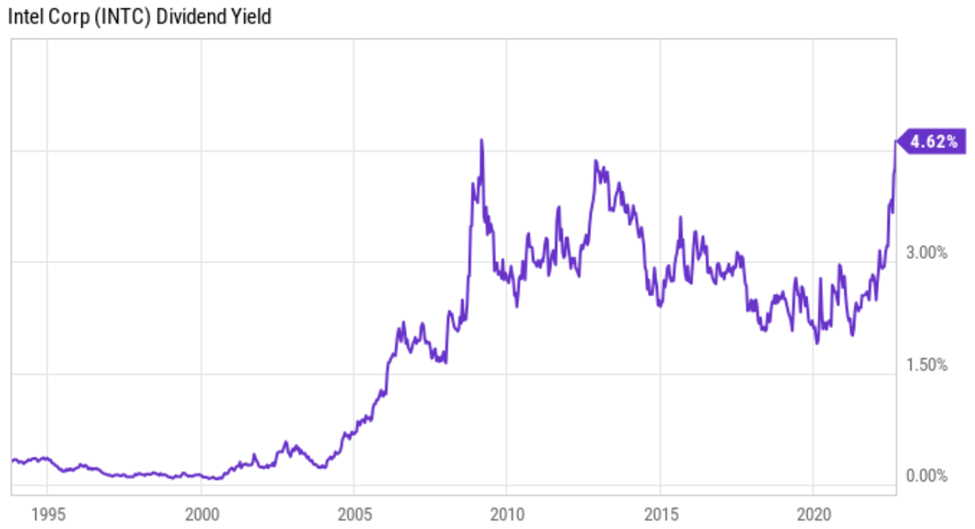

What is the dividend yield of Intel Corporation (INTC)?

The dividend yield of Intel Corporation (INTC) is 1.15%.

What is the 1-year target estimate for Intel Corporation (INTC)?

The 1-year target estimate for Intel Corporation (INTC) is 39.84.

What is the ex-dividend date for Intel Corporation (INTC)?

The ex-dividend date for Intel Corporation (INTC) is February 6, 2024.

What is the beta of Intel Corporation (INTC)?

The beta of Intel Corporation (INTC) is 1.00.

What is the price-to-earnings (P/E) ratio of Intel Corporation (INTC)?

The price-to-earnings (P/E) ratio of Intel Corporation (INTC) is 109.12.

What is the earnings date for Intel Corporation (INTC)?

The earnings date for Intel Corporation (INTC) is April 25, 2024 – April 29, 2024.

What is the forward dividend of Intel Corporation (INTC)?

The forward dividend of Intel Corporation (INTC) is 0.50.

Conclusion

In conclusion, Intel’s stock may appear cheap due to its aggressive manufacturing expansion, geopolitical dynamics, and competition. However, the company has been making progress and is expected to grow its bottom line at a faster pace than industry peers. While there are risks and considerations to take into account, Intel’s potential for growth and its position in the semiconductor industry make it an attractive investment opportunity for some investors. The company’s current valuation is sitting well below its normal price-to-earnings ratio, and its new CEO’s leadership and strategy changes could support further gains in the future.