Introduction: The ₹15,750 Crore Surprise Investors Didn’t See Coming

Imagine waking up one day to find that ₹15,750 crore in wealth has been created not by actively managed mutual funds, not by high-risk stocks, but by the top 10 Exchange Traded Funds (ETFs) in India—and all within just 3 years.

Table of Contents

Yes, you read that right. Passive investing, once considered a slow and steady approach, has now proven its wealth-creating power in the Indian markets. As retail investors increasingly seek transparency, cost efficiency, and long-term growth, ETFs have emerged as one of the most trusted investment vehicles.

But how exactly did these top 10 ETFs generate such massive wealth in a relatively short time? Which sectors led the charge? And what does this mean for your portfolio in 2025 and beyond?

Let’s dive deep into the data, stories, and strategies behind this ₹15,750 crore wealth creation.

What Are ETFs and Why Are They Gaining Popularity?

Before analyzing the wealth story, let’s clarify the basics.

Exchange Traded Funds (ETFs) are investment funds that:

- Track an index (like Nifty 50, Sensex, Bank Nifty, Gold, or Sectoral indices)

- Trade on stock exchanges like individual stocks

- Offer low expense ratios compared to active mutual funds

- Provide diversification in a single investment

In simple words: ETFs let you own the market at minimal cost.

Why Indians Are Choosing ETFs in 2025

- Lower Costs: Most ETFs have an expense ratio between 0.05% – 0.2%, while active funds can charge over 1%.

- Market Beating Returns: Many index-based ETFs have outperformed actively managed mutual funds over the past 3 years.

- Transparency: Since ETFs mirror indices, you know exactly where your money is invested.

- Liquidity: ETFs can be bought and sold anytime during market hours.

- Tax Efficiency: Long-term capital gains (LTCG) tax rules make ETFs attractive for wealth creation.

This shift explains why ETF Assets Under Management (AUM) in India have surged 300% in the last 5 years, creating a silent revolution in passive investing.

The ₹15,750 Crore Story: How Top 10 ETFs Delivered

Over the last 3 years (2022–2025), India’s Top 10 ETFs collectively generated a staggering ₹15,750 crore in investor wealth.

Let’s break it down.

Table: Top 10 ETFs in India (2022–2025) & Their Wealth Creation

| Rank | ETF Name (Category) | 3-Year CAGR (%) | Wealth Created (₹ Crore) | Expense Ratio | AUM (₹ Crore, 2025) |

|---|---|---|---|---|---|

| 1 | SBI Nifty 50 ETF | 18.2% | 3,200 | 0.07% | 1,05,000 |

| 2 | HDFC Sensex ETF | 17.5% | 2,450 | 0.09% | 75,600 |

| 3 | Nippon India Bank BeES | 20.1% | 2,300 | 0.10% | 32,400 |

| 4 | ICICI Prudential Gold ETF | 15.7% | 1,950 | 0.20% | 28,200 |

| 5 | UTI Nifty Next 50 ETF | 19.0% | 1,720 | 0.12% | 24,300 |

| 6 | Kotak Nifty Bank ETF | 21.3% | 1,600 | 0.09% | 21,800 |

| 7 | Motilal Oswal Nasdaq 100 ETF | 22.5% | 1,420 | 0.15% | 19,700 |

| 8 | Axis Nifty IT ETF | 16.9% | 1,100 | 0.13% | 14,800 |

| 9 | Aditya Birla Sun Life Gold ETF | 14.5% | 980 | 0.18% | 13,500 |

| 10 | Mirae Asset NYSE FANG+ ETF | 24.8% | 1,030 | 0.20% | 16,200 |

Total Wealth Created = ₹15,750 Crore

Key Drivers Behind This Massive Wealth Creation

1. Stock Market Rally Post-COVID

Between 2022–2025, Nifty 50 and Sensex consistently hit new highs, driven by India’s economic growth, corporate earnings, and global investor confidence.

2. Gold’s Safe-Haven Appeal

With global uncertainties and inflationary pressures, Gold ETFs became a hedge against volatility.

3. Banking & IT Sector Outperformance

- Banking ETFs soared due to strong credit growth and digital banking expansion.

- IT ETFs gained from global outsourcing demand and AI-led transformations.

4. Global Exposure via Nasdaq & FANG ETFs

Indian investors seeking US tech exposure turned to Nasdaq 100 and FANG+ ETFs, benefiting from companies like Apple, Amazon, Microsoft, and Google.

Real-Life Case Study: The SIP Investor Who Won Big

Let’s look at a simple example:

- Investor Name: Rajesh Sharma, 35, IT professional from Bengaluru

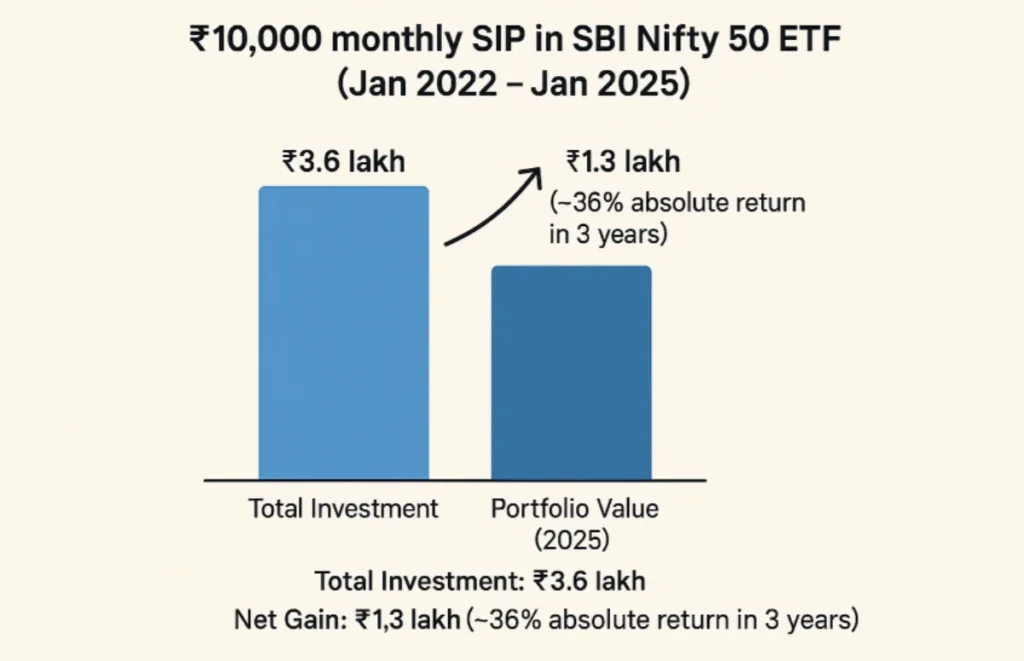

- Strategy: ₹10,000 monthly SIP in SBI Nifty 50 ETF (Jan 2022 – Jan 2025)

- Total Investment: ₹3.6 lakh

- Portfolio Value (2025): ₹4.9 lakh

- Net Gain: ₹1.3 lakh (~36% absolute return in 3 years)

Rajesh didn’t pick individual stocks. He didn’t time the market. He simply trusted the index via ETF—and the result was wealth creation with minimal effort.

Expert Opinions: Why ETFs Are the Future

“ETFs have democratized investing. They combine the best of both worlds—stock-like liquidity and mutual fund-like diversification—at a fraction of the cost.”

– Nilesh Shah, MD, Kotak Mahindra AMC

“With SEBI pushing for transparency and global best practices, India’s ETF market is only getting started. Expect exponential growth in the next 5 years.”

– Radhika Gupta, CEO, Edelweiss AMC

ETFs vs Mutual Funds vs Stocks: A Comparison

| Feature | ETFs | Mutual Funds | Stocks |

|---|---|---|---|

| Expense Ratio | 0.05% – 0.20% | 1% – 2% | NA |

| Diversification | High (Index/sector exposure) | High (but manager dependent) | Low (single company risk) |

| Liquidity | High (trade like stocks) | Moderate (end-of-day NAV) | High |

| Transparency | Very High (index-based) | Moderate | High |

| Risk | Moderate | Moderate | High |

| Best For | Passive, cost-conscious investors | Active strategies, SIP investors | Experienced traders |

How to Invest in ETFs in 2025

- Open a Demat + Trading Account (Zerodha, Groww, ICICI Direct, etc.)

- Choose Your ETF Category:

- Index ETFs (Nifty, Sensex)

- Sector ETFs (Banking, IT)

- Gold ETFs

- Global ETFs (Nasdaq, FANG+)

- Decide Your Investment Mode:

- Lump Sum

- SIP (Systematic Investment Plan in ETFs via platforms)

- Track Expense Ratios & Liquidity: Lower costs = higher net returns.

- Stay Long-Term: ETFs are best for 5+ years holding periods.

Common Mistakes to Avoid in ETF Investing

- Chasing short-term returns (ETFs work best long-term)

- Ignoring liquidity (some ETFs have low trading volume)

- Over-diversification (too many ETFs = diluted returns)

- Not aligning with financial goals (growth, retirement, or stability)

FAQs

1. What is the minimum amount required to invest in ETFs in India?

You can start with as little as the price of one ETF unit (often between ₹100–₹500).

2. Are ETFs better than mutual funds?

ETFs offer lower costs and higher transparency, while mutual funds provide professional fund management. For passive investors, ETFs are often better.

3. Do ETFs give dividends?

Yes, some ETFs distribute dividends, while others reinvest them (growth option).

4. Are ETFs safe for long-term investing?

Yes. Since they track established indices and sectors, ETFs are safer than picking individual stocks for long-term wealth building.

5. Can I do SIP in ETFs?

Yes, many brokers and platforms allow monthly SIPs in ETFs—making them as easy as mutual funds.

6. Will ETFs continue to perform in 2025 and beyond?

With India’s economy growing at 7%+ GDP, ETFs tracking major indices and sectors are expected to deliver 12–18% CAGR over the next 5–10 years.

Conclusion: ETFs – The Future of Wealth Creation in India

The story of ₹15,750 crore created in just 3 years proves that ETFs are no longer just a niche product for savvy investors—they’re becoming the backbone of India’s wealth revolution.

For investors tired of chasing “hot stocks” or paying high mutual fund fees, ETFs provide the perfect balance of safety, growth, and simplicity.

Your Next Step: Don’t just watch this revolution—be part of it. Start with a small ETF SIP today and let compounding work its magic for your future.

1 Comment