Beginner’s Guide to Wealth Creation

Investing might sound like something reserved for the wealthy, but the truth is, anyone can start investing—even with just a small amount of money. Thanks to modern technology and innovative platforms, building wealth is now accessible to everyone, regardless of their budget.

In this guide, we’ll explore how to start investing with little money, the strategies to grow your wealth, and the tools you can use to embark on your investment journey.

Table of Contents

Why Should You Start Investing with Little Money?

Investing early, even with a small amount, can make a big difference in your financial future. Here’s why:

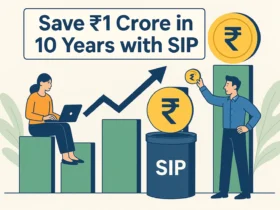

- Compound Growth: Your returns earn returns, creating a snowball effect that significantly grows your wealth over time. For example, if you invest $100 per month at an annual return rate of 8%, you could have over $150,000 in 30 years.

- Habit Formation: Starting small helps you develop the habit of investing, which is crucial for long-term success. Even consistent investments of $5 a week can instill discipline and motivation.

- Low Entry Barriers: Many platforms now allow you to start investing with as little as $1, making it easier than ever. Micro-investing apps like Acorns or Stash are perfect for beginners.

Let’s address a myth—investing isn’t just for the wealthy. It’s a powerful tool that anyone can leverage to secure their financial future.

Step 1: Define Your Financial Goals

Before you begin investing, identify your goals. Are you saving for:

- Short-Term Goals: Like a vacation, a wedding, or an emergency fund?

- Mid-Term Goals: Such as buying a car or paying for higher education?

- Long-Term Goals: Such as retirement or buying a home?

For example, if your goal is short-term, you might prioritize safer investments like high-yield savings accounts or bonds. For long-term goals, you could explore stocks or ETFs for potentially higher returns.

Step 2: Start with What You Have (Even $5)

Contrary to popular belief, you don’t need thousands of dollars to invest. Start with whatever you can afford. Even $5 or $10 invested consistently can grow significantly over time.

Example:

Let’s say you start with $10 and invest an additional $20 each month at an average annual return of 7%. In 20 years, you could accumulate over $10,000. Starting small doesn’t just build wealth; it builds confidence.

Step 3: Choose the Right Investment Option

Here are some of the best ways to invest small amounts of money:

1. Exchange-Traded Funds (ETFs)

- What They Are: A collection of stocks or bonds you can buy and sell like a single stock.

- Why They’re Great: Diversified and low-cost.

- Minimum Investment: Many platforms allow you to start with $1.

- Platforms to Try: Vanguard, Fidelity, Robinhood.

Case Study:

Sarah, a 28-year-old teacher, started investing $50 monthly into ETFs using Vanguard. Over five years, her portfolio grew to $3,500 with an average annual return of 8%. By reinvesting dividends, Sarah’s portfolio compounds faster.

2. Fractional Shares

- What They Are: Buy a portion of a stock rather than a whole share.

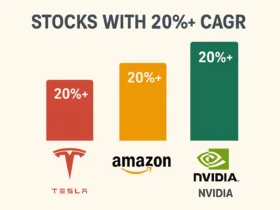

- Why They’re Great: Invest in high-value companies like Apple or Tesla with just a few dollars.

- Best Platforms: Robinhood, Webull, Stash.

Example:

John wanted to invest in Tesla, but a single share cost over $800. Using Robinhood’s fractional shares, he started with just $20, gaining exposure to one of the fastest-growing companies.

3. Robo-Advisors

- What They Are: Automated platforms that invest your money based on your goals and risk tolerance.

- Why They’re Great: No expertise needed.

- Popular Options: Betterment, Wealthfront, Acorns.

4. Micro-Investing Apps

- What They Are: Apps that let you invest spare change or small amounts automatically.

- Why They’re Great: Ideal for beginners who want to start small.

- Top Apps: Acorns, Stash, Public.

Case Study:

Emma used Acorns, which rounds up her daily purchases to the nearest dollar and invests the spare change. Over three years, Emma’s spare change investments totaled $1,500.

5. High-Yield Savings Accounts or CDs

- What They Are: While not technically investments, these are safe ways to grow your money.

- Why They’re Great: Low risk and reliable returns.

- Best for: Emergency funds or short-term goals.

Step 4: Automate Your Investments

Automation ensures consistent investing. Many platforms allow automatic contributions, so you can “set it and forget it.” Even small recurring investments can compound into significant wealth over time.

Example:

If you automate $50 per month into a diversified ETF portfolio with a 7% annual return, you’d accumulate nearly $12,000 in 10 years.

Step 5: Diversify Your Investments

Diversification reduces risk by spreading your money across various assets, such as:

- Stocks

- ETFs

- Bonds

Example of Diversification:

Mike invested $1,000 and split it into:

- 50% in ETFs

- 30% in stocks

- 20% in bonds

When the stock market dipped, Mike’s bond investments balanced the losses, reducing his overall risk.

Step 6: Minimize Fees

Fees can erode your returns, especially when investing small amounts. Opt for platforms with low or no fees, such as:

- Robinhood: No trading fees.

- Webull: No commissions.

- Betterment: Low management fees for automated investing.

Example:

Imagine you invest $1,000 in a mutual fund with a 2% fee. Over 30 years, that fee could cost you over $100,000 in lost returns. Choosing low-cost platforms can save you significant money.

Step 7: Stay Consistent and Patient

Investing is a long-term game. Stay consistent and don’t panic during market fluctuations. For example:

- Investing $50/month at a 7% annual return grows to $12,000 in 10 years.

- Investing $100/month grows to $24,000 in 10 years.

Consistency and patience are your best allies.

Real-Life Example:

Anna started investing $100 monthly in her 20s. By the time she turned 50, her portfolio exceeded $150,000. Her secret? Consistency, diversification, and reinvesting earnings.

Common Mistakes to Avoid

- Trying to Time the Market: Consistent investing beats guessing market highs and lows.

- Ignoring Fees: High fees can eat into your returns.

- Lack of Diversification: Avoid putting all your money into a single asset.

- Not Starting Early: The earlier you start, the more time your investments have to grow.

FAQs: Starting Investing with Little Money

1. Can I start investing with $10?

Yes! Platforms like Acorns, Robinhood, and Stash allow you to begin with as little as $1-$10.

2. What’s the safest way to invest small amounts?

High-yield savings accounts, certificates of deposit (CDs), or diversified ETFs are safe options for beginners.

3. How often should I invest?

Aim to invest regularly, either weekly or monthly. Automating your investments makes this easier.

4. What’s the best platform for beginners?

Platforms like Robinhood, Betterment, and Acorns are user-friendly and perfect for new investors.

Conclusion: Start Small, Think Big

Starting to invest with little money is easier than ever. With the right tools, strategies, and consistency, even small investments can grow into substantial wealth. Don’t let the idea of “not having enough money” hold you back—begin with what you have and let compounding work its magic.

Take the first step today by signing up for a beginner-friendly platform like Robinhood or Acorns, set your financial goals, and start investing in your future.

Leave a Reply