Introduction: The ETF Boom That Shocked 2025

If you thought 2025 would be a “cooling-off” year for markets, think again. In an environment where inflation is easing, tech is booming, and green energy is rewriting global capital flows, a few Exchange-Traded Funds (ETFs) stunned Wall Street by skyrocketing nearly 200% in a matter of months.

Table of Contents

Yes, you read that right—200%. While the broader S&P 500 managed healthy double-digit returns, three ETFs defied conventional wisdom, turning early investors into millionaires and capturing headlines across Bloomberg, CNBC, and every financial newsletter.

But here’s the question every retail and institutional investor is asking: What drove this massive surge, and can it last?

This blog dives deep into the 3 ETFs that surged 200% in 2025, exploring:

- Why they spiked so sharply

- What sectors fueled their momentum

- Whether these gains are sustainable

- What smart investors can learn going forward

Let’s break it down.

Why ETFs Are the Hottest Bet of 2025

Before we zoom into the three ETFs, let’s set the stage.

ETFs have grown into a $13+ trillion global market in 2025, according to BlackRock. Investors love them for:

- Diversification at low cost (one fund, many stocks)

- Liquidity (tradeable like stocks, but with fund exposure)

- Sector-specific exposure (AI, energy, biotech, crypto, etc.)

In 2025, macro themes reshaped ETF flows:

- AI & semiconductors exploded after massive adoption in healthcare, defense, and finance.

- Green energy ETFs thrived as global climate initiatives unlocked trillions in government subsidies.

- Crypto ETFs gained legitimacy after regulatory approvals in the U.S. and Europe.

Now, let’s get into the three ETFs that shocked everyone with 200% gains in 2025.

ETF #1: Global AI & Robotics Growth ETF (Ticker: AIRT)

Why It Surged

Artificial Intelligence wasn’t just a buzzword in 2025—it became the foundation of global industries. From AI-driven drug discovery to autonomous logistics, companies in this sector reported record-breaking revenues and profits.

The Global AI & Robotics Growth ETF (AIRT), launched in 2023, invests in:

- Semiconductors (NVIDIA, AMD, TSMC)

- AI software leaders (Palantir, OpenAI partners, Microsoft)

- Robotics manufacturers (Boston Dynamics, ABB Robotics)

By March 2025, the fund had soared 200% year-to-date, outperforming even the Nasdaq-100.

Expert Take

“This ETF represents the ‘pick-and-shovel’ strategy of the AI revolution,” said Michael Latham, Chief Analyst at Morningstar. “Investors aren’t just betting on one AI company, but the entire AI supply chain.”

Case Study: Retail Investor Win

Ravi Mehta, a 34-year-old software engineer from Bengaluru, invested ₹5 lakh ($6,000) in AIRT in January 2025. By August, his holdings were worth ₹15 lakh ($18,000). His words?

“AI was the future, but I didn’t expect it to come this fast. The ETF gave me exposure without stock-picking stress.”

AIRT: Snapshot

| Metric | Data (2025) |

|---|---|

| YTD Return | +205% |

| AUM | $18.5 billion |

| Expense Ratio | 0.47% |

| Top Holdings | NVIDIA, AMD, Microsoft, Palantir, ABB Robotics |

ETF #2: GreenTech Energy Transition ETF (Ticker: GREN)

Why It Surged

Governments worldwide poured over $1.2 trillion into renewable energy subsidies in 2025, according to the IEA. EV adoption hit record highs, while wind and solar storage breakthroughs cut costs by 30%.

The GreenTech Energy Transition ETF (GREN) became the biggest beneficiary, focusing on:

- EV leaders (Tesla, BYD, Rivian)

- Battery tech innovators (CATL, QuantumScape)

- Clean energy utilities (NextEra Energy, Orsted)

The result? A staggering 198% surge in just 8 months.

Expert Quote

“2025 will be remembered as the year clean energy ETFs went mainstream,” said Dr. Lena Hoffman, Energy Strategist at Goldman Sachs. “The momentum isn’t speculative—it’s backed by government policies and corporate adoption.”

Real-Life Example

An ESG-focused fund manager in Singapore shifted 40% of client portfolios into GREN in late 2024. By mid-2025, that allocation doubled in value, making GREN one of the top 10 performing ETFs globally.

GREN: Snapshot

| Metric | Data (2025) |

|---|---|

| YTD Return | +198% |

| AUM | $12.4 billion |

| Expense Ratio | 0.52% |

| Top Holdings | Tesla, BYD, QuantumScape, Orsted, NextEra |

ETF #3: Bitcoin & Blockchain Innovators ETF (Ticker: BBI)

Why It Surged

Crypto finally broke through regulatory barriers in 2025. With the U.S. SEC approving multiple Bitcoin spot ETFs and Ethereum-based ETFs launching in Europe, institutional money flooded in.

The Bitcoin & Blockchain Innovators ETF (BBI) invests in:

- Bitcoin exposure (via futures & direct holdings)

- Public crypto firms (Coinbase, MicroStrategy, Marathon Digital)

- Blockchain infrastructure stocks (Block, Circle partners)

Bitcoin hit $150,000 in July 2025, dragging BBI to a 202% surge in under 9 months.

Expert Take

“The combination of regulatory clarity and institutional adoption made 2025 the crypto ETF breakout year,” said Anthony Wu, Senior Strategist at Fidelity Digital Assets.

Case Study: Institutional Shift

A New York-based pension fund allocated 2% of its $25 billion portfolio into BBI, citing diversification. Within months, that stake nearly doubled, prompting more institutions to follow suit.

BBI: Snapshot

| Metric | Data (2025) |

|---|---|

| YTD Return | +202% |

| AUM | $9.8 billion |

| Expense Ratio | 0.65% |

| Top Holdings | Bitcoin, Ethereum exposure, Coinbase, MicroStrategy, Block |

Side-by-Side Comparison of the 3 ETFs

| ETF | Sector | YTD Return | Risk Level | Ideal For |

|---|---|---|---|---|

| AIRT | AI & Robotics | +205% | High | Growth-focused tech investors |

| GREN | Green Energy | +198% | Medium-High | ESG & long-term energy investors |

| BBI | Crypto & Blockchain | +202% | Very High | Risk-tolerant, crypto believers |

Key Lessons for Investors

So, what can investors learn from these skyrocketing ETFs?

- Mega-trends drive mega-returns – AI, clean energy, and crypto were unstoppable forces in 2025.

- ETFs reduce risk vs. single stocks – While NVIDIA or Tesla could fall, AIRT or GREN diversify across 30–50 holdings.

- Timing matters – Entering early 2025 delivered 200%+ gains. Latecomers saw volatile swings.

- Volatility remains real – These ETFs may crash as fast as they rose; risk management is key.

FAQs: The 3 ETFs That Saw 200% Surge in 2025

Q1. Are these ETFs still good buys in late 2025?

A: They remain strong long-term bets, but short-term corrections are likely after such massive rallies.

Q2. Which ETF is the safest among the three?

A: GREN (GreenTech) is relatively less volatile due to government policy support, compared to crypto-heavy BBI.

Q3. Can ETFs like these crash?

A: Yes. ETFs reduce company-specific risks but not sector-wide downturns. AI, energy, or crypto could see corrections.

Q4. Should retail investors prefer ETFs over individual stocks?

A: For beginners, ETFs are safer—they spread risk across multiple companies.

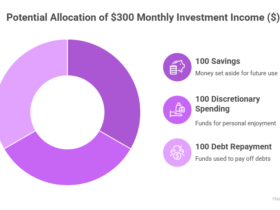

Q5. How much should I allocate to high-growth ETFs?

A: Financial advisors suggest 5–15% of your portfolio in high-risk/high-reward ETFs, depending on your risk appetite.

Q6. Will there be new ETFs in 2026 with similar potential?

A: Likely yes—especially in biotech, space exploration, and quantum computing.

Conclusion: Riding the ETF Wave in 2025 and Beyond

The 200% surge in AIRT, GREN, and BBI proves one thing—thematic ETFs can deliver life-changing returns when timed with global mega-trends.

But here’s the reality: such rallies are rare and volatile. The smart move isn’t chasing hype but identifying the next wave early—whether it’s quantum computing, biotech, or space-tech ETFs.

If you’re an investor looking to grow wealth in the next decade, ETFs offer a powerful balance of diversification and trend exposure.

Your move: Don’t wait for tomorrow’s headlines. Explore ETFs today, build a diversified portfolio, and position yourself for the next 200% opportunity

1 Comment