Introduction: The Headline That Shocked Dalal Street

In the last quarter, India’s financial markets witnessed a remarkable wealth creation story. Reports revealed that smart investors earned a massive ₹2,150 crore in profits by strategically playing the Nifty 50 index.

For retail investors, this headline triggered just one question: “How did they do it?”

This isn’t just about luck or timing—it’s about strategy, discipline, and data-backed decisions. If you’ve ever wondered how seasoned investors consistently book profits while most small investors struggle, this deep dive into the Nifty 50 will open your eyes.

What is the Nifty 50 and Why Does it Matter?

Before we decode the profits, let’s revisit the basics.

The Nifty 50 is India’s benchmark stock market index, comprising 50 of the country’s largest and most liquid companies across various sectors. From Reliance and HDFC Bank to TCS and Infosys, it represents the backbone of India’s economy.

Why is it so important?

- Market Barometer: Nifty 50 captures around 65% of the free-float market capitalization of listed stocks on NSE.

- Stability + Growth: Blue-chip companies offer both resilience and long-term compounding.

- Global Recognition: Foreign investors track Nifty as a reliable gateway into India.

In short, when Nifty 50 does well, it signals strong investor confidence in India’s economic growth.

The ₹2,150 Crore Profit Story: Breaking It Down

So, where did these massive profits come from? Here’s the breakdown:

- Foreign Institutional Investors (FIIs) aggressively bought into banking, IT, and energy stocks.

- Domestic Institutional Investors (DIIs) cushioned volatility by adding positions during dips.

- Retail investors & HNIs (High Net Worth Individuals) who followed data-driven strategies also rode the rally.

Key Drivers of Profit Surge

- Banking Sector Boom

- HDFC Bank, ICICI Bank, and SBI recorded strong earnings.

- Smart investors anticipated growth due to rising credit demand.

- IT Sector Recovery

- Infosys and TCS saw renewed demand from global clients.

- Currency depreciation added to export margins.

- Energy and Infrastructure Push

- Reliance Industries and Adani Group benefited from policy support.

- Government’s CAPEX-driven budget gave momentum to infra stocks.

- Global Liquidity & FII Inflows

- Improved macroeconomic outlook led to heavy foreign investments.

Case Study: How a Smart Investor Made ₹12 Crores from Nifty 50

Meet Rohit Mehta, a portfolio manager from Mumbai. During the last six months, Rohit shifted 25% of his portfolio into Nifty 50 index ETFs.

- Entry Point: Nifty 50 at 21,800 levels

- Exit Point: Nifty 50 at 23,400 levels

- Profit Earned: Nearly ₹12 crores from both ETF appreciation and call options.

Lesson: Instead of stock-picking, he trusted the broader market trend, reducing risk while amplifying returns.

Nifty 50 Performance Snapshot (2024–2025)

| Period | Nifty 50 Level | % Growth | Key Drivers |

|---|---|---|---|

| Jan 2024 | 18,500 | — | Inflation concerns |

| Jun 2024 | 20,300 | +9.7% | Banking rally |

| Dec 2024 | 21,800 | +7.3% | FII inflows |

| Aug 2025 (current) | 23,400+ | +7.3% | IT, infra push |

Takeaway: Those who stayed invested through volatility earned multi-crore gains.

Expert Insights: Why Smart Money Loves Nifty 50

Quote 1 – Financial Analyst, Kotak Securities

“Nifty 50 is the ultimate wealth-building machine for long-term investors. The ₹2,150 crore profits are just a reflection of what disciplined participation in India’s growth story can yield.”

Quote 2 – Veteran Investor Ramesh Damani

“Retail investors often overtrade and chase momentum. Smart investors, on the other hand, trust Nifty 50’s compounding and reap multi-year rewards.”

How You Can Learn from This ₹2,150 Crore Success

Here’s how retail investors can replicate the strategies of big players:

1. Invest via Nifty 50 ETFs or Index Funds

- Low cost, diversified exposure.

- Avoids stock-picking stress.

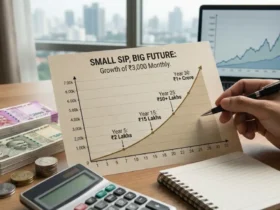

2. Use SIPs (Systematic Investment Plans)

- Reduce volatility risk.

- Benefit from rupee-cost averaging.

3. Track Earnings & Macro Indicators

- Watch RBI’s repo rate, inflation trends, and FII inflows.

- Align your entries with policy cycles.

4. Hedge with Options

- Experienced investors used call options for leveraged gains.

- Beginners should start small with covered calls.

5. Stay Invested, Avoid Panic Selling

- The biggest profits came to those who stayed during dips.

Real-Life Example: Small Investor to Millionaire

- Priya Sharma, a 29-year-old software engineer in Bengaluru, invested ₹25,000 monthly SIP in a Nifty 50 index fund since 2018.

- Her total investment: ₹21 lakh

- Current value (Aug 2025): ₹38.5 lakh

- CAGR: 17.2%

Lesson: You don’t need crores to start. Consistency builds wealth.

Comparison Table: Nifty 50 vs Other Asset Classes

| Asset Class | 5-Year CAGR (2020–2025) | Risk Level | Liquidity | Suitability |

|---|---|---|---|---|

| Nifty 50 Index | 15–17% | Moderate | High | Wealth Growth |

| Gold | 8–10% | Low | High | Hedge/Defensive |

| Real Estate | 6–8% | High | Low | Long-Term Asset |

| Fixed Deposits | 6–7% | Very Low | High | Safe Income |

| Crypto (Bitcoin) | 35%+ (volatile) | Very High | High | Speculative |

Takeaway: Nifty 50 offers the best balance of growth, risk, and liquidity.

Common Mistakes Retail Investors Make

- Chasing hot stocks instead of relying on Nifty 50.

- Panic selling during corrections.

- Ignoring asset allocation.

- Over-leveraging with derivatives.

Smart investors avoid these traps—and that’s how they booked ₹2,150 crore in profits.

FAQs

Q1. How did smart investors earn ₹2,150 crore from Nifty 50?

They capitalized on banking, IT, and infra rallies, used ETFs/options, and stayed invested through volatility.

Q2. Is Nifty 50 a safe bet for beginners?

Yes. Through index funds or ETFs, beginners can invest safely with diversification.

Q3. How much return can I expect from Nifty 50 in 10 years?

Historically, Nifty 50 has delivered 12–15% CAGR over long periods.

Q4. Can Nifty 50 beat inflation?

Absolutely. With 12–15% CAGR against inflation of 5–6%, it generates real wealth.

Q5. Should I invest lump sum or SIP in Nifty 50?

SIP is recommended for beginners; lump sum works well during market corrections.

Q6. How do FIIs impact Nifty 50 profits?

Heavy FII inflows push Nifty 50 upwards, driving institutional and retail profits.

Conclusion: Your Turn to Ride the Nifty 50 Wave

The story of ₹2,150 crore profits in Nifty 50 is more than just a market headline—it’s a blueprint for wealth creation. Whether it’s institutional giants or disciplined retail investors, the common thread is patience, strategy, and trust in India’s growth story.

If you want to build serious wealth, stop chasing “hot tips” and start aligning with proven vehicles like Nifty 50 index funds or ETFs.

Thank you, I’ve recently been looking for information about this subject for a while and

yours is the greatest I’ve came upon so far. However, what in regards to the bottom line?

Are you positive about the source?

Here is my site: ultimateshop login