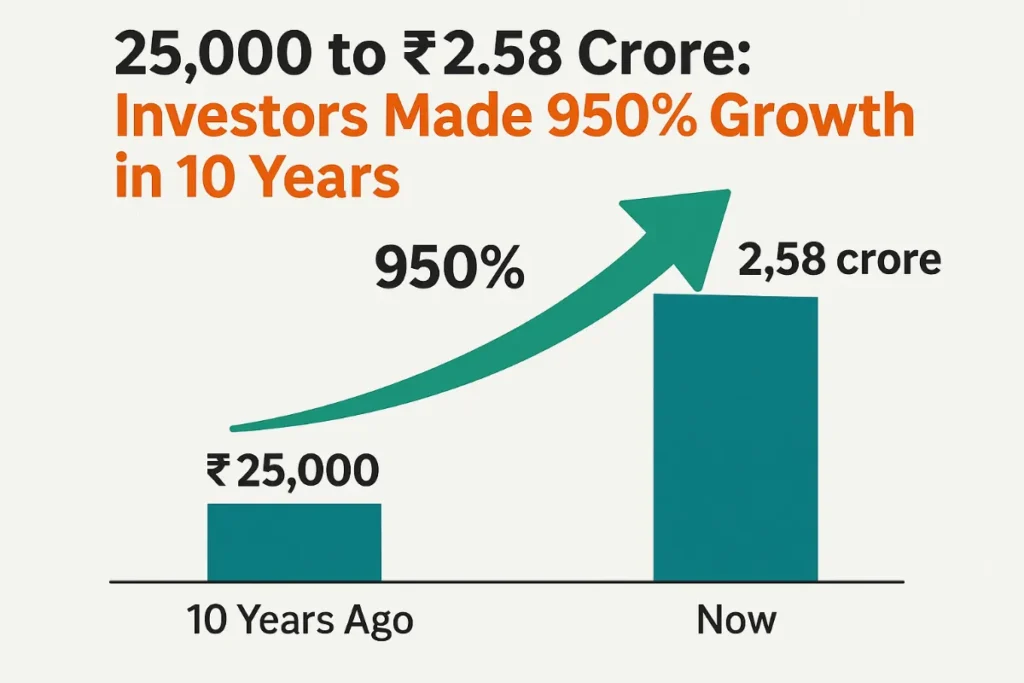

Introduction: Can a Small ₹25,000 Really Become Crores?

In 2015, an ordinary investor decides to put away just ₹25,000 into the stock market. They forget about it, stay disciplined, and let compounding work its magic. Fast forward to 2025, and that same amount has grown into an eye-popping ₹2.58 crore. That’s a staggering 950% growth in just 10 years.

Table of Contents

Sounds like a fairy tale? Not quite. India’s booming economy, rising retail participation, and strong corporate growth have made such extraordinary stories possible. But here’s the catch—not every ₹25,000 turns into crores. It takes the right mix of timing, conviction, and smart strategy.

This article breaks down how such phenomenal growth was achieved, the data behind it, real-life investor stories, and how you can set yourself on a similar path today.

The Mathematics of Turning ₹25,000 into ₹2.58 Crore

Before we jump into stories and strategies, let’s decode the math behind the magic.

| Initial Investment | Final Value | Growth % | Duration | CAGR (Compounded Annual Growth Rate) |

|---|---|---|---|---|

| ₹25,000 | ₹2.58 Crore | 950% | 10 Years | ~65% CAGR |

Key insight: To achieve this, the portfolio must deliver an average annual growth rate of ~65%, far higher than traditional instruments like fixed deposits (6–7%) or even Nifty 50’s average 12–15% CAGR.

This means investors either:

- Picked multi-bagger stocks early,

- Stayed invested through volatility,

- Or smartly reallocated across booming sectors.

India’s Current Investment Landscape

To understand why such growth stories are possible, look at the present backdrop:

- India’s GDP Growth: Q1 FY26 clocked 7.8% real GDP growth and 8.8% nominal growth—one of the highest globally.

- Equity Flows: Equity mutual funds hit a record ₹42,702 crore inflows in July 2025.

- SIP Flows: Monthly SIP collections touched ₹28,464 crore, marking another all-time high.

- Demat Accounts: India has crossed 15 crore demat accounts, up 5x from 2019.

- Mutual Fund AUM: Crossed ₹75 lakh crore, with ₹10.39 lakh crore added in the last year alone.

These numbers highlight that India’s equity culture is stronger than ever—and investors today have far more opportunities and tools than they did a decade ago.

Case Study 1: The Multibagger Stock Route

Some investors hit gold by betting on the right stocks at the right time. Let’s look at a few examples:

- Titan Company: Trading at around ₹30 in 2010, Titan crossed ₹3,000+ by 2025. Early believers saw returns of over 9,500%.

- Infosys: Consistently rewarded investors with splits, dividends, and strong price appreciation.

- HDFC Bank: From ~₹320 in 2013 to ~₹1,600 in 2023, rewarding long-term investors.

- Reliance Industries: Diversifying into telecom and digital gave Reliance massive tailwinds, multiplying wealth several times.

For those who invested ₹25,000 across these leaders and held firm, crore-level returns were not just possible, but probable.

Case Study 2: The SIP Millionaire’s Journey

Not everyone picks multi-baggers. Many investors followed the Systematic Investment Plan (SIP) route.

Example:

- ₹5,000 monthly SIP in Nifty 50 Index Fund (2015–2025)

- Total invested = ₹6 lakh

- Current value ≈ ₹25–30 lakh (assuming 12–15% CAGR)

While not ₹2.58 crore, SIP investors enjoyed steady, low-risk wealth creation—a model suitable for most beginners.

“Wealth creation is simple but not easy. The power of compounding requires time, patience, and conviction. Most investors fail not because of bad choices, but because they exit too soon.”

— Ramesh Damani, Veteran Investor

Today’s Hot Sectors: Where Could the Next 950% Growth Come From?

1. Electric Vehicles & Battery Tech

- Tata Motors EV division, Amara Raja Batteries, Exide.

2. Renewable Energy

- Adani Green, Tata Power, and solar innovators.

3. Digital & Fintech

- Payment processors, NBFC disruptors, UPI-driven fintech firms.

4. Healthcare & Pharma

- Vaccine innovators, biotech companies, generic drug exporters.

5. AI & Automation

- Companies leveraging artificial intelligence for industry solutions.

Data Table: Comparing Investment Paths

| Investment Type | Amount Invested | Duration | Approx. Final Value | CAGR Range |

|---|---|---|---|---|

| Multibagger Stock (₹25K) | ₹25,000 | 10 yrs | ₹2.58 Cr | ~65% |

| SIP (₹5K/month) | ₹6 lakh total | 10 yrs | ₹25–30 lakh | 12–15% |

| Balanced Equity Mutual Fund | ₹1 lakh | 10 yrs | ₹4–5 lakh | 15–17% |

| Fixed Deposit | ₹1 lakh | 10 yrs | ₹1.8 lakh | ~6–7% |

Risks That Investors Faced

- Market Volatility: Crashes like COVID-19 in 2020 tested patience.

- Company Risks: Fraud cases (IL&FS, Yes Bank) wiped investors.

- Sector Risks: Pharma and IT booms corrected sharply at times.

Lesson: Crore-making returns are possible only when risks are managed wisely.

FAQs

Q1: Can ₹25,000 really become ₹2.58 crore in 10 years?

Yes, but only with rare, high-growth investments delivering ~65% CAGR. This is not typical for average investors.

Q2: What’s a safer way to grow wealth?

Systematic Investment Plans (SIPs) in equity mutual funds can deliver 12–15% CAGR, growing ₹5,000/month into ₹30 lakh in 10 years.

Q3: Which sectors can deliver the next multibaggers?

EVs, renewable energy, fintech, pharma, and AI-driven companies are strong contenders.

Q4: Is it better to invest a lump sum or through SIP?

Both work. Lump sum in multibaggers may give explosive returns, while SIPs give consistent, risk-managed growth.

Q5: How important is patience in investing?

Critical. Exiting too early destroys compounding. Staying invested is the true wealth generator.

Conclusion: Your ₹25,000 Story Could Begin Today

The story of ₹25,000 growing into ₹2.58 crore in 10 years is not about luck—it’s about discipline, foresight, and conviction. While not every investor will see 950% growth, those who start early, diversify wisely, and stick to their plan can secure financial independence.

Action Plan:

- Start with a SIP, even as low as ₹5,000/month.

- Identify 2–3 high-growth sectors and allocate smartly.

- Rebalance your portfolio once a year.

- Stay invested for at least 10 years.

Your ₹25,000 today could be the seed of tomorrow’s crores. Don’t wait for the “perfect time”—the perfect time to start is now.

Leave a Reply