You’re scrolling through your banking app on a Friday evening, and there it is—a notification that instantly brightens your day. It’s not a salary credit. It’s not a random cashback. It’s a dividend. A silent, steady transfer of wealth from a thriving business you own a piece of, directly into your account. While the market’s daily noise continues, this stream of income remains a testament to a powerful, proven wealth-building strategy. Fresh data reveals that India’s top corporate giants have distributed a mind-boggling ₹6,200 Crore and more to their shareholders in the recent payouts.

Why Dividend Investing is Your Anchor in the 2025 Market

With interest rates, inflation, and global events causing uncertainty, dividends provide a tangible, predictable return that isn’t solely dependent on market sentiment. It’s a strategy built on the solid foundation of cash flow.

The Unstoppable Engine of Compounding

The real magic isn’t in the single dividend; it’s in the relentless reinvestment of those payments. This process, called compounding, is what turns a trickle into a waterfall over time.

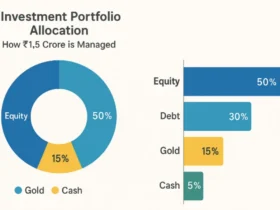

- 2025 Scenario: Suppose you allocated ₹15 lakh to a basket of dividend stocks averaging a 4.8% yield. Year 1: ₹72,000 in dividends. If reinvested, your new capital base is ₹15,72,000. Year 2: A 4.8% dividend generates ₹75,456. Over a decade, this self-fueling engine significantly accelerates your equity growth without you injecting new capital.

A Buffer Against Economic Shifts

Market corrections are inevitable. However, a company that maintains or increases its dividend during a downturn is sending an unequivocal signal of operational resilience and financial fortitude. This income acts as a psychological and financial cushion, allowing you to hold steady while others panic.

Your Personal Inflation-Adjusting Income

Unlike the fixed returns from traditional instruments, dividends from high-quality companies have the potential to grow annually. This means your passive income can potentially outpace inflation, protecting and enhancing your purchasing power year after year.

The 2025 Dividend Detective Kit: Key Metrics to Live By

Before we reveal the top performers, arm yourself with these three essential metrics to separate the true aristocrats from the imposters.

- Dividend Yield: (Annual Dividend per Share / Current Stock Price) x 100. This is your immediate cash-on-cash return. Word of Caution: A yield dramatically higher than its historical average and sector peers can be a classic “value trap,” often indicating underlying business stress.

- Dividend Payout Ratio: (Total Dividends Paid / Net Income) x 100. A sustainable ratio typically lies between 40-80%. A ratio consistently above 90% is a red flag, suggesting the dividend may be funded by debt or dwindling reserves.

- Dividend Growth & Consistency: The hallmark of a champion. Prioritize companies with a long, unbroken track record of not just paying, but increasing their dividends over many years.

The Top 5 Passive Income Powerhouses of 2025

Based on the most recent financial results and dividend declarations, here are five companies that have demonstrated an exceptional commitment to rewarding their shareholders. Disclaimer: This is not a buy recommendation. The market is dynamic. Please consult a SEBI-registered financial advisor before making any investment decisions.

1. Coal India Limited: The Unabashed Cash Distributor

Coal India continues to be the heavyweight champion of dividend yields, leveraging its essential role in India’s energy ecosystem.

- Sector: Metals & Mining

- Latest Dividend (FY25): ₹28.50 per share (Interim Dividend declared for FY25).

- Total Payout (FY25 so far): Approximately ₹1,750 Crore (with a final dividend likely to follow).

- Dividend Yield (as of 30 Aug 2025): ~7.9%.

The 2025 Analysis:

Despite the global push for renewables, Coal India remains critical for base-load power generation in India. Strong production volumes and efficient cost management have ensured massive cash generation. With the government’s strategic focus and the company’s low capex requirements, the high dividend payout policy is expected to persist in the near term.

2. ITC Limited: The Steadfast Performer

ITC has seamlessly navigated its recent demergers and continues to be a bedrock of consistency for dividend investors.

- Sector: FMCG, Hotels (Demerged), Paperboards, Agri-Business

- Latest Dividend (FY25): ₹7.50 per share (First Interim Dividend for FY25).

- Total Payout (FY25 so far): Over ₹950 Crore.

- Dividend Yield (as of 30 Aug 2025): ~3.9%.

The 2025 Analysis:

The demerger has created a more focused FMCG-ITC, which is doubling down on its strong brands and distribution network. The core profitability remains robust, fueling its generous shareholder returns. Its commitment to a high payout ratio makes it a less volatile core holding for any income portfolio.

3. Power Grid Corporation of India Ltd.: The Predictable Powerhouse

As the backbone of the national grid, Power Grid’s regulated business model is a masterclass in predictable cash flow generation.

- Sector: Power – Transmission

- Latest Dividend (FY25): ₹6.00 per share (First Interim Dividend for FY25).

- Total Payout (FY25 so far): Around ₹400 Crore.

- Dividend Yield (as of 30 Aug 2025): ~5.2%.

The 2025 Analysis:

Power Grid’s role in facilitating India’s renewable energy ambition has only grown, ensuring its relevance and growth. The regulated return model provides unparalleled visibility on future revenues and profits, which directly translates into reliable and sustainable dividends. It remains a top-tier defensive stock.

4. Infosys Ltd.: The Tech Giant’s Reliable Return Policy

Infosys continues to balance global growth ambitions with its steadfast commitment to returning excess cash to shareholders.

- Sector: Information Technology

- Latest Dividend (FY25): ₹18.50 per share (Interim Dividend).

- Total Payout (FY25 so far): Approximately ₹770 Crore.

- Dividend Yield (as of 30 Aug 2025): ~2.8%.

The 2025 Analysis:

Despite a evolving global IT landscape, Infosys’s strong balance sheet and cash flow generation allow it to uphold its capital allocation policy. The promise to return 85% of the free cash flow over a 5-year period via dividends and buybacks continues to be a major draw for investors seeking growth and income.

5. Oil and Natural Gas Corporation (ONGC): The Resurgent Dividend Payer

Benefitting from a complex global energy market, ONGC has seen a resurgence in its profitability, leading to generous dividend declarations.

- Sector: Oil & Gas

- Latest Dividend (FY25): ₹9.25 per share (Interim Dividend).

- Total Payout (FY25 so far): Nearly ₹1,160 Crore.

- Dividend Yield (as of 30 Aug 2025): ~6.5%.

The 2025 Analysis:

ONGC stands as a direct beneficiary of India’s strategic focus on energy security. Stronger realizations and stable production have boosted its net realizations, leading to improved cash flows. As a Maharatna PSU, a significant portion of this is shared with shareholders, making it a high-yield option, though inherently linked to volatile global oil prices.

Comparison Table: The 2025 Dividend Leaders (So Far)

| Stock Name | Sector | Latest Dividend (₹/share) | Total FY25 Payout (Crore ₹) | Dividend Yield (Aug ’25) |

|---|---|---|---|---|

| Coal India | Mining | 28.50 | ~1,750 | ~7.9% |

| ONGC | Oil & Gas | 9.25 | ~1,160 | ~6.5% |

| ITC Ltd. | FMCG | 7.50 | ~950 | ~3.9% |

| Infosys Ltd. | IT | 18.50 | ~770 | ~2.8% |

| Power Grid | Utilities | 6.00 | ~400 | ~5.2% |

Building Your Dividend Portfolio in 2025: A Tactical Approach

Buying stocks based on a list is not a strategy. Here’s how to build a resilient income portfolio in the current climate:

- Sector Diversification is Key: Avoid concentration risk. The ideal portfolio has a mix across sectors—FMCG (defensive), IT (growth), Utilities (stable), and Commodities (cyclical).

- Sustainability is Everything: A moderately growing dividend is far superior to a high but risky one. Always analyze the payout ratio and the company’s debt-to-equity profile.

- Automate Reinvestment (DRIP): The single most powerful step you can take. Enroll in a Dividend Reinvestment Plan to automatically compound your holdings without any effort.

- Play the Long Game: Dividend investing is a marathon of decades, not a sprint of quarters. Focus on business quality and long-term dividend history over short-term yield chasing.

Frequently Asked Questions (FAQs)

Q1: How are dividends taxed in 2025?

Dividends are taxed at the recipient’s applicable income tax slab rate. They are classified as “Income from Other Sources” and must be declared in your ITR. There is no TDS deducted by the company for shareholders.

Q2: What’s the difference between a dividend’s record date and ex-date?

The ex-date (ex-dividend date) is the first day the stock trades without the value of its next dividend payment. If you buy on or after the ex-date, you will NOT receive the dividend. The record date is when the company reviews its books to identify all shareholders of record who are eligible for the dividend. You must own the shares before the ex-date to be on the record date list.

Q3: A stock has a very high yield. Should I buy it?

Not necessarily. An abnormally high yield can be a major red flag. It often means the market expects the dividend to be cut, usually because the company’s earnings or cash flow are deteriorating, causing the share price to fall and the yield to spike. Always investigate the reason.

Q4: Can I live off dividend income alone?

It is possible, but it requires significant capital. The goal is to build a portfolio large enough where the annual dividend income meets or exceeds your annual living expenses. This is a primary objective for many retirees.

Q5: Do all companies pay dividends?

No. Many high-growth companies (e.g., new-age tech startups) reinvest 100% of their profits back into the business to fuel expansion. Dividend payers are typically mature, established companies with stable cash flows and fewer high-return investment opportunities.

Q6: How often are dividends paid in India?

It varies. Many large-cap companies have moved to quarterly or half-yearly interim dividends, followed by a final dividend after the annual results. Some still pay only an annual final dividend.

Conclusion: Your Share of the Crores is Waiting

The updated figure of over ₹6,200 Crore in dividends isn’t just a number—it’s proof. Proof that the principles of ownership, patience, and prudent capital allocation are timeless. In the dynamic market of 2025, these dividend-paying giants offer a path to building genuine, self-sustaining wealth.

Your journey begins with research and a single share. Analyze these companies, understand their business models, and see how they fit into your broader financial goals.

Your Call to Action: Open your demat account today. Review your portfolio’s dividend yield. Calculate what portion of your future investments can be allocated to building this powerful passive income stream. Start small, stay consistent, and let the compounding begin.

Disclaimer: This article is for educational and informational purposes only. It is not a substitute for professional investment advice. The stock market is subject to risks. The dividend data mentioned is based on recent declarations and is subject to change. Please consult with a qualified and SEBI-registered financial advisor before making any investment decisions.

1 Comment