Turning a modest monthly investment of ₹5,000 into a fortune of ₹1 crore. It might sound like a fantasy, but with the power of a Systematic Investment Plan (SIP) and the magic of compounding, this dream can become your reality. In India, SIPs have become a go-to choice for millions looking to build wealth steadily, and in this blog post, we’ll unravel how investing just ₹5,000 per month can pave your way to becoming a millionaire.

So, grab a cup of chai, and let’s dive into the world of SIPs and the 5+15+25 formula that can lead you to a crore!

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan, or SIP, is like planting a seed that grows into a mighty tree over time. It’s a method where you invest a fixed amount—say, ₹5,000—every month into a mutual fund of your choice. Instead of trying to predict the stock market’s ups and downs, you commit to regular investments, letting time and compounding work their magic.

Table of Contents

How Does SIP Work?

When you start a SIP, you pick a mutual fund scheme and decide your monthly investment amount. On a fixed date each month, this amount is deducted from your bank account and used to buy units of the mutual fund. The number of units you get depends on the fund’s Net Asset Value (NAV) that day—when the NAV is low, you buy more units; when it’s high, you buy fewer. Over time, this averages out your cost and builds a solid investment base.

Why Choose SIP?

SIPs are a game-changer for wealth creation, especially for beginners. Here’s why:

- Rupee Cost Averaging: You don’t need to stress about market timing. By investing regularly, you buy more units when prices dip and fewer when they rise, smoothing out your average cost.

- Discipline Made Simple: SIPs automate your savings, turning investing into a habit rather than a chore.

- Start Small, Dream Big: With as little as ₹500, you can kick off your SIP journey—₹5,000 is just a sweet spot for bigger goals!

- Compounding Power: Your returns earn returns, creating a snowball effect that grows your wealth exponentially over decades.

Think of SIP as your financial fitness routine—small, consistent efforts lead to impressive results.

The Magic of Compounding: Your Wealth Multiplier

Albert Einstein reportedly called compounding “the eighth wonder of the world,” and for good reason. It’s the secret sauce that turns ₹5,000 monthly investments into ₹1 crore. But how does it work?

Compounding is when your investment earns returns, and those returns start earning returns of their own. Picture this: you invest ₹5,000 every month in a mutual fund with a 12% average annual return. In year one, you earn returns on your contributions. In year two, you earn returns on both your contributions and the previous year’s gains. Over time, this growth accelerates, transforming small sums into substantial wealth.

Here’s a famous quote from Warren Buffett that sums it up perfectly:

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

The longer you let compounding work, the more dramatic the results. That’s why SIPs shine brightest over the long haul—time is your biggest ally.

Can ₹5,000 Per Month Really Make You a Millionaire?

Now, let’s get to the million-rupee question: how does ₹5,000 per month grow into ₹1 crore? To answer this, we’ll crunch some numbers based on realistic assumptions and show you the timeline.

Assumptions

- Monthly Investment: ₹5,000

- Annual Return: 12% (a common average for equity mutual funds in India over the long term)

- Goal: ₹1 crore (₹10,00,000)

The Calculation

To find out how long it takes, we use the SIP future value formula:

FV = P × [{(1 + r)^n – 1} / r]

Where:

- FV = Future Value (₹10,00,000)

- P = Monthly Investment (₹5,000)

- r = Monthly Return Rate (12% annual ÷ 12 = 1% or 0.01, but for precision, we’ll adjust below)

- n = Number of Months

Since mutual fund returns are typically compounded annually, we need the effective monthly rate for a 12% annual return. The precise monthly rate is:

(1 + 0.12)^(1/12) – 1 ≈ 0.009488 (0.9488%)

Now, plug this into the formula:

10,00,000 = 5,000 × [{(1.009488)^n – 1} / 0.009488]

Let’s solve step-by-step:

- 10,00,000 / 5,000 = 2,000

- 2,000 = [(1.009488)^n – 1] / 0.009488

- 2,000 × 0.009488 ≈ 18.976

- (1.009488)^n – 1 ≈ 18.976

- (1.009488)^n ≈ 19.976

- n × ln(1.009488) ≈ ln(19.976)

- n × 0.00944 ≈ 2.994

- n ≈ 317.16 months

Convert months to years: 317.16 ÷ 12 ≈ 26.43 years.

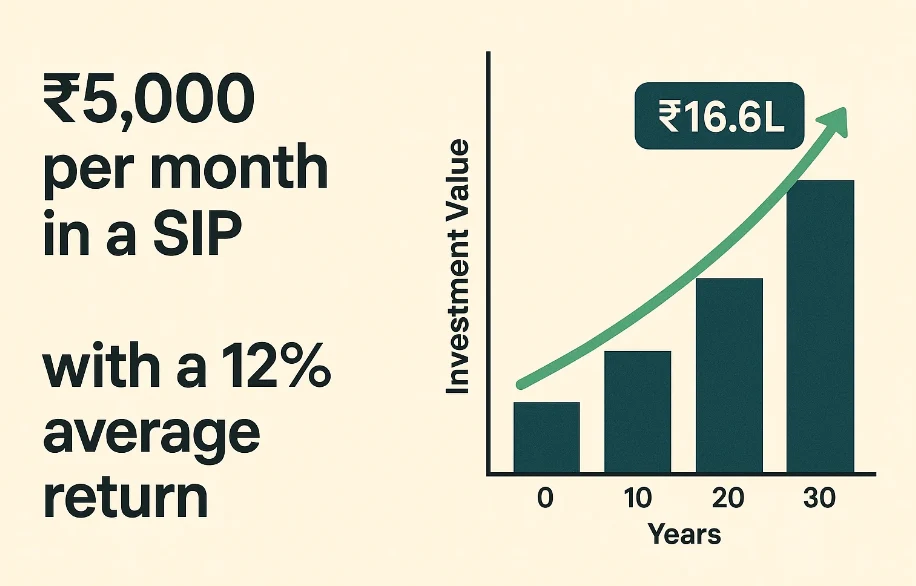

So, investing ₹5,000 per month at a 12% annual return grows to ₹1 crore in approximately 26.5 years. For simplicity, let’s round it to 27 years—a conservative estimate that accounts for market fluctuations.

Growth Over Time: A Snapshot

Here’s a table showing how your ₹5,000 monthly SIP grows at key milestones, assuming a 12% annual return:

| Years | Number of Months | Approximate Value (₹) |

|---|---|---|

| 5 | 60 | 4,01,650 |

| 10 | 120 | 11,10,000 |

| 15 | 180 | 23,57,000 |

| 20 | 240 | 45,56,500 |

| 25 | 300 | 84,30,000 |

| 27 | 324 | 1,07,01,500 |

| 30 | 360 | 1,52,65,000 |

Note: Values are approximate and based on a monthly return rate of 0.9488%. Actual returns may vary due to market conditions.

After 25 years, you’re at ₹84.3 lakhs—close to your goal. By year 27, you cross the ₹1 crore mark with ₹1.07 crore. Keep going to 30 years, and you’re looking at over ₹1.5 crore! This table highlights the exponential growth fueled by compounding.

The 5+15+25 SIP Formula: Breaking Down the Journey

The “5+15+25 SIP Formula” in the title refers to key milestones in your investment journey—5 years, 15 years, and 25 years. These checkpoints show how your wealth multiplies over time:

- After 5 Years: ₹4,01,650

You’ve invested ₹3,00,000 (₹5,000 × 60 months), and returns add another ₹1,01,650. It’s a modest start, but the foundation is set. - After 15 Years: ₹23,57,000

Your total investment is ₹9,00,000, and compounding has boosted it by over ₹14 lakhs. The growth is picking up pace. - After 25 Years: ₹84,30,000

With ₹15,00,000 invested, your returns now dwarf your contributions at over ₹69 lakhs. This is where compounding truly shines.

From 5 to 15 years, your wealth grows nearly sixfold. From 15 to 25, it nearly quadruples again. The longer you stay invested, the faster your money multiplies. To hit ₹1 crore, you just need a couple more years beyond 25—around 27 years total.

This formula isn’t a rigid rule but a way to visualize the power of persistence. It’s about starting small, staying consistent, and letting time do the heavy lifting.

Why Starting Early is Your Superpower

Time is the secret ingredient in the SIP recipe. The earlier you start, the more compounding works in your favor. Let’s compare two investors:

- Investor A: Starts at age 25, invests ₹5,000/month for 30 years until age 55.

Result: ₹1,52,65,000 (from the table). - Investor B: Starts at age 35, invests ₹5,000/month for 20 years until age 55.

Result: ₹45,56,500.

Difference: Over ₹1 crore! Investor A invested ₹6,00,000 more (10 extra years), but the returns are triple Investor B’s—thanks to an extra decade of compounding.

Here are the key advantages of long-term investing:

- Exponential Growth: More years mean more compounding cycles.

- Risk Reduction: Longer horizons help you weather market dips.

- Financial Freedom: Early investing aligns with big goals like retirement or a dream home.

- Habit Building: Regular SIPs instill discipline that pays off lifelong.

Start at 25, and by 52, you’re a crorepati. Delay to 35, and you’ll need to invest more or wait longer. Time is money—literally!

Risks and Realities: What You Need to Know

SIPs are powerful, but they’re not a guaranteed ticket to riches. Here’s what to watch out for:

- Market Volatility: The 12% return is an average—some years might be higher, others lower. Equity funds can be rollercoasters, but long-term trends often smooth them out.

- Fund Choice Matters: A poorly performing fund can derail your goals. Research funds with strong historical returns and reliable management.

- Inflation: ₹1 crore in 27 years won’t buy as much as it does today. Plan for rising costs.

- Consistency: Skipping SIPs can slow your progress, so stay committed.

Here’s a nugget of wisdom from financial expert Benjamin Graham:

“The investor’s chief problem—and even his worst enemy—is likely to be himself.”

Patience and discipline outweigh market risks. Diversify across equity and debt funds, review your portfolio yearly, and stick to your plan.

How to Start Your SIP Journey

Ready to turn ₹5,000 into ₹1 crore? Here’s your step-by-step guide:

- Define Your Goal: Aim for ₹1 crore in 27 years—or adjust based on your timeline.

- Pick a Fund: Opt for equity mutual funds with a solid track record (e.g., large-cap or multi-cap funds). Use platforms like Moneycontrol or consult an advisor.

- Complete KYC: Submit your PAN, Aadhaar, and address proof online or via a fund house.

- Set Up Your SIP: Register online (e.g., via Zerodha Coin, Groww, or the fund’s site) or visit a distributor. Choose ₹5,000/month and a date.

- Automate It: Link your bank account for seamless debits.

- Track Progress: Use apps or statements to monitor growth; tweak as needed.

Beginner Tips

- Start Small: Test the waters with ₹1,000 if ₹5,000 feels steep, then scale up.

- Step-Up SIPs: Increase contributions as your income rises (e.g., 10% annually).

- Stay Long-Term: Avoid cashing out early—let compounding work.

- Learn: Read up on mutual funds (try “The Intelligent Investor” or online blogs).

Conclusion: Your Millionaire Roadmap

Becoming a millionaire doesn’t require a windfall—it’s about small, smart choices. Investing ₹5,000 per month in a SIP, with a 12% average return, can grow to over ₹1 crore in about 27 years. The 5+15+25 formula shows how your wealth snowballs: ₹4 lakhs in 5 years, ₹23 lakhs in 15, and ₹84 lakhs in 25, crossing ₹1 crore soon after.

The secret? Start early, stay invested, and trust compounding. As financial guru Dave Ramsey says:

“Wealth is not an accident—it’s a choice.”

Take that choice today. Open your SIP account, commit to ₹5,000 a month, and watch your financial future transform. Your crore awaits!

FAQs: Your SIP Questions Answered

Q: What’s the minimum amount to start a SIP?

A: Many funds let you begin with ₹500/month, though ₹5,000 is ideal for bigger goals like ₹1 crore.

Q: Can I increase my SIP amount over time?

A: Absolutely! Use the “step-up SIP” option or manually adjust as your income grows.

Q: What if I miss a few SIP payments?

A: No big deal over 27 years—just resume ASAP. Consistency matters more than perfection.

Q: How do I choose the right mutual fund?

A: Look at 5-10 year returns, expense ratios, and fund manager reputation. Diversify for safety.

Q: Is SIP better than a lump sum?

A: For most, yes—SIPs reduce timing risk and suit regular savers. Lump sums work if you’ve got cash and a bullish market.

Leave a Reply