Have you ever dreamed of growing your wealth but felt held back by a lack of funds? You’re not alone. Many people believe that investing is only for the wealthy, but that’s simply not true. With as little as ₹5,000, you can embark on your investment journey and watch your money grow over time. In this comprehensive guide, we’ll demystify the world of investing and show you how to make the most of your hard-earned rupees. Whether you’re a college student, a young professional, or someone looking to secure their financial future, this blog is for you. So, let’s dive in and discover how you can start investing with just ₹5,000!

Investing might sound intimidating, especially when you’re starting with a small amount. But here’s the good news: even a modest sum like ₹5,000 can be the foundation of something big. As Warren Buffett famously said, “Do not save what is left after spending, but spend what is left after saving.” This guide will walk you through everything you need to know—setting goals, understanding risks, exploring investment options, and avoiding common pitfalls—all tailored for a beginner with a budget of ₹5,000.

Table of Contents

Why Start Investing with ₹5,000?

Before we get into the how-to, let’s talk about the why. Investing is about making your money work for you instead of letting it sit idle. With ₹5,000, you’re not going to become a millionaire overnight, but you can plant the seed for future growth. Thanks to the power of compounding, even small investments can grow significantly over time. The key? Starting early and staying consistent.

Imagine this: You’re 25 years old, just starting your career, and you’ve managed to save ₹5,000. You invest it wisely, and over the years, it grows into a substantial sum—enough to fund a dream vacation, a down payment on a house, or even a comfortable retirement. That’s the magic of investing, and it’s within your reach.

In this blog, we’ll cover:

- Setting clear investment goals

- Understanding your risk tolerance

- Exploring investment options for ₹5,000

- The power of diversification

- A step-by-step guide to investing wisely

- Common mistakes to avoid

- Answers to frequently asked questions

Let’s get started!

1. Setting Your Investment Goals

Every successful investment journey begins with a clear destination. Why are you investing? Your goals will shape every decision you make, from the type of investments you choose to how long you stay invested.

Why Goals Matter

Goals give your investments purpose. Are you saving for a short-term need, like a new gadget or a vacation? Or do you have long-term dreams, such as buying a house or retiring early? With ₹5,000, your options might be limited at first, but having a goal keeps you focused.

Questions to Ask Yourself

Here’s a quick list to help you define your investment goals:

- What do I want to achieve? (e.g., financial security, a big purchase)

- When do I need the money? (e.g., in 2 years, 10 years, or 30 years)

- How much can I afford to invest regularly? (Even ₹500 a month adds up!)

For example, if you’re aiming to build an emergency fund, you might lean toward safer options. If you’re thinking long-term, like wealth creation, you might take on more risk for higher returns.

A Famous Perspective

As Benjamin Franklin once said, “An investment in knowledge pays the best interest.” Knowing your goals is the first step to investing wisely.

2. Understanding Your Risk Tolerance

Investing always involves some level of risk. Your risk tolerance is how much uncertainty you’re willing to handle. It’s a personal choice and depends on factors like your age, income, financial responsibilities, and comfort level with market ups and downs.

Risk and Reward

Generally, the higher the risk, the higher the potential reward—but also the greater the chance of losing money. If you’re young and have time to recover from market dips, you might be okay with riskier investments. If you’re more cautious or need the money soon, low-risk options might suit you better.

Risk Levels Table

Here’s a simple breakdown of investment types based on risk:

| Risk Level | Investment Type | Suitable For |

|---|---|---|

| Low | Fixed Deposits, Recurring Deposits | Conservative investors, short-term goals |

| Medium | Balanced Mutual Funds, Blue-chip Stocks | Moderate investors, medium-term goals |

| High | Equity Mutual Funds, Small-cap Stocks | Aggressive investors, long-term goals |

With ₹5,000, you’ll want to balance risk and reward carefully. Let’s explore your options next.

3. Exploring Investment Options for ₹5,000

You might think ₹5,000 limits your choices, but there are plenty of ways to get started. Here are some beginner-friendly options:

Mutual Funds (via SIPs)

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. A Systematic Investment Plan (SIP) lets you invest small amounts regularly—perfect for a ₹5,000 budget.

- Pros: Diversification, professional management, low entry point (some SIPs start at ₹500).

- Cons: Market risk, management fees.

- How to Start: Use apps like Groww or Zerodha to open an account and pick a fund.

Stocks

Buying individual stocks means owning a tiny piece of a company. With ₹5,000, you can buy shares of affordable, established companies (blue-chip stocks) or even dividend-paying stocks for steady income.

- Pros: High growth potential, ownership in companies.

- Cons: High risk, requires research.

- Tip: Start with a demat account and focus on companies you understand.

Fixed Deposits (FDs)

FDs are bank investments where you lock in your money for a fixed period at a guaranteed interest rate.

- Pros: Safe, predictable returns (around 5-7% annually).

- Cons: Low returns, money is locked in.

- Good For: Risk-averse investors.

Recurring Deposits (RDs)

Similar to FDs, RDs let you save a fixed amount monthly, earning interest over time.

- Pros: Encourages saving, low risk.

- Cons: Limited growth potential.

- How to Start: Open an RD with your bank.

Gold Investments

Gold is a traditional favorite in India. With ₹5,000, you can buy Gold ETFs (exchange-traded funds) or Sovereign Gold Bonds.

- Pros: Hedge against inflation, easy to start.

- Cons: Prices can fluctuate, no regular income.

- Where to Buy: Through a demat account or government schemes.

Peer-to-Peer (P2P) Lending

P2P platforms connect you with borrowers, letting you lend small amounts and earn interest.

- Pros: Higher returns (8-12% or more).

- Cons: Risk of borrower default, less regulated.

- Caution: Research platforms like LenDenClub carefully.

Each option has its strengths. The best choice depends on your goals and risk tolerance.

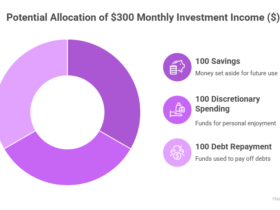

4. The Power of Diversification

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” That’s diversification in a nutshell. Even with ₹5,000, spreading your money across different investments reduces risk.

Why It Works

If one investment underperforms, others might balance it out. For example, if stocks drop, your fixed deposit still earns interest. Here’s a sample portfolio for ₹5,000:

- 50% (₹2,500): Mutual Funds (SIP)

- 30% (₹1,500): Blue-chip Stocks

- 20% (₹1,000): Fixed Deposit

Visualizing Growth

Imagine investing ₹5,000 and adding ₹500 monthly. Here’s how it might grow (assuming average returns):

| Investment | Annual Return | Value in 5 Years | Value in 10 Years |

|---|---|---|---|

| Mutual Funds | 12% | ₹11,500 | ₹23,000 |

| Fixed Deposit | 6% | ₹8,500 | ₹12,000 |

| Diversified Mix | 10% | ₹10,500 | ₹19,500 |

Diversification keeps your money safer while still growing.

5. Starting Small: How to Invest ₹5,000 Wisely

Ready to take the plunge? Here’s a step-by-step guide:

Step 1: Set Clear Goals

Define what you’re investing for and when you’ll need the money.

Step 2: Assess Your Risk Tolerance

Use the table above to gauge how much risk you’re comfortable with.

Step 3: Choose Your Investments

Pick 1-2 options that align with your goals. For example:

- ₹3,000 in a mutual fund SIP

- ₹2,000 in a fixed deposit

Step 4: Open Necessary Accounts

- Demat Account: For stocks and mutual funds (try Zerodha or Upstox).

- Bank Account: For FDs or RDs.

Step 5: Start Investing

Make your first investment. Apps like Paytm Money make it easy to start an SIP with ₹500.

Step 6: Monitor and Adjust

Check your investments quarterly. Adjust if your goals or market conditions change.

Pro Tip

Start small, but aim to invest regularly. Even ₹500 a month can grow into lakhs over decades.

6. Common Mistakes to Avoid

Beginners often stumble, but you don’t have to. Watch out for these pitfalls:

- Investing Without a Plan: Always know your “why” before you invest.

- Chasing High Returns: If it sounds too good to be true, it probably is.

- Not Diversifying: Spread your ₹5,000 to minimize risk.

- Panic Selling: Market dips are normal—don’t sell in fear.

- Ignoring Fees: High charges can eat into your returns. Compare options.

7. FAQs on Investing with Small Amounts

Got questions? We’ve got answers!

Q: Can I really start investing with just ₹5,000?

A: Yes! Options like mutual funds, stocks, and gold ETFs let you start small. The key is consistency.

Q: What’s the best investment for beginners?

A: Mutual funds (via SIPs) are great—they’re diversified, managed by experts, and affordable.

Q: How do I choose the right mutual fund?

A: Look for a strong track record, low expense ratio (under 1%), and alignment with your goals.

Q: Is it safe to invest in stocks with ₹5,000?

A: Stocks carry risk, but sticking to established companies and diversifying reduces it.

Q: How often should I review my investments?

A: Check every 3-6 months or after major market shifts.

Real-Life Inspiration

Meet Priya, a 28-year-old teacher from Mumbai. Five years ago, she started a mutual fund SIP with ₹5,000. She added ₹1,000 monthly, and today, her portfolio is worth ₹50,000—enough to kickstart her dream of owning a home. Small steps, big results!

Wrapping Up: Your First Step to Financial Freedom

Investing with ₹5,000 isn’t about getting rich quick—it’s about starting smart. As the Chinese proverb says, “The journey of a thousand miles begins with a single step.” With this guide, you’ve got the tools to take that step. Set your goals, pick your investments, diversify, and stay patient. Your future self will thank you.

Ready to begin? Share your plans or questions in the comments below—we’d love to hear from you! Start today, stay informed, and watch your ₹5,000 grow into something amazing.

Leave a Reply