Understanding Gold Investments: A Timeless Asset

Gold isn’t just jewelry or a wedding gift—it’s a powerful investment tool that’s stood the test of time. Whether you’re buying gold bars, trading ETFs, or investing in sovereign bonds, gold offers a unique mix of security and potential growth. Let’s explore the ways you can invest in this precious metal:

- Physical Gold: Think gold coins, bars, or jewelry. It’s tangible, often cherished, but comes with storage hassles and security concerns.

- Gold Exchange-Traded Funds (ETFs): These are like mutual funds that track gold prices and trade on stock exchanges—no need to store anything yourself!

- Sovereign Gold Bonds (SGBs): Backed by the Indian government, these bonds let you invest in gold without holding it physically, plus you earn a small interest rate (around 2.5% annually).

Table of Contents

Why Gold Shines

Gold has a knack for thriving when the world gets chaotic. During the 2008 financial crisis, as stock markets tanked, gold prices soared. More recently, amidst the pandemic’s market rollercoaster, gold jumped 34% in a single year, according to data from Groww. Over the long haul, it’s delivered steady returns—about 10.7% over five years, 11.9% over 15 years. That’s not bad for a “safe haven” asset!

What Moves Gold Prices?

Several factors keep gold prices dancing:

- Inflation: When money loses value, gold often holds steady or climbs.

- Geopolitical Tensions: Wars or crises send investors flocking to gold.

- Supply and Demand: Mining output and demand from big buyers like India and China sway the market.

Pros and Cons of Gold

- Advantages:

- Protects against inflation

- Easy to buy and sell (high liquidity)

- A cultural favorite in India

- Disadvantages:

- No regular income (unlike bonds or FDs)

- Prices can swing wildly in the short term

Gold’s allure lies in its ability to hedge against uncertainty, but it’s not a one-size-fits-all solution. Let’s see how it compares to other options.

Fixed Deposits (FDs): The Safety Net

Fixed deposits are the comfort food of investments—simple, reliable, and loved by millions, especially in India. You deposit a lump sum with a bank or NBFC for a set period, and they reward you with a fixed interest rate. Here’s the lowdown:

How FDs Work

Choose your amount, pick a tenure (from a week to a decade), and lock in your rate. Current FD rates in India hover between 5% and 7% per year—senior citizens might snag a bit more, say 7.5%. For example, ₹1 lakh in a 5-year FD at 6.5% grows to about ₹1.37 lakh. Predictable? Yes. Exciting? Not so much.

Why People Love FDs

- Guaranteed Returns: No surprises here—you get exactly what’s promised.

- Low Risk: Insured up to ₹5 lakh by the DICGC, FDs are as safe as it gets.

- Flexible Options: Short-term or long-term, there’s an FD for every goal.

The Catch

- Modest Gains: Returns often lag behind inflation, shrinking your real wealth over time.

- Locked In: Need cash early? You’ll face penalties or lower interest.

- Tax Bite: Interest is taxed as income, which can sting high earners.

FDs are perfect for parking emergency funds or saving for a near-term goal, like a vacation. But for beating inflation or building serious wealth? You might need something with more punch.

Bonds: Steady Income with a Twist

Bonds are like lending money to a friend who promises to pay you back with interest—except the “friend” is a government or company. They strike a balance between safety and reward, making them a versatile pick.

Types of Bonds

- Government Bonds: Think Indian G-Secs—super safe, with yields around 6-7%.

- Corporate Bonds: Issued by companies, these can offer 8-10% or more, but the risk depends on the issuer’s creditworthiness.

How Bonds Work

You buy a bond, collect interest (called coupons) periodically, and get your principal back when it matures. If interest rates shift, bond prices wiggle—sell early, and you might gain or lose. Many bonds also trade on secondary markets, adding liquidity.

Why Bonds Matter

- Regular Income: Great for retirees or anyone craving cash flow.

- Variety: From ultra-safe to higher-yield options, there’s something for everyone.

- Moderate Risk: Government bonds are low-risk; corporate ones vary.

Watch Out

- Interest Rate Risk: Rising rates can drop bond prices.

- Credit Risk: Companies might default, especially lower-rated ones.

Bonds are a solid choice if you want stability with a bit more juice than FDs. But how do they stack up against gold’s glitter?

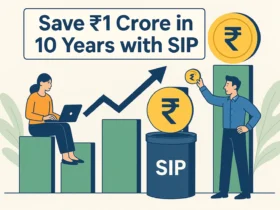

Mutual Funds: The Growth Powerhouse

Mutual funds are like a financial buffet—professional managers mix stocks, bonds, or both into a diversified dish for you to savor. They promise higher returns but demand you stomach some risk.

Types of Mutual Funds

- Equity Funds: Stock-heavy, aiming for 12-15% long-term returns. Think rollercoaster rides!

- Debt Funds: Bond-focused, offering 7-9% with less drama.

- Hybrid Funds: A blend of both, balancing growth and safety.

How They Work

You invest, the fund manager builds a portfolio, and your returns depend on how those assets perform. Equity funds shine over decades (think 12-15% CAGR in India), while debt funds offer steadier gains.

Why Choose Mutual Funds?

- Diversification: Spreads risk across many assets.

- Liquidity: Redeem anytime (watch for exit loads).

- Professional Management: Experts handle the heavy lifting.

The Risks

- Market Swings: Equity funds can dip hard in bad times.

- Fees: Management costs nibble at your returns.

- Tax Complexity: Varies by fund type and holding period.

Mutual funds are your ticket to growth—ideal for long-term goals like retirement or your kid’s education. But are they worth the risk compared to gold’s steady glow?

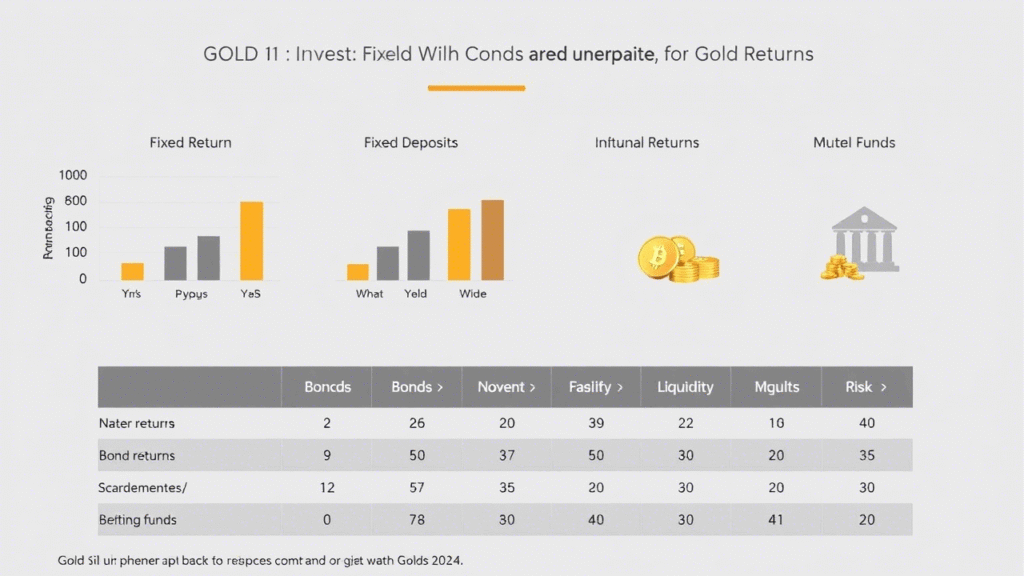

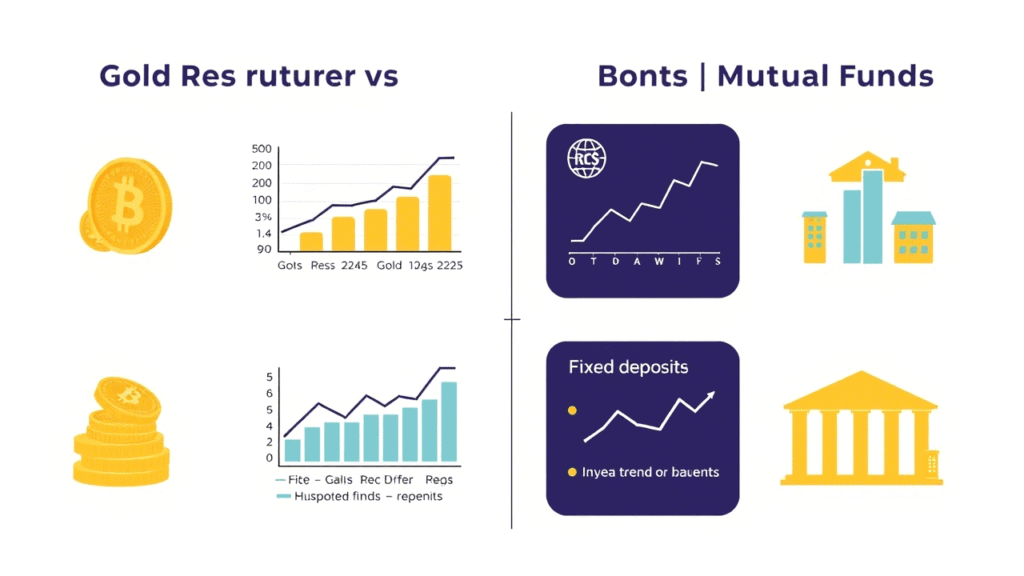

Gold vs. FDs vs. Bonds vs. Mutual Funds: The Showdown

Let’s put these contenders head-to-head across five key metrics. Numbers are approximate, based on historical trends and current data, but remember: past performance isn’t a crystal ball!

| Parameter | Gold | Fixed Deposits | Bonds | Mutual Funds |

|---|---|---|---|---|

| Returns | 10-12% (long-term) | 5-7% | 6-10% | 7-15%+ (varies) |

| Risk | Moderate | Low | Low to Moderate | Low to High |

| Liquidity | High | Low to Moderate | Moderate | High |

| Taxation | Capital gains (20% with indexation) | Interest taxed as income | Interest taxed, capital gains | Varies (LTCG, STCG) |

| Suitability | Inflation hedge, long-term | Safety, short-term | Income, stability | Growth, diversification |

Breaking It Down

- Returns: Mutual funds (especially equity) lead the pack, followed by gold and bonds. FDs lag but deliver certainty.

- Risk: FDs win on safety; mutual funds, especially equity, are the wild card. Gold and bonds sit in the middle.

- Liquidity: Gold and mutual funds are quick to cash out; FDs and bonds might tie you up.

- Taxation: Gold’s long-term gains get indexation benefits. FD interest hits your tax slab hard. Bonds and mutual funds vary—equity funds enjoy favorable LTCG tax after a year.

- Suitability: Gold fights inflation, FDs offer peace of mind, bonds pay steadily, and mutual funds chase growth.

A Real-Life Example

Meet Amit and Priya, each with ₹1 lakh to invest five years ago:

- Amit picks gold: At 10% annual growth, his ₹1 lakh becomes ₹1.61 lakh.

- Priya chooses an FD: At 6%, her ₹1 lakh grows to ₹1.34 lakh.

- What if Priya went mutual funds? An equity fund at 12% could’ve turned her ₹1 lakh into ₹1.76 lakh—but with bumps along the way.

This snapshot shows how risk and reward play out. Gold outpaces FDs, but mutual funds could’ve topped both—if Priya braved the volatility.

Expert Voices: What the Pros Say

Financial gurus weigh in to guide us:

- From Angel One: “Gold hedges against inflation & uncertainty with fluctuating prices, while FDs offer stable, low-risk returns suited for conservative investors.”

- From Groww’s Advisor: “An investor’s portfolio should be diversified using both gold and mutual funds. Investors should refrain from making investment decisions emotionally during a crisis.”

- Famous Quote: “Don’t put all your eggs in one basket,” says the timeless investing adage—and it rings true here.

Experts agree: diversification is king. Mixing these assets could smooth out risks while boosting returns.

How to Choose the Right Investment for You

So, which option wins? It’s not about “best”—it’s about “best for you.” Ask yourself:

- Risk Tolerance: Can you sleep with market dips, or do you crave certainty?

- Time Horizon: Saving for next year or 20 years from now?

- Goals: Need income, growth, or inflation protection?

- Cash Needs: How soon might you need the money?

A young professional might lean toward mutual funds for growth, while a retiree might mix bonds and FDs for income and safety. Gold? It’s a wildcard for everyone, hedging against stormy times.

FAQs: Your Burning Questions Answered

- Is gold a better investment than fixed deposits?

Gold often outpaces FDs over time (10-12% vs. 5-7%), but it’s riskier and volatile. FDs are better for short-term safety. - How do mutual funds compare to gold for returns?

Equity mutual funds can hit 12-15%, beating gold’s 10-12% long-term average. But they’re tied to market ups and downs. - Are bonds safer than gold?

Government bonds are safer, with guaranteed returns. Gold’s price swings make it riskier, though it’s more liquid. - Can I lose money in mutual funds?

Yes, especially in equity funds during market slumps. Long-term holding and diversification reduce the odds. - Should I invest all my money in gold?

No! Gold’s great for diversification, but it doesn’t pay dividends or interest. Spread your bets.

Conclusion: Crafting Your Perfect Portfolio

Investing isn’t a one-horse race—it’s a marathon with multiple lanes. Gold dazzles as an inflation shield and crisis buddy, delivering 10-12% over time. Fixed deposits offer a cozy 5-7% with zero stress. Bonds blend income and moderate risk at 6-10%, while mutual funds flex their muscles with 7-15% potential—if you can ride the waves.

The real winner? A diversified portfolio tailored to you. Blend gold’s stability, FDs’ safety, bonds’ steady payouts, and mutual funds’ growth engine. That way, you’re not betting the farm on one option—you’re building a fortress of wealth, brick by brick.

Ready to invest? Start small, research deep, and let your goals light the way. Your financial future is waiting!

Leave a Reply