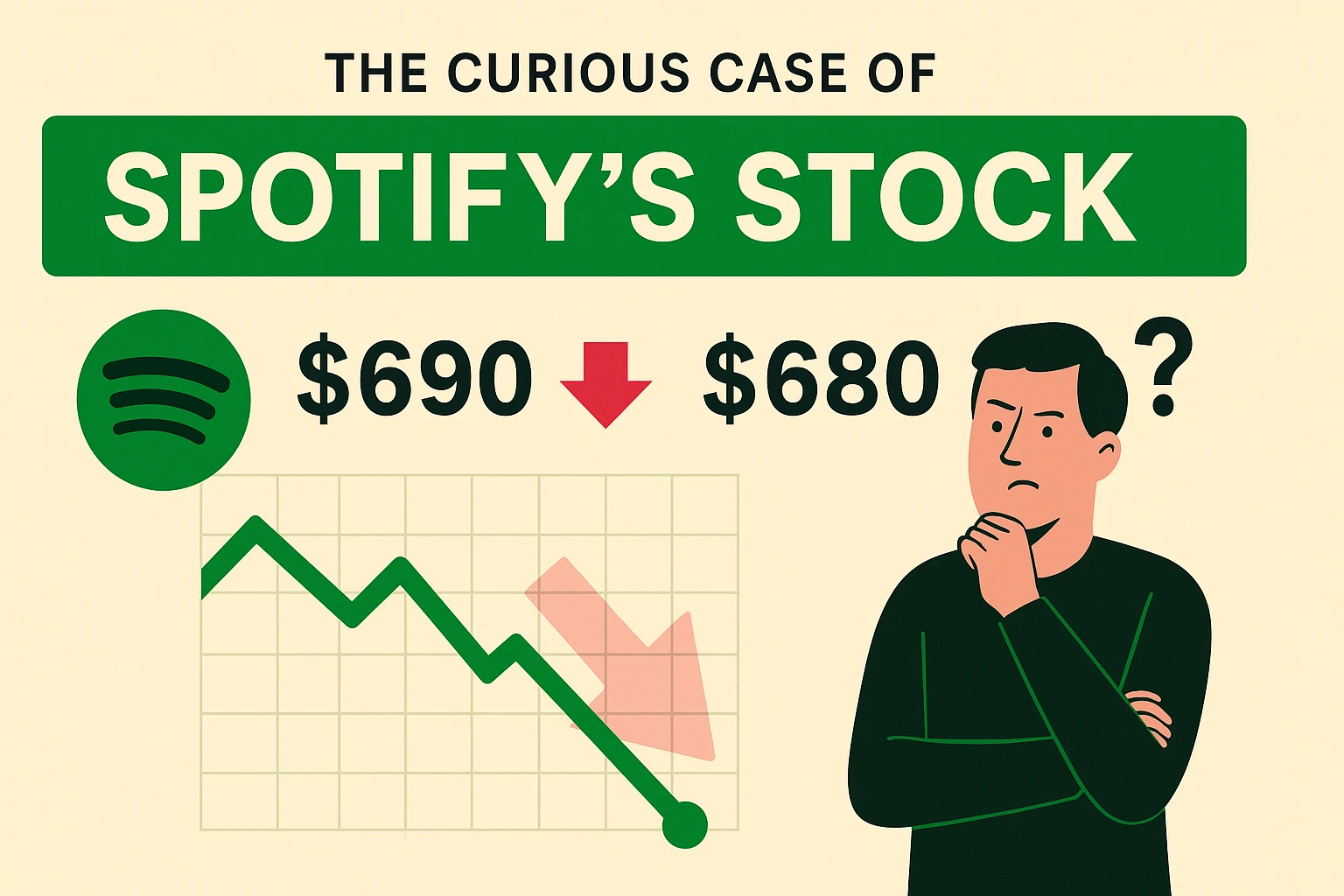

Spotify Technology S.A. (NYSE: SPOT) has become a household name, transforming how we listen to music, podcasts, and more. With its innovative freemium model and global reach, it’s no surprise that investors keep a close eye on its stock performance. Recently, there’s been chatter about Spotify’s stock price potentially moving from its current level of $690 to $680—a slight dip that has sparked curiosity. Why are investors making this prediction? Is it a sign of caution, a market adjustment, or something else entirely?

The Curious Case of Spotify’s Stock: Setting the Stage

Spotify’s journey from a Swedish startup to a global audio streaming powerhouse is nothing short of remarkable. As of April 2025, its stock has been a hot topic, with investors speculating about its next move. The prediction that Spotify’s stock will drop from $690 to $680 might seem counterintuitive at first—after all, the company has been posting impressive growth numbers. But stock prices aren’t just about growth; they’re about perception, market dynamics, and a dash of psychology.

Table of Contents

So, what’s driving this subtle bearish outlook? To answer that, we need to peel back the layers of Spotify’s business, its market environment, and the tools investors use to make such calls. Whether you’re a seasoned investor or just curious about the stock market, this exploration will shed light on why $680 is on the radar.

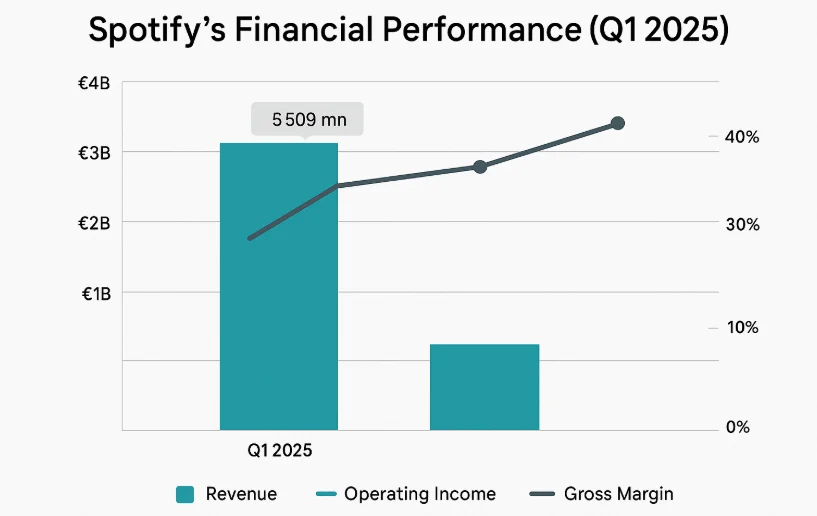

Spotify’s Financial Performance: A Double-Edged Sword

Spotify’s recent earnings paint a picture of a company firing on all cylinders—yet with some cracks that might explain investor caution.

The Bright Side: Growth and Profitability

In its Q1 2025 earnings report, Spotify showcased numbers that would make any investor smile:

- Subscribers Up: Premium subscribers grew 12% year-over-year to 268 million.

- Revenue Surge: Total revenue hit €4.2 billion, a 15% increase from the previous year.

- Profit Milestone: Operating income soared to €509 million, reflecting a shift toward profitability.

These figures signal that Spotify isn’t just growing—it’s maturing. The company’s ability to boost its gross margin by 400 basis points to 31.6% shows it’s getting smarter about costs, a big win for a business once criticized for burning cash.

“Spotify’s Q1 2025 results demonstrate a company hitting its stride, balancing growth with profitability in a way that’s rare for tech giants,” says TechCrunch analyst Sarah Miles.

The Flip Side: Valuation and Expectations

But here’s the catch: Spotify’s stock is trading at a lofty 51 times its consensus 2025 earnings per share (EPS) of $10.68. That’s a high price-to-earnings (P/E) ratio, suggesting the stock might be overvalued. When a company’s price outpaces its fundamentals, investors start to get jittery. A drop from $690 to $680 could reflect a correction—a recalibration to a level more in line with perceived value.

Analyst Insights: What the Experts Are Saying

Wall Street analysts are a key piece of this puzzle. Their forecasts often guide investor sentiment, and for Spotify, the picture is mixed.

Price Targets and Predictions

- TipRanks Consensus: 27 analysts peg the average 12-month price target at $661.25, with a high of $740 and a low of $457.

- WallStreetZen Forecast: 23 analysts suggest $619.30 by April 2026, ranging from $416 to $740.

Notice something? These targets are below $690, hinting that some analysts see downside risk. The $680 prediction could be a midpoint—a cautious step down from the current price, aligning with these broader forecasts.

Analyst Sentiment

The consensus rating is “Moderate Buy,” with 18 buy, 9 hold, and 0 sell ratings. While bullish overall, the lack of unanimous enthusiasm might signal tempered expectations. Analysts love Spotify’s growth story but are wary of its premium valuation and competitive pressures.

“Spotify’s leadership in streaming is undeniable, but its high P/E ratio leaves little room for error,” notes Barron’s analyst Mark Thompson.

Market Trends and Technical Analysis: Reading the Charts

Stock prices don’t move in a vacuum—they’re influenced by market trends and technical signals. Let’s break it down.

Broader Market Context

The tech sector has been volatile in 2025, with macroeconomic factors like interest rate hikes and inflation concerns weighing on growth stocks. Spotify, as a high-valuation tech play, isn’t immune. If investors expect a market correction, a slight dip to $680 could be a preemptive adjustment.

Technical Indicators

Technical analysis—studying price patterns and indicators—offers clues about short-term moves:

- Resistance at $690: If $690 is a resistance level (a price the stock struggles to break above), a pullback to a support level like $680 makes sense.

- Moving Averages: Spotify’s stock is above its 50-day and 200-day moving averages, a bullish sign. But overbought conditions could trigger a minor retreat.

While no web result explicitly ties $680 to a technical pattern, the prediction could stem from traders eyeing these levels.

Competitive Pressures: The Streaming Wars Heat Up

Spotify dominates audio streaming, but it’s not alone. Competitors like Apple Music, Amazon Music, and YouTube Music are nipping at its heels.

Rising Costs and Royalties

Music publishers and content creators have been pushing for higher royalties, which could squeeze Spotify’s margins. One web source notes:

“Increased royalty demands could raise Spotify’s costs by 5-10% over the next two years,” warns Forbes contributor Emily Carter.

Higher costs without matching revenue growth might dampen investor enthusiasm, nudging the stock lower.

Subscriber Growth Concerns

Spotify’s 12% subscriber growth is stellar, but what if it slows? Mature markets like North America and Europe are nearing saturation, and competitors are vying for emerging markets. A perceived growth plateau could justify a $680 forecast.

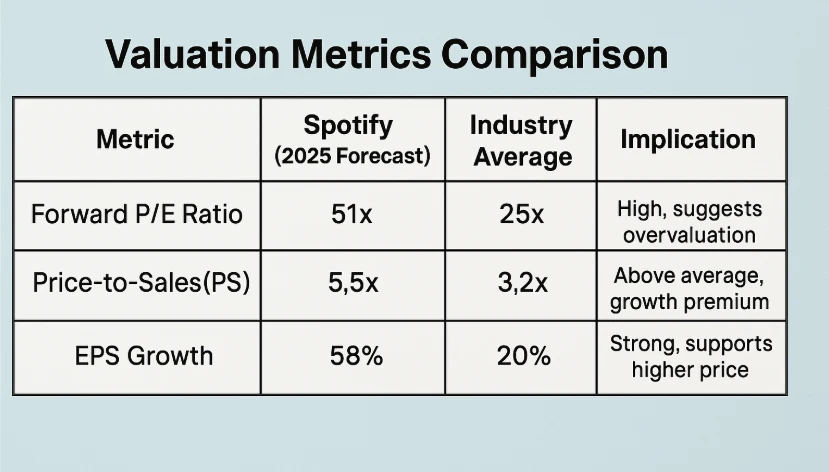

Valuation Debate: Is Spotify Overpriced?

Let’s dig into the numbers with a table comparing Spotify’s valuation metrics:

| Metric | Spotify (2025 Forecast) | Industry Average | Implication |

|---|---|---|---|

| Forward P/E Ratio | 51x | 25x | High, suggests overvaluation |

| Price-to-Sales (P/S) | 5.5x | 3.2x | Above average, growth premium |

| EPS Growth | 58% | 20% | Strong, supports higher price |

Spotify’s high P/E ratio is a red flag for value investors, but its explosive EPS growth could justify it—if it delivers. A drop to $680 might reflect a compromise: optimism tempered by valuation reality.

Key Factors Behind the $680 Prediction

Here’s a quick rundown of why investors might see $680 as Spotify’s next stop:

- Overvaluation Concerns: A 51x P/E ratio raises eyebrows, prompting a slight correction.

- Competitive Risks: Rising costs and rival pressure could cap upside potential.

- Market Sentiment: Broader tech sector jitters might drag Spotify down modestly.

- Technical Signals: Resistance at $690 could lead to a retreat to $680 support.

The Bullish Counterpoint: Why Spotify Could Defy the Dip

Not everyone’s bearish. Spotify’s strengths could push it past $690:

- Podcast Power: Investments in exclusive content (think Joe Rogan) boost engagement.

- Global Expansion: New markets like India and Africa offer untapped growth.

- Profit Momentum: Consistent profitability reassures investors.

If these factors dominate, the $680 prediction might be too conservative. But for now, caution seems to prevail.

FAQ: Your Burning Questions Answered

Q: What’s Spotify’s current stock price?

A: As of April 2025, it’s around $690, though prices fluctuate daily. Check Yahoo Finance for the latest.

Q: Why predict a drop to $680 instead of a rise?

A: Investors might see the current $690 as overvalued, factoring in risks like competition and high valuation.

Q: How reliable are these predictions?

A: They’re educated guesses based on data and trends, but markets are unpredictable. Always do your own research.

Q: Should I sell if it hits $680?

A: Depends on your goals. A small dip might not warrant action for long-term holders, but consult a financial advisor.

Q: What’s Spotify’s biggest risk?

A: Competition and rising content costs could challenge its growth and profitability.

Conclusion: Spotify at a Crossroads

So, why are investors predicting Spotify’s stock will fall from $690 to $680? It’s a blend of valuation concerns, competitive pressures, and market dynamics. While Spotify’s growth story remains compelling, its high price tag and external risks suggest a minor pullback could be on the horizon. Yet, with its innovation and market leadership, this dip might just be a speed bump on a longer upward journey.

Ready to dive deeper into Spotify’s stock or other investment opportunities? Subscribe to our blog for more insights, and share your thoughts in the comments below. Investing is a marathon, not a sprint—stay informed, stay curious, and always do your homework.

Leave a Reply