What Are Mutual Funds, Anyway?

Think of a mutual fund as a giant potluck dinner. Everyone brings something to the table—your $100, your neighbor’s $500, your colleague’s $1,000—and together, you create a feast. In this case, the “feast” is a diversified portfolio of stocks, bonds, or other assets, managed by a professional chef (aka the fund manager) who knows how to whip up a tasty financial dish. The beauty of mutual funds is that they spread your money across many investments, reducing the risk that comes with putting all your eggs in one basket.

Table of Contents

Why do people love mutual funds? Three big reasons:

- Diversification: If one stock tanks, others might rise to balance it out.

- Professional Management: You don’t need to be a Wall Street wizard; the experts handle it.

- Accessibility: You can start with as little as a few bucks, making it beginner-friendly.

But here’s where our main question sneaks in: how long does it take for your investment to double in this financial potluck? To answer that, we need to understand how mutual funds grow—or, more specifically, how they generate returns.

How Do Mutual Funds Grow Your Money?

When you invest in a mutual fund, your money doesn’t just sit there collecting dust. It’s working hard, earning returns through two primary channels:

- Capital Gains: This happens when the fund sells an asset—like a stock—for more than it paid. Buy at $50, sell at $70, and boom—$20 profit per share.

- Dividends and Interest: Many stocks pay dividends, and bonds pay interest. These payouts get funneled back to you, the investor.

Here’s the catch: mutual fund returns aren’t like a savings account with a predictable 2% interest rate. They’re more like a roller coaster—thrilling highs, stomach-dropping lows, and everything in between. One year, your fund might soar by 15%; the next, it could dip into the red. This variability is why the question “in how many days does the money double?” doesn’t have a straightforward answer. It hinges on one critical factor: the rate of return.

The Dream of Doubling Your Money

Doubling your money is the holy grail of investing. Picture turning $5,000 into $10,000 or $50,000 into $100,000—it’s a milestone that feels both achievable and exhilarating. In investing, how fast this happens depends on how much your money grows each year. The higher the return, the quicker the doubling. Simple, right?

Not quite. With mutual funds, returns fluctuate, and that throws a wrench into the timeline. But don’t worry—we’ve got a nifty tool up our sleeve to estimate it: the Rule of 72. Before we get there, let’s explore what affects this doubling timeline.

What Influences the Doubling Time?

Your mutual fund’s journey to doubling isn’t a straight highway; it’s a winding road with twists, turns, and a few speed bumps. Here are the key factors steering the course:

- Rate of Return: The star of the show. A fund averaging 10% annually doubles faster than one at 5%. But higher returns often mean higher risk—more on that later.

- Fees and Expenses: Every mutual fund charges a fee (called the expense ratio) for management. A 1% fee might not sound like much, but over time, it nibbles away at your returns.

- Market Conditions: Bull markets (when prices rise) can turbocharge growth; bear markets (when prices fall) can stall it. Economic factors like interest rates or global events play a role too.

- Time Horizon: Patience is a virtue here. The longer you stay invested, the more time your money has to compound and grow.

- Reinvestment: If you reinvest dividends and gains, your money snowballs faster thanks to the magic of compounding.

Because of these variables, doubling your money in a mutual fund isn’t a fixed date you can circle on your calendar. It’s an estimate, a ballpark figure we can calculate with some clever math.

Enter the Rule of 72: Your Doubling Calculator

Say hello to the Rule of 72—a quick, easy way to estimate how long it takes for your investment to double based on a steady annual return. Here’s how it works:

- Take the number 72.

- Divide it by the annual rate of return (in percent).

- The result is the approximate number of years it takes to double your money.

Since our question asks for days, we’ll convert years to days by multiplying by 365. Let’s try a few examples:

- 5% Return: 72 ÷ 5 = 14.4 years. That’s 14.4 × 365 = 5,256 days.

- 8% Return: 72 ÷ 8 = 9 years. That’s 9 × 365 = 3,285 days.

- 12% Return: 72 ÷ 12 = 6 years. That’s 6 × 365 = 2,190 days.

Here’s a handy table to visualize it:

| Annual Return (%) | Doubling Time (Years) | Doubling Time (Days) |

|---|---|---|

| 4 | 18.0 | 6,570 |

| 6 | 12.0 | 4,380 |

| 8 | 9.0 | 3,285 |

| 10 | 7.2 | 2,628 |

| 12 | 6.0 | 2,190 |

| 15 | 4.8 | 1,752 |

Cool, right? But here’s the fine print: the Rule of 72 assumes a constant return, which mutual funds rarely deliver. In reality, your fund might hit 15% one year, lose 5% the next, and average out to 8% over a decade. So, this is a rough guide, not a crystal ball.

The Power of Compounding: Your Secret Weapon

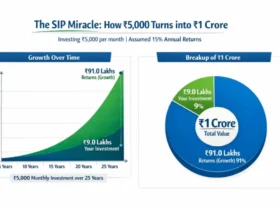

If the Rule of 72 is the calculator, compounding is the rocket fuel. Compounding happens when your returns start earning returns of their own. It’s like planting a tree: at first, it’s just a sapling, but over time, it grows branches, which grow more branches, and soon you’ve got a forest.

Let’s break it down with an example:

- You invest $10,000 at an 8% annual return.

- Year 1: $10,000 × 1.08 = $10,800.

- Year 2: $10,800 × 1.08 = $11,664.

- Year 9: After 9 years of compounding, you’re at roughly $20,000—doubled!

Albert Einstein reportedly called compound interest the “eighth wonder of the world,” saying, “He who understands it, earns it; he who doesn’t, pays it.” Whether he actually said it or not, the point stands: compounding is a game-changer. Reinvesting your dividends and sticking with your fund long-term can shave years—or thousands of days—off your doubling timeline.

Real-World Examples: Doubling in Action

Let’s put this into context with some hypothetical mutual funds based on typical performance:

Example 1: The Steady Bond Fund

- Average Return: 5%

- Doubling Time: 72 ÷ 5 = 14.4 years ≈ 5,256 days

- Profile: A conservative fund heavy on bonds. It’s stable but grows slowly.

Example 2: The Balanced Fund

- Average Return: 7%

- Doubling Time: 72 ÷ 7 ≈ 10.3 years ≈ 3,759 days

- Profile: A mix of stocks and bonds. Moderate risk, moderate reward.

Example 3: The Aggressive Stock Fund

- Average Return: 10%

- Doubling Time: 72 ÷ 10 = 7.2 years ≈ 2,628 days

- Profile: Heavy on stocks, especially growth companies. High potential, high volatility.

Historically, the U.S. stock market (a benchmark for many equity funds) has averaged 7-10% annually over decades, per data from the S&P 500. But past performance isn’t a promise—it’s a clue. Your actual doubling time could be shorter in a booming market or longer if a recession hits.

Choosing a Mutual Fund: Tips to Speed Up Doubling

While doubling time depends on returns, picking the right fund can set you up for success. Here’s what to consider:

- Match Your Goals: Want growth? Go for stock funds. Need stability? Try bond funds.

- Check Fees: A 0.5% expense ratio beats a 2% one every time—more money stays in your pocket.

- Assess Risk: Higher returns often mean bigger swings. Can you stomach the ride?

- Look at History: A fund’s 5- or 10-year average return hints at its doubling potential.

- Diversify: Spread your investments across fund types to balance risk and reward.

Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” Picking a solid fund and sticking with it could get you to that doubling milestone faster.

FAQs: Your Burning Questions Answered

Let’s tackle some common curiosities about doubling your money in mutual funds:

Q: Is there a guaranteed way to double my money?

A: Nope. Mutual funds aren’t savings accounts; they’re tied to markets, which are unpredictable. No guarantees, just potential.

Q: Can I double my money quickly?

A: High-return funds (15%+) could double in under 5 years (1,752 days), but they’re risky. Most folks see better odds with a 7-10% average over time.

Q: How does inflation affect doubling?

A: Inflation erodes purchasing power. If your $10,000 doubles to $20,000 but prices double too, you’re back where you started in real terms. Aim for returns above inflation.

Q: What if my fund loses money?

A: Negative returns set you back. A -10% year means you’ll need even higher gains later to double. Diversification helps cushion the blow.

Q: Are mutual funds better than stocks or real estate?

A: It depends. Stocks might double faster but crash harder. Real estate takes more cash upfront. Mutual funds offer a middle ground—growth with less hassle.

Wrapping It Up: So, How Many Days?

Here’s the bottom line: in how many days does your money double in a mutual fund? It depends on the annual return. Using the Rule of 72, an 8% return means about 9 years, or 3,285 days. A 10% return drops it to 7.2 years, or 2,628 days. But since mutual funds zig and zag with the market, these are estimates, not etched-in-stone deadlines.

The real secret? Patience and compounding. Start early, reinvest your earnings, and pick funds that fit your risk appetite. As Peter Lynch put it, “The key to making money in stocks is not to get scared out of them.” Stay the course, and your money could double—and then some—before you know it.

2 Comments