Introduction: What Are Mutual Funds and Why Invest in Them?

Picture this: You’re at a buffet with endless options—savory stocks, hearty bonds, and a sprinkle of other securities. You could spend hours picking each dish yourself, or you could grab a pre-made platter that’s balanced and ready to enjoy. That’s essentially what a mutual fund is—an investment vehicle that pools money from many investors to buy a diversified mix of assets, managed by professionals who know the menu inside out.

Mutual funds are a go-to choice for millions because they offer:

- Diversification: Spreading your money across many investments reduces the sting if one goes south.

- Professional Management: Experts handle the research and decisions, saving you time and stress.

- Accessibility: You don’t need a fortune to start—some funds let you begin with just a few hundred dollars.

- Liquidity: Need your money back? You can typically sell your shares any business day.

“Mutual funds are the democratization of investing,” says John Bogle, the legendary founder of Vanguard. “They allow everyday people to own a slice of the market without needing a PhD in finance.”

But here’s the catch: with thousands of mutual funds out there, picking the right one isn’t a one-size-fits-all deal. Your choice depends on your goals. Are you saving for a car in two years or a retirement in 20? This guide will show you how to match a mutual fund to your aspirations, step by step.

Table of Contents

Identifying Your Financial Goals

Before you even glance at a mutual fund prospectus, you need to know where you’re headed. Your financial goals are the compass that guides your investment journey. Without them, you’re just wandering—and that’s a recipe for disappointment.

Financial goals come in all shapes and sizes, often tied to their time horizon:

- Short-term goals (1-3 years): Think a dream vacation, a new gadget, or an emergency fund.

- Medium-term goals (3-10 years): Maybe a house down payment or your kid’s college tuition.

- Long-term goals (10+ years): Retirement, financial independence, or leaving a legacy.

Next, pin down the details:

- How much do you need? A $5,000 trip is different from a $50,000 home deposit.

- When do you need it? Timing affects how much risk you can take.

- What’s your risk tolerance? Can you sleep at night if your investment drops 20% in a year, or do you need steady ground?

Let’s meet two fictional investors to see this in action:

- Sara, 28: She’s saving for retirement in 35 years. With decades ahead, she’s fine with market rollercoasters and wants big growth.

- Mark, 45: He’s eyeing a vacation home in 5 years. He prefers calm waters over wild waves, favoring stability over high returns.

Sara might lean toward an equity fund packed with stocks, while Mark might opt for a debt fund focused on bonds. Your goals and comfort zone shape your path—so let’s define yours before moving on.

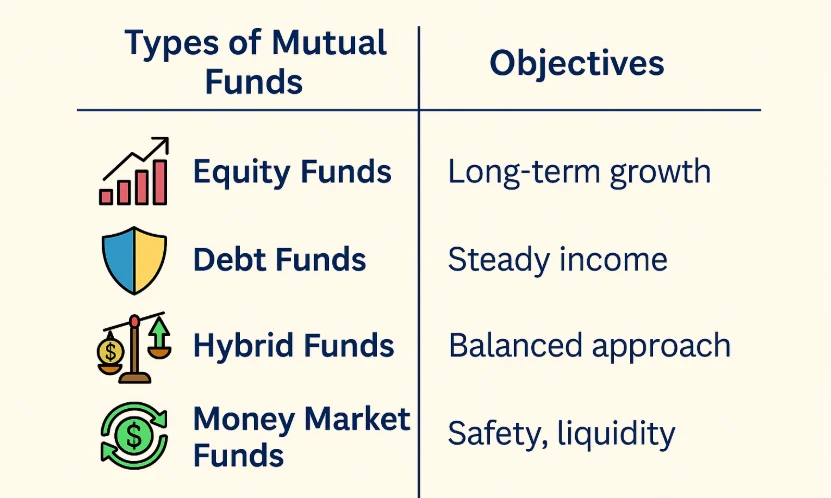

Different Types of Mutual Funds and Their Objectives

Mutual funds aren’t a monolith; they’re a diverse crew, each with its own personality and purpose. Knowing the types helps you pick the one that vibes with your goals. Here’s the lineup:

- Equity Funds

- What they do: Invest in stocks for long-term growth.

- Risk & Reward: High risk, high potential returns.

- Best for: Long-term goals like retirement.

- Subtypes: Large-cap (big companies), mid-cap (medium-sized), small-cap (up-and-comers), or sector-specific (e.g., tech or healthcare).

- Debt Funds

- What they do: Focus on bonds and fixed-income securities for steady income.

- Risk & Reward: Low to moderate risk, modest returns.

- Best for: Short-term goals or cautious investors.

- Hybrid Funds

- What they do: Blend stocks and bonds for a balanced approach.

- Risk & Reward: Moderate risk, moderate returns.

- Best for: Medium-term goals or those wanting a middle ground.

- Index Funds

- What they do: Mirror a market index (like the S&P 500) with minimal management.

- Risk & Reward: Varies by index, average market returns, low fees.

- Best for: Passive investors who believe in steady market growth.

- Quote: “Don’t look for the needle in the haystack. Just buy the haystack!” – Warren Buffett.

- Money Market Funds

- What they do: Invest in safe, short-term securities like Treasury bills.

- Risk & Reward: Very low risk, low returns.

- Best for: Emergency funds or parking cash.

- Sector Funds

- What they do: Target specific industries (e.g., energy, biotech).

- Risk & Reward: High risk, high potential (but less diversified).

- Best for: Experienced investors betting on a sector’s boom.

- International Funds

- What they do: Invest globally, beyond your home country.

- Risk & Reward: High risk (currency shifts, geopolitical factors), varied returns.

- Best for: Diversification seekers.

Here’s a quick comparison table:

| Fund Type | Risk Level | Potential Returns | Ideal Goal |

|---|---|---|---|

| Equity Funds | High | High | Long-term growth |

| Debt Funds | Low-Moderate | Low-Moderate | Short-term stability |

| Hybrid Funds | Moderate | Moderate | Balanced growth |

| Index Funds | Varies | Market Average | Passive investing |

| Money Market Funds | Very Low | Low | Safety, liquidity |

| Sector Funds | High | High | Sector-specific bets |

| International Funds | High | Varies | Global diversification |

Match the fund’s objective to your timeline and risk appetite. A 20-year retirement plan screams equity or index funds, while a 2-year car fund whispers debt or money market.

Key Factors to Consider When Selecting a Mutual Fund

Found a fund type that fits? Great! Now, let’s zoom in on the details to pick the right fund. Here are the must-check factors:

- Performance History

Look at 5- or 10-year returns to gauge consistency—not just last year’s hot streak. Past results aren’t a crystal ball, but they hint at reliability. - Expense Ratio

This is the annual fee you pay. A 0.5% ratio beats a 1.5% one—over decades, those savings compound. “Costs matter,” says Bogle. “In investing, you get what you don’t pay for.” - Fund Manager’s Experience

A seasoned manager with a solid track record can steer the ship through storms. Check their tenure and past performance. - Investment Style

- Active: Managers chase outperformance (higher fees).

- Passive: Tracks an index (lower fees).

Your preference depends on whether you trust human picks or market averages. - Risk Level

Dig into metrics like beta (market sensitivity) or standard deviation (volatility). Match this to your comfort zone. - Asset Allocation

For hybrid funds, check the equity-debt split. More equity = more risk; more debt = more stability. - Tax Implications

High turnover funds trigger more taxes. Index funds or tax-managed funds can save you come April. - Fund Size

Too small? Higher fees. Too big? Harder to maneuver. Aim for the Goldilocks zone. - Exit Load

Some funds charge if you cash out early. Know the rules before you commit.

Imagine choosing between two equity funds:

- Fund A: 12% 10-year return, 0.7% expense ratio, veteran manager.

- Fund B: 10% return, 1.3% expense ratio, newbie manager.

Fund A looks stronger—but weigh all factors together.

Step-by-Step Guide to Choosing the Right Mutual Fund for Your Goals

Ready to roll? Here’s a foolproof, actionable plan to find your perfect mutual fund:

- Define Your Goal Clearly

- Example: Save $30,000 for a wedding in 4 years.

- Current savings: $5,000. Monthly contribution: $500.

- Assess Your Risk Tolerance

- Love adventure? High risk is fine. Prefer safety? Go low.

- Wedding saver: Moderate risk, since 4 years isn’t forever.

- Pick Your Asset Allocation

- Short-term: More debt. Long-term: More equity.

- Wedding: 60% equity, 40% debt for balanced growth.

- Research Funds

- Filter by type (e.g., hybrid), then compare performance, fees, and ratings.

- Use tools like Morningstar or fund fact sheets.

- Diversify

- Spread your $500 across a couple of funds—say, one hybrid and one debt—to hedge your bets.

- Monitor and Rebalance

- Check quarterly. If equity jumps to 70%, sell some and buy debt to reset to 60/40.

Real-life tip: When I started investing for my son’s college fund, I went all-in on equity. A year later, a market dip taught me diversification’s value—now I balance it with debt.

Tools and Resources to Help You Decide

You don’t have to go it alone. These tools can light the way:

- Morningstar: Ratings, performance data, and comparisons.

- Value Research: In-depth fund analysis and rankings.

- Apps like Mint: Track goals and investments in one spot.

- Financial Advisors: Personalized guidance if DIY isn’t your thing.

Most fund websites also offer calculators. Plug in your goal, timeline, and investment amount to see what’s possible.

Common Pitfalls and How to Avoid Them

Even smart investors trip up. Dodge these traps:

- Chasing Past Performance: A 20% return last year doesn’t mean squat tomorrow. Focus on consistency.

- Ignoring Fees: A 1% higher expense ratio could cost you thousands over decades. Compare costs.

- No Clear Goal: Investing blindly is like driving without a map. Set your destination first.

- Panic Selling: Markets dip. Don’t ditch your plan—stay the course.

- Tax Blindness: High-turnover funds can surprise you at tax time. Opt for efficiency.

Conclusion: Taking the Next Steps

Choosing the right mutual fund isn’t magic—it’s method. Define your goals, know your risk tolerance, and sift through funds with a critical eye. Whether it’s a short-term win or a long-term legacy, there’s a fund out there for you.

Investing is a marathon, not a sprint. Keep learning, tweak your strategy, and stay patient. Ready to start? Grab a pen, jot down your goals, and explore funds today. Your financial future is waiting!

FAQs

Q: What’s the minimum amount to invest in a mutual fund?

A: It varies—some start at $500-$1,000, but SIPs (Systematic Investment Plans) can dip to $50-$100 monthly.

Q: How do I cash out my mutual fund?

A: Contact your fund company or broker. Funds usually settle in your account within 2-5 business days.

Q: Are mutual funds safe?

A: They carry risks (you can lose money), but regulation and diversification help. Match risk to your comfort level.

Q: Mutual funds vs. ETFs—what’s the difference?

A: Mutual funds trade once daily via the fund company; ETFs trade like stocks all day. ETFs often have lower fees and more flexibility.

Leave a Reply