Introduction: The Power of Long-Term Investing

When it comes to building wealth, few strategies rival the power of long-term investing. The magic of compounding, paired with the resilience of markets over decades, can transform modest contributions into life-changing sums. But here’s the catch: not all investment options are equally suited for the very long term—think 20, 30, or even 40 years. If you’re currently invested in a flexi cap fund, you might be wondering if there’s a better vehicle to carry your money into the distant future. Spoiler alert: there just might be.

Table of Contents

What Are Flexi Cap Funds and S&P 500 Index Funds?

To understand why switching might make sense, we first need to know what we’re dealing with. Let’s unpack these two investment options.

Flexi Cap Funds: Flexibility with a Price Tag

Flexi cap funds are mutual funds that give managers the freedom to invest across the entire stock market—small, mid, and large-cap companies alike. This flexibility is their big selling point: fund managers can pivot based on market trends, chasing opportunities wherever they pop up.

Key Features of Flexi Cap Funds:

- Active Management: A human manager picks stocks, aiming to beat the market.

- Broad Scope: Investments span companies of all sizes and sectors.

- Higher Costs: Active management means higher fees, often 1-2% annually.

Sounds great, right? Well, not so fast. That flexibility comes with a downside: performance hinges on the manager’s skill. Even the sharpest minds can misjudge, and over time, many flexi cap funds fail to outpace broader market benchmarks.

S&P 500 Index Funds: The Passive Giant

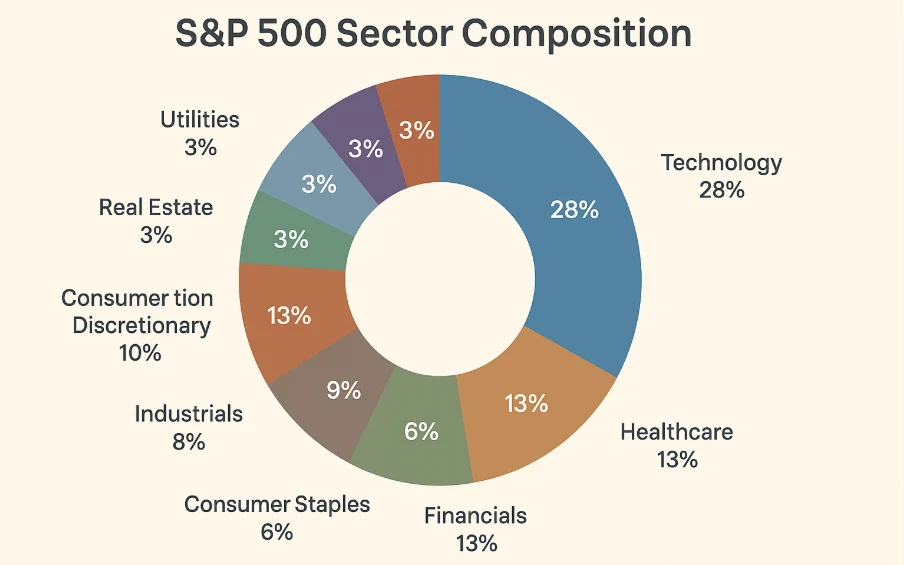

S&P 500 index funds take a different approach. These funds track the S&P 500 index, which includes the 500 largest publicly traded companies in the USA—think Apple, Microsoft, and Amazon. Instead of trying to outsmart the market, they simply mirror it.

Key Features of S&P 500 Index Funds:

- Passive Management: No stock picking; the fund replicates the index.

- Low Fees: Minimal management means expense ratios as low as 0.03-0.1%.

- Market Leaders: Exposure to the biggest, most stable US companies.

The S&P 500 is often called the pulse of the US economy. Its long-term track record is impressive, but we’ll dig into that shortly.

Why Switch to an S&P 500 Index Fund for the Very Long Term?

So, why might an S&P 500 index fund be a better fit for your decades-long investment horizon? Let’s break it down with some compelling reasons.

1. Historical Performance: A Proven Winner

When you’re investing for the very long term, history matters. The S&P 500 has a stellar record, averaging around 10% annual returns from 1926 to 2023, according to Macrotrends. That’s through wars, recessions, and booms—a testament to its staying power.

Flexi cap funds, however, are a mixed bag. While some shine in specific years, most struggle to beat the market consistently. A S&P Dow Jones Indices report found that over 15 years, 88% of actively managed funds lagged their benchmarks. Ouch.

Table 1: Historical Performance Comparison (10-Year Annualized Returns)

| Fund Type | Average Annual Return | Expense Ratio |

|---|---|---|

| Flexi Cap Funds | 8.5% | 1.2% |

| S&P 500 Index Funds | 10.2% | 0.04% |

Data sourced from Morningstar and Vanguard, as of 2023.

The numbers don’t lie: the S&P 500 index fund edges out flexi cap funds in both returns and cost efficiency.

2. Lower Fees: More Money in Your Pocket

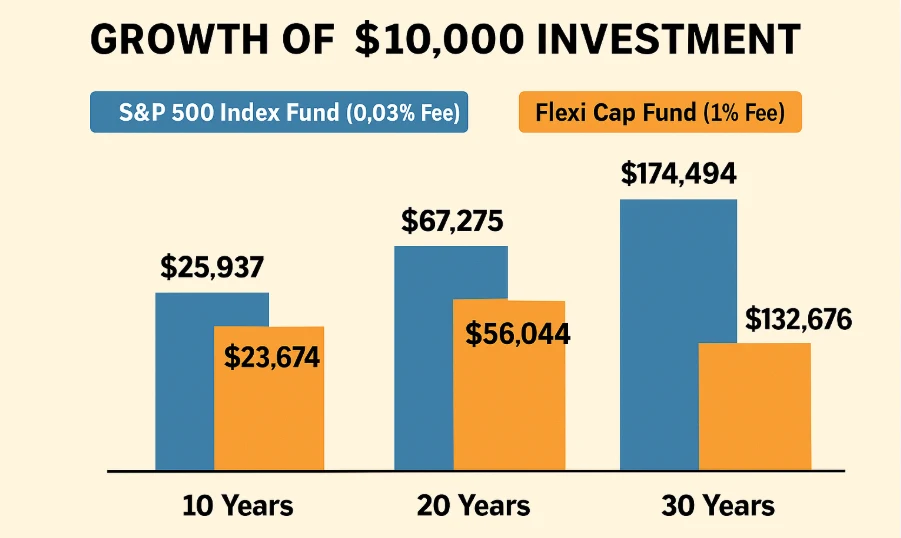

Fees might seem like a small detail, but over decades, they’re a big deal. Flexi cap funds, with their active management, often charge 1-2% annually. S&P 500 index funds? Try 0.04% or less. That difference compounds over time, and the results are jaw-dropping.

Imagine investing $10,000:

- In a flexi cap fund at 8.5% return with a 1.2% fee, you’d have ~$76,000 after 30 years.

- In an S&P 500 index fund at 10.2% return with a 0.04% fee, you’d have ~$174,000.

That’s nearly $100,000 more—just by slashing fees!

Bullet Points: Why Fees Matter

- Erosion Over Time: A 1% fee can cut your returns by tens of thousands over decades.

- Compounding Effect: Fees grow alongside your investment, magnifying their impact.

- Index Fund Edge: Ultra-low fees keep more of your money working for you.

3. Diversification and Stability

Flexi cap funds diversify across market caps, which is nice. But the S&P 500 offers something different: exposure to 500 of the largest, most established US companies. These giants span sectors like tech, healthcare, and finance, providing a broad safety net. Plus, their size and stability make them less volatile than smaller firms—a big plus for long-term peace of mind.

Quote from Warren Buffett:

“A low-cost index fund is the most sensible equity investment for the great majority of investors.” — Warren Buffett

If the Oracle of Omaha backs it, that’s a pretty strong vote of confidence.

4. Simplicity: Set It and Forget It

Long-term investing shouldn’t feel like a second job. With an S&P 500 index fund, you don’t need to track market trends or second-guess a manager’s picks. You’re betting on the US economy’s growth—a bet that’s paid off for over a century. It’s low-maintenance wealth building at its finest.

Expert Voices: What the Gurus Say

Let’s hear from some heavy hitters in the finance world to seal the deal.

Quote from John Bogle, Founder of Vanguard:

“Don’t look for the needle in the haystack. Just buy the haystack!” — John Bogle

Bogle’s advice is refreshingly straightforward: skip the guesswork and own the market.

Quote from Burton Malkiel, Author of A Random Walk Down Wall Street:

“The beauty of indexing is that you can’t fail to do as well as the market. And you can be sure that very few active managers will beat the market over the long term.” — Burton Malkiel

Malkiel nails it—index funds offer reliability that active funds rarely match.

Flexi Cap vs. S&P 500 Index Funds: A Head-to-Head Comparison

Still on the fence? Let’s put these two side by side.

Table 2: Flexi Cap vs. S&P 500 Index Funds

| Feature | Flexi Cap Funds | S&P 500 Index Funds |

|---|---|---|

| Management Style | Active | Passive |

| Investment Universe | All market caps | Large-cap US companies |

| Fees | Higher (1-2%) | Very low (0.03-0.1%) |

| Historical Performance | Varies; often underperforms | Consistent with market |

| Risk | Manager-dependent | Market risk only |

| Best For | Short to medium-term | Very long-term investors |

The takeaway? Flexi cap funds might shine short-term, but for the very long haul, the S&P 500’s consistency and cost savings take the crown.

Key Advantages of S&P 500 Index Funds for the Long Haul

Here’s a quick rundown of why the S&P 500 index fund stands out:

- Low Fees: Maximize your returns by minimizing costs.

- Strong Returns: A century of data backs its performance.

- Diversification: 500 top companies across industries.

- Ease of Use: No expertise required—just invest and wait.

- Resilience: Large-cap stability weathers market storms.

FAQ: Your Questions, Answered

Got doubts? Let’s clear them up.

Q: Doesn’t the S&P 500 miss out on small and mid-cap growth?

A: Yes, it focuses on large caps, but these firms are global powerhouses with plenty of growth potential. Want smaller stocks? Add a separate fund—but the S&P 500 is a rock-solid core.

Q: What if the US market tanks long-term?

A: No guarantees, but the US has led global markets for decades. Even after downturns, the S&P 500 has always bounced back.

Q: How do I make the switch?

A: Sell your flexi cap fund and buy an S&P 500 index fund through your broker. Watch for taxes if it’s not in a tax-advantaged account.

Q: Any risks I should know about?

A: Market risk is real—if stocks drop, so does your fund. But over decades, the upward trend has held strong.

Conclusion: Your Path to Long-Term Wealth

For very long-term investing, the S&P 500 index fund offers a compelling case: lower fees, proven returns, and simplicity that flexi cap funds can’t match. It’s not about chasing short-term wins—it’s about building wealth steadily, reliably, over decades.

Ready to rethink your strategy? Explore top S&P 500 index funds from providers like Vanguard, Fidelity, or Schwab. Your future self will thank you

1 Comment