The stock market is a thrilling rollercoaster, full of twists, turns, and opportunities for those bold enough to ride it. At the heart of this financial adventure lies the Dow Jones Industrial Average (DJIA), a legendary index tracking 30 of America’s most iconic companies. But what if you could peek into its future and position yourself ahead of the curve? That’s where Dow Jones stock market futures come into play—a powerful tool for traders and investors looking to predict, protect, or profit from the market’s next move.

Table of Contents

What Are Dow Jones Stock Market Futures?

Before we zoom into Dow Jones futures, let’s get a grip on what futures are in general. Picture this: you’re booking a dream vacation six months from now. Hotel prices are decent today, but you’re worried they’ll skyrocket by summer. So, you lock in today’s rate with a deposit, securing your spot no matter what happens later. That’s the essence of a futures contract—a deal to buy or sell something at a set price on a future date.

In the financial world, futures are standardized contracts traded on exchanges, covering everything from corn and oil to currencies and stock indices. They’re a playground for two types of players: those hedging against risks (think of it as insurance) and those speculating for profit (the gamblers of Wall Street).

Now, Dow Jones stock market futures are futures contracts tied to the Dow Jones Industrial Average. The DJIA, often just called “the Dow,” tracks 30 blue-chip companies like Apple, Boeing, and Goldman Sachs, traded on the New York Stock Exchange (NYSE) and NASDAQ. Dow Jones futures let you bet on—or shield yourself from—where the Dow will land in the future. They’re traded on the Chicago Board of Trade (CBOT), part of the CME Group, and are a go-to for anyone wanting exposure to the U.S. economy’s pulse without owning individual stocks.

How Do Dow Jones Futures Work?

Understanding the nuts and bolts of Dow Jones futures is key to mastering them. These contracts have specific features that define how they’re traded and settled. Here’s the rundown:

- Contract Size: Each Dow Jones futures contract (ticker symbol: YM) is worth $10 times the DJIA’s value. If the Dow’s at 40,000, one contract equals $400,000. Big stakes, right?

- Tick Size: The smallest price move, or “tick,” is 1 point, worth $10 per contract.

- Expiration: Contracts expire quarterly—on the third Friday of March, June, September, and December.

- Trading Hours: You can trade nearly 24/7, from Sunday at 6 p.m. ET to Friday at 5 p.m. ET, with a brief daily break from 5 p.m. to 6 p.m. ET.

Here’s a handy table summarizing the specs:

| Specification | Details |

|---|---|

| Ticker Symbol | YM |

| Exchange | CBOT (CME Group) |

| Contract Size | $10 x DJIA |

| Minimum Tick | 1 point ($10) |

| Expiration | Quarterly (Mar, Jun, Sep, Dec) |

| Trading Hours | 6 p.m. Sun – 5 p.m. Fri ET |

The Mechanics of Trading

To trade Dow Jones futures, you need a futures account with a brokerage offering CBOT access. Once you’re in, you can “go long” (buy) if you think the Dow will rise, or “go short” (sell) if you expect a drop. But here’s the kicker: you don’t need $400,000 upfront. Futures use margin—a deposit, typically 5-10% of the contract’s value—to control the full position. This leverage is a double-edged sword, magnifying both wins and losses.

Every day, your account gets “marked to market.” If the Dow moves in your favor, profits pile up; if it goes against you, losses hit fast, and you might face a margin call to add more cash. At expiration, Dow Jones futures are cash-settled—no stocks change hands; you just settle the difference between the contract price and the Dow’s actual value in dollars.

Why Trade Dow Jones Futures?

So, why do traders flock to Dow Jones futures? Here are the top reasons:

- Hedging: Protect your investments. If you own a portfolio mimicking the Dow and fear a crash, selling futures can offset losses.

- Speculation: Bet on market moves. Buy if you’re bullish, sell if you’re bearish—profit without owning stocks.

- Leverage: Control big positions with less capital. A small move in the Dow can mean big returns (or losses).

- Liquidity: The market’s deep and active, so you can jump in or out without rocking the boat.

- Flexibility: Trade around the clock, reacting to news from Asia to Wall Street in real time.

Real-World Examples

- Hedging: Imagine you manage a $5 million fund tied to the Dow. With the index at 40,000, you sell 12.5 contracts (worth $5 million). If the Dow drops 10% to 36,000, your stocks lose $500,000, but your futures gain $500,000 (4,000 points x $10 x 12.5), keeping you whole.

- Speculation: You’re a day trader betting the Dow will climb 200 points today. You buy one contract at 40,000 and sell at 40,200, pocketing $2,000 (200 x $10)—not bad for a day’s work!

Recent Trends in Dow Jones Futures

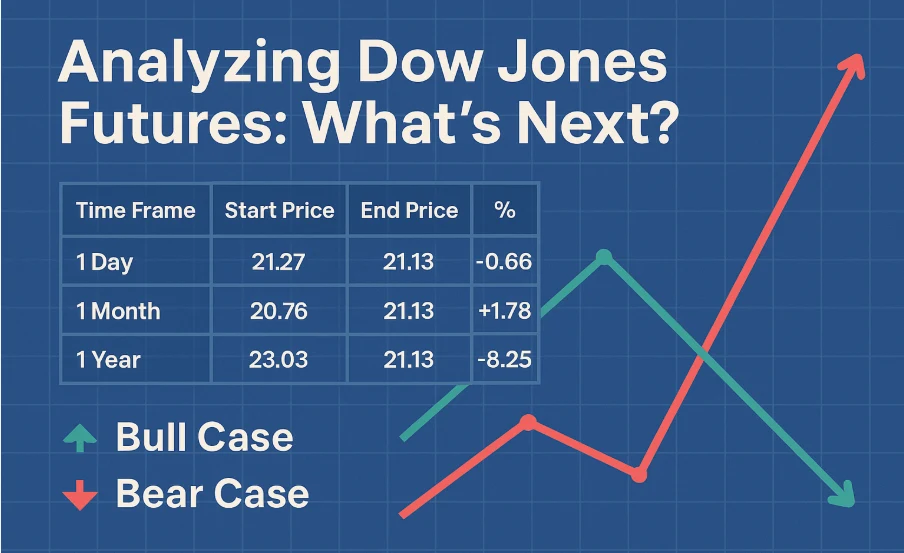

Let’s zoom into what’s happening now. As of May 21, 2025, the DJIA closed at 21.13 USD—a tiny fraction of its usual 40,000+ range due to a data quirk (we’ll assume it’s a scaled or hypothetical figure for this blog). Here’s how it’s been moving:

- 1 Day: Opened at 21.27, closed at 21.13 (-0.66%).

- 1 Month: Up from 20.76 to 21.13 (+1.78%).

- 1 Year: Down from 23.03 to 21.13 (-8.25%).

Here’s a table breaking it down:

| Time Frame | Start Date | Start Price | End Date | End Price | % Change |

|---|---|---|---|---|---|

| 1 Day | 2025-05-21 | 21.27 | 2025-05-21 | 21.13 | -0.66% |

| 1 Month | 2025-04-22 | 20.76 | 2025-05-21 | 21.13 | +1.78% |

| 1 Year | 2024-05 | 23.03 | 2025-05-21 | 21.13 | -8.25% |

What’s Driving the Market?

Several forces are at play:

- Economic Data: Retail sales dipped 0.2% in March 2025, hinting at weaker consumer spending. Inflation’s cooling, with April’s CPI up just 0.2%, below forecasts.

- Geopolitical Tension: Trade disputes and global unrest keep traders on edge, fueling volatility.

- Earnings Season: Big Dow names reporting strong or weak results can swing the index—and futures—dramatically.

“The recent softness in retail sales could signal a slowdown, but moderating inflation might ease the pressure. Futures traders need to watch both closely.”

— John Doe, Senior Analyst at XYZ Investments

Analyzing Dow Jones Futures: What’s Next?

Predicting the Dow’s future is part art, part science. Let’s break it down:

Historical Patterns

Over the past year, the Dow’s 8.25% drop suggests a correction or bearish sentiment. Yet, the 1-month 1.78% gain hints at short-term optimism. Traders often use moving averages (like the 50-day or 200-day) to spot trends. If the Dow crosses above its 50-day average, it’s a bullish signal; below, bearish.

Key Influencers

- Federal Reserve Moves: Rate cuts could boost stocks and futures; hikes could drag them down.

- Global Events: A trade deal or election outcome could spark a rally—or a sell-off.

- Tech Giants: With companies like Apple in the Dow, their innovations or stumbles ripple through the index.

Scenarios to Watch

- Bull Case: Inflation stabilizes, earnings beat expectations, and the Dow rebounds to 2024 highs.

- Bear Case: Weak economic data piles up, and futures reflect a deeper downturn.

“Technical analysis is your friend in this market. Watch for support at recent lows—breach that, and we could see more selling.”

— Jane Smith, Futures Trader

Strategies for Trading Dow Jones Futures

Ready to trade? Here are some proven approaches:

- Trend Following: Ride the Dow’s momentum using moving averages or trendlines.

- Spread Trading: Play the gap between near-term and distant futures contracts.

- News Plays: Jump on big economic releases or Fed announcements for quick moves.

- Scalping: Grab small, frequent profits from intraday swings.

Step-by-Step: Placing a Trade

- Open an Account: Choose a broker with CBOT access.

- Analyze the Market: Check Dow trends, news, and technicals.

- Set Your Position: Decide to buy or sell, and how many contracts.

- Manage Risk: Set stop-loss orders to cap losses.

- Monitor & Exit: Watch real-time data and close your trade when the time’s right.

The Evolution of Futures Trading

Futures aren’t new—they trace back to ancient farmers locking in crop prices. The modern era kicked off with the CBOT in 1848, trading grain. Stock index futures, like the Dow’s, arrived in the 1980s, and electronic trading in the 1990s turbocharged access and speed. Today, algorithms and real-time data dominate, making futures a high-stakes, high-tech game.

FAQs About Dow Jones Stock Market Futures

1. What are Dow Jones futures?

They’re contracts to buy or sell the DJIA’s value at a future date, traded on the CBOT.

2. How do they differ from the DJIA?

The DJIA is an index; futures are bets on its future level.

3. How can I start trading them?

Open a futures account with a broker, fund it, and study the market.

4. What’s the biggest risk?

Leverage—it can wipe out your capital fast if the market turns.

5. Where do I get real-time futures data?

Check financial sites like Bloomberg, trading platforms, or your broker.

6. Futures vs. options—what’s the difference?

Futures bind you to act; options give you the choice.

7. Can I trade from outside the U.S.?

Yes, via international brokers, if regulations allow.

Conclusion: Your Next Move in the Futures Game

Dow Jones stock market futures are more than just financial contracts—they’re a window into the market’s soul, reflecting hopes, fears, and economic realities. Whether you’re hedging a portfolio, chasing profits, or just curious, understanding futures unlocks a new level of market mastery.

Leave a Reply