Introduction: A ₹1 Lakh Dilemma

It’s 2025, and you’ve got ₹1 lakh burning a hole in your pocket. You’re standing at a financial crossroads, weighing two tempting options—gold, the timeless treasure that’s been a safe haven for centuries, or mutual funds, the modern powerhouse promising growth and diversification. Both whisper promises of profit, but which one will truly shine by 2030?

In India, gold isn’t just an investment; it’s an emotion, a tradition, a fallback for rainy days. Meanwhile, mutual funds have surged in popularity, offering a ticket to the stock market’s rollercoaster ride without needing a finance degree. With five years ahead—from 2025 to 2030—how do you choose?

Table of Contents

Understanding Gold as an Investment

The Golden Legacy

Gold has dazzled humanity for millennia. From ancient kings adorning their crowns to Indian households stashing jewelry for weddings, gold is more than metal—it’s a symbol of wealth and security. But does its shine translate to profits?

Why Invest in Gold?

Gold’s appeal as an investment isn’t just emotional; it’s practical:

- Inflation Shield: When prices rise, gold often holds its value, protecting your purchasing power.

- Safe Haven: During economic chaos—like recessions or wars—gold tends to glitter brighter as investors seek stability.

- Portfolio Balance: Gold moves differently from stocks, reducing your overall risk.

How to Invest in Gold

You’ve got options beyond buying bangles:

- Physical Gold: Coins, bars, or jewelry—tangible but tricky to store securely.

- Gold ETFs: Exchange-traded funds tracking gold prices, tradable like stocks with no locker needed.

- Gold Mutual Funds: Funds investing in gold or gold-related assets, managed by pros.

- Sovereign Gold Bonds: Government-backed, offering interest plus gold price gains.

Pros and Cons of Gold

Pros:

- Stability in turbulent times

- Cultural significance in India

- Easy to diversify with

Cons:

- No dividends or interest

- Short-term price swings

- Storage costs for physical gold

“Gold remains a cornerstone of financial security, especially when markets tremble.” – Ankit Sharma, Wealth Advisor

Understanding Mutual Funds

The Mutual Fund Magic

Mutual funds are like a financial buffet—pooling money from many investors to buy a spread of stocks, bonds, or both. Managed by experts, they’re designed to make investing simple yet powerful.

Types of Mutual Funds

Here’s the menu:

- Equity Funds: Stock-focused, high-risk, high-reward—think Nifty 50 or sectoral funds.

- Debt Funds: Bond-based, safer bets for steady returns.

- Hybrid Funds: A mix of stocks and bonds, balancing growth and stability.

- Index Funds: Low-cost trackers of market indices like Sensex.

Why Choose Mutual Funds?

- Diversification: One fund, many assets—less risk than betting on a single stock.

- Expertise: Fund managers do the heavy lifting.

- Flexibility: Start small with SIPs (as low as ₹500!).

Risks to Watch

- Market Volatility: Equity funds can dip with the market.

- Fees: Expense ratios nibble at returns.

- Manager Risk: A bad call can hurt performance.

“Mutual funds are a gateway to wealth creation, but they demand patience and a risk appetite.” – Priya Mehra, Investment Strategist

Historical Performance Face-Off

Gold’s Track Record

Gold has been a steady climber. Over the past 20 years, it’s averaged 9-10% annual returns globally, with standout moments:

- 2008-2011: Soared during the financial crisis.

- 2020: Hit record highs amid the pandemic.

In India, gold prices have risen from ₹30,000 per 10 grams in 2015 to a projected ₹1 lakh by 2025—a 15%+ annual growth in recent years.

Mutual Funds’ Past Glory

Mutual funds vary widely:

- Equity Funds: Large-cap funds in India averaged 12-15% annually over the last decade.

- Debt Funds: Delivered 6-8%, less flashy but reliable.

Table: Historical Returns (2015-2025)

| Period | Gold (Annualized) | Equity Funds | Debt Funds |

|---|---|---|---|

| 2015-2020 | 10% | 13% | 7% |

| 2020-2025 | 15% | 16% | 6% |

Takeaway: Equity funds often outpace gold in bullish markets, but gold shines during uncertainty.

Projecting Profits: 2025-2030

Gold’s Future Glitter

What drives gold prices? Here’s the crystal ball:

- Economic Turbulence: Trade wars or recessions could push gold to ₹1.5 lakh per 10 grams by 2030.

- Inflation: Rising costs might boost gold as a hedge.

- Demand: Central banks and Indian weddings keep demand strong.

Projection: Experts estimate 5-7% annual returns, with a bullish case hitting 10% if chaos reigns.

Mutual Funds’ Growth Path

Mutual funds hinge on the economy:

- Boom Times: A 7-8% GDP growth could see equity funds return 12-15% annually.

- Tech Surge: AI and green energy might supercharge sectoral funds.

- Rate Cuts: Lower interest rates could lift debt funds to 6-8%.

Projection: Equity funds might average 10-12%, debt funds 5-7%.

Table: Projected Returns (2025-2030)

| Investment | Conservative | Optimistic |

|---|---|---|

| Gold | 5-7% | 10% |

| Equity Funds | 10-12% | 15% |

| Debt Funds | 5-7% | 8% |

Scenario Insight: Gold thrives in gloom; mutual funds soar in growth.

Gold vs. Mutual Funds – The Profit Verdict

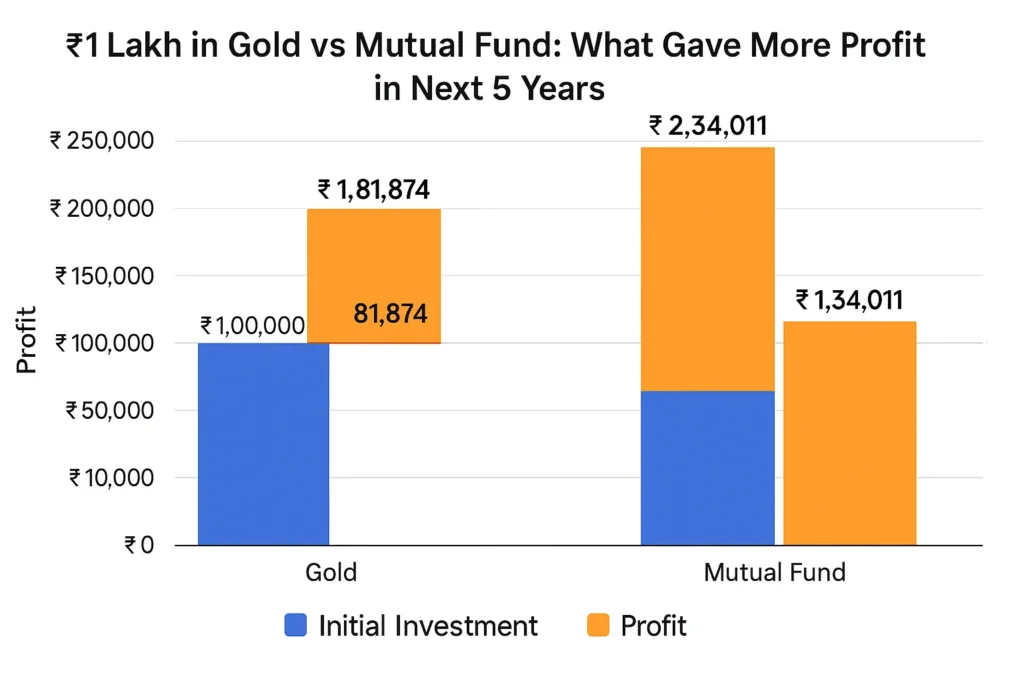

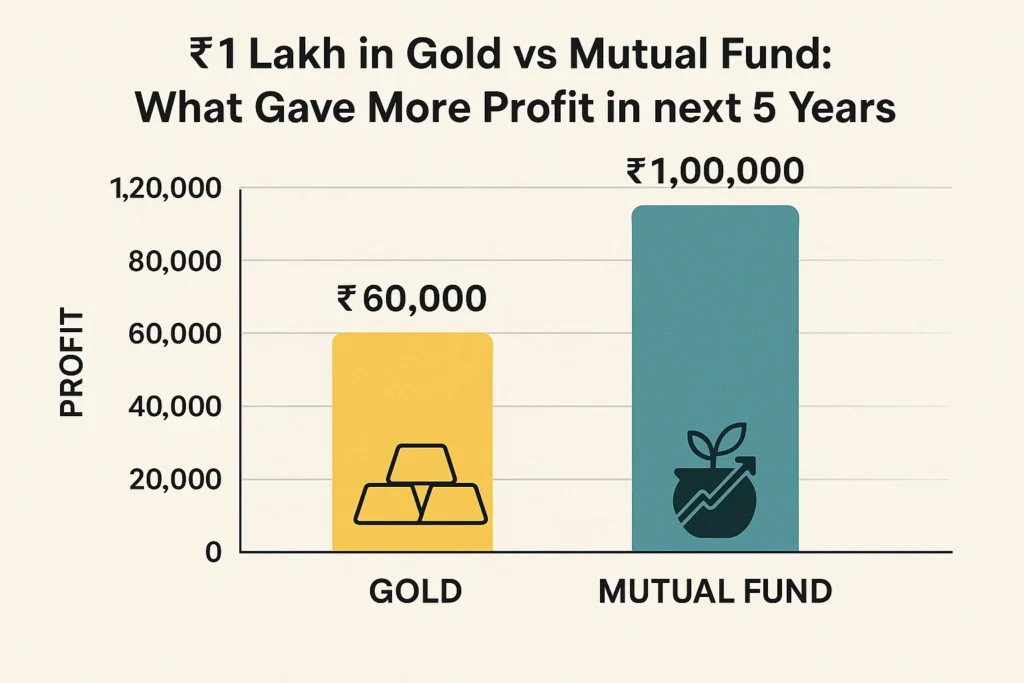

Crunching ₹1 Lakh

Let’s calculate:

- Gold (7% annual return): ₹1 lakh grows to ₹1.40 lakh by 2030.

- Equity Funds (12% annual return): ₹1 lakh becomes ₹1.76 lakh.

- Debt Funds (6% annual return): ₹1 lakh reaches ₹1.34 lakh.

Risk vs. Reward

- Gold: Low risk, modest gains—perfect for the cautious.

- Mutual Funds: Higher risk, bigger rewards—ideal for the bold.

Your Goals Matter

- Preservation: Gold or debt funds.

- Growth: Equity funds.

The Diversification Play

Why choose? Split it:

- ₹20,000 in Gold: Stability cushion.

- ₹60,000 in Equity Funds: Growth engine.

- ₹20,000 in Debt Funds: Steady income.

By 2030, this mix could balance risk and reward beautifully.

FAQs – Your Burning Questions Answered

Q: Is gold still a smart investment in 2025?

A: Yes, especially if you fear economic storms. Its stability shines when stocks falter.

Q: Which mutual funds should I pick for 2025-2030?

A: Growth seekers, go for equity funds (large-cap or multi-cap). Safety first? Debt or hybrid funds. Research past performance and fees!

Q: Can I lose money in gold or mutual funds?

A: Absolutely. Gold prices can drop short-term, and mutual funds tank with markets. Diversify to soften the blow.

Q: How much of ₹1 lakh should I put in each?

A: A classic split: 10-20% in gold, 50-70% in equity funds, rest in debt funds—tweak based on your risk comfort.

Q: What’s the tax angle?

A: Gold gains face capital gains tax (20% long-term). Mutual funds vary—equity (10% LTCG over ₹1 lakh), debt (slab rate).

Conclusion: Your ₹1 Lakh Destiny

So, where should your ₹1 lakh go from 2025 to 2030? Gold offers a golden parachute—safe, steady, and culturally resonant. Mutual funds promise a rocket ride—risky but potentially richer.

If you’re a worrier, gold’s your friend. If you’re a dreamer, mutual funds beckon. But the smartest move? Blend them. A diversified portfolio could turn your ₹1 lakh into a small fortune while dodging the pitfalls of going all-in.

As Warren Buffett once said, “Risk comes from not knowing what you’re doing.” Now you know. Will you stack gold or ride the mutual fund wave? The clock’s ticking—your 2030 self is watching!

Leave a Reply