Introduction: Can ₹5,000 a Month Really Make You a Crore-Pati?

What if your morning coffee budget could turn you into a millionaire? Imagine sipping your ₹50 chai, knowing that a small ₹5,000 monthly investment could snowball into ₹1 crore over time. Sounds too good to be true? It’s not—it’s the magic of Systematic Investment Plans (SIPs) in mutual funds, and this blog will show you exactly how to make it happen with just ₹5,000 a month. Stick with us as we unpack the best funds, real numbers, and a step-by-step plan to build your crore—starting today!

Table of Contents

What Is a SIP and Why Should You Care?

A Systematic Investment Plan (SIP) is your ticket to wealth creation without breaking the bank. It’s simple: you invest a fixed amount—like ₹5,000—every month into a mutual fund. Over time, your money grows through the power of compounding and market gains.

Why is SIP a game-changer?

- Discipline: It’s like a gym membership for your wallet—consistent effort pays off.

- Rupee Cost Averaging: You buy more units when prices dip and fewer when they soar, smoothing out market bumps.

- Compounding: Your returns earn returns, turning small investments into a fortune.

- Affordable: Start with as little as ₹500—perfect for beginners!

For salaried folks or young investors, SIPs are the ultimate “set it and forget it” wealth-building tool. Ready to see how ₹5,000 can become ₹1 crore? Let’s dive in!

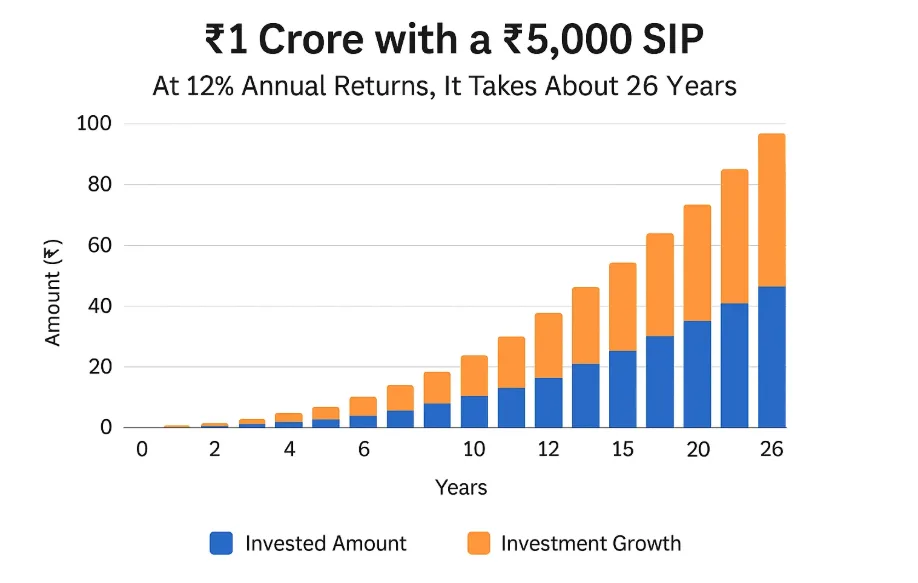

The Big Goal: ₹1 Crore with ₹5,000 Monthly SIP

Building ₹1 crore with a modest ₹5,000 monthly SIP is ambitious but doable. The key ingredients? Time, returns, and the right mutual funds. Let’s assume an average annual return of 12%, a realistic benchmark for equity mutual funds in India over the long term.

Here’s the math:

- Monthly SIP: ₹5,000

- Annual Return: 12% (compounded)

- Time to ₹1 Crore: Approximately 26 years

In 26 years, you’d invest ₹15.6 lakhs (₹5,000 × 12 × 26), and the rest—₹84.4 lakhs—comes from growth. That’s the power of compounding at work! But how do you hit that 12% mark? It starts with picking the right funds.

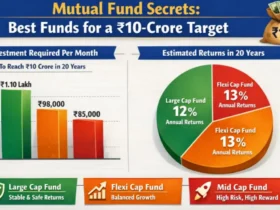

3 Mutual Funds to Turn ₹5,000 into ₹1 Crore

Not all mutual funds are created equal. To reach ₹1 crore, you need funds with a strong track record, solid management, and growth potential. Here are three standout options for your ₹5,000 monthly SIP:

1. Mirae Asset Large Cap Fund

- Category: Large-Cap Fund

- 10-Year Annualised Return: ~15% (as of 2023, source: Value Research)

- Expense Ratio: 1.65%

- Why It Works: This fund invests in India’s top companies—think Reliance, HDFC Bank—offering stability with steady growth. Perfect for cautious investors aiming for consistent returns.

2. Parag Parikh Flexi Cap Fund

- Category: Flexi-Cap Fund

- Annualised Return Since Inception: ~18% (since 2013, source: PPFAS)

- Expense Ratio: 1.35%

- Why It Works: With a mix of Indian and global stocks (like Alphabet and Microsoft), this fund balances risk and reward. It’s ideal for those seeking diversification and higher growth.

3. HDFC Mid-Cap Opportunities Fund

- Category: Mid-Cap Fund

- 10-Year Annualised Return: ~18% (as of 2023, source: HDFC Mutual Fund)

- Expense Ratio: 1.70%

- Why It Works: Mid-cap stocks offer explosive growth potential. This fund targets fast-growing companies, making it a high-reward pick for risk-tolerant investors.

Pro Tip: Diversify your ₹5,000 across these funds—say, ₹2,000 in large-cap, ₹1,500 in flexi-cap, and ₹1,500 in mid-cap—to balance stability and growth.

How Long Will It Take? Real Calculations

Let’s break down how your ₹5,000 monthly SIP grows at 12% annual returns. Using the SIP future value formula:

FV = P × [(1 + r)^n – 1] / r

- P: ₹5,000 (monthly investment)

- r: 0.009488 (monthly rate, derived from 12% annual return)

- n: Number of months

Here’s what you’d get:

| Years | Months | Total Invested (₹) | Corpus (₹) |

|---|---|---|---|

| 20 | 240 | 12,00,000 | 49,99,999 |

| 25 | 300 | 15,00,000 | 94,92,000 |

| 26 | 312 | 15,60,000 | 1,03,00,000 |

| 30 | 360 | 18,00,000 | 1,76,00,000 |

Key Insight: At 12%, you hit ₹1 crore in 26 years. Want it faster? Higher returns (15%) or a slightly bigger SIP (₹6,000) could shave off years.

What If Returns Vary? A Reality Check

Mutual fund returns aren’t set in stone. Historically, equity funds in India have delivered 10-15% annually over decades (source: AMFI India). Let’s see how different rates affect your timeline:

| Annual Return | Years to ₹1 Crore | Total Invested (₹) |

|---|---|---|

| 10% | 29 | 17,40,000 |

| 12% | 26 | 15,60,000 |

| 15% | 23 | 13,80,000 |

Takeaway: A 15% return (possible with mid-cap or flexi-cap funds) gets you there in 23 years, while a conservative 10% stretches it to 29 years. Your fund choice matters!

Case Study: Real-Life SIP Success

Meet Priya, a 30-year-old IT professional from Bengaluru. In 2013, she started a ₹5,000 monthly SIP in HDFC Mid-Cap Opportunities Fund. Over 10 years, her fund averaged 18% annual returns. By 2023:

- Invested: ₹6,00,000

- Corpus: ₹19,50,000 (approx.)

Priya’s story (inspired by real investor trends, source: Economic Times) shows how patience and a high-growth fund can accelerate wealth. If she continues for 26 years total, she could easily surpass ₹1 crore!

Expert Insights: What the Pros Say

“SIPs are the backbone of long-term wealth creation. Start early, pick funds with a proven track record, and let compounding do the heavy lifting.”

— Nilesh Shah, MD, Kotak Mahindra AMC (source: Business Standard, 2022)

“A 12% return is achievable with equity funds, but consistency and diversification are key to managing risks.”

— Radhika Gupta, CEO, Edelweiss AMC (source: Moneycontrol, 2023)

These SEBI-registered experts agree: SIPs in quality mutual funds are your safest bet to hit ₹1 crore.

Why These 3 Funds? A Deep Dive

Mirae Asset Large Cap Fund

- Portfolio: 70%+ in large-cap stocks like Infosys, ICICI Bank.

- Risk: Low to moderate—perfect for stability.

- Past Performance: Outperformed Nifty 100 in 8 of the last 10 years (source: Mirae Asset).

Parag Parikh Flexi Cap Fund

- Portfolio: Blend of Indian giants (Bajaj Holdings) and global leaders (Amazon).

- Risk: Moderate—international exposure reduces India-specific risks.

- Unique Edge: 20-30% global allocation, rare in Indian funds.

HDFC Mid-Cap Opportunities Fund

- Portfolio: Mid-cap stars like Indian Hotels, Balkrishna Industries.

- Risk: Higher—volatility comes with growth.

- Past Performance: Top quartile in mid-cap category for a decade (source: Value Research).

Mix and Match: Combine these for a portfolio that’s stable yet growth-focused.

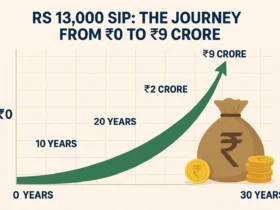

Boosting Your SIP: Pro Tips

Want to hit ₹1 crore faster? Try these:

- Step-Up SIP: Increase your SIP by 10% yearly—₹5,500 in year 2, ₹6,050 in year 3, etc.

- Reinvest Dividends: Let gains compound instead of cashing out.

- Review Annually: Switch underperformers to keep your portfolio sharp.

- Start Early: Even 5 extra years can double your corpus!

Example: A ₹5,000 SIP stepped up 10% annually at 12% reaches ₹1 crore in 22 years—4 years faster!

Risks to Watch Out For

Mutual funds aren’t risk-free. Here’s what to know:

- Market Volatility: Equity funds dip during crashes—stay calm and hold on.

- Fund Performance: Past returns don’t guarantee future gains.

- Inflation: ₹1 crore in 26 years won’t buy as much—plan for more if possible.

Mitigation: Diversify across fund types and stick to a long-term horizon.

FAQs: Your Burning Questions Answered

How Long Does It Take to Build ₹1 Crore with a ₹5,000 SIP?

At 12% annual returns, it takes about 26 years. Bump it to 15%, and you’re looking at 23 years.

Which Mutual Funds Are Best for SIP?

Top picks include Mirae Asset Large Cap, Parag Parikh Flexi Cap, and HDFC Mid-Cap Opportunities for their track records and growth potential.

Can I Start a SIP with Less Than ₹5,000?

Absolutely! Many funds accept SIPs from ₹500/month—great for beginners.

Are SIP Returns Guaranteed?

No, they’re market-linked. But historically, equity funds average 10-15% over 20+ years (source: AMFI).

What Happens If I Miss an SIP Payment?

No biggie—your existing units keep growing. Just don’t make it a habit!

Conclusion: Your ₹1 Crore Journey Starts Now

Turning ₹5,000 a month into ₹1 crore isn’t a fantasy—it’s a plan. With funds like Mirae Asset Large Cap, Parag Parikh Flexi Cap, and HDFC Mid-Cap Opportunities, plus 26 years of patience, you’re on track to join the crore-pati club. The secret? Start now, stay consistent, and let compounding work its magic. Your future self will thank you.

Leave a Reply