Introduction: A Financial Revolution Ignites

You’re scrolling through your phone one lazy Sunday morning, sipping your coffee, when a notification pops up. Your mutual fund app shows your investment has grown by 25% in just two years. You’re no Wall Street hotshot—just an everyday person who decided to stash away a few thousand rupees every month. And now, you’re smiling ear to ear.

This isn’t a fantasy. It’s the reality for millions of Indians fueling a blazing financial revolution. In 2025, Systematic Investment Plans (SIPs) in India crossed a jaw-dropping ₹15 trillion in assets under management (AUM)—and the leap from ₹10 trillion to ₹15 trillion? It happened in a record-breaking 17 months, the fastest ₹5 trillion jump ever. Investors are on fire, and SIPs are the spark lighting up wealth creation across the nation.

Table of Contents

Why should you care? Because this milestone isn’t just about big numbers—it’s about you. It’s about how regular folks like us are rewriting the rules of money with small, steady steps. Curious? Stick with me. In this post, we’ll uncover what SIPs are, why they’re exploding in India, and how you can jump on this wealth-building train. Whether you’re a newbie or a seasoned investor, there’s something here to ignite your financial journey. Let’s get started!

What Are SIPs and How Do They Work?

The Basics: Investing Made Simple

If “SIP” sounds like financial jargon, don’t worry—I’ve got you covered. A Systematic Investment Plan is a smart, no-fuss way to invest in mutual funds. You commit to putting in a fixed amount—like ₹5,000—every month, and that money buys units in a mutual fund of your choice. It’s like a subscription to your financial future.

Here’s the magic: You don’t need to be rich to start. Some SIPs let you kick off with as little as ₹500. Over time, your money grows as the fund performs, and you don’t have to stress about timing the market. It’s automatic, disciplined, and—dare I say it—fun when you see those returns roll in.

The Mango Analogy: Rupee Cost Averaging Explained

Still confused? Let’s break it down with an analogy. Imagine you’re buying mangoes every month. In summer, they’re cheap—₹100 gets you 10 mangoes. In winter, prices spike, and ₹100 only buys 5. But because you buy regularly, your average cost evens out. You’re not sweating the price swings—you’re just stacking up mangoes.

SIPs work the same way. When the market dips, your ₹5,000 buys more mutual fund units. When it soars, you get fewer. This trick, called rupee cost averaging, smooths out volatility and sets you up for solid long-term gains. Pretty cool, right?

Types of Funds: Pick Your Flavor

Not all SIPs are the same. You can choose from:

- Equity Funds: High risk, high reward—perfect for the bold.

- Debt Funds: Safer, steady returns for the cautious.

- Hybrid Funds: A mix of both for balance.

Whatever your vibe, there’s an SIP for you. It’s like picking your favorite chai blend—customized to your taste.

The Journey to ₹15 Trillion: A Meteoric Rise

From Humble Beginnings to a Mega Milestone

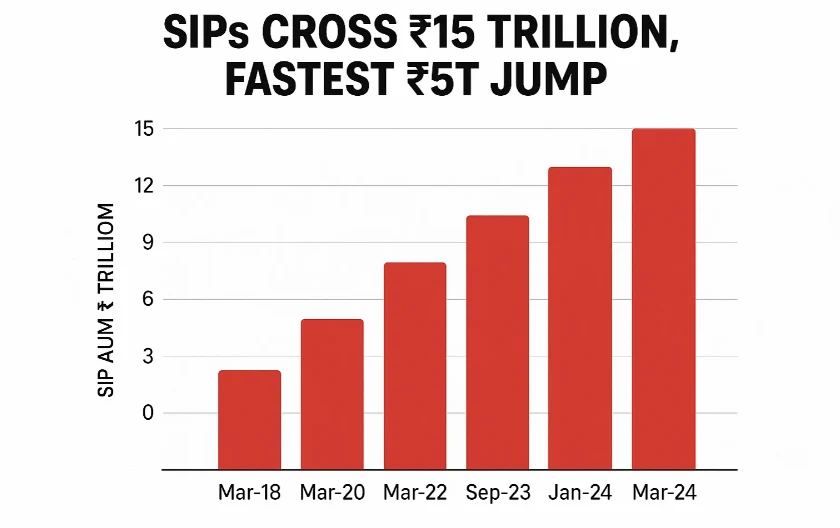

SIPs weren’t always this hot. Let’s rewind and look at the numbers:

| Year | SIP AUM (₹ Trillion) |

|---|---|

| 2016 | 1 |

| 2021 | 5 |

| 2024 | 10 |

| 2025 | 15 |

From ₹1 trillion in 2016 to ₹5 trillion in 2021 took over five years. The next ₹5 trillion to ₹10 trillion? About 31 months. But the latest jump from ₹10 trillion to ₹15 trillion in just 17 months? That’s a wildfire spreading fast. Indian investors are pouring in, and the momentum is unreal.

What’s Fueling the Blaze?

So, why the sudden surge? Here’s the scoop:

- Financial Literacy: More of us are waking up to investing, thanks to campaigns like “Mutual Funds Sahi Hai.”

- Tech Boom: Apps and platforms make starting an SIP as easy as ordering biryani online.

- Market Wins: Strong equity returns lately have lured newbies and veterans alike.

- Trust: People believe in the system now—SIPs feel safe, reliable, and rewarding.

This isn’t just a stat—it’s a movement. Millions are betting on SIPs to secure their futures, and it’s working.

Why SIPs Are Popular in India

The Perks That Keep Us Hooked

SIPs aren’t just trending—they’re a game-changer. Here’s why we’re obsessed:

- Affordable: Start with ₹500. No need to break the bank.

- Discipline: Auto-debits force you to save—like a strict but loving parent.

- Rupee Cost Averaging: Market ups and downs? No problem.

- Flexibility: Increase, pause, or stop anytime—your money, your rules.

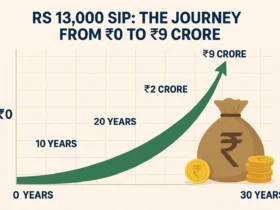

- Compounding Power: Small investments snowball into big bucks over time.

SIPs vs. Lump Sum: Why Steady Wins

Lump sum investing—dumping a big chunk of cash at once—can be risky. If the market tanks right after, ouch. SIPs spread that risk. Check this out:

| Investment Type | ₹1 Lakh Invested | Market Falls 20% | Value After Fall |

|---|---|---|---|

| Lump Sum | All at once | Immediate loss | ₹80,000 |

| SIP (₹10K/month) | Over 10 months | Averaged out | ₹92,000 (approx.) |

SIPs cushion the blow. It’s like sipping tea slowly instead of chugging it and burning your tongue.

A Cultural Fit: Saving Meets Investing

In India, we’ve always loved saving—think piggy banks or Diwali bonus stashes. SIPs take that habit and turbocharge it. Instead of hoarding cash, we’re growing it. It’s our tradition of planning for tomorrow, just smarter.

Real-Life Success Stories: SIPs That Paid Off

Rajesh’s Leap of Faith

Meet Rajesh, a 35-year-old IT guy from Bangalore. In 2018, he was skeptical about investing. “The stock market’s a gamble,” he thought. But his friend convinced him to try an SIP—₹10,000 a month in an equity fund. Fast forward to 2025, and Rajesh’s portfolio is worth ₹15 lakhs. He’s eyeing a down payment on a house now, all thanks to that first step.

“I was nervous,” Rajesh admits. “But seeing my money grow gave me confidence. SIPs turned my doubts into dreams.”

Priya’s Pandemic Win

Then there’s Priya, a 28-year-old teacher from Mumbai. In 2020, amid lockdown chaos, she started an SIP with just ₹2,000 monthly. Markets wobbled, but she stuck with it. By 2025, her investment hit ₹1.5 lakhs. “It’s not millions,” she says, “but it’s proof I can build something big, step by step.”

These aren’t outliers. SIPs are turning regular Indians into wealth creators—one month at a time.

Expert Insights: What the Pros Say

The ₹15 trillion milestone has financial bigwigs buzzing. Here’s what they’re saying:

“Indian investors are on fire, and SIPs are the fuel. This jump shows a shift toward disciplined wealth-building—a game-changer for our economy.”

— Nilesh Shah, MD, Kotak Mahindra AMC

How to Get Started with SIPs

Your Step-by-Step Playbook

Ready to light up your financial future? Here’s how to start an SIP:

- Define Your Goal: House? Retirement? Dream vacation? Know your “why.”

- Check Your Risk: Love adventure? Go equity. Prefer safety? Try debt.

- Pick a Fund: Research or ask an advisor—find a scheme that fits.

- Get KYC Done: A quick one-time process (PAN, Aadhaar, etc.).

- Set It Up: Choose your amount and date—most platforms do it online.

- Stay the Course: Review yearly, but don’t panic at dips. Think long-term.

Pro Tips for Newbies

- Start Small: Even ₹500 works—build the habit first.

- Diversify: Spread your SIPs across fund types.

- Use Apps: Platforms like Groww or Zerodha make it a breeze.

Mistake to avoid? Don’t chase “hot” funds based on past returns. Pick what suits you.

SIPs vs. Other Investments: A Quick Comparison

Wondering how SIPs stack up? Here’s a snapshot:

| Option | Risk | Returns (Avg.) | Flexibility | Minimum |

|---|---|---|---|---|

| SIP (Equity) | Medium-High | 12–15% | High | ₹500 |

| Fixed Deposit | Low | 5–7% | Low | ₹1,000 |

| Gold | Medium | 8–10% | Medium | ₹5,000 |

SIPs shine for growth and ease. Want more bang for your buck? They’re your ticket.

Conclusion: Join the Fire

SIPs crossing ₹15 trillion isn’t just a headline—it’s a wake-up call. It’s proof that small, steady steps can set your financial world ablaze. From Rajesh’s house fund to Priya’s growing nest egg, millions of Indians are proving you don’t need to be rich to get rich. You just need to start.

This milestone screams opportunity. It’s about trust, growth, and a future where you call the shots. So, why sit on the sidelines? Investors are on fire, and there’s room for you in this revolution.

Start your SIP today! Take that first step—₹500 or ₹5,000, it doesn’t matter. What matters is you’re in. Let’s build wealth together, one month at a time.

FAQs: Your SIP Questions Answered

1. What’s an SIP in simple terms?

An SIP lets you invest a fixed amount (like ₹1,000) in mutual funds every month. It’s automated, affordable, and grows over time.

2. How little can I invest in an SIP?

As low as ₹500 a month—perfect for beginners or tight budgets.

3. Are SIPs risky?

They carry some risk (especially equity funds), but rupee cost averaging and long-term investing lower it. Match the fund to your comfort level.

4. Can I stop my SIP anytime?

Yep! Pause or stop whenever you want—no penalties, total control.

5. How do I pick the best mutual fund?

Look at your goals, risk tolerance, and fund performance. Chat with an advisor if you’re unsure.

6. Why are SIPs better than saving cash?

Cash doesn’t grow—SIPs do. Compounding turns small sums into big wins over years.

Leave a Reply