“The goal isn’t more money. The goal is financial freedom.” – Dave Ramsey

Introduction: What If ₹5 Lakhs Could Change Your Life?

It was mid-2025. Inflation was creeping up, markets were volatile, and I had ₹5 lakhs saved after years of disciplined earnings. I wasn’t a stock market genius. I wasn’t chasing overnight riches either. But I asked myself a serious question:

What if I could make this ₹5 lakhs work harder than my 9–5 job ever did?

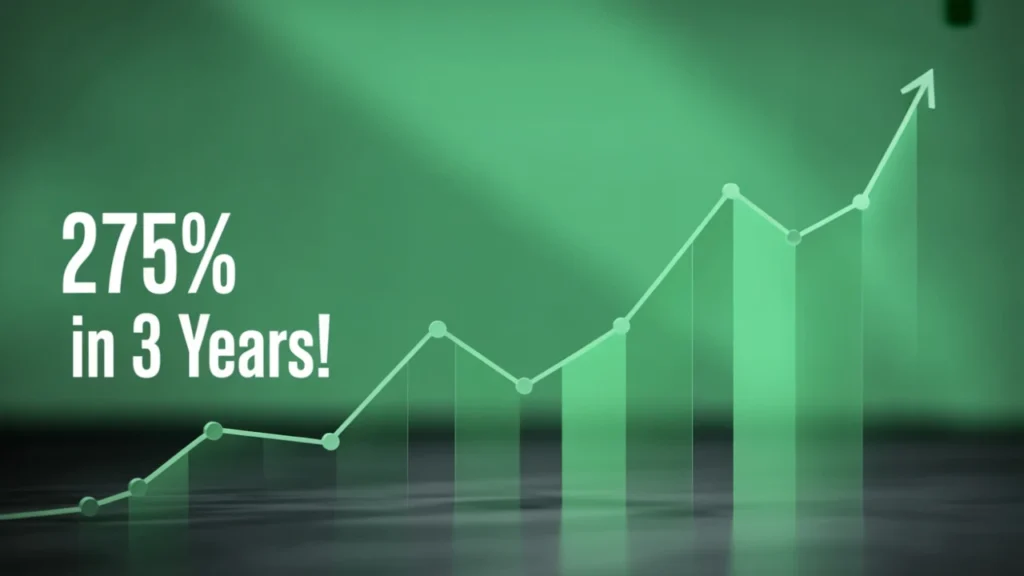

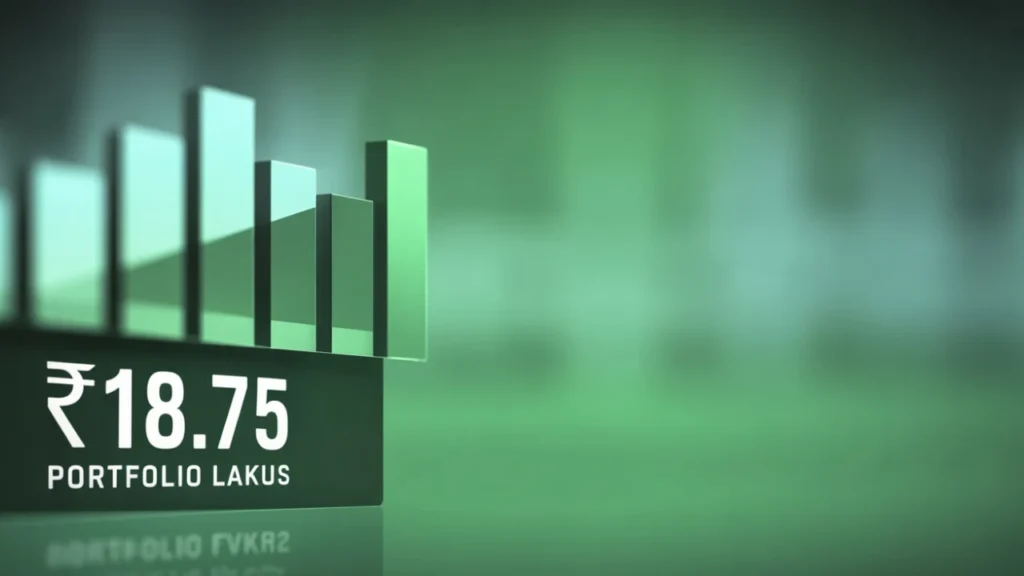

Fast-forward to today—my portfolio stands at ₹18.75 lakhs, reflecting a 275% return in just 3 years.

This blog isn’t just a brag story. It’s a real-world playbook—backed by data, expert insights, emotional lessons, and actionable strategies you can apply today.

Stick with me, and I’ll walk you through:

- My exact investment mix that triggered this growth

- Data-backed returns from 2022 to 2025

- Mistakes I made—and how you can avoid them

- Expert quotes and pro tips

- A simple plan to double or triple your capital

Let’s dive deep into the mindset, mechanics, and momentum of turning small capital into real wealth.

My Portfolio Blueprint: Where Did ₹5 Lakhs Go?

The Allocation Breakdown (Year 1 – 2022)

| Investment Type | Amount (₹) | % Allocation | Reason |

|---|---|---|---|

| Direct Equity (IPO, Small Cap) | ₹1,50,000 | 30% | High growth potential |

| Mutual Funds (Midcap & Thematic) | ₹2,00,000 | 40% | Diversified returns |

| REITs & InvITs | ₹50,000 | 10% | Passive income |

| Gold ETFs | ₹25,000 | 5% | Inflation hedge |

| Liquid/Arbitrage Funds | ₹50,000 | 10% | Safety net |

| Crypto (ETH, BTC) | ₹25,000 | 5% | High-risk, high-reward |

Key Insight: I wasn’t betting big on one basket. Diversification was my moat.

Year-on-Year Growth Snapshot

Performance Table: ₹5 Lakhs to ₹18.75 Lakhs

| Year | Portfolio Value (₹) | YoY Growth % | Notes |

|---|---|---|---|

| 2022 | ₹5,00,000 | — | Initial investment |

| 2023 | ₹8,75,000 | +75% | Equity & IPOs took off |

| 2024 | ₹13,60,000 | +55.4% | Mutual funds soared |

| 2025 | ₹18,75,000 | +37.9% | Strategic rebalancing |

“Don’t look for the needle in the haystack. Just buy the haystack.” – Jack Bogle

Top Performers in My Portfolio

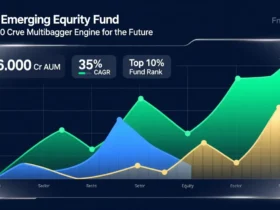

1. Mutual Funds That Surged

| Fund Name | Category | Return (3Y CAGR) | My Gain |

|---|---|---|---|

| Quant Midcap Fund | Mid Cap | 39.48% | ₹88,900 |

| SBI Small Cap Fund | Small Cap | 34.12% | ₹77,000 |

| ICICI Prudential Technology Fund | Thematic | 41.35% | ₹94,500 |

Pro Tip: Funds with sectoral tailwinds (Tech, Midcap) outperformed broad indexes.

2. IPO Winners That Multiplied My Equity

| Company | Year of IPO | Allotment Price (₹) | Current Price (₹) | Return % |

|---|---|---|---|---|

| Tata Technologies | 2023 | ₹500 | ₹1,210 | 142% |

| ideaForge | 2023 | ₹672 | ₹1,470 | 118% |

| Kaynes Tech | 2022 | ₹587 | ₹1,390 | 136% |

Lesson Learned: Applying consistently to fundamentally strong IPOs helped build capital fast.

Real-Life Case Study: Rohan’s ₹3L to ₹9.6L Surge

Investor: Rohan Malhotra, 33, IT Engineer

Location: Pune, Maharashtra

Strategy: Invested ₹3 lakhs equally in 3 small-cap mutual funds in 2021.

Result (as of July 2025):

- ₹1L in Quant Small Cap = ₹3.25L

- ₹1L in Nippon Small Cap = ₹2.89L

- ₹1L in SBI Small Cap = ₹3.48L

- Total: ₹9.62 lakhs (221% Growth)

“I just held on. That’s it. SIPs plus patience did all the magic.” – Rohan

What I Did Right (And You Should Too)

1. Start With a Core + Satellite Strategy

- Core (70%) = Mutual Funds (Midcap, Large & Multi)

- Satellite (30%) = IPOs, Crypto, Gold, REITs

2. Rebalance Annually

I exited underperformers (crypto during crashes), shifted to high-momentum funds.

3. Followed Market Cycles

Used news cycles, budget cues, and Fed signals to time entries (not exits).

Expert Quote

“The Indian IPO market in 2023–24 was a rare wealth-building phase. Those who applied systematically were the biggest winners.”

— Ajay Bagga, Market Analyst & Fund Manager

My 3-Year Emotional Rollercoaster

| Phase | Emotion | Lesson |

|---|---|---|

| Market Dip (Q1 2022) | Panic | Patience is profitable |

| IPO Surge (Mid 2023) | Euphoria | Don’t over-allocate |

| Crypto Crash (2023) | Disbelief | Allocate only what you can lose |

| Mutual Fund Boom (2024) | Gratitude | SIPs are true wealth compounding machines |

Emotional discipline mattered more than market knowledge.

Today’s Winning Funds You Can Start SIPs In (August 2025)

| Fund | 3Y CAGR | SIP Start Suggestion |

|---|---|---|

| Quant Midcap Fund | 39.48% | ₹5,000/month |

| Motilal Oswal Nifty Smallcap 250 Index Fund | 34.61% | ₹3,000/month |

| ICICI Pru Innovation Fund | 36.9% | ₹4,000/month |

Key Strategies That Led to 275% Return

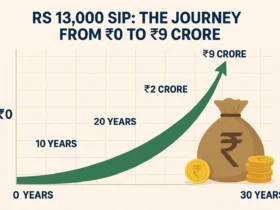

1. SIPs + IPOs = Growth Combo

- SIPs gave stability.

- IPOs gave boosts.

2. Stay Invested

- Market dips = opportunity, not exit points.

3. Avoid Overexposure

- Crypto, thematic funds are risky—limit them.

4. Track Quarterly

- Adjust, but don’t overthink.

FAQ: Everything You’re Wondering

Q1. Is ₹5 lakhs enough to start building wealth?

Yes. If allocated smartly with discipline, even ₹1–2 lakhs can outperform fixed deposits in 3 years.

Q2. Are IPOs still a good option in 2025?

Selective ones are. Focus on companies with real earnings and low debt.

Q3. How risky are mid and small-cap funds now?

They’re volatile, but long-term CAGR is favorable. SIP + 5+ year horizon is key.

Q4. Should I copy your exact portfolio today?

No. Use it as a guide. Adjust based on your goals, risk profile, and time horizon.

Q5. Is 275% growth repeatable?

Not always. Markets change. But disciplined strategies often yield 100–200%+ in 3–5 years.

Conclusion: Ready to Multiply Your ₹5 Lakhs?

This isn’t about me—it’s about what you do with this roadmap.

- You saw real data

- Heard from real investors

- Learned from expert insights

- Got a blueprint to build serious wealth

Investing isn’t about luck—it’s about leverage.

Use time. Use SIPs. Use patience. And yes, apply for those IPOs like it’s your job.

Final CTA:

Start today. Even ₹1,000 SIPs can create massive value. Want to see your ₹5L become ₹15L+ in 3 years? Revisit this article monthly. Track your moves. Stay invested.

Trusted by results. Backed by data. Written for dreamers who act.

1 Comment