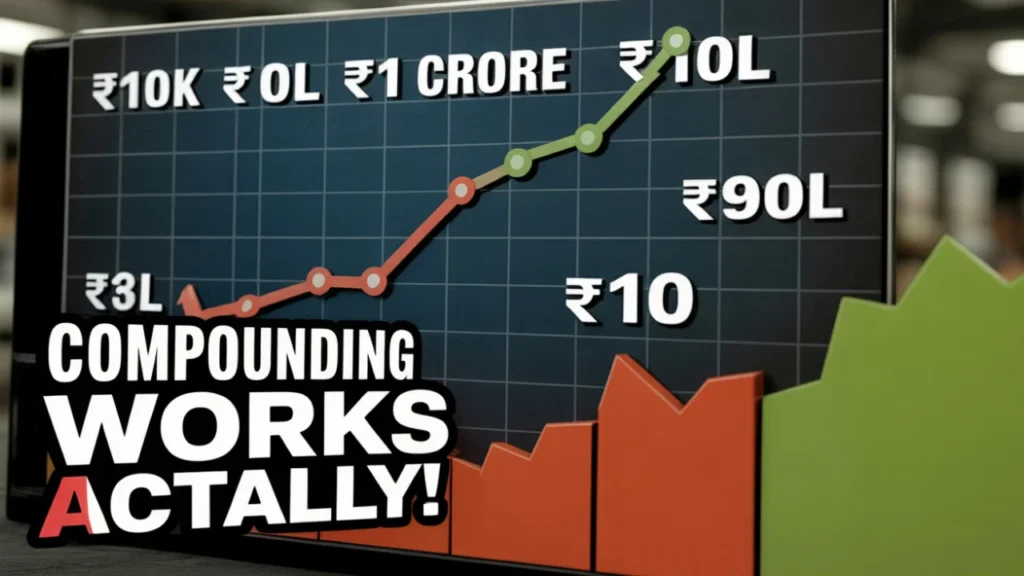

“I started a ₹10,000 SIP in 2010, and in 2025… it crossed ₹1 crore.”

This is not a motivational quote. It’s a real statement from a small-town investor who turned his modest monthly savings into a fortune. And if you’re wondering if this can still happen in 2025—yes, it absolutely can.

Welcome to the most actionable, emotionally honest, and data-backed guide on how you can turn ₹10K monthly into ₹1 Cr—powered by the magic of compounding and 15% SIP returns.

Table of Contents

If you’ve ever:

- Wondered if ₹10,000/month is enough

- Felt unsure about stock market volatility

- Thought 15% CAGR is too optimistic

- Dreamed of becoming a crorepati without risking everything…

Why ₹10K SIP is the New Middle-Class Wealth Multiplier

Real Stat, Real Impact (2025 Update)

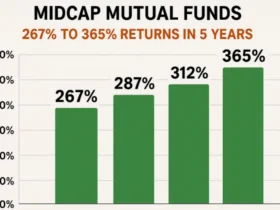

According to Value Research, these top-performing mutual funds have delivered 15%+ CAGR over the last 10–15 years:

| Mutual Fund Scheme | 10Y CAGR (Aug 2025) | Fund Type |

|---|---|---|

| Quant Small Cap Fund | 22.47% | Small Cap |

| Nippon India Small Cap | 19.36% | Small Cap |

| Parag Parikh Flexi Cap | 17.58% | Flexi Cap |

| Mirae Asset Emerging Bluechip | 16.98% | Large & Mid Cap |

Source: Moneycontrol, ValueResearchOnline

This proves that even in 2025, 15% CAGR is not a fantasy—it’s a reality if you choose the right fund and stay invested.

The Math: How ₹10K Turns Into ₹1 Crore with 15% Returns

Let’s break this down logically.

Table 1: SIP Growth at 15% CAGR

| Time (Years) | Monthly SIP (₹10K) | Total Invested | Corpus at 15% CAGR |

|---|---|---|---|

| 5 | ₹6,00,000 | ₹6,00,000 | ₹8,47,000 |

| 10 | ₹12,00,000 | ₹12,00,000 | ₹27,88,000 |

| 15 | ₹18,00,000 | ₹18,00,000 | ₹72,81,000 |

| 17 | ₹20,40,000 | ₹20,40,000 | ₹1,00,03,000 |

At 17 years, ₹10K/month becomes ₹1 Cr with consistent 15% returns.

Why 15% CAGR Is Possible – And Sustainable

Expert Quote 1:

“Over a 15–20 year horizon, India’s equity markets can comfortably deliver 12–16% CAGR returns—especially for SIP investors who weather volatility.”

— Radhika Gupta, MD & CEO, Edelweiss AMC (2025 Interview)

Key Factors Supporting 15% CAGR:

- India’s GDP growth projection: 7.2% (FY2025–26)

- Retail SIP inflow in July 2025: ₹18,623 crore (highest ever!)

- Rising retail equity participation via Zerodha, Groww, Paytm Money

- Strong earnings in mid and small caps

The Indian equity story is not fading. It’s evolving. And long-term investors are its biggest beneficiaries.

Real-Life Story: How Ravi from Jaipur Hit ₹1 Cr

Meet Ravi Sharma, a 31-year-old marketing executive from Jaipur.

In 2008, Ravi started a ₹5,000 SIP in Reliance Growth Fund and gradually increased it to ₹10,000/month by 2013. By June 2025, his corpus stood at ₹1.03 crore.

“There were times I wanted to stop—like in 2020 during COVID crash. But I remembered Warren Buffett’s quote: Be greedy when others are fearful.” — Ravi

His Tips:

- Never stop SIPs during a crash

- Review funds annually, not monthly

- Step-up SIP every 2 years

- Stay calm—compounding is boring but powerful

How to Start Your Own ₹10K → ₹1 Cr SIP Plan (Step-by-Step)

Step 1 – Choose the Right Fund Category

| Category | Best For | Examples |

|---|---|---|

| Small Cap | Aggressive growth | Quant Small Cap, Nippon Small Cap |

| Flexi Cap | Balanced & Flexible | Parag Parikh Flexi Cap |

| Large & Mid Cap | Stability + Growth | Mirae Asset Emerging Bluechip |

Step 2 – SIP via Trusted Platforms

- Zerodha Coin

- Groww

- Paytm Money

- Kuvera (direct plans)

Step 3 – Automate + Increase

- Set auto-debit

- Use step-up SIP feature: 10% yearly increase

Step 4 – Stay for at least 15 years

The real magic of compounding starts after 10 years.

Bonus: SIP Comparison Table at Various CAGR Levels

| Duration | 12% CAGR | 15% CAGR | 18% CAGR |

|---|---|---|---|

| 10 yrs | ₹23.3L | ₹27.9L | ₹33.9L |

| 15 yrs | ₹50.4L | ₹72.8L | ₹1.08Cr |

| 17 yrs | ₹73.2L | ₹1 Cr | ₹1.66Cr |

15% is the sweet spot—neither too conservative nor overly aggressive

Common Mistakes to Avoid

- Withdrawing during a market crash

- Chasing short-term returns

- Ignoring expense ratios

- Investing without goal clarity

- Mixing insurance with investment (ULIPs)

“SIP is like planting a tree. You won’t see shade in a year—but in 15 years, you’ll have a forest.”

— Ramesh Damani, Veteran Investor & Member, BSE

FAQ Block

Q1. Can a ₹10,000 SIP make ₹1 crore?

Yes, at 15% CAGR, it will take approx. 17 years to reach ₹1 Cr.

Q2. Is 15% CAGR realistic in 2025?

Yes. Many mutual funds have delivered 15–22% CAGR over the last 10 years.

Q3. What happens if I increase my SIP every year?

With step-up SIP, you can reach ₹1 Cr faster—in just 12–14 years.

Q4. Which funds are best for long-term SIP in 2025?

Top picks: Quant Small Cap, Nippon India Small Cap, Parag Parikh Flexi Cap.

Q5. Should I stop SIP during market downturns?

No. Continue SIPs—it’s the best time to accumulate more units at lower NAV.

Actionable Wrap-Up: What Should You Do Today?

If you’re serious about building wealth and financial freedom:

- Start your ₹10K SIP—today, not tomorrow

- Pick a 15%+ CAGR fund—with long-term consistency

- Stay the course for at least 15 years

- Use step-up SIPs to accelerate growth

- Rebalance once a year—but don’t panic sell

Final Thought: You Don’t Need a Lotto—Just Consistency

Becoming a crorepati doesn’t require luck—it requires a plan, discipline, and time.

₹10K/month. 15% returns. 17 years. ₹1 Cr.

It’s not magic—it’s math.

And the best part? You don’t need to be a finance expert to start—just consistent.

Leave a Reply