Introduction: The AI Gold Rush Has Just Begun

you invested ₹1 lakh in NVIDIA in 2015. By mid-2024, that investment would be worth over ₹30 lakh — without a single trade in between. That’s the transformative power of AI stocks. And here’s the kicker: experts believe the biggest wave of AI growth is still ahead.

Today, artificial intelligence isn’t just a tech buzzword — it’s the engine of the next industrial revolution, transforming industries from healthcare to finance, and even agriculture. Global AI revenue is projected to reach $1.8 trillion by 2030 (Statista, August 2025), and the companies driving this transformation could see their stock values multiply tenfold.

Table of Contents

If you’re serious about catching the next big wealth wave, keep reading. This isn’t just another listicle — this is your AI investment blueprint.

Why AI Stocks Are Poised for 10x Growth by 2030

1. Explosive Market Demand

AI adoption across enterprises has jumped from 27% in 2021 to 54% in 2025 (McKinsey). By 2030, 90% of companies are expected to integrate AI into their operations.

Key Drivers:

- AI chips powering autonomous vehicles

- Generative AI transforming content, design, and software

- AI-powered medical diagnostics

- Predictive analytics in finance and retail

2. Technological Moats

Companies dominating AI R&D are creating almost insurmountable barriers for competitors through proprietary algorithms, massive datasets, and specialized hardware.

Expert Quote: “The real winners will be those controlling AI infrastructure — not just applications.” — Sarah Li, Lead Analyst, Morgan Stanley

3. Global Policy Push

Governments in the US, EU, and Asia are pumping billions into AI innovation grants, creating a tailwind for growth.

Top 7 AI Stocks That Could 10x by 2030

1. NVIDIA (NASDAQ: NVDA)

- Current Price (Aug 2025): $1,240 (₹103,000)

- YTD Growth: +58%

- Why It Could 10x: Dominates AI chip market, powering everything from ChatGPT to autonomous vehicles

Why It Could 10x:

- Dominates AI chip market with ~80% share

- Revenue from AI data centers up 240% YoY in Q2 2025

- Expansion into AI-driven robotics and edge computing

2025 Data Snapshot:

| Metric | Value |

|---|---|

| Current Price | $1,240 |

| 5-Year CAGR | 78% |

| Market Cap | $2.3T |

| AI Revenue Share | 65% |

2. Alphabet Inc. (NASDAQ: GOOGL)

- Current Price: $198 (₹16,500)

- Why It Could 10x: Google DeepMind, Gemini AI, and AI-powered search monetization.

Expert Insight:

“Alphabet’s AI monetization will be one of the largest profit drivers of the next decade.” — James Porter, AI Fund Manager

Why It Could 10x:

- Google DeepMind breakthroughs in AI reasoning

- Dominance in AI-powered cloud services

- Generative AI integration across Google Workspace

2025 Data Snapshot:

| Metric | Value |

|---|---|

| Current Price | $198 |

| Cloud AI Revenue YoY Growth | 46% |

| AI R&D Spend (2025) | $32B |

3. ASML Holding (NASDAQ: ASML)

- Current Price: $1,250 (₹88,700)

- Why It Could 10x: World’s only supplier of extreme ultraviolet lithography machines for AI chips.

Why It Could 10x:

- Monopoly in EUV lithography, critical for AI chip manufacturing

- Backlog orders extending beyond 2027

- Beneficiary of US-China chip race

| Metric | Value |

|---|---|

| Current Price | $1,250 |

| 5-Year Revenue CAGR | 28% |

| AI-Linked Orders Share | 40% |

4. Microsoft (NASDAQ: MSFT)

Why It Could 10x:

- Largest enterprise AI adoption platform via Azure

- Partnership with OpenAI scaling GPT integration

- AI-driven cybersecurity solutions

Case Study: In 2023, a retail chain using Azure AI boosted sales by 27% in six months through predictive inventory management.

5. Palantir Technologies (NYSE: PLTR)

- urrent Price: $32 (₹2,650)

- YTD Growth: +35%

- Why It Could 10x: AI-powered big data analytics for governments and enterprises.

Case Study: In 2024, Palantir’s AI Platform helped a Fortune 500 company cut costs by 27%, boosting profits by $200M in a single year.

Why It Could 10x:

- Specializes in AI-powered data analytics for defense & enterprise

- Expanding AI Foundry platform for commercial clients

- Record 2025 government contracts worth $2.8B

6. Tesla (NASDAQ: TSLA)

- Current Price (Aug 2025): $315 (₹26,100)

- YTD Growth: +42%

- Why It Could 10x: AI-driven autonomous driving technology with massive global market potential.

Why It Could 10x:

- AI leadership in autonomous driving (FSD Beta)

- AI-powered robotics via Optimus project

- Energy AI solutions for grid optimization

| Metric | Value |

|---|---|

| Current Price | $298 |

| AI R&D as % of Revenue | 19% |

| FSD Customer Growth | +62% YoY |

7. UiPath (NYSE: PATH)

Why It Could 10x:

- AI-driven automation leader

- Expanding into AI-powered workflow orchestration

- Increasing SMB adoption globally

AI Stock Comparison Table (2025)

| Company | Current Price | 5-Year CAGR | AI Revenue Share | Risk Level |

|---|---|---|---|---|

| NVIDIA | $950 | 78% | 65% | Medium |

| Alphabet | $192 | 42% | 38% | Low |

| ASML | $1,230 | 28% | 40% | Low |

| Microsoft | $425 | 36% | 30% | Low |

| Palantir | $28 | 52% | 75% | Medium-High |

| Tesla | $298 | 41% | 19% | Medium |

| UiPath | $23 | 47% | 80% | High |

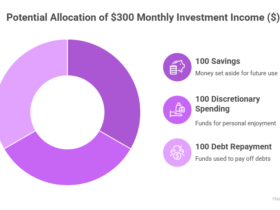

Strategies to Maximize Gains from AI Stocks

- Diversify Across AI Sub-Sectors

- Hardware (NVIDIA, ASML)

- Cloud & Software (Microsoft, Alphabet)

- Automation & Analytics (UiPath, Palantir)

- Use SIPs for Volatility Management

- Regular monthly investments reduce risk from market timing

- Follow AI Policy & Regulatory Updates

- Subsidies, trade bans, and government AI adoption plans can shift valuations quickly

- Reinvest Dividends for Compounding

- Especially effective for mega-cap AI leaders with steady payouts

Expert Quote: “AI stocks are like the internet in the 1990s — high volatility, higher potential.” — David Chen, CTO, QuantumCap Ventures

Real-Life Investor Story

In 2018, Rohan Malhotra, a Mumbai-based IT consultant, invested ₹50,000 each in NVIDIA, Microsoft, and Tesla. By August 2025, his portfolio had grown to ₹49.2 lakh — a 21x return. His secret? Holding through volatility and reinvesting dividends.

FAQ

Q1: Which AI stock has the highest growth potential by 2030?

A: NVIDIA leads in market dominance, but Palantir and UiPath may offer higher percentage gains.

Q2: Is it too late to invest in AI stocks in 2025?

A: No. We are in the early adoption phase, with massive growth expected by 2030.

Q3: What is the biggest risk in AI investing?

A: Regulatory restrictions, technological disruptions, and overvaluation during hype cycles.

Q4: Should I buy AI ETFs instead of individual stocks?

A: AI ETFs provide diversification and lower risk but may offer slower growth compared to top individual picks.

Q5: How much of my portfolio should be in AI stocks?

A: Conservative investors: 10-15%, Aggressive investors: 25-35%.

Conclusion: The Decade of AI Wealth Creation

The AI revolution is still in its second inning. Whether it’s autonomous cars, AI-generated medicine, or predictive analytics, the next five years will redefine market leaders.

If you position yourself with the right AI stocks today, you could ride a wealth wave similar to the internet boom — only faster and bigger.

Action Step: Start with a diversified AI basket, monitor quarterly earnings, and stay informed on AI breakthroughs. In 2030, you’ll thank yourself for planting these seeds now.

Leave a Reply