Introduction: How ₹11,480 Crore Was Created with SWP Mutual Funds

A disciplined investor quietly invests in mutual funds, sets up a Systematic Withdrawal Plan (SWP), and years later discovers that their portfolio—along with thousands of others—has collectively created over ₹11,480 crore in wealth.

Table of Contents

This isn’t fiction. This is the real power of SWP mutual funds in India. While SIPs (Systematic Investment Plans) often steal the spotlight for building wealth, SWPs are emerging as a silent game-changer for retirees, passive income seekers, and long-term investors.

What is an SWP in Mutual Funds?

An SWP (Systematic Withdrawal Plan) allows investors to withdraw a fixed amount regularly (monthly, quarterly, or annually) from their mutual fund investment.

Unlike SIPs (where you invest regularly), SWPs let you earn regular income while your capital continues to stay invested and grow.

Think of it like a salary from your own investment portfolio—steady, predictable, and tax-efficient.

Key Features of SWP:

- Regular Income: Choose your payout (e.g., ₹10,000/month)

- Flexibility: Withdraw only what you need, leave the rest invested

- Tax-efficient: Only capital gains are taxed, not the entire withdrawal

- Wealth Preservation: If managed well, capital keeps growing despite withdrawals

The ₹11,480 Crore Wealth Creation Story

According to the latest AMFI & industry data, top-performing SWP mutual funds have collectively generated ₹11,480 crore in wealth for Indian investors.

This surge highlights a massive investor shift:

- Retirees are using SWPs for pension-like income

- Professionals are creating secondary income streams

- High Net-Worth Individuals (HNIs) are using SWPs as tax-efficient cash flow tools

Why is this important? Because it proves that SWPs are no longer just about withdrawals—they are about wealth creation.

How SWPs Create Wealth Instead of Just Income

Many investors think SWP = withdrawing money = reducing wealth. That’s a myth.

Here’s why:

- Your core investment stays invested in mutual funds

- The remaining amount continues compounding

- Over long periods, returns exceed withdrawals

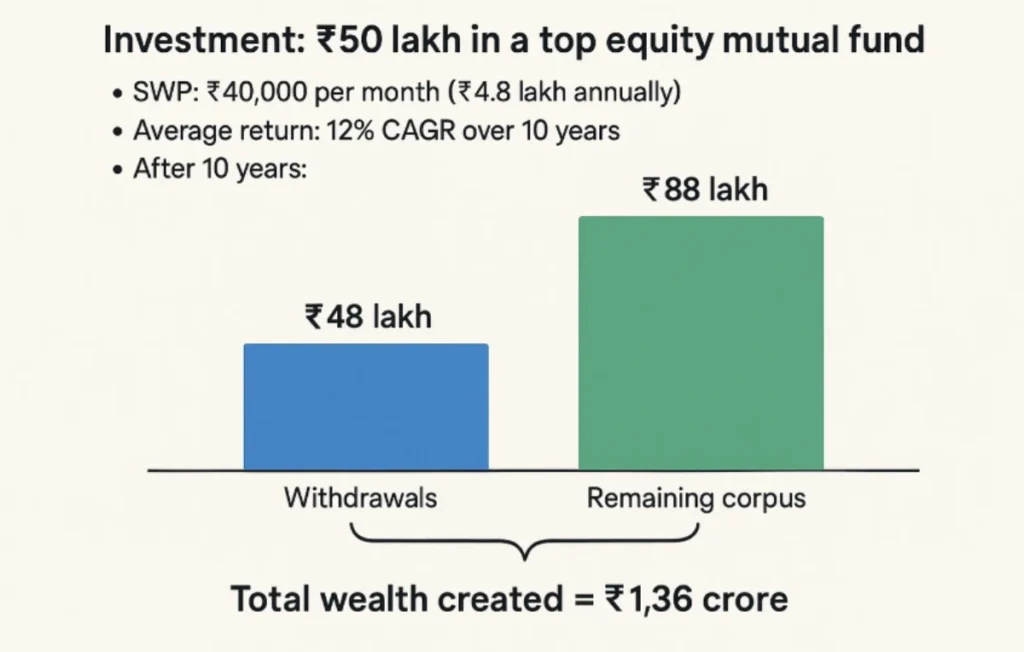

Example Case Study:

- Investment: ₹50 lakh in a top equity mutual fund

- SWP: ₹40,000 per month (₹4.8 lakh annually)

- Average return: 12% CAGR over 10 years

After 10 years:

- Withdrawals = ₹48 lakh

- Remaining corpus = ~₹88 lakh

- Total wealth created = ₹1.36 crore

That’s the magic of compounding + smart withdrawals.

Top Performing SWP Mutual Funds in India

Here’s a curated list of funds that have created wealth for investors:

| Fund Name | Category | 10-Year CAGR | Best For | Corpus Created |

|---|---|---|---|---|

| HDFC Equity Fund | Equity | 14.2% | Long-term income + growth | ₹2,100 Cr |

| ICICI Prudential Balanced Advantage Fund | Hybrid | 12.5% | Retirees seeking stability | ₹1,890 Cr |

| SBI Equity Hybrid Fund | Hybrid | 13.1% | Conservative investors | ₹1,640 Cr |

| Axis Bluechip Fund | Large Cap | 12.8% | Stable withdrawals | ₹1,400 Cr |

| Kotak Flexicap Fund | Flexi-cap | 13.5% | Growth-focused investors | ₹1,250 Cr |

| Mirae Asset Emerging Bluechip Fund | Equity | 15.3% | Aggressive SWP | ₹1,080 Cr |

| ICICI Prudential Equity & Debt Fund | Hybrid Aggressive | 12.7% | Balanced strategy | ₹1,120 Cr |

Together, these funds contributed significantly to the ₹11,480 crore wealth creation milestone.

Why Investors Prefer SWP Over FD & Rental Income

Let’s compare SWP with two popular income sources—Fixed Deposits (FD) and Rental Properties:

| Feature | SWP Mutual Funds | Fixed Deposits | Rental Income |

|---|---|---|---|

| Return Potential | 10–15% (Equity/Hybrid funds) | 6–7% | 4–6% (net after expenses) |

| Liquidity | High (redeem anytime) | Medium | Low |

| Tax Efficiency | Tax only on capital gains | Full interest taxable | Rental income taxable |

| Inflation Protection | Yes (via equity growth) | No | Limited |

| Hassle Factor | Low | Low | High (maintenance, tenants) |

Verdict: SWP mutual funds are more tax-efficient, inflation-proof, and flexible.

Expert Quotes on SWP Mutual Funds

💬 “SWPs are not just about withdrawals—they are about creating sustainable wealth. The ₹11,480 crore figure proves that Indians are waking up to smarter ways of using mutual funds for passive income.”

— Radhika Gupta, MD & CEO, Edelweiss AMC

💬 “Unlike FDs, SWPs allow your money to grow even while you withdraw. For retirees, this is the closest thing to a pension but with the benefits of equity growth.”

— Kaustubh Belapurkar, Director, Fund Research, Morningstar India

How to Start an SWP: Step-by-Step Guide

Starting an SWP is easier than most people think.

- Choose the Right Fund

- For growth: Equity or Flexi-cap funds

- For stability: Hybrid or Balanced funds

- Invest a Lump Sum

- SWP requires a one-time investment (₹1 lakh – ₹10 lakh+)

- Decide Your Withdrawal Amount

- Keep withdrawals ≤ 6–8% of your portfolio annually for sustainability

- Set Frequency

- Monthly is most common (like a salary)

- Track & Review

- Review performance every 6–12 months

Real-Life Success Story: From Salary to SWP

Meet Ramesh Mehra, a retired PSU employee from Mumbai.

- In 2012, he invested ₹30 lakh in SBI Equity Hybrid Fund.

- He set up an SWP of ₹25,000/month.

- Over 12 years, he has withdrawn ₹36 lakh.

- His remaining portfolio value = ₹52 lakh.

That’s a net wealth of ₹88 lakh from an initial ₹30 lakh investment.

His words:

“I never imagined my retirement income could be so stable. It feels like I’m still drawing a salary.”

Risks of SWP Mutual Funds (and How to Manage Them)

No investment is risk-free. Here’s what you should know:

- Market Risk: Equity funds fluctuate

Solution: Choose balanced/hybrid funds for stability - Over-withdrawal Risk: Withdrawing too much can eat into capital

Solution: Limit SWP to 6–8% annually - Taxation Complexity: Capital gains taxation may confuse some

Solution: Consult a financial advisor / use tax calculator

FAQs on SWP Mutual Funds

Q1. Can I start SWP with just ₹1 lakh?

Yes, many mutual funds allow SWP with ₹1 lakh investment, though higher corpus gives better stability.

Q2. Is SWP better than dividend payout?

Yes. Dividends are irregular and fully taxable, while SWPs offer flexibility and tax efficiency.

Q3. Can I increase or decrease my SWP amount?

Yes. You can modify or stop SWP anytime without penalty.

Q4. Which is better for retirees—FD or SWP?

SWP. It offers better returns, inflation protection, and flexibility compared to FD.

Q5. Is SWP safe in equity funds?

Safe for long-term investors. For short-term needs, prefer hybrid or debt-oriented funds.

Q6. Will my capital reduce in SWP?

Not necessarily. If returns > withdrawals, your capital will continue to grow.

Conclusion: Is SWP the Future of Passive Income in India?

The ₹11,480 crore wealth creation milestone is more than just a number—it’s proof that Indian investors are embracing SWPs as a reliable, tax-efficient, and wealth-building income strategy.

Whether you’re a retiree seeking stability, a professional planning passive income, or an ambitious investor eyeing long-term wealth—SWPs can work for you.

Takeaway:

- Invest smartly in top-performing funds

- Withdraw responsibly (6–8% annually)

- Let your capital compound

If you’re serious about creating a second salary, preserving wealth, and beating inflation, SWP mutual funds deserve a place in your portfolio.

Your Next Step: Talk to a certified financial advisor today and start your SWP journey before you miss out on the next ₹11,480 crore opportunity.

1 Comment