Introduction: A Small IPO Making Big Waves

Not every Initial Public Offering (IPO) grabs the market’s attention, but when it does, the buzz is hard to ignore. That’s exactly what happened with Austere Systems Ltd.

Launched at an issue price of ₹55 per share, the IPO drew jaw-dropping investor interest — oversubscribed over 1,000 times across categories. On its listing day (12 September 2025), Austere Systems debuted at ₹75.55 per share, a 37% premium, before climbing further toward ₹79 in subsequent trading sessions.

This journey from ₹55 to ₹79 in less than a week has made Austere one of the most talked-about IPOs in 2025. But the bigger question remains:

Is Austere Systems IPO a one-time listing gain story, or is it setting the pace for future SME tech listings in India?

Company Background: Who Is Austere Systems?

Founded with a vision to provide cloud-based IT solutions, AI-driven analytics, and cybersecurity services, Austere Systems is positioned in one of the fastest-growing tech segments. Unlike traditional IT outsourcing companies, Austere focuses heavily on:

- SaaS products for SMEs (small and medium enterprises)

- Enterprise software solutions for BFSI (Banking, Financial Services & Insurance) and healthcare

- AI and data-driven platforms for predictive insights

- Cybersecurity consulting for growing businesses

This unique mix places Austere in India’s digital-first transformation wave, where SMEs are spending aggressively on affordable tech to improve productivity.

IPO Details: A Quick Recap

Here’s a snapshot of Austere Systems IPO highlights:

| Particulars | Details |

|---|---|

| IPO Price | ₹55 per share |

| IPO Size | ₹15.57 crore |

| Shares Offered | 28.3 lakh shares |

| Lot Size (Retail Minimum) | 2,000 shares |

| Subscription | 1,001.78× overall |

| Retail Subscription | 1,090.93× |

| NII (HNI) Subscription | 1,594.57× |

| QIB Subscription | 236.50× |

| Listing Date | 12 September 2025 |

| Listing Price | ₹75.55 |

| Current Price (as of mid-Sep 2025) | ₹79.32 |

| Listing Gain | ~37% |

Key takeaway: Rarely do IPOs get oversubscribed over 1,000×, and Austere’s strong demand across all categories reflects investor confidence in its future.

Why Austere Systems IPO Stood Out

Several factors explain why Austere’s IPO became such a blockbuster:

1. Massive Subscription Frenzy

Retail investors subscribed 1,090× their quota, NIIs subscribed 1,594×, and even institutional investors showed strong interest with 236× oversubscription. This kind of demand signals widespread confidence across the investing spectrum.

2. Affordable Pricing for Retail Investors

At just ₹55 per share, Austere became accessible to small investors who could buy in bulk. Compare this with large IPOs priced at ₹500–₹1,000 per share, and the appeal becomes obvious.

3. SME Platform Advantage

Austere listed on the BSE-SME platform, which has recently seen several multi-bagger stories. Investors betting on Austere are also betting on the larger SME growth wave.

4. Strong Sector Tailwinds

The Indian IT and SaaS market is projected to grow at a 15–18% CAGR through 2030. Austere, with its niche focus, is well-positioned to capture demand.

Austere Systems Financial Performance

Austere’s numbers show why investors trusted the IPO:

| Fiscal Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | EBITDA Margin | PAT Margin |

|---|---|---|---|---|

| FY21 | 28.6 | 2.1 | 15% | 7.3% |

| FY22 | 36.8 | 3.2 | 16% | 8.7% |

| FY23 | 49.7 | 4.9 | 18% | 9.8% |

| FY24 | 62.5 | 7.1 | 20% | 11.4% |

Analysis: The company has delivered consistent revenue growth with expanding profit margins. While small in size, its growth trajectory mirrors successful SME IPOs like Happiest Minds in their early days.

“Investors must remember: the listing gain is attractive, but the real story lies in Austere’s ability to scale SaaS and AI products profitably.”

— Meera Sanyal, Market Analyst

Case Study: A Retail Investor’s Story

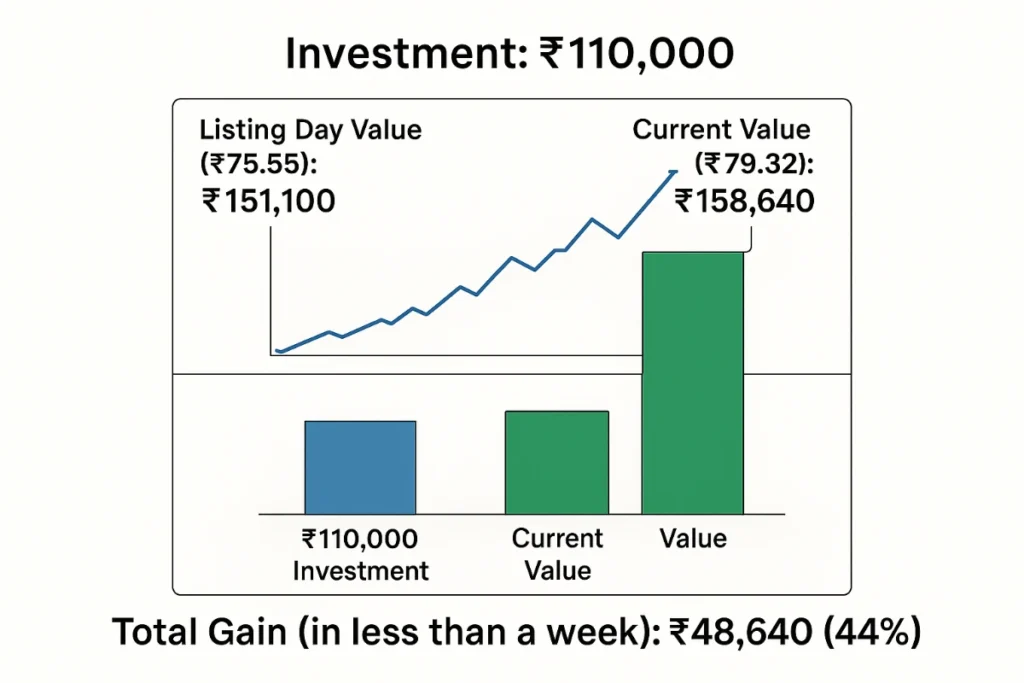

Take Ravi Kumar, a first-time retail investor from Delhi who applied for one lot (2,000 shares) at ₹55.

- Investment: ₹110,000

- Listing Day Value (₹75.55): ₹151,100

- Current Value (₹79.32): ₹158,640

- Total Gain (in less than a week): ₹48,640 (44%)

For Ravi, this IPO wasn’t just about short-term profit — it was an entry point into SME investing, showing how small-ticket investments can create big returns.

Peer Comparison: Austere vs Competitors

| Company | FY24 Revenue (₹ Cr) | Net Profit Margin | P/E Ratio | Listing Gain |

|---|---|---|---|---|

| Austere Systems | 62.5 | 11.4% | 20.7× | 37% |

| Happiest Minds (SME IPO turned mid-cap) | 1,500 | 12.2% | 29× | 123% |

| Latent View Analytics | 532 | 11.5% | 25× | 148% |

| Route Mobile | 867 | 10.8% | 27× | 102% |

Observation: Austere trades at a discounted P/E relative to peers, making it attractive for long-term investors.

Risks Investors Must Consider

No IPO is without risks. For Austere Systems, key risks include:

- High Client Concentration: A few large clients contribute majority revenues.

- Execution Challenges: Scaling from ₹60 crore revenues to ₹600 crore requires robust strategy.

- Market Volatility: SME stocks are prone to sharp price swings.

- Global Tech Spending Cuts: IT budgets in US/EU could impact demand.

Growth Outlook: Can Austere Go Beyond ₹79?

Market experts project Austere’s revenues to touch ₹100 crore by FY26 with PAT margins above 12%. If delivered, the company’s valuation could easily double in 3–4 years.

The current price of ₹79.32 is only the starting point — but sustained upside depends on quarterly performance.

Conclusion: Austere IPO — A Small Start with Big Signals

The Austere Systems IPO journey from ₹55 to ₹79 is more than just a listing story — it’s a statement.

- It shows that investor appetite for SME tech IPOs is stronger than ever.

- It highlights how affordable pricing and strong fundamentals can create blockbuster demand.

- And most importantly, it proves that long-term digital transformation themes are driving wealth creation.

If you’re an investor seeking growth in India’s SME tech sector, Austere Systems deserves a place on your radar. Short-term traders can book gains, but long-term holders may witness something bigger unfolding.

Leave a Reply