Introduction: The Quest for Tomorrow’s Market Leaders

In the dynamic world of investing, identifying the next big winners can be as exhilarating as it is challenging. While many investors focus on the Nifty 50, the elite group of India’s top 50 companies, there’s a burgeoning opportunity in the Nifty Next 50. These are the companies poised to join the ranks of the Nifty 50, representing the future of India’s corporate landscape.

Table of Contents

Enter the Tata Nifty Next 50 Index Fund, a new offering from Tata Mutual Fund that aims to provide investors with exposure to this promising segment. But is it the right investment for you? Let’s delve deeper.

Understanding the Nifty Next 50 Index

The Nifty Next 50 Index comprises the 51st to 100th largest companies listed on the National Stock Exchange (NSE). These companies are often in the growth phase, exhibiting strong potential to become future blue chips.

Key Characteristics:

- Growth Potential: Many companies in this index have the trajectory to join the Nifty 50.

- Sectoral Diversification: Exposure to various sectors, including finance, healthcare, and consumer goods.

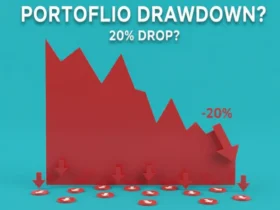

- Higher Volatility: Due to their growth phase, these companies can experience more significant price fluctuations.

Tata Nifty Next 50 Index Fund: Key Details

| Feature | Details |

|---|---|

| Fund House | Tata Mutual Fund |

| Scheme Type | Open-ended Index Fund |

| Benchmark Index | Nifty Next 50 Total Return Index (TRI) |

| NFO Period | September 12, 2025 – September 26, 2025 |

| Minimum Investment | ₹5,000 (Lumpsum), ₹100 (SIP) |

| Exit Load | 0.25% if redeemed within 15 days from the date of allotment |

| Risk Profile | Very High |

| Fund Manager | Nitin Sharma |

Historical Performance of Nifty Next 50 Index

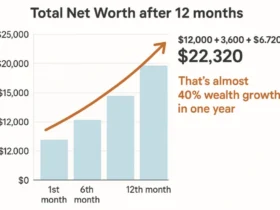

While the Tata Nifty Next 50 Index Fund is newly launched and doesn’t have a performance history, the underlying Nifty Next 50 Index has shown promising returns:

- 3-Year CAGR: Approximately 15%

- 5-Year CAGR: Approximately 27.45%

- 10-Year CAGR: Approximately 11.59%

These figures suggest that the index has outperformed the Nifty 50 in certain periods, highlighting the growth potential of the companies within it.

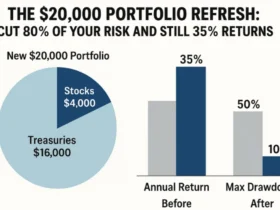

Sector Allocation and Diversification

The Nifty Next 50 Index offers diversified exposure across various sectors:

- Financial Services: Companies like SBI Life Insurance and HDFC Life.

- Consumer Goods: Brands such as Dabur India and Marico.

- Healthcare: Firms like Dr. Lal PathLabs and Biocon.

- Information Technology: Companies including Mindtree and Tech Mahindra.

This diversification helps mitigate sector-specific risks and provides a balanced investment approach.

Taxation and Liquidity

- Short-Term Capital Gains (STCG): Taxed at 15% if units are sold within 1 year.

- Long-Term Capital Gains (LTCG): Taxed at 10% if units are sold after 1 year, with gains exceeding ₹1 lakh in a financial year.

- Liquidity: The fund will reopen for continuous transactions on October 7, 2025.

Who Should Consider This Fund?

The Tata Nifty Next 50 Index Fund is suitable for:

- Long-term Investors: Those with an investment horizon of 5–10 years.

- Risk-Tolerant Investors: Individuals comfortable with higher volatility for potentially higher returns.

- Passive Investors: Those seeking a low-cost, passive investment option to gain exposure to mid-to-large-cap stocks.

Final Thoughts

The Tata Nifty Next 50 Index Fund presents a compelling opportunity for investors looking to tap into the growth potential of India’s future market leaders. With its diversified portfolio, low expense ratio, and alignment with the Nifty Next 50 Index, this fund is poised to be a valuable addition to a long-term investment strategy.

Call to Action: If you’re interested in investing in the Tata Nifty Next 50 Index Fund, consider subscribing during the NFO period from September 12 to September 26, 2025. Always consult with a financial advisor to ensure this investment aligns with your financial goals and risk tolerance.

Leave a Reply