Introduction: The Shiny Illusion of IPOs

Whenever a new IPO (Initial Public Offering) launches, retail investors see it as their shortcut to wealth. News channels hype it, YouTube influencers call it a “golden opportunity”, and WhatsApp groups flood with “apply fast” messages.

Table of Contents

But the reality? 7 out of 10 new investors lose money in IPOs. And most don’t even realize where they went wrong.

IPO Investor Reality Check

| Category | Data | Source |

|---|---|---|

| Retail investors losing money | 70% | NSE 2025 |

| Average IPO loss (1 year) | 12–18% | SEBI 2024 |

| Institutional profit booking | 15–25% | Bloomberg 2023 |

Why IPOs Look So Attractive

The IPO market plays on emotions. New investors believe they are getting a “rare chance”. In reality, hype pushes them into bad decisions.

- Scarcity effect: “Limited shares, apply quickly.”

- Social proof: “Everyone is applying, so should I.”

- Lottery effect: “I’ll double my money on listing day.”

- FOMO: “If I miss this, I’ll regret it.”

Investor Psychology in IPOs

| Bias | Explanation | Impact |

|---|---|---|

| Scarcity Effect | Limited availability | Over-subscription |

| Social Proof | Everyone applying | Blind investing |

| Lottery Effect | Dream of quick profits | Later losses |

| FOMO | Fear of missing out | Panic investing |

Real-Life Examples: IPOs That Trapped Investors

Let’s look at some big IPOs that turned into wealth destroyers for retail investors.

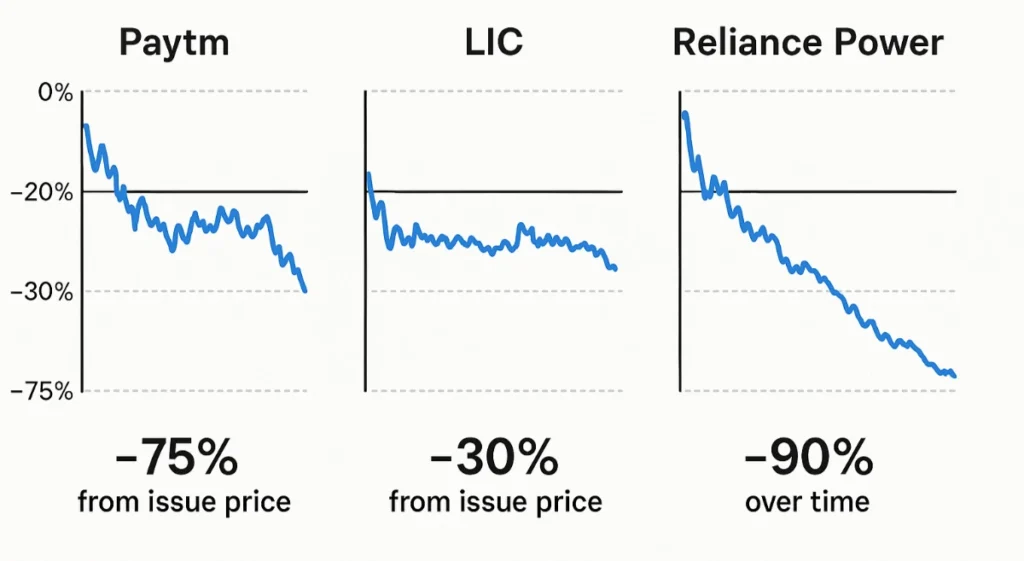

- Paytm (2021): Issue price ₹2,150 → 2025 price ₹550 (–75%).

- LIC (2022): Issue price ₹949 → 2025 price ₹650 (–30%).

- Zomato (2021): Issue price ₹76 → 2025 price ₹65 (flat/loss).

- Nykaa (2021): Peak ₹2,018 → 2025 price ₹1,400 (–30% from peak).

IPO Performance Snapshot (2021–2025)

| IPO | Issue Price | Listing Price | Current Price | Status |

|---|---|---|---|---|

| Paytm | ₹2,150 | ₹1,950 | ₹550 | –75% |

| LIC | ₹949 | ₹872 | ₹650 | –30% |

| Zomato | ₹76 | ₹116 | ₹65 | Flat |

| Nykaa | ₹1,125 | ₹2,018 | ₹1,400 | –30% from peak |

| MapMyIndia | ₹1,033 | ₹1,581 | ₹1,700 | Gain |

The Biggest Mistake: Overvaluation

During IPO launches, companies often sell shares at inflated valuations to raise maximum funds. Retail investors buy at these high prices and suffer losses when reality hits.

IPO Pricing Truth

| Pricing Type | Investor Outcome | Example |

|---|---|---|

| Overpriced | Loss within 6–12 months | Paytm, LIC |

| Fair Value | Stable performance | MapMyIndia |

| Undervalued (rare) | Strong long-term growth | IRCTC |

The Listing Gain Myth

Most beginners enter IPOs expecting quick listing gains. But SEBI data proves only 30% of IPOs sustain their listing-day highs.

Listing Gain Reality

| Category | % IPOs | Outcome |

|---|---|---|

| Sustained gains | 30% | Profitable |

| Direct listing losses | 40% | Loss |

| Initial gain → later fall | 30% | Investors trapped |

Expert Opinions on IPOs

Market experts have consistently warned that IPOs are designed as exit routes for promoters and insiders, not entry points for retail investors.

Expert Quotes on IPOs

| Expert | Quote | Source |

|---|---|---|

| Nirmal Jain (IIFL) | “IPO is often an exit route for promoters.” | CNBC 2024 |

| Warren Buffett | “IPO means It’s Probably Overpriced.” | Berkshire AGM |

| SEBI Report | “Retail participation high but performance weak.” | SEBI 2024 |

A Smarter Way to Approach IPOs

If you still want to invest in IPOs, follow a disciplined approach:

- Read the DRHP and analyze financials.

- Avoid loss-making companies.

- Track anchor investor behavior.

- Limit IPO exposure to 5–10% of your portfolio.

- Think long-term, not just listing gains.

Smart vs Blind IPO Investing

| Approach | Result | Example |

|---|---|---|

| Blind investing (hype-driven) | Heavy losses | Paytm, Reliance Power |

| Research-driven investing | Moderate returns | MapMyIndia |

| Long-term holding | Compounding wealth | IRCTC |

IPO Trap vs Safer Investments

While IPOs are a gamble, long-term investment vehicles like mutual funds, index funds, and blue-chip stocks have consistently created wealth.

IPO vs Safer Options

| Strategy | Short-Term | Long-Term | Risk |

|---|---|---|---|

| IPO Investing | Volatile, hype-driven | 70% underperform | High |

| SIP in Equity MF | Slow start | 12–15% CAGR | Moderate |

| Blue-Chip Stocks | Stable | Wealth creators | Low–Moderate |

| Index Funds | Market average | Consistent compounding | Low |

FAQs: IPO Trap – Everything New Investors Must Know

Q1. Why do 70% of new investors lose money in IPOs?

Because most IPOs are overpriced. Promoters and investment banks push valuations higher. Once the stock lists, prices correct, and retail investors are left with losses.

Q2. Are IPO listing gains guaranteed?

No. Only about 30% of IPOs sustain their listing-day gains. Many crash within months due to profit booking by institutional investors.

Q3. Which Indian IPOs have been the biggest wealth destroyers?

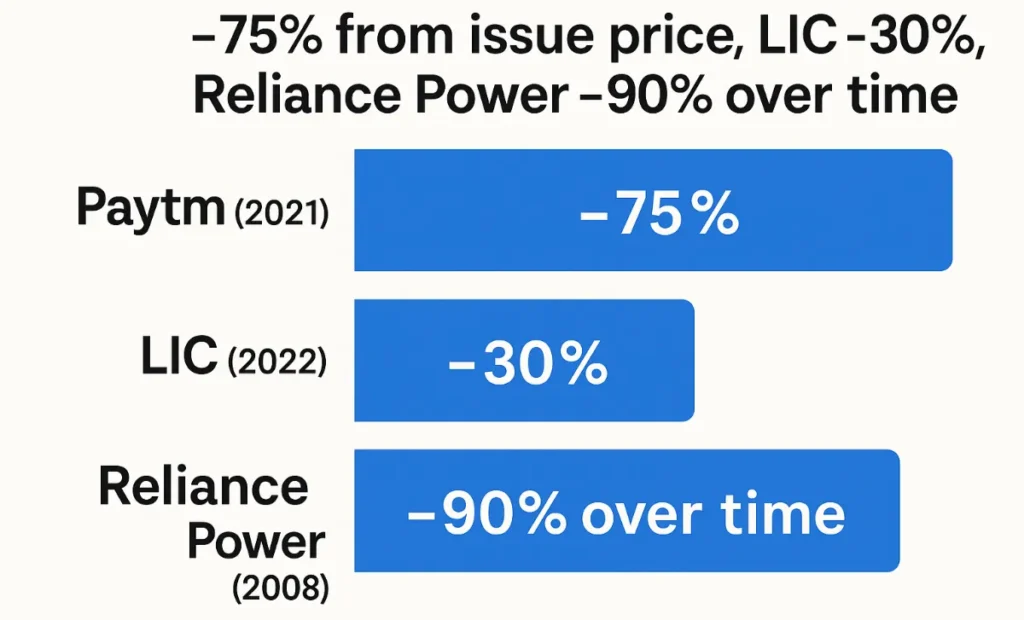

Paytm (2021): –75% from issue price

LIC (2022): –30%

Reliance Power (2008): –90% over time

Q4. Should beginners invest in IPOs?

Beginners should avoid applying blindly. IPOs are risky. If you do, choose only profitable, fairly valued companies with strong fundamentals.

Conclusion: Stay Alert, Stay Safe

The IPO market thrives on hype and emotion, but the data is clear—most retail investors lose money here. If you truly want to build wealth, focus on long-term, research-backed investments rather than chasing IPO lotteries.

Next time you see a “hot IPO” trending, ask yourself:

“Am I investing in a strong business, or just falling for the IPO trap?”

Leave a Reply