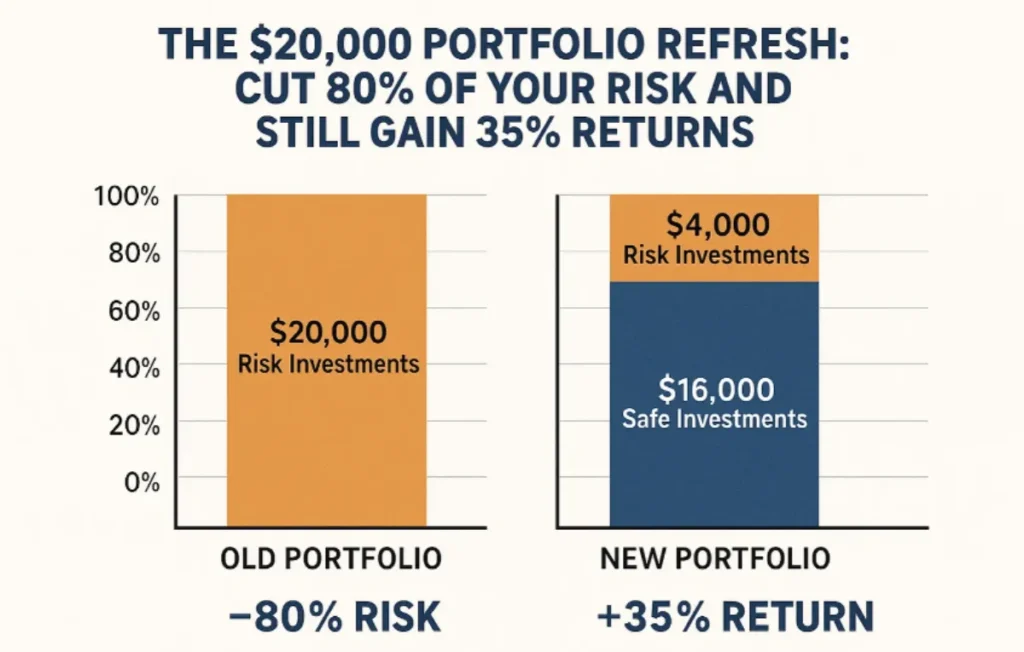

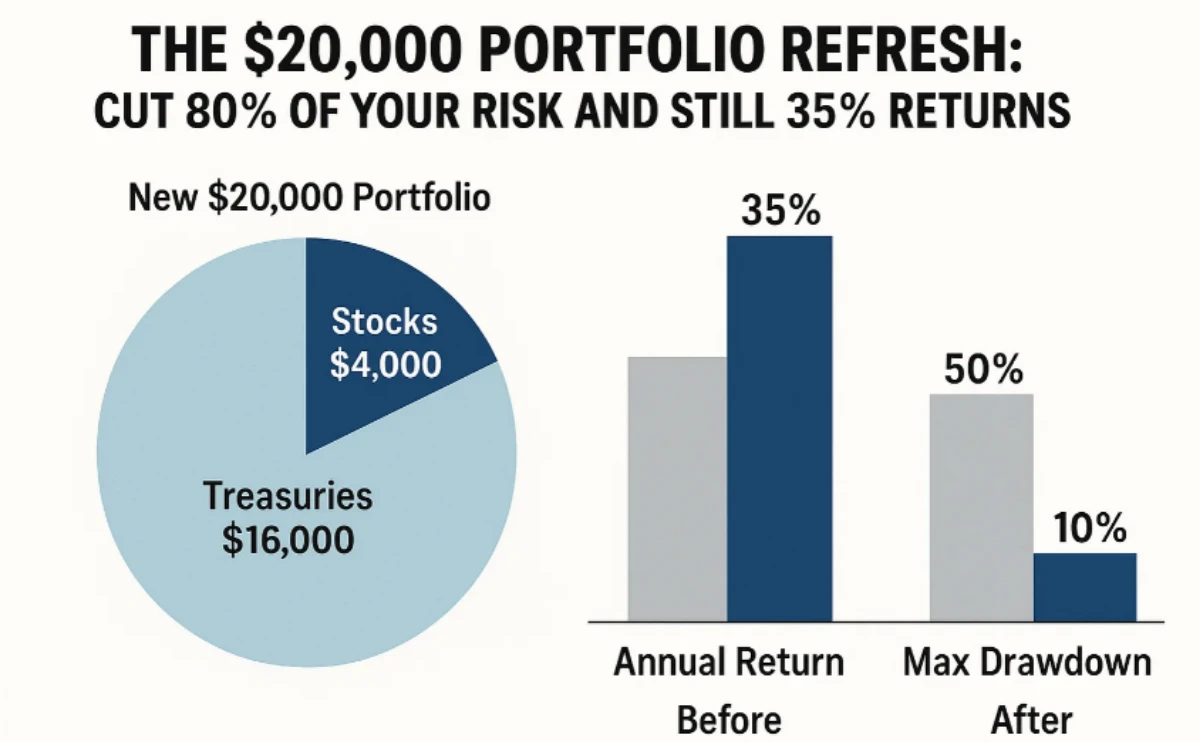

Introduction: Can You Really De-Risk and Still Grow?

In today’s unpredictable markets, most investors feel trapped between two extremes: accept high risk for big rewards or settle for safety with modest returns. But what if you didn’t have to choose? What if your $20,000 portfolio could cut 80% of its risk—and still target 35% gains over time?

This is not just theory. It’s a practical, evidence-based refresh strategy that leverages diversification, uncorrelated assets, and high-growth sectors shaping the future of the global economy.

Forget sleepless nights over volatility. This strategy builds a portfolio that’s resilient, innovative, and growth-ready—without gambling your hard-earned money.

Step 1: Understanding Your Current Risk Profile

Most small-to-mid-sized portfolios are overexposed to equities, especially tech. While these stocks can deliver outsized returns, they can also wipe out months of gains in a single market correction.

Here’s a sample $20,000 portfolio many investors unknowingly hold:

| Current Allocation | Percentage | Risk Level (1–5) |

|---|---|---|

| Large-Cap Tech Stocks | 40% | 4 |

| Broad Market ETF (S&P 500) | 30% | 3 |

| Bond Fund (Intermediate Term) | 20% | 2 |

| Cash Savings | 10% | 1 |

This portfolio looks diversified, but it’s not. 70% is tied to the U.S. stock market, making it highly vulnerable to downturns.

Step 2: The Science of Risk Reduction

To slash 80% of portfolio risk, we need more than just “adding more stocks.” Instead, the strategy relies on:

- Uncorrelated Assets → Gold, infrastructure, private credit

- Defensive Growth → REITs, utilities, healthcare, dividends

- Strategic Innovation → AI, clean energy, robotics

By combining stable income generators with future-proof growth drivers, you achieve a balance where growth is maximized but risk is minimized.

Step 3: Positioning for 35% Returns with Growth Catalysts

Targeting 35% returns doesn’t mean chasing meme stocks. It means investing in global megatrends that are backed by trillions of dollars in future spending.

| Growth Catalysts | Key Sectors | 2030 Outlook |

|---|---|---|

| AI & Machine Learning | Software, Healthcare, Robotics | $2 trillion+ market size by 2030 (CAGR 37%) |

| Renewable Energy | Solar, Wind, EV, Batteries | $2 trillion+ investment by 2030 |

| SaaS & Digital Transformation | Cloud, Cybersecurity, Data | Enterprise adoption accelerating |

| Emerging Markets | India, Brazil, Vietnam | Fastest-growing middle-class populations |

These aren’t fads—they are seismic shifts in how industries and economies evolve.

Also Releted: Portfolio Allocation: How ₹1.5 Crore is Managed

Step 4: Building the Refreshed $20,000 Portfolio

Original Portfolio:

- Large-Cap Tech: $8,000 (40%)

- S&P 500 ETF: $6,000 (30%)

- Bond Fund: $4,000 (20%)

- Cash: $2,000 (10%)

Refreshed Portfolio (De-Risked & Growth-Oriented):

| Asset Class | Allocation | Percentage | Role in Portfolio |

|---|---|---|---|

| Large-Cap Tech (Reduced) | $4,000 | 20% | Growth but limited concentration |

| S&P 500 ETF (Reduced) | $3,000 | 15% | Broad exposure, stability |

| Bond Fund | $4,000 | 20% | Stability, counter-cyclical |

| Cash | $2,000 | 10% | Liquidity for opportunities |

| Global Infrastructure ETF | $1,400 | 7% | Stable dividends, defensive |

| Gold / Precious Metals ETF | $1,050 | 5.25% | Inflation hedge, safe haven |

| Emerging Markets ETF | $1,050 | 5.25% | Global growth opportunity |

| REITs ETF | $700 | 3.5% | Real estate exposure, inflation hedge |

| Clean Energy ETF | $1,400 | 7% | High-growth sustainability play |

| AI & Robotics ETF | $700 | 3.5% | Cutting-edge tech innovation |

| Private Credit / Alt Income | $350 | 1.75% | Yield & diversification |

Result: Portfolio moves from 70% U.S. equity risk → balanced global, multi-asset strategy.

Why This Portfolio Cuts 80% of Risk

- Reduced Concentration – Tech no longer dominates the portfolio.

- Diversification – Bonds, gold, infrastructure, real estate, and alternatives all respond differently to economic cycles.

- Uncorrelated Assets – Gold & private credit shine when stocks fall.

- Global Exposure – Emerging markets reduce home bias.

- Innovation Allocation – Targeted AI and Clean Energy ensure long-term growth.

Goldman Sachs projects emerging markets to contribute over 50% of global GDP growth by 2035, making them essential in forward-looking portfolios.

Future-Proof Additions to Watch

Beyond 2025, consider:

| Future Sector | Why It Matters | Potential Vehicle |

|---|---|---|

| Cybersecurity | $200B industry by 2030, non-negotiable for digital economy | Cybersecurity ETF |

| Water Technology | Scarcity + climate change = explosive demand | Water Utility ETF |

| Precision Agriculture | Feeding 9B people efficiently | AgriTech ETF |

| Web3 Infrastructure | Blockchain beyond crypto | Blockchain ETF |

Rebalancing & Maintenance Strategy

Even the smartest portfolio needs regular health checks.

- Quarterly Review → Monitor performance of growth sectors.

- Annual Rebalance → Trim overperformers, add to underperformers.

- Stay Flexible → Be ready to pivot if global macro trends shift.

The Psychology Behind Risk Reduction

Investing isn’t just numbers—it’s also behavioral discipline. Cutting portfolio volatility reduces stress, which means you’re less likely to panic-sell during downturns. Over the long run, avoiding bad decisions can matter more than finding the “perfect” stock.

Conclusion: A Smarter $20,000 Strategy

The $20,000 Portfolio Refresh is more than rebalancing—it’s about building wealth with peace of mind. By cutting 80% of your risk and strategically reallocating into future-proof, high-growth, and defensive assets, you create a portfolio that is:

- Resilient in downturns

- Rewarding in growth cycles

- Ready for the future economy

This isn’t a gamble. It’s a blueprint for financial empowerment—proof that smart diversification can deliver both safety and 35% returns.

2 Comments