₹1 Crore Corpus by 2030: PPF vs NPS vs Mutual Funds — The 2025–2035 Showdown

In every Indian investor’s journey, the dream of building a ₹1 crore corpus is a defining milestone. For some, it’s about achieving financial freedom; for others, it’s securing their family’s future. But with multiple investment options available, the real question is:

Which is the fastest, safest, and smartest way to reach ₹1 crore — PPF, NPS, or Mutual Funds?

Table of Contents

Let’s dive deep into this decade-long analysis — blending hard data, expert insights, and futuristic projections from 2025 to 2035 — to uncover which investment really wins by 2030.

Understanding the Three Contenders

Before we compare, here’s a quick refresher:

- PPF (Public Provident Fund) – A government-backed savings scheme offering ~7.1% annual return, with EEE (Exempt-Exempt-Exempt) tax benefit.

- NPS (National Pension System) – A long-term retirement plan with market-linked returns, averaging 8–10% depending on your asset allocation.

- Mutual Funds (Equity-focused) – High-growth instruments that can deliver 10–12% average annualized returns over a 10-year horizon.

All three have different risk levels, tax treatments, and compounding power. Let’s see how each performs when you aim for that ₹1 crore target.

The Base Scenario (2025–2035)

Let’s assume you begin investing on January 1, 2025, with three investment styles:

- Lump-sum investment: One-time capital at the start.

- Annual investment: Consistent yearly additions.

- Monthly SIP (Systematic Investment Plan): Equal monthly contributions.

To keep our projections fair, we’ll use the following return assumptions:

| Investment Type | Expected Annual Return | Tax Status |

|---|---|---|

| PPF | 7.1% | Fully tax-free (EEE) |

| NPS | 10% | Partially tax-free (60% lump sum; 40% annuity) |

| Mutual Funds | 12% | Subject to capital gains tax |

Table 1: ₹25 Lakh Lump Sum in 2025 – Value in 2030 & 2035

| Investment | 5-Year Value (2030) | 10-Year Value (2035) |

|---|---|---|

| PPF @ 7.1% | ₹35.05 Lakh | ₹49.18 Lakh |

| NPS @ 10% | ₹40.26 Lakh | ₹64.84 Lakh |

| Mutual Funds @ 12% | ₹44.06 Lakh | ₹77.65 Lakh |

Insight:

Even a modest difference of 2–3% in annual returns compounds into a huge gap over a decade. By 2035, equity mutual funds can potentially outperform PPF by over ₹28 lakh on the same investment.

Yearly SIP Example – ₹3 Lakh per Year

Let’s calculate how annual disciplined investments perform.

| Instrument | Annual Return | 5-Year Value (2030) | 10-Year Value (2035) |

|---|---|---|---|

| PPF | 7.1% | ₹17.0 Lakh | ₹44.0 Lakh |

| NPS | 10% | ₹18.3 Lakh | ₹47.8 Lakh |

| Mutual Funds | 12% | ₹19.1 Lakh | ₹52.7 Lakh |

Observation:

With equal annual investments, mutual funds grow the fastest, followed by NPS, while PPF lags but ensures stability and tax-free maturity.

Also Read: Mutual Funds That Earned Me $2,450 – My Winning Portfolio

How Much You Need to Invest to Reach ₹1 Crore by 2030

Let’s reverse-engineer the numbers — how much should you invest starting 2025 to hit ₹1 crore by 2030 or 2035?

| Year | PPF (7.1%) | NPS (10%) | Mutual Funds (12%) |

|---|---|---|---|

| 2030 (5 yrs) Lump Sum | ₹71.4 Lakh | ₹62.1 Lakh | ₹56.7 Lakh |

| 2035 (10 yrs) Lump Sum | ₹50.7 Lakh | ₹38.6 Lakh | ₹32.2 Lakh |

Result:

If your time horizon is just 5 years, you need significant capital upfront. But if you stretch it to 10 years, even moderate yearly SIPs can compound into ₹1 crore, especially in mutual funds.

Table 2: Annual Investment Needed to Reach ₹1 Crore

| Tenure | PPF | NPS | Mutual Fund |

|---|---|---|---|

| 5 Years | ₹17.6 Lakh/year | ₹16.4 Lakh/year | ₹15.7 Lakh/year |

| 10 Years | ₹7.3 Lakh/year | ₹6.3 Lakh/year | ₹5.7 Lakh/year |

Interpretation:

Time is your biggest ally. A 10-year disciplined SIP requires almost ⅓rd the annual investment compared to a 5-year goal.

The Tax and Liquidity Game

| Investment | Tax Treatment | Lock-in Period | Liquidity |

|---|---|---|---|

| PPF | Fully Tax-Free | 15 years | Partial withdrawals after 5 years |

| NPS | Partial Tax-Free | Until 60 years | Limited partial withdrawals |

| Mutual Funds | Taxable (LTCG/STCG) | None | Fully liquid (exit load applies) |

Conclusion:

PPF wins on tax-free safety, NPS balances growth + retirement, while Mutual Funds dominate in liquidity and flexibility.

Expert Insights

“PPF’s 7.1% return is stable but not enough for long-term wealth creation. It’s great for stability, not for aggressive goals.”

— Rakesh Jhunjhunwala (Late Investor, via archival interviews)

“NPS works best when you commit long-term and allocate wisely between equity and debt. The equity component is what boosts returns.”

— NPS Trust Analysis, 2025 Data

“Equity mutual funds reward patience. A 10–15 year SIP can multiply wealth far beyond fixed-income products, despite volatility.”

— Anand Rathi Wealth Report, 2025

Table 3: Risk-Return Snapshot (2025–2035 Projection)

| Parameter | PPF | NPS | Mutual Funds |

|---|---|---|---|

| Risk Level | Very Low | Moderate | High |

| Average Return | 7.1% | 10% | 12% |

| Ideal For | Conservative | Retirement-focused | Aggressive wealth creation |

| Tax Advantage | High | Moderate | Moderate |

Scenario Simulation: ₹50 Lakh Investment (2025–2030)

| Expected Return | PPF | NPS | Mutual Funds |

|---|---|---|---|

| Conservative | ₹67.3 Lakh | ₹73.8 Lakh | ₹80.5 Lakh |

| Base | ₹70.1 Lakh | ₹76.9 Lakh | ₹85.5 Lakh |

| Optimistic | ₹72.6 Lakh | ₹84.7 Lakh | ₹96.9 Lakh |

Even small return variations create massive end-value changes — a true reflection of compounding power.

Also Read: ₹1 Crore Corpus: PPF (7.1%) vs NPS (10%) vs Mutual Funds (12%) — Which Wins?

The Blended Strategy That Actually Works

A smart investor doesn’t bet everything on one horse.

Here’s a realistic allocation model for 2025–2035:

| Asset | Allocation | Expected CAGR | 10-Year Value (₹5L/year) |

|---|---|---|---|

| Mutual Funds | 50% | 12% | ₹43.8 Lakh |

| NPS | 30% | 10% | ₹23.9 Lakh |

| PPF | 20% | 7.1% | ₹9.6 Lakh |

| Total (2035) | — | — | ₹77.3 Lakh |

By slightly increasing annual investment or SIPs, this mix can realistically reach ₹1 crore by 2035 while balancing safety and growth.

Expert Suggestion: Rebalance, Don’t React

“Investors often chase short-term performance. Instead, stick to asset allocation, rebalance yearly, and let compounding do its job.”

— Morningstar India, 2025 Report

The Final Verdict: Which One Wins by 2030?

| Category | Winner | Why |

|---|---|---|

| Safety & Stability | PPF | Government-backed and tax-free |

| Balanced Retirement Growth | NPS | Equity + Debt exposure and tax benefits |

| Maximum Wealth Creation | Mutual Funds | High return potential and full liquidity |

Overall Winner → Mutual Funds (for long-term wealth creation)

But a blended strategy of all three ensures growth, safety, and tax efficiency — the real formula to hit ₹1 crore confidently.

Motivational CTA — Start Today, Not Tomorrow

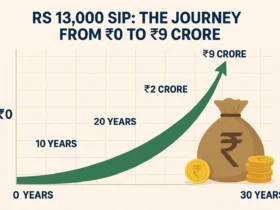

Time is money, and compounding loves discipline.

If you start investing today — even ₹10,000/month — the difference by 2035 could be life-changing. Don’t wait for the “perfect time.” Every month you delay, your money loses the magic of growth.

Open your PPF account for stability

Activate NPS Tier I for retirement

Start SIPs in 2–3 good equity mutual funds for growth

In 2030, you’ll look back and thank yourself for starting today.

Because in wealth creation — it’s not timing the market, it’s time in the market that builds crores.

Leave a Reply