Introduction: The Dream of Multi-Crore Wealth — Made Possible by SIPs

Everyone wants to be a crorepati investor — not by luck, but through smart investing.

The best way to achieve this? SIPs (Systematic Investment Plans) in equity mutual funds — India’s most consistent, compounding, and inflation-beating wealth engine.

If you invest ₹10,000–₹50,000 monthly with discipline from 2025 to 2035, you could be looking at multi-crore returns — yes, even if markets fluctuate in between.

This isn’t a get-rich-quick promise. It’s a mathematically proven wealth-building framework backed by expert fund managers and decades of data.

Let’s dive into how you can make 2025–2035 your decade of financial transformation.

Why SIP + Equity Funds Are the Ultimate Wealth-Building Combo

- SIPs = discipline: You invest monthly without worrying about timing the market.

- Equity funds = compounding: High long-term returns (10–18% CAGR) beat inflation.

- Rupee cost averaging: You buy more units when markets dip — enhancing long-term gains.

- Long-term power: A 10-year SIP can multiply your capital 4–6× depending on returns.

Table 1: SIP Compounding Magic (2025–2035)

| Monthly SIP | Expected CAGR | 10-Year Corpus | 15-Year Corpus |

|---|---|---|---|

| ₹10,000 | 12% | ₹23.2 lakh | ₹45.9 lakh |

| ₹25,000 | 14% | ₹54.6 lakh | ₹1.32 crore |

| ₹50,000 | 16% | ₹1.15 crore | ₹3.08 crore |

| ₹1,00,000 | 17% | ₹2.60 crore | ₹7.00 crore |

Insight: Even modest SIPs can create multi-crore wealth if you let compounding work uninterrupted.

The 2025–2035 Investment Blueprint

To reach the multi-crore milestone, you need:

- Diversified fund mix — large, flexi, and mid/small caps.

- Long-term horizon — at least 10 years.

- SIP step-up strategy — increase SIP by 10–15% annually.

- Periodic review — check performance every 12 months.

- Emotional control — stay invested through volatility.

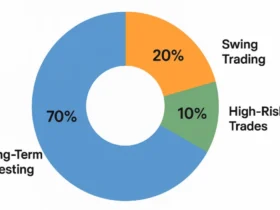

Table 2: Ideal Portfolio Mix by Risk Appetite

| Risk Profile | Large-Cap (%) | Flexi-Cap (%) | Mid/Small-Cap (%) | Thematic/Intl (%) |

|---|---|---|---|---|

| Conservative | 60 | 25 | 10 | 5 |

| Moderate | 40 | 30 | 20 | 10 |

| Aggressive | 25 | 30 | 30 | 15 |

Pro Tip: Even aggressive investors should keep 25% in large-caps for stability.

Top SIP & Equity Fund Categories for 2025–2035

Each category plays a unique role in your long-term wealth creation journey. Let’s explore the top contenders.

Large-Cap Funds — The Foundation of Stability

Large-caps form the backbone of any portfolio. They invest in blue-chip companies like HDFC Bank, Reliance Industries, Infosys, etc., providing stable long-term growth.

Why invest:

- Less volatile compared to mid/small-caps.

- Ideal for conservative and first-time investors.

- Consistent performance across market cycles.

Top-performing large-cap funds (as of Oct 2025):

- ICICI Prudential Bluechip Fund — 5-yr CAGR ~15.6%1

- SBI Bluechip Fund — 5-yr CAGR ~14.9%

- Axis Bluechip Fund — 5-yr CAGR ~13.8%

Table 3: Large-Cap Performance Snapshot

| Fund Name | 5-Year CAGR | AUM (₹ Cr) | Risk | Ideal Horizon |

|---|---|---|---|---|

| ICICI Pru Bluechip | 15.6% | 44,000 | Moderate | 7–10 yrs |

| SBI Bluechip | 14.9% | 38,000 | Moderate | 7–10 yrs |

| Axis Bluechip | 13.8% | 34,000 | Low-Moderate | 7+ yrs |

Expert insight: “Large-caps deliver steady alpha with lower volatility. Every long-term SIP must anchor here.” — Radhika Gupta, CEO, Edelweiss AMC

Flexi-Cap Funds — The Dynamic Growth Engine

Flexi-cap funds can invest across large, mid, and small-caps — giving fund managers full flexibility.

Why invest:

- Adaptive allocation = better returns across market cycles.

- Perfect balance between risk and reward.

- Historically beaten both large and mid-cap funds in 10-yr periods.

Top-performing flexi-cap funds:

- Parag Parikh Flexi Cap Fund — CAGR 18.2% (10 yrs)

- HDFC Flexi Cap Fund — CAGR 17.5% (10 yrs)

- Kotak Flexi Cap Fund — CAGR 16.9% (10 yrs)

Table 4: Flexi-Cap Category Metrics

| Fund Name | 10-Year CAGR | AUM (₹ Cr) | Risk | Manager Tenure |

|---|---|---|---|---|

| Parag Parikh Flexi Cap | 18.2% | 68,000 | Moderate | 9 yrs |

| HDFC Flexi Cap | 17.5% | 61,500 | Moderate | 8 yrs |

| Kotak Flexi Cap | 16.9% | 54,700 | Moderate | 7 yrs |

Expert quote: “Flexi-caps reward patience and diversification. They are SIP investors’ best long-term friend.” — Nilesh Shah, MD, Kotak AMC

Mid & Small-Cap Funds — The Wealth Accelerators

Mid and small-cap funds deliver the highest long-term CAGR but with short-term volatility.

Perfect for investors with a 10+ year horizon and higher risk tolerance.

Why invest:

- India’s growth story (manufacturing, infra, EV, fintech) benefits mid-caps.

- Small-caps outperform post-corrections.

- 2023–2025 bull run reaffirmed long-term mid-cap dominance.

Top performers (as of Oct 2025):

- SBI Small Cap Fund — 10-yr CAGR 22.4%

- Nippon India Small Cap Fund — 10-yr CAGR 21.7%

- Kotak Emerging Equity Fund — 10-yr CAGR 20.5%

Table 5: Mid/Small-Cap Returns vs Large-Cap

| Fund Type | Avg 10-Year CAGR | Risk Level | Recommended SIP Duration |

|---|---|---|---|

| Large-Cap | 13–15% | Low-Moderate | 7–10 yrs |

| Flexi-Cap | 15–18% | Moderate | 10 yrs |

| Mid/Small-Cap | 18–22% | High | 10–15 yrs |

Expert note: “In India’s next decade, mid-caps could lead wealth creation as earnings growth compounds 20%+ annually.” — Sankaran Naren, CIO, ICICI Prudential AMC

Thematic & Sectoral Funds — The Satellite Boosters

These funds invest in specific themes like Technology, Infrastructure, Consumption, or ESG.

Use them as spice — not the meal.

Ideal allocation: Max 10–15% of total SIP.

Popular themes for 2025–2035:

- EV & Green Energy

- Artificial Intelligence & Digital Tech

- Manufacturing & Make in India

Best thematic picks (2025):

- Tata Digital India Fund — CAGR 19.8%

- ICICI Pru Infrastructure Fund — CAGR 17.4%

- Quant ESG Equity Fund — CAGR 18.2%

Table 6: Thematic Fund Highlights

| Theme | Representative Fund | 5-Year CAGR | Allocation Suggestion |

|---|---|---|---|

| Tech | Tata Digital India Fund | 19.8% | 5% |

| Infra | ICICI Pru Infrastructure | 17.4% | 5% |

| ESG | Quant ESG Fund | 18.2% | 5% |

Expert quote: “Thematic funds capture trends shaping the next decade — but limit exposure.” — Kaustubh Belapurkar, Director, Morningstar India

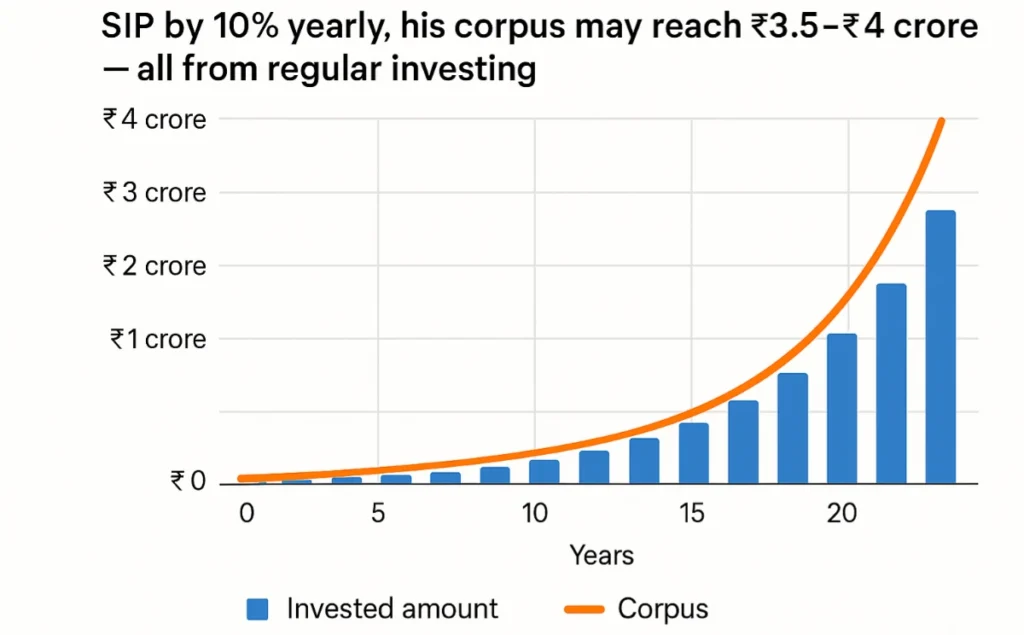

2025–2035 Futuristic Projections: The Multi-Crore Roadmap

Let’s simulate two real-world SIP plans for the decade ahead.

Assumptions:

- SIP duration: 10 years (2025–2035)

- Annual SIP step-up: 10%

- CAGR range: 12–18%

Table 7: Futuristic SIP Projection Scenarios

| Monthly SIP | Step-Up (%) | Expected CAGR | Corpus by 2035 | Potential Wealth |

|---|---|---|---|---|

| ₹25,000 | 10% | 12% | ₹60 lakh | Comfortable |

| ₹50,000 | 10% | 15% | ₹1.4 crore | Crorepati |

| ₹75,000 | 12% | 16% | ₹2.6 crore | Multi-Crore |

| ₹1,00,000 | 12% | 17% | ₹3.9 crore | Multi-Crore |

| ₹2,00,000 | 15% | 18% | ₹8.6 crore | Financial Freedom |

Insight: A ₹1 lakh SIP for 10 years can potentially build ₹3.9 crore — purely from disciplined investing.

Smart Strategies to Maximize SIP Performance

- Step-Up SIP: Increase your SIP amount by 10–15% every year.

- Market Corrections = Opportunity: When markets fall 10–20%, invest extra.

- Avoid Over-Diversification: Limit to 5–7 equity funds max.

- Use Direct Plans: Save 0.5–1% in expense ratio = higher returns.

- Stay Invested: The biggest alpha is time in the market, not timing the market.

Table 8: SIP Mistakes to Avoid

| Mistake | Consequence | Fix |

|---|---|---|

| Stopping SIP in market dips | Missed units at low price | Continue SIPs |

| Too many funds | Overlap & confusion | Stick to 5–7 max |

| No review | Misses underperformance | Review yearly |

| Regular plan | Lower returns | Switch to direct plan |

Expert advice: “Don’t let short-term fear destroy long-term compounding. SIPs are designed to thrive in volatility.” — R. Sivakumar, Head – Fixed Income, Axis MF

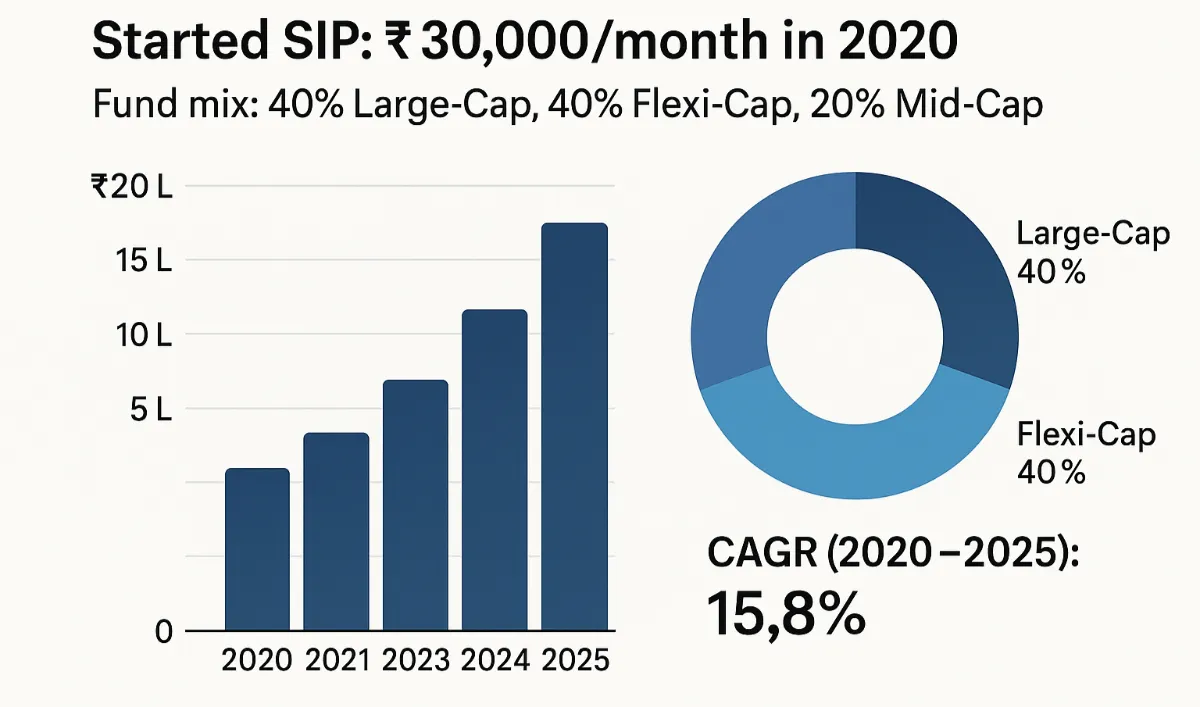

SIP + Equity = Real-World Multi-Crore Case Study

Investor Profile:

- Name: Rohit Sharma (Age 28)

- Started SIP: ₹30,000/month in 2020

- Fund mix: 40% Large-Cap, 40% Flexi-Cap, 20% Mid-Cap

- CAGR (2020–2025): 15.8%

By 2035, if he continues increasing SIP by 10% yearly, his corpus may reach ₹3.5–₹4 crore — all from regular investing.

Lesson: You don’t need crores to start; you need consistency to finish.

Table 9: Rohit’s SIP Growth Projection

| Year | SIP/Month | Cumulative Investment | Projected Corpus (15%) |

|---|---|---|---|

| 2025 | ₹30,000 | ₹3.6 lakh | ₹3.9 lakh |

| 2030 | ₹48,000 | ₹10.8 lakh | ₹16.5 lakh |

| 2035 | ₹77,000 | ₹24.5 lakh | ₹3.8 crore |

How to Choose the Right Funds (Step-by-Step)

- Define goal & time horizon: 10–15 years for wealth building.

- Check consistency: Use 5- and 10-year CAGR rankings.

- Assess manager reputation: Prefer 5+ years of stable management.

- Monitor drawdown: Select funds that fall less than the market.

- Track expense ratio: Direct plans have 0.5–1% higher annual gains.

Table 10: Fund Evaluation Scorecard

| Criteria | Ideal Range | Why It Matters |

|---|---|---|

| 5-Year CAGR | >12% | Long-term compounding |

| Expense Ratio | <1% (Direct) | Saves on costs |

| Manager Tenure | >3 years | Stability |

| Portfolio Overlap | <30% | Diversification |

| Drawdown | Below index | Risk control |

Motivational CTA — Start Your Multi-Crore Journey Today

Every crore starts with the first thousand invested. Don’t wait for the “perfect” market; start the perfect habit instead — your SIP.

The Indian economy is on track to become a $7 trillion powerhouse by 2035. The next decade belongs to consistent investors who stay invested through every cycle.

Remember: “Time in the market beats timing the market — always.”

Take action today:

- Pick 3–5 top-ranked equity funds.

- Start your SIP (even ₹10,000/month).

- Increase it yearly.

- Watch compounding build your multi-crore future.

Also Read: Best Midcap Mutual Funds 267% to 365% Returns in 5 Years

This is brilliant. Simple and to the point.