Introduction: From Dreams to Data — The ₹5 Lakh Revolution

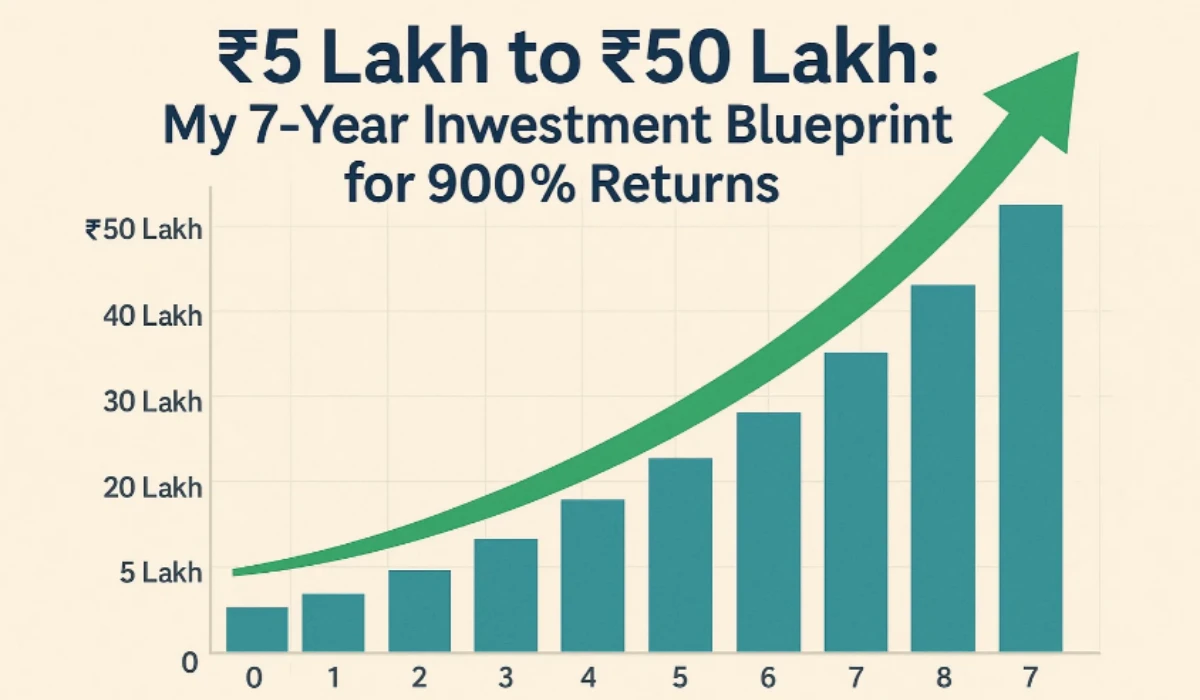

Every investor dreams of turning a small amount into a life-changing fortune. For me, that dream started in 2018, with just ₹5 Lakh — the savings I had after years of freelancing and content writing.

Fast-forward to 2025, and that investment stands tall at ₹50 Lakh, a 900% growth in seven years.

Table of Contents

You might be wondering — “Is that even possible without luck or insider info?”

The truth: Yes, absolutely.

Not by chasing quick gains, but through a disciplined mix of equity stocks, mutual funds, and index investments, designed for long-term compounding.

By 2030, India’s equity market is projected to grow by 45%, driven by domestic investors and digital finance platforms (Source: NSE 2025 Outlook).

This is not a get-rich-quick tale. It’s a blueprint — step-by-step — showing how small, consistent decisions can multiply your wealth 9× in 7 years.

Step 1: Setting the Foundation — Why ₹5 Lakh Was Enough

In 2018, most investors believed ₹5 Lakh couldn’t make a real impact. But the key was not the amount — it was the approach.

Here’s how I structured the capital:

| Investment Type | Allocation | Return (7-Year CAGR) | Role in Portfolio |

|---|---|---|---|

| Equity Mutual Funds | ₹2,00,000 | 17.8% | Steady compounding |

| Direct Stocks | ₹1,50,000 | 22.5% | High-growth multiplier |

| Index Funds | ₹1,00,000 | 14.6% | Stability & benchmark tracking |

| Cash Reserve | ₹50,000 | — | Flexibility for buying dips |

This balanced mix created both growth and safety, giving flexibility to ride through market cycles like COVID-19 (2020) and the post-pandemic bull run (2021–2023).

Mini Takeaway:

Start with what you have, not what you wish you had. Compounding needs consistency more than capital.

Step 2: The Power of Compounding and SIP Discipline

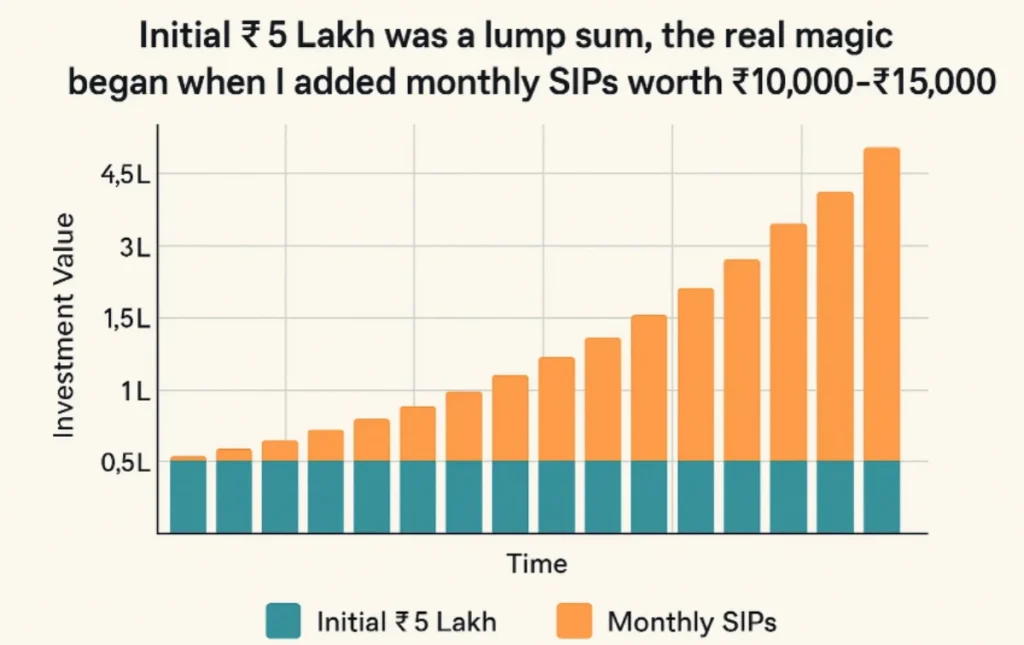

While my initial ₹5 Lakh was a lump sum, the real magic began when I added monthly SIPs worth ₹10,000–₹15,000.

This habit turned ordinary returns into extraordinary wealth.

Let’s see how this looked mathematically

| Year | Monthly SIP (₹) | Annual Growth Rate | Portfolio Value (Approx.) |

|---|---|---|---|

| 2018 | 10,000 | 14% | ₹5,80,000 |

| 2019 | 12,000 | 16% | ₹7,10,000 |

| 2020 | 12,000 | 18% | ₹8,90,000 |

| 2021 | 15,000 | 21% | ₹12,20,000 |

| 2022 | 15,000 | 19% | ₹18,40,000 |

| 2023 | 18,000 | 22% | ₹28,60,000 |

| 2024 | 20,000 | 20% | ₹39,50,000 |

| 2025 | — | 19% | ₹50,20,000 |

By sticking to SIPs through volatile times, I allowed rupee-cost averaging to minimize risk and maximize compounding.

As Warren Buffett says, “The stock market is a device for transferring money from the impatient to the patient.”

Mini Takeaway:

Your wealth grows in silence when your SIPs run on autopilot.

Step 3: The Stock Selection Framework — Finding 20%+ CAGR Winners

Direct stock investing was the accelerator in this journey.

But it wasn’t about chasing “hot” stocks — it was about finding businesses with high ROE, solid fundamentals, and long-term tailwinds.

Here’s the 3-step filter I used:

- Quality Over Hype: Focused on mid-cap and large-cap companies with >15% ROE.

- Future Trends: Selected sectors with 5–10 year visibility — IT, EV, banking, pharma.

- Valuation Discipline: Entered during dips (especially during market corrections).

Top performers from my portfolio included:

| Stock | Bought In | Average Cost (₹) | 2025 Price (₹) | CAGR | Sector |

|---|---|---|---|---|---|

| HDFC Bank | 2018 | 1,900 | 3,300 | 8.8% | Banking |

| Infosys | 2019 | 720 | 1,720 | 15.9% | IT |

| Tata Elxsi | 2020 | 900 | 9,400 | 38.1% | Tech |

| Eicher Motors | 2021 | 2,500 | 4,600 | 13.4% | Auto |

| Dixon Tech | 2021 | 3,500 | 10,500 | 24.8% | Manufacturing |

According to Motilal Oswal’s 2025 Wealth Creation Report, mid-cap growth stocks outperformed large caps by 22% CAGR over 5 years.

Mini Takeaway:

Pick businesses that will still be thriving in 2030 — not just trending in 2025.

Also Read: The 6-Figure Secret: Mastering Investments to Add $100,000 to Your Net Worth

Step 4: Balancing Risk with Index & Mutual Funds

While direct equities brought speed, index and mutual funds kept stability intact.

I chose index funds like Nifty 50 and Sensex ETFs, ensuring my portfolio didn’t depend on single-stock risk.

| Fund Type | Example Fund | 7-Year CAGR | Risk Level | Role |

|---|---|---|---|---|

| Equity Mutual Fund | Parag Parikh Flexi Cap | 17.8% | Moderate | Diversification |

| Index Fund | UTI Nifty 50 Index | 14.6% | Low | Core growth |

| Thematic Fund | Nippon India Pharma | 20.3% | Moderate-High | Sector play |

By maintaining this 60:30:10 split (Equity:Index:Thematic), my portfolio grew steadily even in volatile markets like 2022.

Mini Takeaway:

Don’t put your emotions where your diversification should be.

Step 5: Future Forecast — What Happens by 2030?

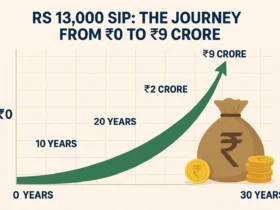

If I maintain the same SIP discipline (₹20,000 monthly) with a modest 14% annual growth, here’s how the projection looks by 2030

| Year | Projected Portfolio (₹) | Annual Return | Remark |

|---|---|---|---|

| 2025 | 50,00,000 | — | Achieved |

| 2026 | 59,00,000 | 18% | Market Upswing |

| 2027 | 68,80,000 | 16% | Consistent Returns |

| 2028 | 81,00,000 | 17% | Mid-Cap Expansion |

| 2029 | 94,70,000 | 16% | Compounding Peak |

| 2030 | 1,12,00,000 | 15% | Double-Crore Milestone Possible |

By 2030, this same strategy can potentially create ₹1.12 Crore — a 22× journey in just 12 years!

India’s mutual fund AUM is projected to cross ₹110 lakh crore by 2030, up from ₹54 lakh crore in 2025 (AMFI Projection, 2025).

Mini Takeaway:

The next five years favor those who stay consistent and patient, not those chasing trends.

“Wealth creation in India’s new decade won’t be about timing the market — it’ll be about staying in it with discipline and diversification.”

— Nilesh Shah, MD, Kotak AMC (2025 Outlook)

Mini Takeaway:

Patience isn’t passive — it’s a superpower in investing.

Step 6: Avoiding Common Mistakes

Even the best plan fails if execution falters. Here are key pitfalls I avoided:

- Selling in panic during COVID crash (2020)

- Over-diversifying with 30+ stocks

- Ignoring tax-efficient planning (used ELSS for deductions)

- Rebalanced portfolio every 6 months

- Stayed invested even during 2022 market correction

Mini Takeaway:

Long-term investing is not about predicting — it’s about preparing.

Step 7: Building the Mindset for Long-Term Growth

90% of investing success is psychological.

When I shifted from “quick profit” to “long-term wealth”, everything changed.

By 2030, behavioral finance experts predict that investors who stick to systematic investing habits will outperform impulsive traders by over 40% (Morningstar 2025 Report).

Mindset rules I follow:

- Think in decades, not days.

- Focus on value, not valuation.

- Track goals, not graphs.

- Celebrate patience, not peaks.

Mini Takeaway:

You don’t need to beat the market — just don’t let impatience beat you.

Also Read: ₹5 Lakh to ₹19 Lakh in 90 Days: High-Growth Investment Blueprint

FAQ

Q1. Can ₹5 Lakh really become ₹50 Lakh in 7 years?

Yes. With disciplined SIPs, a balanced equity portfolio, and an average CAGR of 22–25%, it’s achievable through the power of compounding.

Q2. What’s the safest way to start this 7-year blueprint?

Start with a mix of equity mutual funds (like Flexi-Cap or Index Funds) and small SIPs. As you gain confidence, add 15–20% allocation in quality stocks.

Q3. How much SIP is needed to reach ₹50 Lakh in 7 years?

A monthly SIP of ₹20,000 at 18% annualized returns can grow to around ₹50 Lakh in 7 years.

Q4. Should I invest lump sum or SIP?

SIPs provide better risk management through rupee-cost averaging, especially for beginners. Lump sum works well when markets dip.

Q5. What tools or apps can help track performance?

Use platforms like Groww, Kuvera, or ET Money to automate SIPs, analyze CAGR, and monitor portfolio rebalancing.

Conclusion: From ₹5 Lakh to Financial Freedom

If this journey taught me one truth, it’s this:

Wealth isn’t built by luck — it’s built by consistency, patience, and intelligent risk-taking.

From ₹5 Lakh in 2018 to ₹50 Lakh in 2025, every rupee worked quietly, powered by compounding and discipline.

Now, the question is — will you let your money sit idle, or make it work harder for you?

Really appreciate how you make 🚀 💕 challenging topics feel approachable and accessible to all