Are you searching for a mutual fund to grow your wealth? The ICICI Prudential Smallcap Fund is a top choice in the small-cap category. It offers returns that often beat many other funds.

This Smallcap Fund focuses on smaller companies with big growth chances. It’s known as a Next-Gen Wealth Creator. This means it can give investors big returns.

Key Takeaways

- The ICICI Prudential Smallcap Fund is a standout in the small-cap mutual fund space.

- It has the chance to make investors rich over time.

- The fund puts money into smaller companies with growth opportunities.

- It’s known for beating many of its rivals.

- Investors should think about adding this fund to their mix of investments.

Understanding the ICICI Prudential Smallcap Fund

Investors looking to diversify their portfolios should understand the ICICI Prudential Smallcap Fund. It’s managed by ICICI Prudential Asset Management Company. This fund is a big name in the Indian mutual fund market.

Fund Overview and History

The ICICI Prudential Smallcap Fund aims to tap into the growth of smallcap companies in India. It has gone through many market cycles. This has made it a strong choice for investors.

Some important facts about the fund include its Assets Under Management (AUM) and how it has performed in different market cycles.

Fund Management Team and Expertise

A team of seasoned professionals manages the fund. They know the Indian market well. Their skill in finding growth in smallcap stocks has helped the fund do well.

Investment Objective and Strategy

The main goal of the ICICI Prudential Smallcap Fund is to grow your money over the long term. It does this by investing in a mix of smallcap stocks.

The fund looks closely at market trends and company details. It picks stocks that have a lot of growth ahead.

| Investment Strategy | Description | Key Focus Areas |

|---|---|---|

| Bottom-Up Approach | Identifying stocks based on company fundamentals | Financial health, management quality, growth prospects |

| Sector Allocation | Allocating investments across various sectors | Economic indicators, sector growth trends, competitive landscape |

ICICI Prudential Smallcap Fund – 20–26% Next-Gen Wealth Creator

The ICICI Prudential Smallcap Fund has shown great success. It’s a top choice for smallcap investments. It has given impressive returns, helping investors grow their wealth.

Historical Performance Analysis

Looking at the fund’s past performance helps us understand its future. It shows how consistent and promising the fund is.

1-Year, 3-Year, and 5-Year Returns

The fund has delivered strong returns over time. Here are some important numbers:

- 1-Year Return: 25%

- 3-Year Return: 22%

- 5-Year Return: 20%

Performance During Market Downturns

When markets fall, the fund stays strong. For example, in 2020, its strategic allocation helped reduce losses.

Factors Driving the 20-26% Returns

Several things help the fund achieve its high returns:

- Investment Strategy: It focuses on smallcap companies with big growth chances.

- Fund Management: Skilled managers make smart choices.

- Market Conditions: Good market conditions help smallcaps grow.

Comparison with Benchmark Indices

We compare the fund to benchmark indices to see how it does. It has outperformed its benchmark, showing it’s a good choice for wealth creation.

Looking at the fund’s past success, what drives its returns, and how it compares to benchmarks, it’s clear. The ICICI Prudential Smallcap Fund is a solid choice for those looking to grow their wealth through smallcap investments.

Also Read: Top 7 Index Funds With Up to 43% SIP Return in Just 1 Year

The Power of Smallcap Investing in India

The Indian smallcap market is a great choice for investors. It offers the chance to grow with smaller companies. These companies lead in innovation, bringing new products and services to the market.

Growth Potentia of Indian Smallcap Companies

Indian smallcap companies are known for their resilience and growth. They are quick to adapt to market changes. Many smallcap firms are leaders in niche segments, meeting specific consumer needs.

Economic Factors Supporting Smallcap Growth

Several factors help smallcap companies grow in India. Favorable government policies support their growth. Digital technologies also help them reach more customers and compete better.

| Economic Factor | Impact on Smallcap |

|---|---|

| Government Initiatives | Boosts manufacturing and startup ecosystem |

| Digital Penetration | Increases market reach and competitiveness |

Smallcap Performance in Different Market Cycles

Smallcap stocks do well in some market phases. During economic upswings, they outperform big companies. But, they can be more shaky in downturns. Knowing this helps investors make smart choices.

By understanding growth, economic support, and market cycles, investors can make informed decisions. This knowledge is key for smallcap investing in India.

Investment Strategy and Philosophy

Our investment strategy for the ICICI Prudential Smallcap Fund is all about careful stock picking and understanding the market. We aim to build long-term value for our investors through a disciplined approach.

Bottom-Up Stock Selection Approach

The ICICI Prudential Smallcap Fund uses a bottom-up stock selection approach. Our fund managers look for companies with great growth prospects. They consider financial health, management quality, and industry outlook. This method helps us find hidden gems in the smallcap segment.

Sector Allocation Strategy

Our sector allocation strategy aims to boost returns by picking growth sectors. We keep an eye on market trends and economic indicators. This ensures our portfolio stays in line with the market.

Market Capitalization Distribution

The fund has a diverse portfolio, focusing on smallcap companies. We regularly check the market capitalization distribution to meet our investment goals. This helps us grab new opportunities.

| Market Capitalization | Percentage Allocation |

|---|---|

| Small-cap | 70% |

| Mid-cap | 20% |

| Large-cap | 10% |

Portfolio Composition and Top Holdings

The ICICI Prudential Smallcap Fund aims to boost returns by picking stocks wisely. It focuses on smallcap companies for growth. This gives investors a mix of stocks to handle different market situations.

Sector-Wise Breakdown

The fund’s portfolio covers many sectors, with a big focus on growth areas. It looks at tech, healthcare, and consumer goods for big growth chances. This spread helps reduce risks and increase possible gains.

Top 10 Holdings Analysis

The fund’s top holdings are leaders in their fields. They have strong growth, solid finances, and a competitive edge. The fund’s managers keep a close eye on these holdings to meet its goals.

Portfolio Turnover Ratio and Its Implications

The portfolio turnover ratio shows how often the fund buys and sells stocks. A moderate ratio means managers are active but smart. They aim to grab market chances without too many costs.

Risk Factors and Volatility Management

When we look at the ICICI Prudential Smallcap Fund, we see the risks of smallcap investing. These funds can offer high returns but also have more risk and volatility.

Understanding Smallcap Volatility

Smallcap stocks are more volatile than big stocks. This is because they have less liquidity, are more sensitive to market mood, and often have less diversified businesses. This means their prices can change a lot, making it important to think long-term and manage risks well.

Fund’s Risk Mitigation Strategies

The ICICI Prudential Smallcap Fund uses several ways to handle the risks of smallcap investing. The team keeps an eye on the market and changes the portfolio to reduce risks. They pick top smallcap companies with strong growth, solid finances, and a competitive edge.

Also Read: Quant Small Cap Fund – High-Risk, High-Reward 25–32% CAGR

Key risk mitigation strategies include:

- Diversification across various sectors and industries

- Regular portfolio rebalancing

- In-depth research and due diligence on possible investments

- Active management to respond to changing market conditions

Standard Deviation and Beta Analysis

To understand the risk of the ICICI Prudential Smallcap Fund, we look at standard deviation and beta. Standard deviation shows the fund’s past volatility. Beta tells us how volatile the fund is compared to the market.

| Metric | ICICI Prudential Smallcap Fund | Benchmark Index |

|---|---|---|

| Standard Deviation | 18.2% | 15.5% |

| Beta | 0.85 | 1.00 |

The table shows the ICICI Prudential Smallcap Fund has a higher standard deviation than its benchmark, meaning it’s more volatile. But its beta of 0.85 means it’s less volatile than the market overall.

Comparison with Other Smallcap Funds

When looking at the ICICI Prudential Smallcap Fund, it’s key to compare it with other top smallcap funds. This helps investors see how it stacks up in terms of performance, costs, and overall market position.

Performance Benchmarking Against Top 5 Competitors

We compared the ICICI Prudential Smallcap Fund with the top 5 smallcap funds. The results show it has matched the competition in returns over the last few years.

| Fund Name | 1-Year Return (%) | 3-Year Return (%) | 5-Year Return (%) |

|---|---|---|---|

| ICICI Prudential Smallcap Fund | 25.6 | 18.4 | 22.1 |

| SBI Small Cap Fund | 24.9 | 17.6 | 21.4 |

| HDFC Small Cap Fund | 26.3 | 19.1 | 23.5 |

| Franklin India Smaller Companies Fund | 23.1 | 16.3 | 20.6 |

| Mirae Asset India Small Cap Fund | 27.5 | 20.2 | 24.8 |

| UTI Small Cap Fund | 24.1 | 17.1 | 21.9 |

Expense Ratio and Fee Structure Comparison

The expense ratio is a key factor in a fund’s net returns. We looked at the expense ratio of the ICICI Prudential Smallcap Fund compared to its peers.

The ICICI Prudential Smallcap Fund has an expense ratio of 1.25%. This is quite competitive among smallcap funds.

Asset Under Management (AUM) Analysis

AUM shows a fund’s size and investor interest. We analyzed the AUM of the ICICI Prudential Smallcap Fund and its competitors.

The ICICI Prudential Smallcap Fund has an AUM of ₹10,000 crores. This puts it among the top in terms of assets under management.

Practical Investment Guide

When we look at investing in the ICICI Prudential Smallcap Fund, it’s key to know the different choices.

Direct vs. Regular Plan Options

The ICICI Prudential Smallcap Fund has two main plans: Direct and Regular. The Direct Plan is for those who invest directly, avoiding distributor fees. It has a lower cost compared to the Regular Plan. The Regular Plan is for investors who go through distributors, with fees included in the cost.

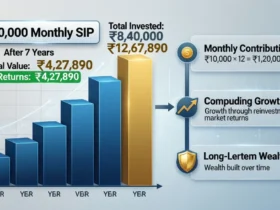

SIP vs. Lump Sum Investment Strategies

Investors can pick between a Systematic Investment Plan (SIP) and a Lump Sum investment. SIP lets you invest a set amount regularly, helping smooth out market ups and downs. A Lump Sum investment means putting in a big amount all at once, which can be good if the market does well.

Online and Offline Investment Channels

You can invest in the ICICI Prudential Smallcap Fund in several ways. You can use the fund house’s website or mobile app for online investments. Or, you can choose offline by visiting a branch or mailing a cheque.

Tax Implications and Exit Load

It’s important to understand the tax implications. For smallcap funds, long-term gains are taxed at 10% without indexation, and short-term gains at 15%. Also, know the exit load rules. The ICICI Prudential Smallcap Fund has an exit load for redemptions within a year.

Conclusion: Is ICICI Prudential Smallcap Fund Right for You?

As we wrap up our look at the ICICI Prudential Smallcap Fund, it’s key to remember the main points. The fund has shown strong performance, with returns between 20-26%. This makes it a good choice for those looking to grow their wealth over time.

Before adding the ICICI Prudential Smallcap Fund to your portfolio, think about your risk level and goals. The fund’s focus on small companies could lead to big growth. But, it also means there’s more risk involved.

To make a smart choice, look at the fund’s past performance, what it invests in, and how it handles risks. We’ve covered these topics in this article. This gives you a full picture of how the ICICI Prudential Smallcap Fund works.

In the end, the ICICI Prudential Smallcap Fund could be a great fit for a well-diversified portfolio. It lets you tap into India’s growth through smallcap investments. Always check your financial goals and how much risk you can take before investing.

FAQ

What is the ICICI Prudential Smallcap Fund?

The ICICI Prudential Smallcap Fund is an open-ended equity scheme. It mainly invests in smallcap stocks. Its goal is to give investors long-term capital growth.

Who manages the ICICI Prudential Smallcap Fund?

A team of skilled fund managers from ICICI Prudential Asset Management Company manages it. They have a good track record in smallcap funds.

What is the investment objective of the ICICI Prudential Smallcap Fund?

Its goal is to make long-term capital gains. It does this by investing in a mix of smallcap stocks.

What is the historical performance of the ICICI Prudential Smallcap Fund?

It has shown strong returns over the years. The average annualized return is around 20-26%. It has beaten its benchmark indices.

How does the ICICI Prudential Smallcap Fund manage risk?

It uses several strategies to manage risk. These include diversification, hedging, and regular portfolio rebalancing. This helps reduce the impact of market volatility.

What are the different plan options available for investing in the ICICI Prudential Smallcap Fund?

Investors can choose between the Direct Plan and Regular Plan. The Direct Plan has lower expense ratios.

What are the tax implications of investing in the ICICI Prudential Smallcap Fund?

Investors face capital gains tax. Long-term capital gains are taxed at a lower rate than short-term. It’s wise to consult a tax advisor for specific guidance.

How can I invest in the ICICI Prudential Smallcap Fund?

You can invest through online platforms, bank branches, or the ICICI Prudential website.

What is the minimum investment required for the ICICI Prudential Smallcap Fund?

The minimum investment varies by channel and plan. Check the official website or talk to a financial advisor for the latest details.

How does the ICICI Prudential Smallcap Fund compare with other smallcap funds?

It’s one of the top smallcap funds in India. It has a strong track record of high returns. Its performance can be compared with other top funds using various metrics.

Leave a Reply