Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Introduction

The world of finance has seen a significant shift in recent years with the rise of cryptocurrencies, including Bitcoin. Bitcoin Exchange Traded Funds (ETFs) are a promising development in this space, as they allow investors to gain exposure to the cryptocurrency market without directly buying and holding Bitcoin. This comprehensive guide will delve into the future of cryptocurrency, focusing on Bitcoin ETFs and their potential impact on the market.

Table of Contents

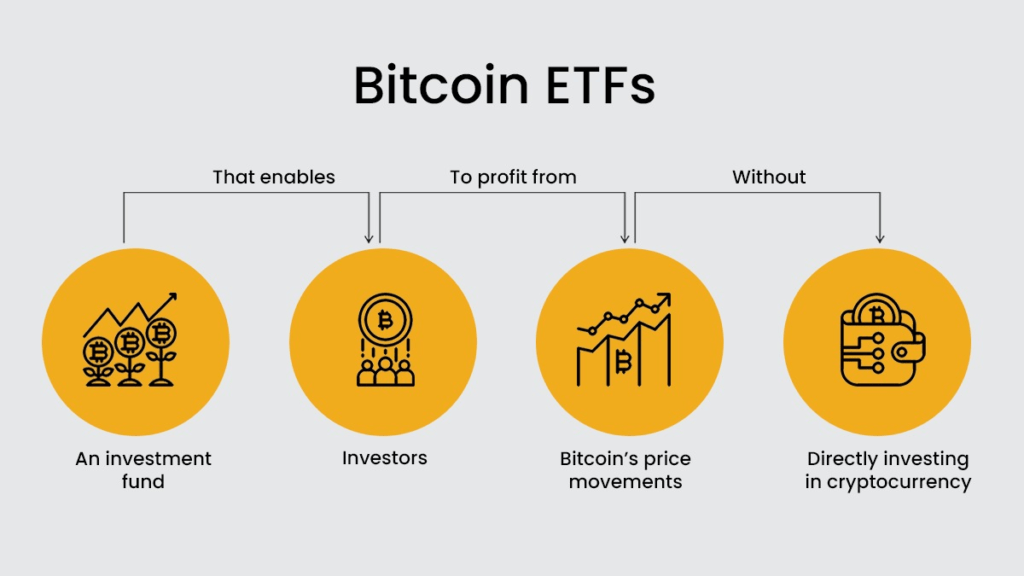

What are Bitcoin ETFs?

Bitcoin ETFs are financial products that are traded on stock exchanges, similar to traditional ETFs. They track the price of Bitcoin and allow investors to gain exposure to its price movements. The approval of Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) is a significant step towards mainstream adoption of cryptocurrencies.

Key Players in the Bitcoin ETF Market

Several key players have been approved to launch Bitcoin ETFs, including:

- BlackRock

- Ark Investments/21Shares

- Fidelity

- Invesco

- VanEck

These ETFs are expected to begin trading soon, with some analysts predicting inflows could reach $50 billion to $100 billion this year alone.

The Impact of Bitcoin ETFs on the Market

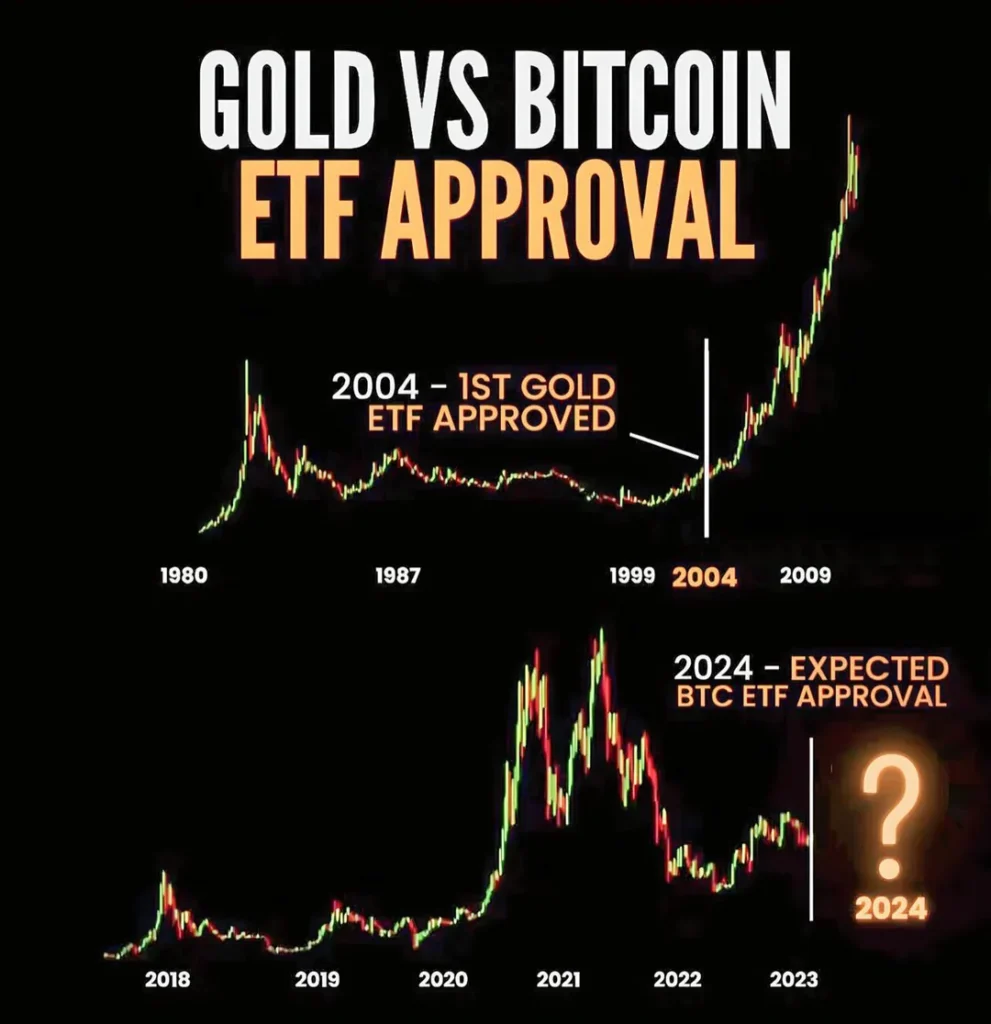

The approval of spot Bitcoin ETFs could potentially drive the price of Bitcoin as high as $100,000. However, other analysts have been more cautious in their predictions, suggesting that ETFs may actually help stabilize crypto prices by broadening their use and potential. Some experts believe that the introduction of Bitcoin ETFs could lead to a “Bitcoin revolution” on Wall Street.

Challenges and Regulations

Despite the growing interest in Bitcoin ETFs, there are still several challenges and regulatory concerns to consider. The SEC has rejected several proposals for Bitcoin ETFs, citing concerns about market manipulation and the potential for fraud. However, with the approval of several Bitcoin ETFs, it seems that the SEC has become more open to the idea of Bitcoin ETFs.

The recent approval of Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) has sparked a wave of excitement and speculation in the financial world. This development is expected to have far-reaching implications for the cryptocurrency market, traditional investors, and the broader economy. In this article, we will explore the potential impact of Bitcoin ETFs on various aspects of the market and the challenges that lie ahead.

Market Dynamics and Price Volatility

The approval of Bitcoin ETFs is anticipated to bring a new wave of capital into the cryptocurrency market. Some analysts predict that the introduction of these investment vehicles could lead to a significant increase in the price of Bitcoin, potentially driving it to new all-time highs. This influx of institutional and retail investment could also contribute to increased price volatility in the short term as the market adjusts to the changing dynamics.

Mainstream Adoption and Investor Access

One of the most significant implications of Bitcoin ETFs is the increased accessibility and exposure to the cryptocurrency market for traditional investors. With the launch of these ETFs, investors who were previously hesitant to directly purchase and hold Bitcoin may now find it easier to gain exposure to the asset through familiar investment channels, such as brokerage accounts and retirement funds. This could potentially lead to a broader adoption of cryptocurrencies as part of diversified investment portfolios.

Regulatory Considerations and Investor Protection

While the approval of Bitcoin ETFs represents a major milestone for the cryptocurrency industry, it also raises important regulatory considerations. The SEC has been cautious in its approach to approving these investment products, citing concerns about market manipulation, liquidity, and investor protection. As a result, the approved ETFs are subject to stringent regulatory oversight to ensure compliance with existing securities laws and regulations.

Global Implications and Market Integration

The approval of Bitcoin ETFs in the United States is expected to have global implications, potentially paving the way for similar investment products in other jurisdictions. This could lead to greater integration of the cryptocurrency market with traditional financial systems, as well as increased regulatory harmonization across different regions. The global expansion of Bitcoin ETFs could further legitimize the cryptocurrency market and open up new opportunities for investors worldwide.

Frequently Asked Questions (FAQ) About Bitcoin ETFs

1. What is a Bitcoin ETF?

A Bitcoin ETF, or Exchange-Traded Fund, is a financial product that tracks the price of Bitcoin. It allows investors to gain exposure to the cryptocurrency market without having to directly buy, hold, and store Bitcoin.

2. How do Bitcoin ETFs work?

Bitcoin ETFs work by holding Bitcoin as the underlying asset and then issuing shares that represent ownership of the Bitcoin. These shares are traded on traditional stock exchanges, making it easier for investors to buy and sell them through their brokerage accounts.

3. Why are Bitcoin ETFs significant?

The approval of Bitcoin ETFs is significant because it provides traditional investors with a regulated and familiar way to gain exposure to the cryptocurrency market. It also signals a greater acceptance of cryptocurrencies within the mainstream financial industry.

4. What are the potential benefits of Bitcoin ETFs?

Some potential benefits of Bitcoin ETFs include increased liquidity, greater market access for retail and institutional investors, and the potential for price stabilization through the participation of a broader investor base.

5. What are the risks associated with Bitcoin ETFs?

Risks associated with Bitcoin ETFs include price volatility, regulatory uncertainty, and the potential for market manipulation. Investors should carefully consider these factors before investing in Bitcoin ETFs.

6. How are Bitcoin ETFs regulated?

Bitcoin ETFs are regulated by the U.S. Securities and Exchange Commission (SEC) and must comply with existing securities laws and regulations. Regulatory oversight is aimed at protecting investors and ensuring the integrity of the market.

7. Can anyone invest in Bitcoin ETFs?

Yes, in most cases, anyone with a brokerage account can invest in Bitcoin ETFs. However, it’s important to check with your broker to ensure that the ETF is available for trading and that you meet any specific eligibility requirements.

8. What is the tax treatment of Bitcoin ETFs?

The tax treatment of Bitcoin ETFs is similar to that of traditional ETFs. Investors may be subject to capital gains tax upon selling their ETF shares, and they should consult with a tax advisor for guidance on their specific tax situation.

9. How can I stay informed about Bitcoin ETF developments?

Investors can stay informed about Bitcoin ETF developments by following reputable financial news sources, monitoring regulatory announcements, and consulting with their financial advisors for the latest information and insights.

Conclusion

In conclusion, the approval of Bitcoin ETFs represents a significant milestone in the evolution of the cryptocurrency market. While it is poised to bring about new opportunities for investors and greater mainstream adoption of digital assets, it also presents challenges in terms of market dynamics, regulation, and global integration. As these investment products begin trading and their impact unfolds, it will be essential to closely monitor their effects on the market and the broader financial ecosystem.

3 thoughts on “Bitcoin ETFs: A Game-Changer For Crypto Investor-2024”