Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

In the fast-paced world of cryptocurrency, few things capture the attention of investors and enthusiasts quite like a major price rally. Bitcoin, the pioneer of the digital currency revolution, has once again taken center stage, hitting a remarkable milestone by surging to $35,000. This resurgence is significant, marking the first time it has achieved such heights since 2022.

The Bitcoin Surge: A Glimpse into the Past

To fully grasp the significance of Bitcoin’s latest price surge, let’s delve into the past. In 2022, the cryptocurrency market experienced a roller-coaster ride, marked by fluctuations and regulatory uncertainties. The year was punctuated by peaks and troughs, and Bitcoin, the flagship cryptocurrency, was no exception.

As Bitcoin rallied to an all-time high of $68,789 in November 2021, it seemed poised for a remarkable 2022. However, regulatory concerns, global economic events, and market sentiment weighed heavily on its performance throughout the year, leading to a decline to around $30,000 by the end of 2022.

Table of Contents

Bitcoin ETF Buzz: A Catalyst for Change

The resurgence of Bitcoin in 2023 can be attributed to the buzz around Exchange-Traded Funds (ETFs). These investment vehicles are considered a game-changer in the world of cryptocurrency. ETFs offer a way for traditional investors to gain exposure to digital assets, and this development has injected fresh optimism into the market.

One of the driving factors behind Bitcoin’s rally is the approval of the first Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC). This landmark decision has paved the way for institutional and retail investors to invest in Bitcoin through a regulated and established financial instrument. As a result, it has reignited interest in Bitcoin and the broader cryptocurrency market.

What ETFs Mean for Bitcoin

1. Accessibility

ETFs make Bitcoin more accessible to a wider range of investors. They provide an avenue for those who may have been hesitant to enter the world of cryptocurrencies directly. This accessibility is likely to drive demand and subsequently boost prices.

2. Regulatory Approval

The SEC’s approval of a Bitcoin ETF brings a level of legitimacy and oversight that was previously lacking in the cryptocurrency market. This regulatory approval provides a sense of security to investors and institutions, encouraging their participation.

3. Increased Liquidity

With the advent of ETFs, Bitcoin’s liquidity is set to increase. This means that larger trades can be executed with less impact on the market, which is particularly important for institutional investors.

4. Diversification

Investors can now diversify their portfolios by including Bitcoin ETFs alongside traditional assets. This diversification can help spread risk and potentially enhance returns.

The Broader Implications

The recent surge in Bitcoin’s price has wider implications for the cryptocurrency market and the financial world as a whole. Here are some key takeaways:

1. Market Sentiment

Bitcoin’s resurgence is indicative of the renewed positive sentiment in the cryptocurrency market. This may influence the prices of other digital assets, leading to a broader market rally.

2. Investor Confidence

The approval of Bitcoin ETFs instills confidence in cryptocurrency as a legitimate and investable asset class. This may encourage more investors to explore digital currencies.

3. Regulatory Landscape

The approval of a Bitcoin ETF signals a potential shift in the regulatory landscape. Governments and regulatory bodies are recognizing the importance of cryptocurrencies and are beginning to provide clearer guidelines for their use and investment.

The Potential for Price Volatility

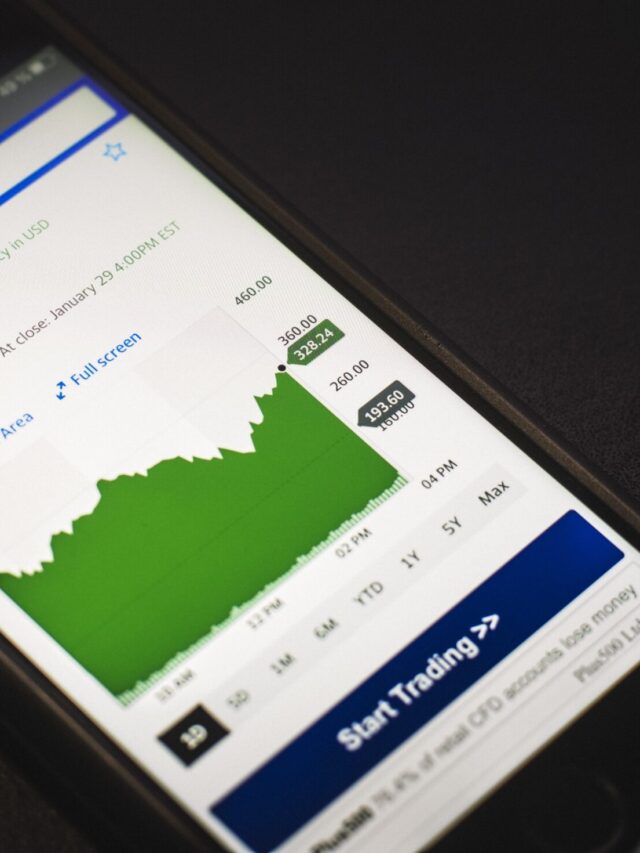

While Bitcoin’s recent surge is undoubtedly significant, it’s important to acknowledge the potential for price volatility in the cryptocurrency market. Historically, Bitcoin has been known for its price swings, and this characteristic is unlikely to disappear completely.

The introduction of ETFs may help mitigate extreme price fluctuations to some extent by enabling institutional investors to enter the market with large sums of capital. However, it’s essential for investors to remain vigilant and use risk management strategies when navigating the crypto landscape.

The Role of Technological Advancements

Beyond the excitement surrounding Bitcoin’s price, it’s essential to consider the role of technological advancements in shaping the cryptocurrency market. Bitcoin, as the pioneer, has its limitations, such as scalability and energy consumption concerns. Newer cryptocurrencies and blockchain projects are continually innovating to address these issues.

In addition, the transition to Ethereum 2.0, which promises improved scalability and sustainability, is on the horizon. These developments may diversify the cryptocurrency landscape and offer more options to investors and enthusiasts.

Geopolitical Factors and Global Events

The cryptocurrency market is not isolated from the broader global economic and geopolitical landscape. Events such as regulatory changes in major economies, economic crises, and technological breakthroughs can influence Bitcoin’s trajectory. It’s vital to stay informed about global events and their potential impact on the cryptocurrency market.

The Importance of Education

As more individuals and institutions express interest in cryptocurrencies, the need for education becomes paramount. Understanding the intricacies of blockchain technology, secure storage methods, and responsible investing is crucial. The cryptocurrency market can be complex, and informed decision-making is essential for long-term success.

Diversification Strategies

While Bitcoin holds a prominent position in the cryptocurrency market, diversification remains a prudent strategy. Diversifying a cryptocurrency portfolio can help spread risk and reduce exposure to the potential volatility of any single digital asset.

Investors should explore various cryptocurrencies with promising use cases, consider their risk tolerance, and develop a diversified investment strategy that aligns with their financial goals.

Final Thoughts

Bitcoin’s resurgence to $35,000 amid the ETF buzz is undoubtedly a significant development in the cryptocurrency world. It showcases the growing acceptance and recognition of digital assets in traditional financial markets.

However, it’s crucial to approach the cryptocurrency market with a well-informed and balanced perspective. While Bitcoin is a leader in the space, it’s just one piece of the larger puzzle. Technological advancements, regulatory changes, and global events will continue to shape the cryptocurrency landscape.

Conclusion: A New Dawn for Bitcoin

In conclusion, Bitcoin’s surge to $35,000 amid ETF buzz represents a pivotal moment in the cryptocurrency landscape. It underscores the evolving nature of digital assets and the growing acceptance of Bitcoin as a mainstream investment. The approval of Bitcoin ETFs has injected fresh optimism into the market, making it an exciting time for both existing and potential investors.