Introduction: Could ₹10 Crore Be Your Reality?

You’re sipping coffee on a quiet morning, scrolling through your investments, and there it is—₹10 crore staring back at you. Sounds like a fantasy, right? But what if I told you it’s not? What if, with a bit of planning, discipline, and the right moves, you could turn this dream into your reality in just 15 years?

I know what you’re thinking—₹10 crore is a massive number. It’s the kind of wealth that buys freedom, security, and maybe even that beach house you’ve always wanted. But here’s the kicker: you don’t need to be a billionaire today to get there. You just need a plan. And that’s exactly what I’m here to give you.

Table of Contents

In this guide, we’re going to unpack everything you need to build a ₹10 crore portfolio from scratch. We’ll dig into the math, explore the best investment options, and share real strategies that work. Whether you’re 25 or 45, earning a modest salary or a hefty paycheck, there’s a path for you. Stick with me, and by the end, you’ll know exactly how to start—and why waiting even one more day could cost you big.

Ready to make ₹10 crore your story? Let’s dive in!

Understanding the Math: How Much Do You Need to Invest?

First things first—let’s talk numbers. Building a ₹10 crore portfolio in 15 years isn’t magic; it’s math. And the key variable? Your expected return. In India, equity investments like stocks and mutual funds have historically delivered 12-15% annual returns over the long haul. So, let’s break it down with two realistic scenarios.

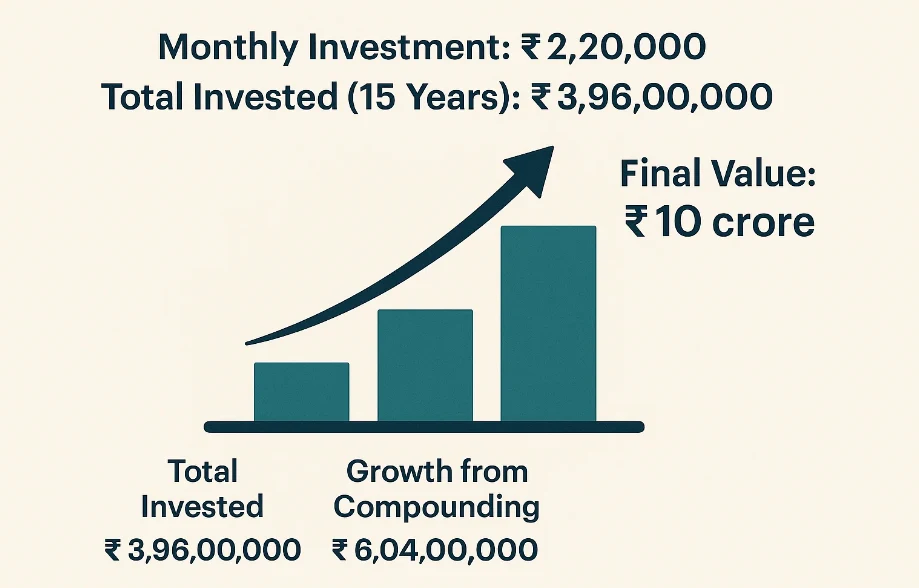

Scenario 1: 12% Annual Return

If you’re banking on a steady 12% return—think equity mutual funds or a diversified stock portfolio—here’s what it takes:

- Monthly Investment: ₹2,20,000

- Total Invested (15 Years): ₹3,96,00,000

- Growth from Compounding: ₹6,04,00,000

- Final Value: ₹10 crore

That’s right—investing ₹2.2 lakhs every month for 15 years could get you there. But I get it—₹2.2 lakhs a month isn’t pocket change for most of us. So, what happens if we aim higher?

Scenario 2: 15% Annual Return

Now, let’s push the return to 15%, which is achievable with a bit more risk (think aggressive mutual funds or smart stock picks):

- Monthly Investment: ₹1,50,000

- Total Invested (15 Years): ₹2,70,00,000

- Growth from Compounding: ₹7,30,00,000

- Final Value: ₹10 crore

At 15%, you’re down to ₹1.5 lakhs a month—still a stretch for many, but more doable if you’ve got a solid income or savings to kick things off.

Why Compounding Is Your Best Friend

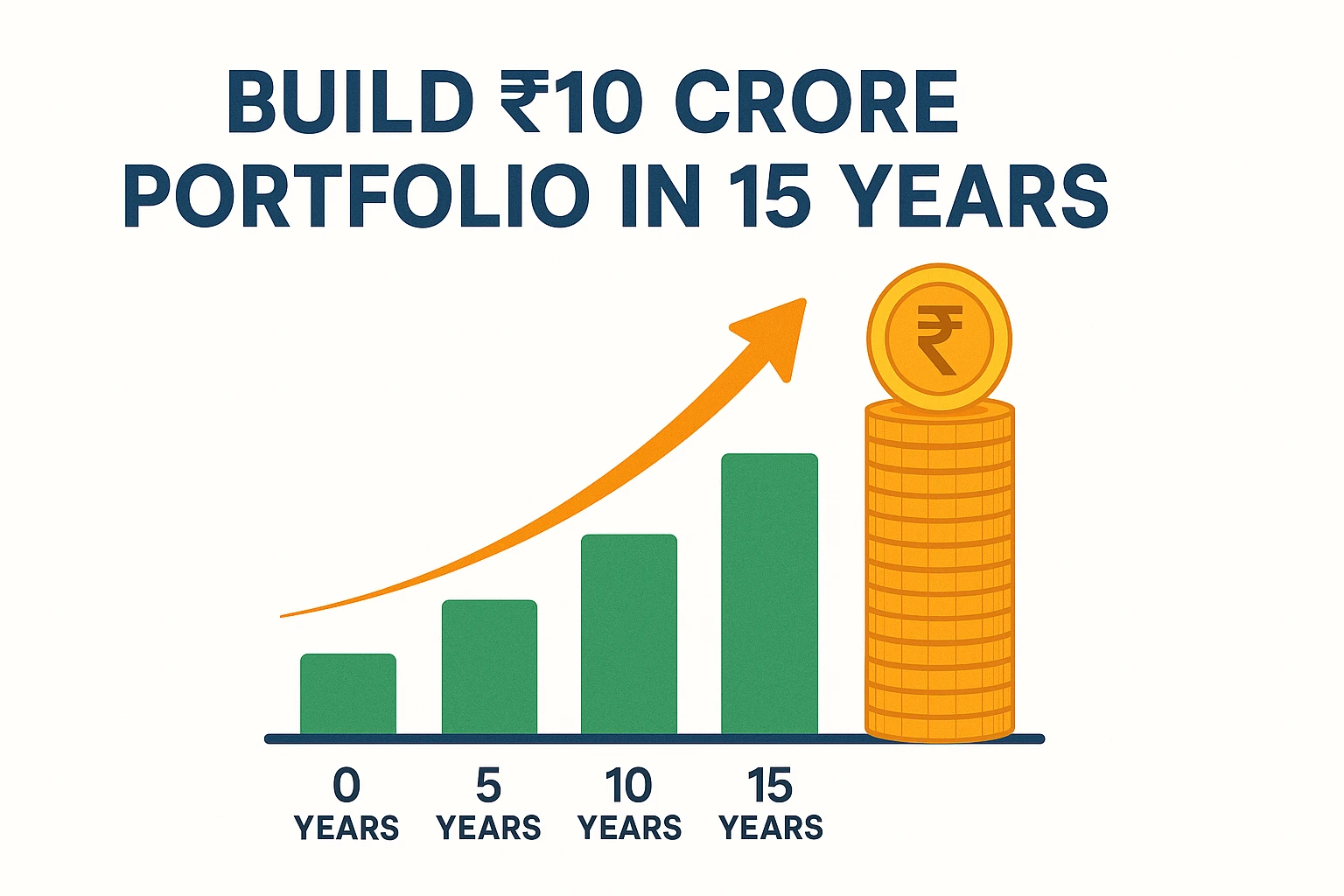

Here’s where it gets exciting. The real secret isn’t how much you invest—it’s how long you let it grow. Compounding turns smallAdministrator, consistent investments into a wealth explosion over time. Check out this table for a 12% return with ₹2,20,000 monthly:

| Year | Total Invested | Portfolio Value |

|---|---|---|

| 1 | ₹26,40,000 | ₹28,56,000 |

| 5 | ₹1,32,00,000 | ₹1,83,00,000 |

| 10 | ₹2,64,00,000 | ₹5,00,00,000 |

| 15 | ₹3,96,00,000 | ₹10,00,00,000 |

See that? In the first five years, growth is slow. But by year 10, it’s picking up steam. And in the last five years? It doubles! That’s compounding at work.

Setting Realistic Goals: Where Do You Start?

Okay, the math makes sense, but how do you make it work for you? It’s all about setting goals that fit your life.

Step 1: Know Your Starting Point

Be honest—how much can you invest each month? If ₹1.5 lakhs or ₹2.2 lakhs feels impossible, don’t panic. You’ve got options:

- Lump Sum Boost: Got ₹50 lakhs from a bonus or property sale? Start with that, and your monthly investment drops big time.

- Step-Up SIPs: Begin with ₹50,000 a month and increase it by 10% each year as your income grows.

- Extra Income: Use freelancing gigs, side hustles, or annual bonuses to pump up your contributions.

Step 2: Assess Your Risk Appetite

Equity is your ticket to high returns, but it’s a rollercoaster. Ask yourself:

- Can I stomach a 20% dip in my portfolio during a market crash?

- Am I in this for the full 15 years, no matter what?

If yes, you’re ready for an equity-heavy approach. If not, you might mix in some safer bets like debt funds—though that’ll slow your growth.

Step 3: Start Early (Or Now!)

Time is your superpower. A 25-year-old has a huge edge over a 40-year-old because of those extra compounding years. But even if you’re starting later, 15 years is plenty. The key? Don’t wait another day.

Choosing the Right Investments: Where Should Your Money Go?

To hit ₹10 crore, you need investments that grow fast. Here’s what works best.

Equity Mutual Funds: The Smart Choice

Mutual funds are a no-brainer for most of us. Why?

- Expert Management: Fund managers do the heavy lifting.

- Diversification: Your money’s spread across dozens of companies.

- SIP Option: Invest monthly and ride out market swings.

Go for large-cap, mid-cap, or multi-cap funds—they’ve delivered 12-15% returns over decades.

Direct Stocks: High Risk, High Reward

Feeling bold? Picking your own stocks can beat the market—if you know what you’re doing. You’ll need:

- Research Skills: Dig into company financials and trends.

- Patience: Hold winners and cut losers.

Spread your bets—don’t dump it all into one stock.

Index Funds & ETFs: Set It and Forget It

Want simplicity? Index funds track the Nifty 50 or Sensex. They’re:

- Low-Cost: Fewer fees mean more money stays with you.

- Reliable: You match the market’s growth, which has been solid in India.

Bonus Options

Equity should dominate, but consider:

- Real Estate: Great for lump sums, but it’s less liquid.

- Gold: A 5-10% hedge against crashes.

- PPF/Debt: Safe, but returns (6-8%) won’t get you to ₹10 crore fast.

Strategies to Supercharge Your Returns

Picking investments is half the battle. Here’s how to maximize growth.

1. Use SIPs for Dollar-Cost Averaging

Investing a fixed amount monthly means you buy more when prices dip and less when they soar. It’s a stress-free way to smooth out volatility.

2. Reinvest Everything

Dividends or capital gains? Put them back into your portfolio. Every rupee reinvested compounds into lakhs over time.

3. Slash Taxes

Keep more of your gains with smart tax moves:

- LTCG Tax: 10% on equity gains above ₹1 lakh.

- ELSS Funds: Tax savings under Section 80C plus equity growth.

4. Stay Calm

Markets crash. It’s normal. Don’t sell in a panic—those who stay invested win long-term.

Managing Risks: Keep Your Portfolio Safe

High returns mean higher risks. Here’s how to protect yourself.

Diversify Like a Pro

Don’t bet it all on one fund or sector. Mix it up:

- Tech, healthcare, banking—cover the bases.

- A pinch of debt or gold for stability.

Review and Rebalance

Every year, check your portfolio. If one fund’s killing it, sell some and buy underperformers to stay balanced.

Build an Emergency Fund

Stash 6-12 months of expenses in a liquid fund. That way, you won’t touch your investments when life throws curveballs.

Think Long-Term

Volatility is noise. Focus on the 15-year prize, and you’ll ride out the storms.

Real-Life Example: Meet Anjali

Let’s see this in action with Anjali, a 30-year-old IT professional earning ₹1.5 lakhs monthly. She’s determined to hit ₹10 crore by 45.

- Starting Point: ₹20 lakhs from savings.

- Monthly SIP: ₹1,20,000 in equity mutual funds.

- Expected Return: 14% (a mix of mid-cap and large-cap funds).

Here’s how it plays out:

- Year 0: ₹20 lakhs grows at 14%.

- Year 15: ₹20 lakhs becomes ₹1.42 crore.

- SIP Growth: ₹1,20,000 monthly grows to ₹8.65 crore.

Total: ₹10.07 crore. Anjali hits her goal by sticking to her plan, even through market dips.

Expert Wisdom: What the Pros Say

Here’s some gold from the experts:

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

Translation? Start early, and let compounding do the heavy lifting.

“In the short run, the market is a voting machine, but in the long run, it’s a weighing machine.” – Warren Buffett

Stay invested, and the market rewards value over hype.

Conclusion: Your ₹10 Crore Journey Starts Now

Building a ₹10 crore portfolio in 15 years isn’t a fairy tale—it’s a plan. Whether it’s ₹1.5 lakhs a month at 15% or ₹2.2 lakhs at 12%, the path is clear. Start small, scale up, or kick off with a lump sum—whatever works for you, the key is to start today.

The road won’t be perfect. Markets will wobble, doubts will creep in. But if you stay the course, the reward is life-changing. Imagine the freedom, the peace, the possibilities ₹10 crore brings.

So, what’s your next step? Open that SIP account today and take control of your financial future. Your ₹10 crore story begins now!

FAQs: Your ₹10 Crore Questions Answered

1. How much do I need to invest monthly to reach ₹10 crore in 15 years?

At 12% returns, ₹2,20,000 monthly. At 15%, ₹1,50,000. Adjust based on your starting capital and risk tolerance.

2. What’s the best investment for high returns?

Equity mutual funds, stocks, and index funds top the list. They’ve historically delivered 12-15% in India.

3. Is 15% annual return realistic?

It’s possible with equity, especially mid-cap funds or stocks, but it’s not guaranteed. Expect ups and downs.

4. How do I reduce risk?

Diversify across funds and sectors, keep an emergency fund, and stay invested long-term.

5. What if I can’t invest a lot now?

Start with what you can—even ₹50,000 monthly grows with time. Add lump sums or step up your SIP later.

1 Comment