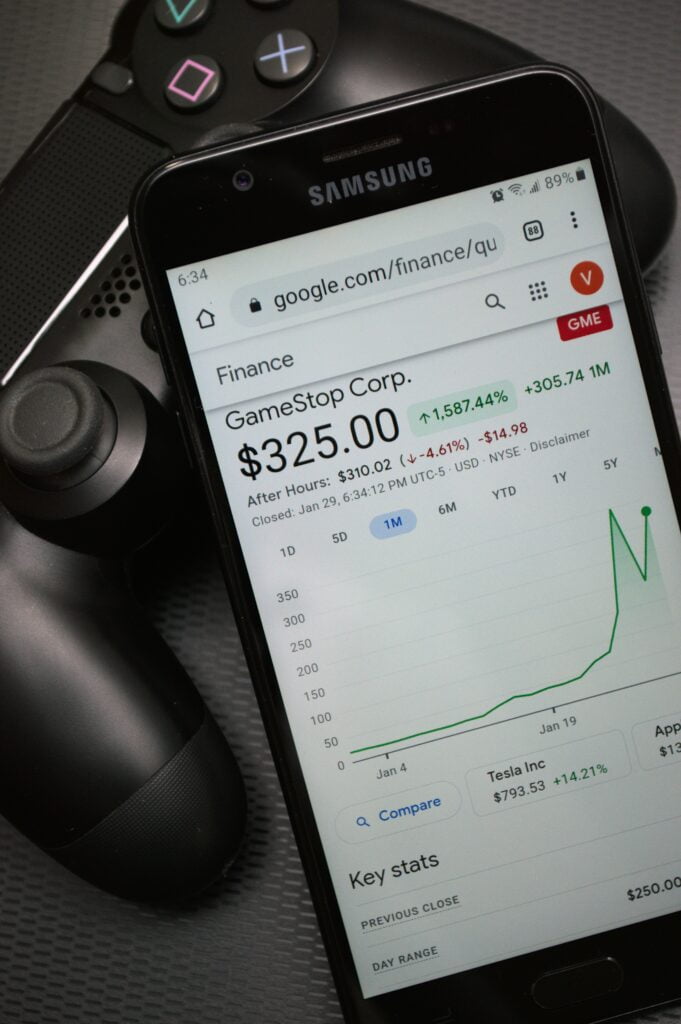

The recent surge in GameStop stock has left many investors and analysts scratching their heads. The company, once considered a relic of the past, has seen its stock price skyrocket by over 900% in just a few weeks. But what’s driving this unprecedented rise? In this blog post, we’ll delve into the complex web of factors that have contributed to GameStop’s stock rise, exploring the role of short sellers, borrowing rates, and the impact of social media on the stock market.

GameStop stock (GME) is currently trading at $54.11, up 23.61% from the previous close. On Monday, May 13, 2024, GameStop opened at $21.63, a 23.78% gain compared to the closing price of $17.48 on Friday, May 10. The stock has a 52-week range of $9.94 to $38.18 and is currently 295.77% above its 52-week low

Short Sellers and the GameStop Short Interest

The GameStop short interest has been a significant topic of discussion in recent times, particularly in the context of the short squeeze phenomenon that has affected the company’s stock price. According to the latest data, GameStop’s short interest stands at $799 million, which represents 22% of the float. This translates to approximately 58.57 million shares being held short. Despite the substantial short interest, short sellers have realized only $7.3 million in mark-to-market profits throughout 2023.

However, the actual short interest may be higher than it appears due to the fact that approximately 25% of GameStop’s outstanding shares are registered with Computershare via the Direct Registration System (DRS). This method of custody provides shareholders with greater autonomy and prevents their shares from being lent to short sellers. As a result, the effective short interest could be as high as 30.4% when considering only the shares available for trading on the open market.

The recent surge in GameStop’s stock price on Monday, which was triggered by a post from the anonymous internet persona ‘Roaring Kitty,’ has inflicted significant losses on short sellers. According to data from S3 Partners, short sellers lost almost $1 billion in Monday’s rally, with total losses in May reaching $1.43 billion. This event highlights the risks associated with short selling, particularly when a stock experiences a sudden and unexpected increase in value.

The GameStop short squeeze is not an isolated incident. In January 2021, a similar short squeeze occurred, causing major financial consequences for certain hedge funds and large losses for short sellers. The event was triggered by users of the subreddit r/wallstreetbets and led to a significant increase in the price of GameStop shares, as well as other heavily shorted securities and cryptocurrencies.

Borrowing Rates and the Cost of Short Selling

GameStop’s short borrowing rates have been on the rise in recent weeks, indicating increased demand from short sellers and limited share availability for lending. As of May 13, 2024, the short borrow fee rate for GME stands at 8.18% annually.

The table below shows the recent trend in GME’s short borrow rates:

| Date | Start | Min | Max | Latest |

|---|---|---|---|---|

| 2024-05-13 | 8.18 | 8.18 | 8.18 | 8.18 |

| 2024-05-10 | 11.11 | 5.95 | 11.11 | 8.18 |

| 2024-05-09 | 16.72 | 11.10 | 16.72 | 11.11 |

| 2024-05-08 | 4.77 | 4.77 | 16.72 | 16.72 |

| 2024-05-07 | 2.86 | 2.86 | 4.77 | 4.77 |

| 2024-05-06 | 1.81 | 1.81 | 2.86 | 2.86 |

The sharp increase in borrow rates, reaching as high as 16.72% on May 8 and 9, suggests that short sellers are facing higher costs to maintain their positions. High borrow rates are also an indicator that short sellers’ demand remains high and that there are fewer GameStop shares available for lending.

As of May 13, 2024, GameStop’s short interest stands at $799 million, representing 22% of the float[. However, the effective short interest may be higher due to the fact that approximately 25% of GameStop’s outstanding shares are registered with Computershare via the Direct Registration System (DRS), which removes these shares from the float and makes them unavailable for lending to short sellers.

The recent surge in GameStop’s stock price, triggered by a post from the anonymous internet persona ‘Roaring Kitty,’ has inflicted significant losses on short sellers. According to data from S3 Partners, short sellers lost almost $1 billion on Monday’s rally, with total losses in May reaching $1.43 billion. This event highlights the risks associated with short selling, particularly when a stock experiences a sudden and unexpected increase in value.

Social Media and the GameStop Stock Rise

The recent surge in GameStop’s stock price has been closely linked to social media activity, particularly the return of Keith Gill, also known as “Roaring Kitty,” to social media platforms after a prolonged absence. Gill’s reappearance on social media, marked by the sharing of a meme featuring a man in an attentive posture, triggered a significant increase in GameStop’s shares, with prices rising by up to 118% during early trading on Monday.

The meme stock phenomenon, which gained momentum in early 2021, involves individual investors leveraging social media platforms to challenge traditional market dynamics and confront short sellers and hedge funds with bearish views on companies like GameStop. This movement has led to forced short position coverings and subsequent spikes in stock prices, as seen in the case of GameStop.

The influence of social media on stock prices has been a subject of regulatory scrutiny, with the Securities and Exchange Commission (SEC) adopting new rules in 2023 to address the risks associated with meme stock trading trends. While there are conflicting regulations regarding the impact of social media influencers on stock prices, authorities are closely monitoring these activities to protect retail investors and maintain market integrity.

The resurgence of meme stocks like GameStop, AMC, and BlackBerry, fueled by social media hype and detached from traditional business fundamentals, has once again captured the attention of investors and traders on platforms like WallStreetBets. The allure of quick profits and the challenge to traditional financial norms have driven renewed interest in these stocks, with members of online forums advocating for investments using terms like YOLO (you only live once).

However, experts caution that the meme stock market is highly speculative and prone to excessive volatility, emphasizing the risks involved for investors, particularly those engaging in short-selling strategies. The recent losses incurred by hedge funds with short positions in GameStop highlight the potential financial consequences of betting against stocks that experience sudden and significant price surges driven by social media activity.

The Role of Institutional Investors

Institutional investors play a significant role in GameStop’s stock ownership landscape. As of the latest data, institutional investors, including major players like Vanguard, BlackRock, and State Street Corporation, hold approximately 29.69% of GameStop’s outstanding shares. This substantial ownership by institutional investors indicates their significant influence on the company’s stock price movements and overall market dynamics.

In the last 24 months, institutional investors have been actively involved in both buying and selling GameStop stock. Notable institutional buyers include BlackRock Inc., Bank of New York Mellon Corp, and Vanguard Group Inc., who have collectively purchased a total of 29,642,383 shares, amounting to approximately $709.84 million in transactions. On the selling side, institutions like Barclays PLC, SG Americas Securities LLC, and Swiss National Bank have sold a total of 2,559,188 shares, representing around $58.06 million in transactions.

The presence of institutional investors in GameStop’s ownership structure brings stability and liquidity to the stock, but it also introduces complexities due to their significant holdings and trading activities. Institutional investors’ decisions can impact the stock’s price movements, especially in conjunction with retail investors and social media-driven trading trends, as seen in the case of GameStop’s recent price surges.

Overall, institutional investors, with their substantial ownership and trading volumes, are key players in shaping GameStop’s stock performance and market behavior. Their actions, along with those of retail investors and other market participants, contribute to the dynamic and sometimes volatile nature of GameStop’s stock price movements.

The Impact of the Pandemic

GameStop’s business operations were significantly impacted by the COVID-19 pandemic in 2020. The company took several actions in response to the crisis, including:

- Implementing temporary base salary reductions of 50% for the CEO, 30% for the CFO, and the executive leadership team

- Reducing cash compensation to directors by 50%

- Offering corporate support staff the option of temporary furlough or reduced workweek/pay programs

- Reducing inventory receipts to match demand, focusing on key hardware, software, and accessories products

- Lowering capital spending to focus on mandatory maintenance or near-term high-value strategic projects

- Discussions with landlords regarding rent payments, including potential abatement, deferral, and/or restructuring of future rents during the period of COVID-19-related closures

As a result of governmental regulations and landlord decisions, approximately one-third of GameStop’s U.S. store locations remained closed, with two-thirds of stores closed to customers but available for curbside pick-up. However, the company was able to retain over 90% of its planned sales volumes in two-thirds of stores conducting curbside operations through enhanced omnichannel fulfillment capabilities.

Despite the challenges posed by the pandemic, GameStop’s stores in Australia remained open and continued to post strong results, with approximately 24% comparable store sales growth for the nine weeks ended April 4, 2020.

The company’s liquidity position remained stable, with $380.8 million in cash and restricted cash as of May 2, 2020. GameStop’s ability to adapt its operations and leverage its omni-channel capabilities allowed it to mitigate some of the negative impacts of the pandemic on its business.

Conclusion

The GameStop stock rise is a complex phenomenon, driven by a combination of factors including short sellers, borrowing rates, social media, and institutional investors. The company’s history of struggling to adapt to the shift towards digital gaming has led to a significant short interest, which has been exacerbated by the recent surge in the stock price. Social media has played a significant role in driving the stock price higher, as investors have been encouraged to buy the stock by the group’s enthusiastic promotion.

As the stock market continues to evolve, it’s clear that social media will play an increasingly important role in driving investment decisions. The GameStop stock rise is a prime example of this, as the company’s stock has been heavily discussed and promoted on platforms like Reddit. As investors continue to navigate the complex and ever-changing landscape of the stock market, it’s essential to stay informed and adapt to new trends and strategies.