Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Warning: Undefined array key 0 in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Deprecated: pathinfo(): Passing null to parameter #1 ($path) of type string is deprecated in /home/u117450413/domains/smartblog91.com/public_html/wp-content/plugins/seo-image-optimizer/options/option-panel.php on line 141

Background

Table of Contents

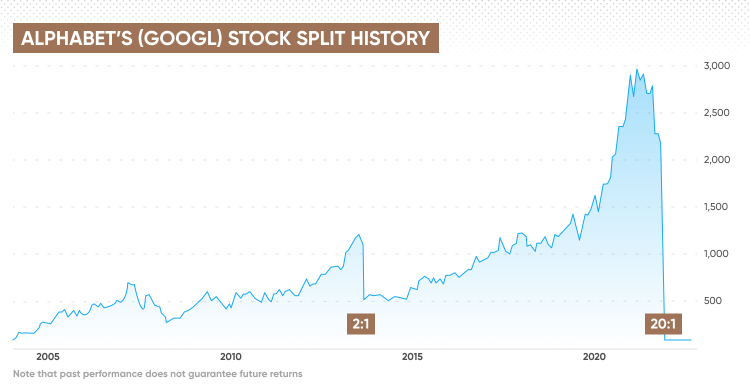

Google-parent Alphabet completed a 20-for-one stock split for its Class A (GOOGL), Class B, and Class C (GOOG) shares in mid-July 2022. This is the second time Google has undergone a stock split, with the first one happening in March 2014. The stock split was implemented in the form of a one-time special stock dividend on each of the company’s Class A, B, and C shares. The change required shareholder approval, which was obtained at the 2022 Annual Meeting of Stockholders on June 1, with the Google stock split date set for July 15.

What is a stock split?

A stock split is a corporate action in which a company issues additional stock to its shareholders. A stock split will result in an increase in the number of shares held by existing shareholders, but the total dollar value of all shares will not change due to a stock split.

Why did Google stock split?

Companies carry out stock splits with the intent of making their stock prices more attractive to investors. The lower price would mean that more investors might be able to afford buying entire, rather than fractional, shares of the advertising company.

How much will Google stock be after the split?

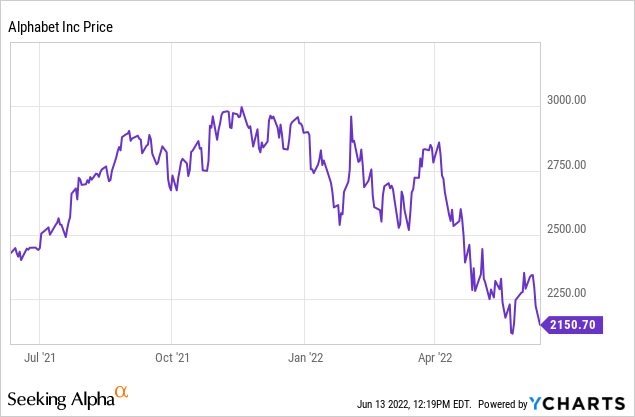

As trading began on July 18, 2022, Alphabet class A stock opened at a split-adjusted price of $112.64. Google’s stock price before the split was $2,255.34 as the market closed on July 15, 2022.

What does the stock split mean for investors?

In Alphabet’s case, its 20-for-1 split means each existing investor will now have 20 shares for each one they previously owned, which has shrunk the price of each share. The stock split intends to make the Alphabet stock more affordable and accessible to individual investors.

Potential benefits for Alphabet

The stock split has two potential benefits for Alphabet:

- Increased accessibility: The split makes Alphabet shares more enticing for everyday investors, as the lower price may encourage more people to invest in the company.

- Dow Jones inclusion: The stock split increases the odds that Alphabet could eventually be added to the prestigious Dow Jones. The Dow, which lists only 30 stocks, is weighted by price, and the addition of a stock with a high price could heavily skew the index. If Alphabet were to be included in the Dow, it would help to maintain the index’s weighting.

FAQ

1. How does a stock split affect the value of a company?

A stock split does not affect the total value of a company. It only increases the number of shares outstanding and reduces the price per share. The market capitalization of the company remains the same.

2. How often do companies split their stock?

There is no set schedule for stock splits. Companies may choose to split their stock when they believe it will benefit their shareholders or when they want to make their shares more affordable to individual investors.

3. What is the difference between Class A, B, and C shares?

Class A shares typically have more voting rights than Class B or C shares. Class B and C shares may have different dividend rates or other characteristics that distinguish them from Class A shares.

Conclusion

Google’s parent company, Alphabet, underwent a 20-for-one stock split in July 2022, which is the second time the company has undergone a stock split. The stock split was implemented in the form of a one-time special stock dividend on each of the company’s Class A, B, and C shares. The change required shareholder approval, which was obtained at the 2022 Annual Meeting of Stockholders on June 1, with the Google stock split date set for July 15. The stock split intends to make the Alphabet stock more affordable and accessible to individual investors.

1 thought on “Google Stock Split: What You Need to Know”