When it comes to building wealth over the long haul, the choices you make today can shape your financial future. Two standout options often come up in the conversation: high-yield savings accounts and stock market index funds. Both have their merits, but which one is the best pick for long-term growth? If you’re wrestling with this decision, you’re not alone—it’s a question that puzzles beginners and seasoned investors alike.

Why Long-Term Growth Matters

Before we jump into the nitty-gritty, let’s talk about why long-term growth is worth your attention. Whether you’re dreaming of a cozy retirement, a dream home, or financial freedom, the money you set aside today needs to work for you over time. The earlier you start, the more your investment can compound—turning small contributions into a substantial nest egg.

But here’s the catch: not all investment options are created equal. Some prioritize safety, while others chase higher returns at the cost of risk. That’s where high-yield savings accounts and stock market index funds come in—two paths to growth with very different vibes. Let’s explore each one.

High-Yield Savings Accounts—Steady and Secure

What is a High-Yield Savings Account?

A high-yield savings account is like the dependable friend who’s always there for you. It’s a savings account offered by banks (often online ones) that pays a higher interest rate than your standard brick-and-mortar savings account. Think of it as a souped-up version of the piggy bank—your money earns interest, and it’s protected by FDIC insurance up to $250,000.

The Perks of High-Yield Savings Accounts

- Safety First: Your principal—the money you deposit—is safe. No rollercoaster rides here; you won’t lose a dime unless the bank goes under (and even then, FDIC has your back).

- Easy Access: Need cash in a pinch? You can withdraw your money anytime without penalties, making it perfect for emergencies or short-term goals.

- Predictable Returns: Interest rates are steady, so you know exactly what you’re getting. No surprises, just slow and steady growth.

The Downsides

- Modest Returns: Even with “high-yield” in the name, the returns pale in comparison to riskier investments. Current rates hover around 4-5% annually—nice, but not life-changing.

- Inflation’s Bite: Over decades, inflation can outpace your interest earnings, shrinking the real value of your money. What feels like growth today might not stretch as far tomorrow.

Top High-Yield Savings Accounts (October 2023)

| Bank Name | Annual Percentage Yield (APY) | Minimum Balance | Monthly Fees |

|---|---|---|---|

| Ally Bank | 4.25% | $0 | None |

| Marcus by Goldman Sachs | 4.30% | $0 | None |

| Discover Bank | 4.20% | $0 | None |

| Capital One | 4.10% | $0 | None |

Note: Rates fluctuate, so double-check with the bank for the latest figures.

High-yield savings accounts shine for short-term needs or as a safe haven for cash you can’t afford to lose. But for long-term growth? Let’s see how they stack up against the competition.

Stock Market Index Funds—Riding the Market Wave

What is a Stock Market Index Fund?

A stock market index fund is your ticket to owning a slice of the stock market without picking individual stocks. These funds track a market index—like the S&P 500, which includes 500 of the biggest U.S. companies (think Apple, Microsoft, and Amazon). It’s a “set it and forget it” approach that spreads your money across hundreds of stocks for instant diversification.

The Perks of Index Funds

- Big Growth Potential: Historically, the stock market delivers average annual returns of 7-10% after inflation. Over decades, that compounds into serious wealth.

- Diversification: One fund, hundreds of companies. If one stock tanks, others can cushion the blow.

- Low Effort: Index funds are passively managed, meaning lower fees than actively managed funds and less hassle for you.

The Risks

- Market Swings: Stocks aren’t for the faint-hearted. Prices can drop 20% or more in a bad year (hello, 2008!), testing your nerves.

- No Safety Net: Unlike savings accounts, your principal isn’t guaranteed. You could lose money, especially if you sell during a dip.

- Patience Required: Index funds thrive over the long term. If you need cash in a year or two, this isn’t your play.

Historical Performance Snapshot

The S&P 500, a go-to benchmark, has averaged about 10% annual returns over the past 30 years (before inflation). Picture this: $10,000 invested in 1993 would be worth over $170,000 today, assuming reinvested dividends. That’s the power of time and compounding—something savings accounts can’t touch.

Head-to-Head: Savings vs. Stocks

Let’s put these two contenders side by side and see how they measure up for long-term growth.

1. Risk Level

- High-Yield Savings: Zero risk to your principal. You sleep easy knowing your money’s safe.

- Index Funds: Moderate to high risk. The market’s ups and downs can be a wild ride, but history shows it trends upward over time.

2. Growth Potential

- High-Yield Savings: Capped at 4-5% annually. After 20 years, $10,000 at 4.5% grows to about $24,000.

- Index Funds: Averages 7-10% annually. That same $10,000 at 8% grows to nearly $47,000 in 20 years—almost double the savings account.

3. Time Horizon

- High-Yield Savings: Great for 1-5 years. Beyond that, inflation starts chipping away.

- Index Funds: Built for 5+ years. The longer you stay in, the more you benefit from market recoveries.

4. Flexibility

- High-Yield Savings: Liquid as water. Withdraw anytime, no stress.

- Index Funds: Less liquid. Selling takes a few days, and timing matters—sell low, and you lose out.

Savings vs. Index Funds at a Glance

| Feature | High-Yield Savings Account | Stock Market Index Fund |

|---|---|---|

| Risk | Low (FDIC-insured) | Moderate to High |

| Average Return | 4-5% per year | 7-10% per year |

| Best For | Short-term goals | Long-term growth |

| Liquidity | Immediate access | Takes a few days |

| Inflation Protection | Limited | Stronger over time |

My Pick: Stock Market Index Funds (Here’s Why)

If I had to choose one for long-term growth, I’d go with a stock market index fund. Why? It boils down to three words: time, compounding, and returns.

- Time is Your Ally: At 31, I’ve got decades ahead to ride out market dips. The S&P 500’s long-term upward trend (despite crashes like 2008 or 2020) gives me confidence that patience pays off.

- Compounding Magic: A 4% savings return can’t compete with 8-10% from stocks. Over 30 years, the gap is massive—hundreds of thousands of dollars, depending on how much I invest.

- Beating Inflation: Savings accounts barely keep up with inflation (currently around 3%). Index funds, with higher returns, ensure my money grows in real terms.

That said, I’m not reckless. I’d pair this with a high-yield savings account for emergencies—say, 6 months’ worth of expenses. But for pure long-term growth? Index funds win hands down.

What Do the Experts Say?

Let’s hear from some financial heavyweights to round out the picture:

“A low-cost index fund is the most sensible equity investment for the great majority of investors. My mentor, Ben Graham, took this position many years ago, and everything I’ve seen since convinces me of its truth.”

— Warren Buffett, Legendary Investor

These pros echo my reasoning: safety has its place, but for long-term wealth, the market’s where it’s at.

Bullet Points: Key Takeaways So Far

- High-Yield Savings Accounts:

- Perfect for safety and short-term goals.

- Low returns limit long-term potential.

- Inflation can erode gains over decades.

- Stock Market Index Funds:

- Higher risk, higher reward.

- Ideal for 5+ year horizons.

- Historically outpace inflation and savings.

- My Choice: Index funds for their growth edge, with savings as a backup.

Real-Life Scenarios: Which Fits You?

Still unsure? Let’s break it down with some examples:

- You’re 28, saving for retirement: Index funds. You’ve got 30+ years to grow your money, and market dips won’t derail you.

- You’re 45, planning a home purchase in 3 years: High-yield savings. You need that cash soon and can’t risk a market crash.

- You’re 60, building a legacy for your kids: Index funds. With a 20-year horizon, you can still harness compounding.

Your age, goals, and risk tolerance steer the ship. Let’s tackle some common questions next.

FAQ: Your Burning Questions Answered

1. How much can I expect to earn with each option?

- Savings: $10,000 at 4.5% grows to $24,117 in 20 years.

- Index Funds: $10,000 at 8% grows to $46,610 in 20 years. (Assumes average returns; actual results vary.)

2. Are high-yield savings accounts really “high yield”?

Yes, compared to traditional savings (0.01-0.5% APY), but they’re still modest next to stocks. A 4.5% APY is “high” in today’s banking world.

3. What if the stock market crashes right after I invest?

It’s a risk, but time smooths it out. A $10,000 investment in the S&P 500 at its 2007 peak (pre-crash) would still be worth over $45,000 today, despite the 2008 plunge.

4. Can I split my money between both?

Absolutely! Many do—savings for safety, index funds for growth. It’s a balanced approach that covers all bases.

5. How do I start with index funds?

Open a brokerage account (e.g., Vanguard, Fidelity), pick a fund (like VOO for the S&P 500), and invest. Start small if you’re nervous!

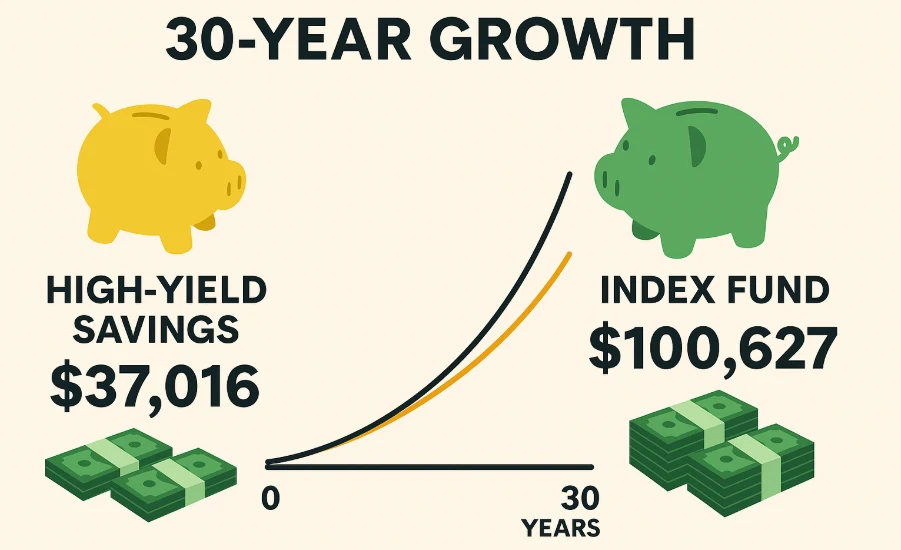

The Numbers Don’t Lie: A 30-Year Showdown

Let’s run a hypothetical to seal the deal. Say you invest $10,000 today and leave it for 30 years:

- High-Yield Savings (4.5% APY): Grows to $37,016.

- Index Fund (8% average return): Grows to $100,627.

That’s a $63,611 difference. Even if the market dips, its long-term trajectory trumps savings by a landslide. (Note: These are simplified projections—real returns fluctuate.)

Tips to Maximize Either Choice

- For Savings:

- Shop for the best rates (online banks often beat traditional ones).

- Automate deposits to build your balance steadily.

- Reinvest interest to compound your gains.

- For Index Funds:

- Dollar-cost average (invest a fixed amount regularly) to smooth out market swings.

- Reinvest dividends for extra compounding power.

- Keep fees low—look for funds with expense ratios under 0.1%.

Conclusion: Your Money, Your Move

So, high-yield savings account or stock market index fund? For me, it’s index funds all the way for long-term growth. The potential to turn $10,000 into $100,000+ over 30 years is too compelling to ignore, especially with time on my side. That said, I’d never ditch savings entirely—it’s my safety net, not my growth engine.

Your choice hinges on your goals, timeline, and comfort with risk. If you crave security or need cash soon, high-yield savings is your friend. If you’re in it for the long game and can stomach some volatility, index funds are your ticket to wealth.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.