Introduction: Could ₹10,000 a Month Really Change Your Life?

You’re sipping coffee at your desk, scrolling through your phone, when you stumble across a jaw-dropping fact—investing just ₹10,000 every month could turn into ₹3.5 crores by the time you retire. Sounds like a fairy tale, doesn’t it? But here’s the kicker: it’s not. It’s the real, tangible magic of something called a Systematic Investment Plan, or SIP.

In India, where we’re taught to save every penny for a rainy day, SIPs are quietly revolutionizing how everyday people—like you and me—build wealth. Picture this: instead of stashing cash under your mattress or in a low-interest savings account, you let your money grow wings and soar over decades. That’s what SIPs do—they take your small, consistent efforts and multiply them into a fortune.

Table of Contents

What is SIP and How Does It Work?

Let’s start with the basics—because if you’re going to trust SIPs with your hard-earned money, you deserve to know what they’re all about.

The Basics of SIP: Your Wealth-Building Sidekick

A Systematic Investment Plan (SIP) is like a financial workout plan—you commit to investing a fixed amount, say ₹10,000, into a mutual fund every month. It’s automatic, hassle-free, and designed to fit into your busy life. You pick a mutual fund that matches your goals (more on that later), set a date, and watch your money get to work. Over time, you’re buying units of that fund, and as the market grows, so does your investment.

Think of it as planting a seed. You don’t need a big plot of land—just a little patch and regular watering. That’s SIP in a nutshell: small, steady steps that grow into something massive.

How SIPs Leverage the Power of Compounding

Here’s where the real magic happens—compounding. When you invest through SIPs, your money doesn’t just sit there; it earns returns. And then those returns earn returns. It’s like rolling a snowball down a hill—small at first, but unstoppable after a while.

For example, if you invest ₹10,000 monthly at a 12% annual return, after 30 years, you’re not just looking at your total investment of ₹36 lakhs. Nope. Thanks to compounding, it balloons to around ₹2.6 crores. The longer you let it roll, the bigger it gets. Time is your secret weapon here.

Why SIPs Beat Lump Sum Investments

Now, you might wonder, “Why not just dump a big chunk of cash into the market instead?” Fair question. But here’s the catch: timing the market is a gamble. Invest a lump sum right before a crash, and you’re toast. SIPs, though? They spread your investment over time, thanks to something called rupee cost averaging. When prices dip, you buy more units; when they rise, you buy fewer. It’s a no-stress way to smooth out the market’s ups and downs.

In short, SIPs take the guesswork out of investing. You don’t need to be a stock market guru—you just need consistency.

The Benefits of SIP Investments

So, why are millions of Indians jumping on the SIP bandwagon? Let’s break down the perks that make it a game-changer.

Rupee Cost Averaging: Your Shield Against Volatility

Markets are moody—they swing up and down like a pendulum. But with SIPs, that volatility works in your favor. By investing a fixed amount every month, you’re averaging out your purchase cost. When the market’s low, your ₹10,000 buys more units; when it’s high, it buys less. Over time, this balances things out, reducing your risk and keeping your nerves intact.

Disciplined Investing: Building Wealth, One Step at a Time

Ever tried saving money but ended up splurging on a sale? We’ve all been there. SIPs fix that by automating your investments. Once you set it up, the money leaves your account before you can spend it. It’s like having a financial coach whispering, “Stay on track!” every month. That discipline is what turns small savings into big wins.

Flexibility and Convenience: Investing on Your Terms

Here’s the best part—you don’t need a fat wallet to start. SIPs let you begin with as little as ₹500 a month. Plus, you can tweak your amount anytime—bump it up when you get a raise or dial it back if times get tight. And with mobile apps and online platforms, managing your SIPs is as easy as ordering food online. Convenience? Check.

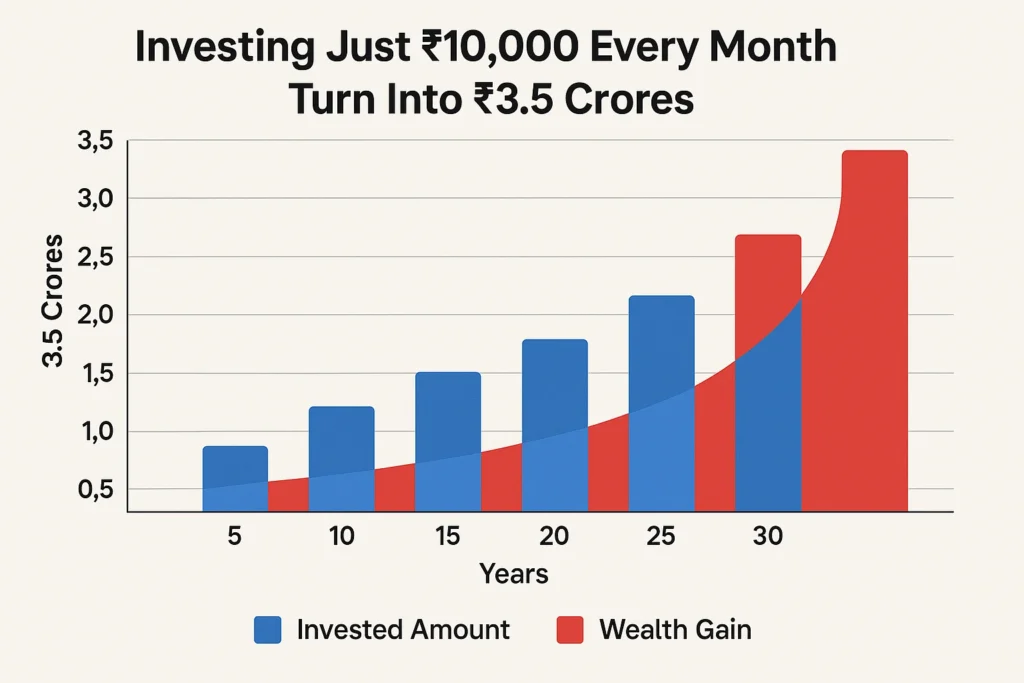

How ₹10,000 a Month Can Make You a Crorepati

Alright, let’s get to the juicy stuff—how does ₹10,000 a month actually turn into crores? It’s all about time, consistency, and a little math.

The Numbers Don’t Lie: Your Path to Crores

Let’s say you’re 25 years old and start investing ₹10,000 monthly in an equity mutual fund with an average annual return of 12%—a realistic figure for many funds in India. You keep it up for 35 years until you hit 60. Here’s what happens:

- Total Invested: ₹42,00,000 (₹10,000 x 12 months x 35 years)

- Final Corpus: Around ₹5.3 crores

Yes, you read that right. Your ₹42 lakhs of effort grows into over 5 crores, thanks to compounding. Want to see how it plays out over different timelines? Check out this table:

| Years Invested | Total Invested (₹) | Corpus at 8% (₹) | Corpus at 10% (₹) | Corpus at 12% (₹) |

|---|---|---|---|---|

| 20 | 24,00,000 | 57,00,000 | 72,00,000 | 90,00,000 |

| 25 | 30,00,000 | 92,00,000 | 1,20,00,000 | 1,60,00,000 |

| 30 | 36,00,000 | 1,40,00,000 | 1,90,00,000 | 2,60,00,000 |

| 35 | 42,00,000 | 2,10,00,000 | 3,00,00,000 | 5,30,00,000 |

See the pattern? The longer you stay in, the more your money multiplies. Even at a modest 8%, you’re a crorepati in 30 years. Crank it up to 12%, and you’re swimming in crores.

Disclaimer: These are projections based on historical averages. Mutual funds are subject to market risks, and past performance isn’t a guarantee of future results. Always read the scheme documents carefully.

Start Early, Win Big

The secret sauce? Time. Start at 25 instead of 35, and you’re giving your money an extra decade to grow. That’s the difference between ₹90 lakhs and ₹2.6 crores over 20 versus 30 years at 12%. Every month you delay is a missed chance to let compounding work its magic.

Case Study: Priya’s SIP Success Story

Need proof this works? Meet Priya, a 28-year-old teacher from Pune. Back in 2015, she started investing ₹10,000 monthly in a diversified equity mutual fund. She wasn’t rich—just a regular person with a modest salary. But she stuck with it, even when the markets wobbled.

Fast forward to 2023—eight years later—her investment is worth over ₹15 lakhs, with an average return of 12%. If she keeps going until she’s 58 (30 years total), she’s on track for ₹2.6 crores. Priya’s not a finance whiz; she just trusted the process. Today, she’s planning an early retirement, confident her SIPs will carry her through.

Priya’s story shows that you don’t need a fancy degree or a big paycheck—just a little faith and a lot of consistency.

Expert Insights: What the Pros Say About SIPs

Don’t just take my word for it—here’s what the experts think:

- A. Balasubramanian, CEO of Aditya Birla Sun Life Mutual Fund: “SIPs are the best way for retail investors to participate in the equity markets without worrying about timing the market. The discipline of regular investing, combined with compounding, creates substantial wealth over time.”

- Warren Buffett, Legendary Investor: “The stock market is a device for transferring money from the impatient to the patient.” SIPs are the ultimate test of patience—and the rewards speak for themselves.

- Radhika Gupta, MD & CEO of Edelweiss Mutual Fund: “For young Indians, SIPs are a no-brainer. Start small, stay consistent, and let your money grow with the country’s economy.”

These pros agree: SIPs are a simple, proven path to wealth.

Busting Myths: Is SIP Really for You?

Let’s tackle some doubts you might have:

- “I need a lot of money to invest.” Nope. You can start with ₹500. ₹10,000 is just an example—adjust it to your budget.

- “It’s too risky.” Sure, markets fluctuate, but SIPs spread that risk over time. Plus, SEBI regulates mutual funds, so your money’s in safe hands.

- “I’ll wait for the perfect time.” Bad move. The best time to start is now—every delay costs you compounding power.

SIPs aren’t some get-rich-quick scheme. They’re a slow, steady climb to financial security, perfect for anyone willing to play the long game.

How to Get Started with SIPs

Ready to jump in? Here’s your quick-start guide:

- Set Your Goal: Retirement? A house? Define it.

- Assess Your Risk: Younger folks can go for equity funds (higher returns, higher risk). Closer to retirement? Try balanced funds.

- Pick a Fund: Research or consult a financial advisor. Look at past performance, fees, and fund manager reputation.

- Start Small: ₹10,000 too much? Begin with ₹1,000 or ₹5,000.

- Automate It: Link your bank account and set a date. Done.

Most mutual fund apps—like Groww, Zerodha Coin, or your bank’s platform—make this a breeze. You’ll be up and running in 15 minutes.

FAQs About SIPs

Got questions? I’ve got answers:

1. What’s the minimum amount to start a SIP?

You can kick off with as little as ₹500 per month. It’s perfect for beginners or tight budgets.

2. Can I change my SIP amount later?

Absolutely. Increase it with a bonus or cut it if needed—flexibility is built in.

3. What if I miss a payment?

No biggie. There’s no penalty. Your SIP picks up with the next installment—just try to stay regular.

4. Are SIPs safe?

They’re as safe as mutual funds get, regulated by SEBI. Risk depends on the fund type, but long-term equity funds balance risk with growth.

5. How do I pick the right mutual fund?

Match it to your goals and risk level. Check its track record, expense ratio, and reviews. A financial advisor can help, too.

6. Can SIPs really make me a crorepati?

Yes—if you start early and stay consistent. ₹10,000 monthly at 12% for 35 years could hit ₹5.3 crores. Time’s the key.

Conclusion: Your Ticket to a Crore-Packed Retirement

Here’s the bottom line: Investing ₹10,000 monthly in SIPs isn’t just a dream—it’s a plan. With the power of compounding, the safety of rupee cost averaging, and the ease of automation, you’re setting yourself up for a retirement most only fantasize about. Priya did it. Millions of Indians are doing it. Why not you?

Don’t let doubt hold you back. You don’t need to be rich, smart, or lucky—just willing to start. Every ₹10,000 you invest today is a brick in the mansion of your future. So, what’s stopping you? Start your SIP today and watch your small steps turn into a giant leap toward financial freedom. Your crores are waiting.

Leave a Reply