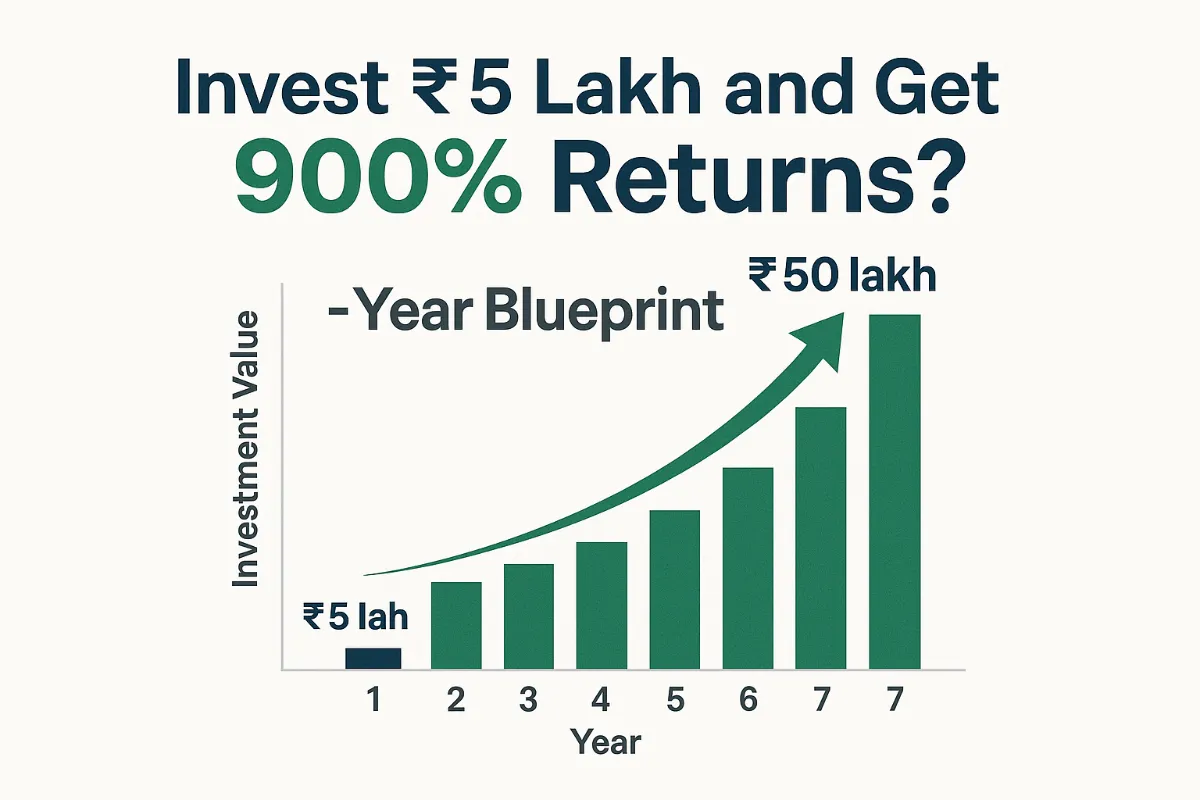

Introduction: Can ₹5 Lakh Really Turn Into ₹50 Lakh?

Investing ₹5 lakh today and watching it snowball into ₹50 lakh or more in just 7 years. Sounds like a fantasy? For many, the idea of a 900% return feels impossible. Yet, history shows us that with the right mix of small-cap funds, equities, and IPO opportunities, investors have achieved this level of growth.

Table of Contents

Why 900% Growth in 7 Years Isn’t Impossible

To put things in perspective:

- To grow 10X in 7 years, your portfolio needs a CAGR (Compounded Annual Growth Rate) of about 37% per year.

- Traditional options like FDs (6–7%), PPF (7.1%), and gold (8–10%) won’t cut it.

- Small-cap funds, select equities, and IPO investments have historically delivered 25–50% CAGR in certain phases, making such returns achievable under the right conditions.

Table 1: Historical Performance by Asset Class (2025 Data)

| Asset Class | Average 5-Year CAGR | Potential for 900% Growth |

|---|---|---|

| Fixed Deposits (FDs) | 6% – 7% | No |

| Gold | 9% – 10% | No |

| PPF / NPS | 7% – 10% | No |

| Nifty 50 Index | 12% – 15% | No |

| Small-Cap Mutual Funds | 30% – 35% | Yes (selective) |

| IPOs (Recent Data 2025) | 50–100% (listing) | Yes (speculative) |

| Crypto / Global ETFs | 20–60% | Volatile |

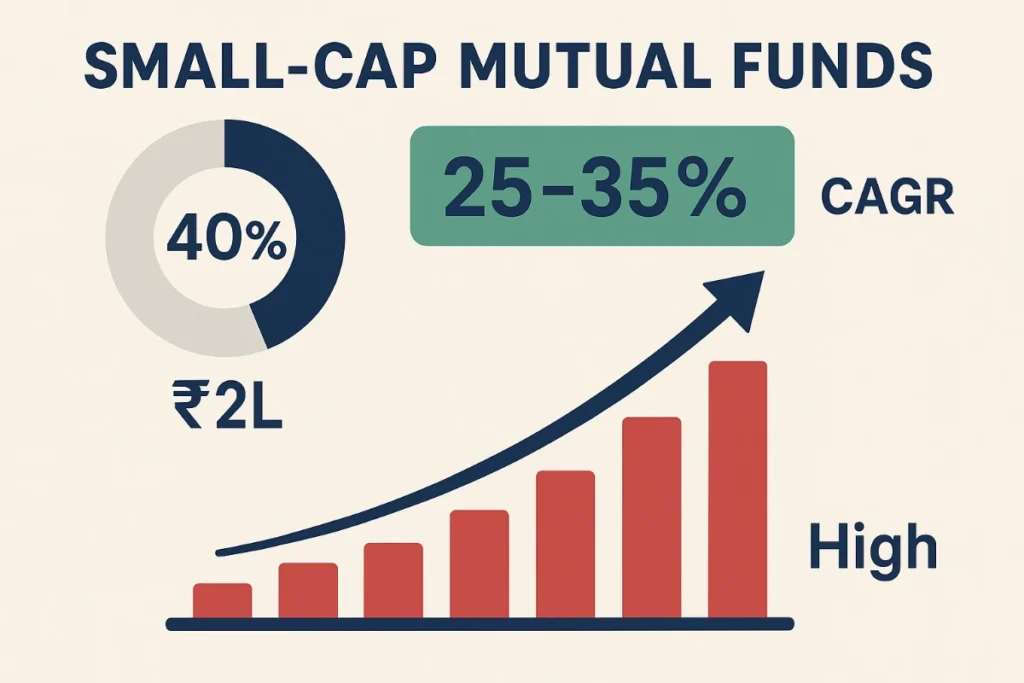

Step 1: Building the Blueprint – Smart Asset Allocation

To target 900% growth, diversification across high-growth opportunities is key.

| Asset Type | Allocation % | Growth Potential (7 yrs) | Risk Level |

|---|---|---|---|

| Small-Cap Mutual Funds | 40% (₹2L) | 25–35% CAGR | High |

| Direct Equity (Growth Stocks) | 30% (₹1.5L) | 30–40% CAGR | High |

| IPO Participation/Funds | 20% (₹1L) | 30–50% CAGR (avg) | High |

| Alternatives (REITs, ETFs) | 10% (₹50K) | 20–25% CAGR | Medium |

This allocation balances explosive growth with diversification, ensuring one winning sector or stock doesn’t just cover risks—it supercharges wealth.

Step 2: Small-Cap Mutual Funds – 2025 Growth Champions

Small-cap funds are the engine of high CAGR growth. Recent data:

- Quant Small Cap Fund (Direct Growth): ~36.8% 5-year CAGR (as of July 2025).

- Nippon India Small Cap Fund: ~34% 5-year CAGR.

- Bandhan & HDFC Small Cap Funds: 30–33% CAGR consistently.

Pro Tip: Combine SIP for stability with lump-sum allocations during market dips.

Expert Quote:

“Patience is your biggest weapon in small-cap investing. Short-term volatility is high, but long-term rewards are unmatched.” – Ramesh Damani, Dalal Street Veteran

Step 3: Direct Equity in High-Growth Sectors

Handpicking stocks in transformational sectors can multiply wealth.

2025 High-Growth Sectors:

- Electric Vehicles & Renewable Energy: Tata Power, Adani Green, Tata Motors EV.

- Artificial Intelligence & Tech: Infosys, Happiest Minds, LTIMindtree.

- Pharma & Healthcare Innovation: Divi’s Lab, Laurus Labs, Sun Pharma.

- Fintech & Digital Platforms: Bajaj Finance, Paytm (restructuring phase).

Table 3: Multibagger Examples (2016–2023)

| Stock | Price in 2016 | Price in 2023 | Growth % |

|---|---|---|---|

| Bajaj Finance | ₹1,100 | ₹7,200 | 550% |

| Adani Green | ₹45 | ₹2,300 | 5,000% |

| Deepak Nitrite | ₹120 | ₹2,000 | 1,567% |

Step 4: IPO Funds & Direct Participation

IPO markets are booming in FY25:

- Average listing gains in FY25: 70% (Q1), 81% (Q2), 50% (Q3), 105% (Q4).

- Example: Current Infraprojects Ltd (SME IPO) gave ~90% gain on listing.

Pro Tip: Don’t put all in one IPO. Instead, spread across IPO-focused funds or multiple IPO applications.

Expert Quote:

“IPO investing is like retail venture capital. Diversification is the key to finding the next big winner.” – Nilesh Shah, MD, Kotak AMC

Step 5: Alternatives – Adding an Edge

For the extra edge, alternatives help:

- Global Tech ETFs (Nasdaq/AI-focused): Capture US market growth.

- REITs & InvITs: Steady income + capital appreciation.

- Crypto (Bitcoin, Ethereum): High-risk, small exposure only (<5%).

Keep alternatives under 10% of portfolio to control volatility.

Step 6: Discipline & Risk Management

No blueprint succeeds without risk management:

- Hold for 7 years. Don’t panic-sell during dips.

- Rebalance yearly. Book profits and reallocate.

- Emergency Fund: Keep 6 months’ expenses separate.

- Avoid over-leverage. Never borrow heavily for high-risk bets.

Real-Life Case Study

In 2014, Ravi Mehta, an IT professional, invested ₹5 lakh split across small-cap funds and direct equity.

- SIPs in SBI Small Cap Fund grew 4.5X.

- Direct stocks like Deepak Nitrite & Bajaj Finance turned into multibaggers.

- By 2021, his portfolio was worth ₹55 lakh+ (1,000%+ growth).

Key Lesson: Diversification + Patience + Sector bets = Extraordinary wealth.

FAQs: Invest ₹5 Lakh and Get 900% Returns

Q1: Is 900% return in 7 years realistic?

Yes, but only with high-growth, high-risk assets like small-cap funds, IPOs, and direct equity.

Q2: What CAGR do I need to achieve 900%?

Approximately 37% CAGR annually.

Q3: Are IPOs a safe bet in 2025?

IPO markets are strong, but not all IPOs succeed. Diversification is critical.

Q4: Should I include crypto?

Only if you can handle extreme volatility. Keep exposure below 5–10%.

Q5: Is SIP better than lump-sum?

A mix works best: SIP for discipline + lump-sum in corrections.

Conclusion: Your 7-Year Wealth Blueprint

Investing ₹5 lakh today with a disciplined, high-growth strategy can realistically target 900% returns in 7 years. It requires:

- Allocation across small-cap funds, direct equity, and IPOs

- Identifying growth sectors early

- Managing risks with discipline

- Rebalancing profits smartly

The next 7 years could transform your financial life—if you start now.

Call to Action: Don’t just dream of turning ₹5 lakh into ₹50 lakh. Start today with smart diversification. Explore small-cap funds, research upcoming IPOs, and build a portfolio designed for exponential growth.

2 Comments