1. Why Investing Rs. 2.5 Lakh Per Month Matters

Investing Rs. 2.5 lakh every month is a bold move that signals financial ambition. Over 10 years, that’s Rs. 3 crore of principal alone—and with smart investing, it could grow far beyond that. The key? Maximizing returns while managing risk. A 10-year horizon gives you enough time to ride out market volatility and harness the magic of compounding, turning your consistent investments into a substantial fortune.

As Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” Your patience and strategy will determine whether you’re on the winning side of that equation. This blog is your guide to making that happen.

Table of Contents

2. Understanding Your Investment Goals

Before you invest a single rupee, ask yourself: What am I investing for? Your goals shape everything—how much risk you can take, where you put your money, and how you measure success. Here are some possibilities:

- Retirement: Building a nest egg to live comfortably after work.

- Wealth Creation: Growing your money for financial freedom or legacy.

- Big Dreams: Funding a child’s education, a luxury home, or travel.

Since you’re aiming for maximum returns over 10 years, we’ll assume a moderate-to-high risk tolerance. A decade is long enough to recover from market dips but short enough to avoid ultra-conservative options like fixed deposits. Let’s build a plan that aligns with your ambition.

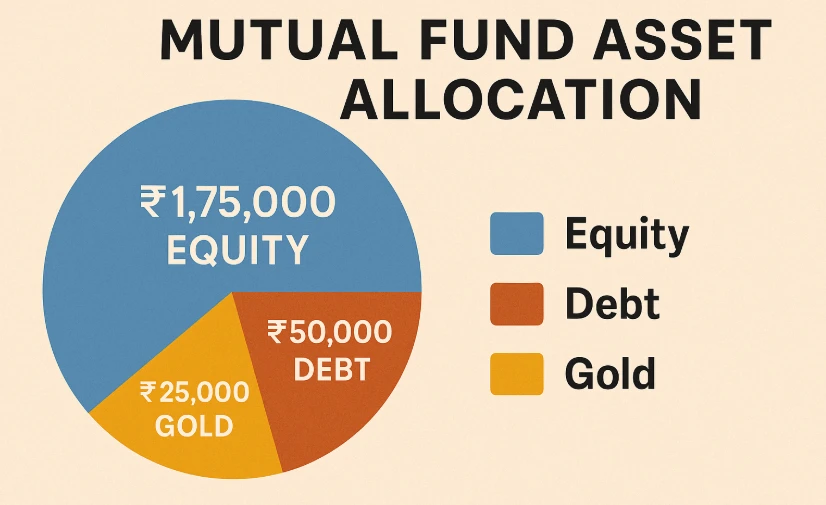

3. Choosing the Right Asset Allocation

Asset allocation is the backbone of your investment strategy. It’s how you divide your Rs. 2.5 lakh each month across different types of investments—equity (stocks), debt (bonds), and alternatives (gold, global funds). For a 10-year horizon aiming for maximum returns, here’s a suggested mix:

- Equity: 70% – High growth potential with calculated risk.

- Debt: 20% – Stability to cushion against volatility.

- Alternatives: 10% – Diversification to hedge against inflation or market slumps.

Why This Mix?

- Equity: Stocks and equity mutual funds historically deliver 12-15% annual returns in India over the long term. With 70% here, you’re prioritizing growth.

- Debt: Bonds or debt funds offer 6-8% returns with lower risk, stabilizing your portfolio.

- Alternatives: Gold and international funds add a safety net and global exposure.

Pro Tip: If you’re more aggressive, bump equity to 80%. If you’re cautious, shift more to debt. Tailor it to your comfort level!

4. Top Investment Options for Maximum Returns

Now, let’s get specific. Here are the best vehicles to park your Rs. 2.5 lakh monthly, based on the allocation above:

Equity (70% – Rs. 1,75,000)

- Large-Cap Mutual Funds (40% – Rs. 1,00,000): Invest in stable, blue-chip companies via funds tracking the Nifty 50 or Sensex. Think reliability with steady growth.

- Mid-Cap Mutual Funds (20% – Rs. 50,000): Target growing companies with higher return potential and moderate risk.

- Small-Cap Mutual Funds (10% – Rs. 25,000): Bet on emerging businesses for explosive growth (and higher risk).

Debt (20% – Rs. 50,000)

- Short-Term Debt Funds (10% – Rs. 25,000): Low-risk funds for liquidity and 6-7% returns.

- Long-Term Debt Funds (10% – Rs. 25,000): Higher yields (7-8%) for a slightly longer lock-in.

Alternatives (10% – Rs. 25,000)

- Gold ETFs (5% – Rs. 12,500): A hedge against inflation and rupee depreciation.

- International Equity Funds (5% – Rs. 12,500): Exposure to global giants like Apple or Tesla via funds investing in the US or other markets.

Why Mutual Funds Over Direct Stocks?

- Diversification: Spread risk across dozens or hundreds of companies.

- Professional Management: Experts pick the winners for you.

- Ease: Perfect for busy investors who don’t want to track markets daily.

5. Step-by-Step Plan to Invest Rs. 2.5 Lakh Monthly

Ready to start? Here’s how to put your plan into action:

- Assess Your Finances First:

- Ensure you have an emergency fund (6-12 months of expenses).

- Clear high-interest debt (like credit cards) before investing heavily.

- Open Investment Accounts:

- Use platforms like Zerodha, Groww, or directly with mutual fund houses.

- Opt for direct plans to save on fees (vs. regular plans with advisors).

- Set Up Systematic Investment Plans (SIPs):

- Automate your Rs. 2.5 lakh monthly investment with this breakdown:

- Large-Cap Fund: Rs. 1,00,000

- Mid-Cap Fund: Rs. 50,000

- Small-Cap Fund: Rs. 25,000

- Short-Term Debt Fund: Rs. 25,000

- Long-Term Debt Fund: Rs. 25,000

- Gold ETF: Rs. 12,500

- International Fund: Rs. 12,500

- Stay Consistent:

- Invest every month, rain or shine. SIPs thrive on discipline.

- Review Annually:

- Check fund performance and rebalance (more on this later).

Quick Tip: Many funds have minimum SIP amounts (e.g., Rs. 5,000). Adjust your allocation slightly if needed.

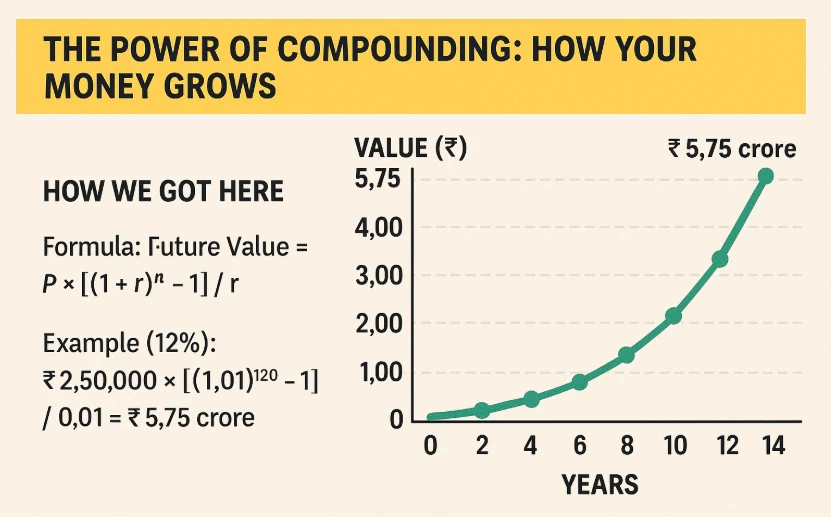

6. The Power of Compounding: How Your Money Grows

Here’s where the magic happens. Compounding turns your monthly Rs. 2.5 lakh into a fortune by earning returns on your returns. Let’s see what your corpus could look like after 10 years:

| Annual Return | Future Value (Rs.) | Notes |

|---|---|---|

| 8% | 4,56,00,000 | Conservative (debt-heavy) |

| 10% | 5,12,00,000 | Balanced portfolio |

| 12% | 5,75,00,000 | Realistic with 70% equity |

| 15% | 6,98,00,000 | Optimistic (equity-focused) |

How We Got Here

- Formula: Future Value = P × [{(1 + r)^n – 1} / r], where:

- P = Rs. 2,50,000 (monthly investment)

- r = monthly rate (e.g., 12% annual ÷ 12 = 1% monthly)

- n = 120 months (10 years)

- Example (12%): Rs. 2,50,000 × [(1.01^120 – 1) / 0.01] ≈ Rs. 5.75 crore.

Reality Check

- 12% is Achievable: Indian equity markets have averaged 12-15% over decades.

- Risk Factor: Higher returns (15%) require more equity and stomach for volatility.

Imagine sipping coffee at 40, knowing your Rs. 5.75 crore corpus could generate Rs. 1.5-2 lakh monthly in passive income. That’s the power of starting now!

7. Tax Considerations to Keep More of Your Returns

Taxes can nibble away at your gains, so let’s optimize:

- Equity Funds:

- Long-Term Capital Gains (LTCG): Gains above Rs. 1 lakh taxed at 10% if held >1 year.

- Short-Term Gains: 15% if sold within a year (avoid this!).

- Debt Funds:

- LTCG: 20% with indexation if held >3 years (reduces tax significantly).

- Short-Term: Taxed as per your income slab if sold earlier.

- Gold ETFs: Same as debt funds—20% with indexation after 3 years.

- Tax-Saving Bonus: Invest Rs. 1.5 lakh/year in Equity-Linked Savings Schemes (ELSS) under Section 80C.

Smart Move: Choose growth options over dividend plans to defer taxes until you sell.

8. Monitoring and Rebalancing Your Portfolio

Your portfolio isn’t static—it evolves with the market. Here’s how to keep it on track:

- Monitor Annually: Check fund performance against benchmarks (e.g., Nifty 50 for large-caps).

- Rebalance: If equity jumps to 80% due to a bull run, sell some and buy debt to restore 70-20-10.

- Why? Maintains your risk level and locks in gains.

- Switch Smartly: Replace consistent underperformers, but avoid frequent churn (it triggers taxes and fees).

Example: If small-caps soar and skew your allocation, trim them and boost debt. It’s like pruning a tree for healthy growth.

9. Overcoming Challenges: Staying the Course

Investing isn’t always smooth sailing. Markets crash, doubts creep in, and headlines scream panic. Here’s how to stay strong:

- Rupee Cost Averaging: SIPs buy more units when prices drop—your silver lining in downturns.

- Patience Pays: Peter Lynch said, “The key to making money in stocks is not to get scared out of them.” A 10-year horizon smooths out bumps.

- Avoid Timing: You’re not a fortune teller. Stay invested, not sidelined.

Story Time: During the 2020 crash, many sold in fear. Those who held—or kept investing—saw the Nifty rebound from 7,500 to 18,000+ in two years. Patience wins.

10. Conclusion: Start Your Wealth Journey Today

Investing Rs. 2.5 lakh per month for 10 years isn’t just about money—it’s about freedom, security, and the life you want to live. With a diversified portfolio, disciplined SIPs, and a long-term mindset, you could turn Rs. 3 crore of principal into Rs. 5-7 crore. That’s not a fantasy; it’s math and commitment.

11. Frequently Asked Questions (FAQ)

Q1: Should I invest Rs. 2.5 lakh as a lump sum or via SIP?

A: SIPs are better for monthly investments. They spread risk and benefit from market dips over time.

Q2: How do I pick the best mutual funds?

A: Look for a strong 5-10 year track record, low expense ratios (below 1%), and trusted fund houses.

Q3: Direct or regular plans—what’s better?

A: Direct plans save on fees (0.5-1% less). Go regular only if you need an advisor’s hand-holding.

Q4: What if the market crashes after I start?

A: Don’t panic. SIPs turn crashes into opportunities by buying low. Markets recover—history proves it.

Q5: Can I stop or withdraw my SIPs early?

A: Yes, but avoid it. Early exits might mean exit loads (1-2%) or taxes. Stick to 10 years for max gains.

Q6: Is 12% return realistic?

A: Yes, Indian equity funds have averaged 12-15% over decades, but it’s not guaranteed. Diversify to balance risk.

Bonus: Key Takeaways in Bullet Points

- Set Goals: Define why you’re investing—retirement, wealth, or dreams.

- Allocate Wisely: 70% equity, 20% debt, 10% alternatives for growth and safety.

- Use SIPs: Automate Rs. 2.5 lakh monthly across mutual funds and ETFs.

- Rebalance Yearly: Keep your risk in check and lock in profits.

- Stay Patient: 10 years is your superpower—let compounding work.

Ready to Build Your Rs. 5 Crore+ Corpus?

This isn’t just a blog—it’s your blueprint to financial success. Investing Rs. 2.5 lakh per month for maximum returns in 10 years is within your reach with the right strategy. Open your investment account today, start your SIPs, and watch your wealth grow. Have questions? Drop them in the comments—I’d love to help you on this journey!

Happy Investing!

1 Comment