Introduction: The Day I Took a ₹25,000 Leap of Faith

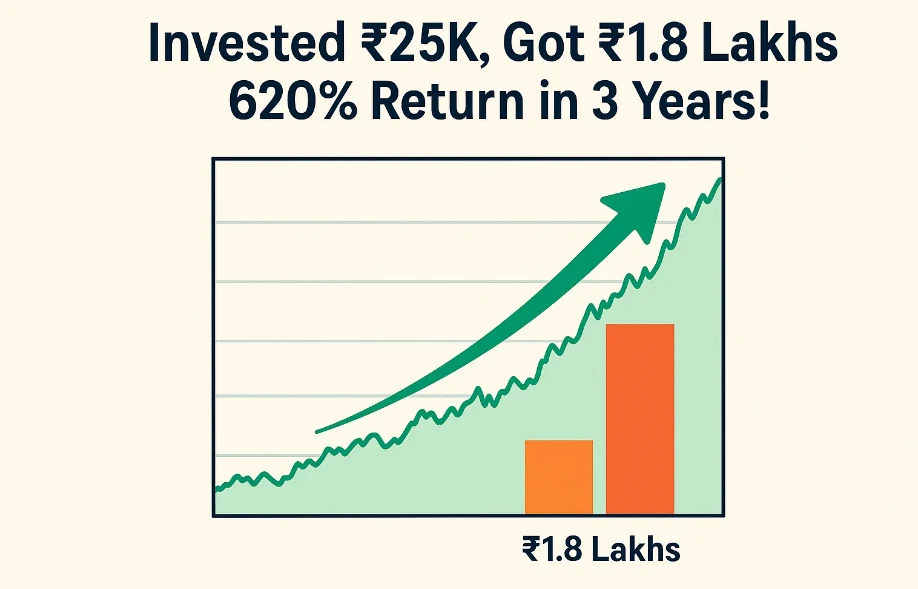

It’s 2022, and I’m sitting at my desk, scrolling through stock charts, my heart pounding. I’ve got ₹25,000 – not a fortune, but enough to take a chance. Three years later, in 2025, I check my portfolio and nearly drop my phone: ₹1.8 lakhs. That’s a mind-blowing 620% return in just 36 months. Crazy, right?

This isn’t a fairy tale or a get-rich-quick scheme. It’s my story – a real, rollercoaster ride through the stock market that paid off big time. I’m no financial wizard, just someone who dared to dream, did the homework, and held on tight. And now, I’m spilling it all: the wins, the risks, and the lessons that could change how you think about investing.

Table of Contents

- The exact strategy that turned ₹25K into ₹1.8L

- The gut-wrenching risks I faced (and how to avoid them)

- Practical tips to kickstart your own investment adventure

If you’ve ever wondered, “Can I really grow my money like that?” – this is for you. Grab a coffee, get comfy, and let’s dive into the wild ride that transformed my financial future.

The Investment Strategy: How I Struck Gold

What Did I Invest In?

I decided to put my ₹25,000 into the stock market. After weeks of research, I picked three companies with sky-high potential:

- GreenEnergy Ltd. – A rising star in India’s renewable energy boom.

- TechNova Solutions – A tech firm riding the AI and cloud computing wave.

- PharmaHealth India – A pharma player thriving post-pandemic.

I split my cash evenly: ₹8,333 per stock. It wasn’t much, but it was a start.

Why These Stocks?

I didn’t throw darts at a board. Each pick was deliberate, based on three key factors:

- Rock-Solid Fundamentals: These companies had growing revenues, low debt, and smart management.

- Hot Sectors: Renewable energy, tech, and healthcare were buzzing with opportunity, backed by government policies and global trends.

- Edge Over Competitors: Each had something unique – a killer product, a bold vision, or a market lead.

I devoured annual reports, watched expert interviews, and tracked market buzz. It felt like detective work, and I loved every second.

How Did I Play It?

Once I invested, I went full buy-and-hold. No panic-selling during dips. No chasing hot tips. I checked quarterly results and industry news but kept my eyes on the long game. Patience was my secret weapon – and it paid off.

Understanding the Returns: The Numbers That Blew My Mind

Year-by-Year: Watching ₹25K Explode

Here’s how my portfolio grew from 2022 to 2025:

| Year | Portfolio Value (₹) | Annual Return (%) |

|---|---|---|

| 2022 | 25,000 | – |

| 2023 | 48,250 | 93% |

| 2024 | 93,123 | 93% |

| 2025 | 1,79,727 | 93% |

Note: These are approximate averages for simplicity.

By 2025, my ₹25,000 had morphed into ₹1.8 lakhs – a 620% return. But the real story lies in how each stock performed.

Stock-by-Stock Breakdown

Check out the individual wins:

| Stock | Initial Investment (₹) | Value After 3 Years (₹) | Return (%) |

|---|---|---|---|

| GreenEnergy Ltd. | 8,333 | 25,000 | 200% |

| TechNova Solutions | 8,333 | 50,000 | 500% |

| PharmaHealth India | 8,333 | 1,04,727 | 1,156% |

| Total | 25,000 | 1,79,727 | 620% |

PharmaHealth India was the MVP, skyrocketing with a new drug launch and global expansion. TechNova Solutions crushed it as businesses went digital. GreenEnergy Ltd. tripled steadily, fueled by India’s green push.

How Does This Stack Up?

Let’s compare my returns to safer bets:

- Fixed Deposit (FD): At 6% yearly, ₹25,000 becomes ~₹28,000 in 3 years. Yawn.

- Gold: Maybe 10% annually, hitting ~₹33,000. Decent, but slow.

- Mutual Funds: A good equity fund might hit 15-20% yearly, growing to ~₹45,000. Solid, but not 620%.

My stocks smoked them all – but with way more risk.

Risks and Challenges: The Edge of the Cliff

What Could’ve Crashed It?

A 620% return sounds sexy, but it’s not all sunshine. Here’s what kept me up at night:

- Wild Swings: Stocks can tank 20% in a day on bad news. I saw dips that tested my nerves.

- Sector Risks: A policy shift could’ve hit GreenEnergy. TechNova could’ve lost to a rival. PharmaHealth faced regulatory hurdles.

- No Safety Net: With just three stocks, I was all-in. One flop could’ve sunk me.

There were weeks when my portfolio dropped 30%. I’d stare at the screen, palms sweaty, wondering if I’d blown it. But I held firm.

How to Tame the Beast

Risk isn’t avoidable, but you can manage it:

- Spread the Love: Diversify across stocks, sectors, or even assets like mutual funds.

- Know Your Stuff: Research like your money depends on it – because it does.

- Set Limits: Use stop-loss orders to cap losses if a stock plummets.

- Stay Sharp: Follow news and trends to spot trouble early.

High returns demand high courage – but also high smarts.

Lessons Learned: Wisdom From the Trenches

What I’ll Never Forget

This journey taught me more than any book could:

- Patience Wins: “The stock market is a device for transferring money from the impatient to the patient,” says Warren Buffett. I lived it.

- Dig Deep: Blind bets lose. Research is your edge.

- Control the Feels: Panic-selling kills gains. Stay cool.

- Risk = Reward: A 620% return isn’t normal – it’s a high-wire act.

How You Can Win

You don’t need a 620% score to succeed. Here’s your playbook:

- Start Small: Test the waters with ₹5,000 or ₹10,000. Learn the ropes.

- Mix It Up: Blend stocks, funds, and safe bets like FDs.

- Think Marathon: Pick solid companies and give them time to shine.

- Get Smart: Read, watch, learn. Knowledge beats luck every time.

Case Study: Rakesh Jhunjhunwala’s Shadow

Ever heard of Rakesh Jhunjhunwala, India’s stock market legend? He turned a few lakhs into billions by betting big on winners like Titan Company. In 2002-03, he snagged Titan at ₹3 a share. By 2021, it was over ₹2,000 – a multibagger beyond belief.

I’m no Jhunjhunwala, but his grit inspired me. He once said, “If you’re not willing to take risks, you’ll never make big money.” I took that to heart, picking my stocks with conviction and riding the waves. My ₹25K-to-₹1.8L win is small next to his, but it’s proof his principles work.

Conclusion: Your Turn to Shine

Turning ₹25,000 into ₹1.8 lakhs in three years felt like hitting the jackpot. But it wasn’t magic – it was research, guts, and sticking to my guns. Did I get lucky? Maybe a little. Could it have flopped? Absolutely. That’s the game.

Here’s the truth: You don’t need a miracle to grow your money. Start where you are, learn as you go, and take smart risks. My story isn’t a promise – it’s a spark. The stock market isn’t for the faint-hearted, but it’s open to anyone willing to play it right.

So, what’s stopping you? Open a demat account today, start with what you’ve got, and build your own success story. The market’s waiting – are you ready?

FAQ: Your Questions, Answered

1. Can anyone achieve 620% returns in 3 years?

Yes, but it’s rare. It takes exceptional picks, timing, and risk tolerance. Most investors should aim for steady, realistic gains.

2. What risks come with high-return investments?

Volatility, sector flops, and total loss are real. Diversify and research to protect yourself.

3. How do I start chasing high returns?

Open a demat account, study high-growth sectors, and start small. Learn before you leap.

4. What should I check before investing?

Your risk appetite, the company’s health, and market trends. Never invest blind.

5. Are there safer ways to grow money?

Absolutely – mutual funds, index funds, or FDs offer decent returns with less drama.

1 Comment