Adapting to new hiring practices in the technology-dominated, post-COVID world

Table of Contents

- Predicted trends for 2023: rising number of applicants, emphasis on technology skills, and partnerships with educational institutions

2. Investment Banking Recruitment in 2023: Trends, Challenges, and Opportunities

Expanded talent pool due to remote and hybrid work arrangements

- Leveraging data analytics for recruitment and identifying skills gaps

- Emphasis on diversity and inclusion in recruitment

- Increased focus on technology skills, including data analysis, programming, and financial modeling

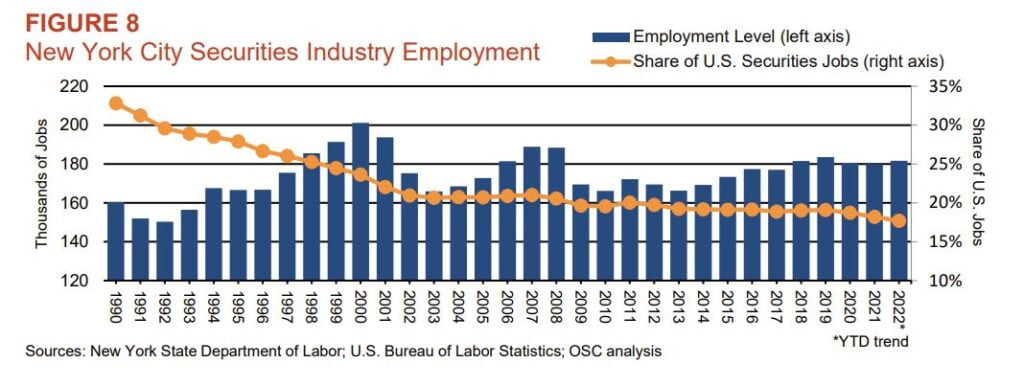

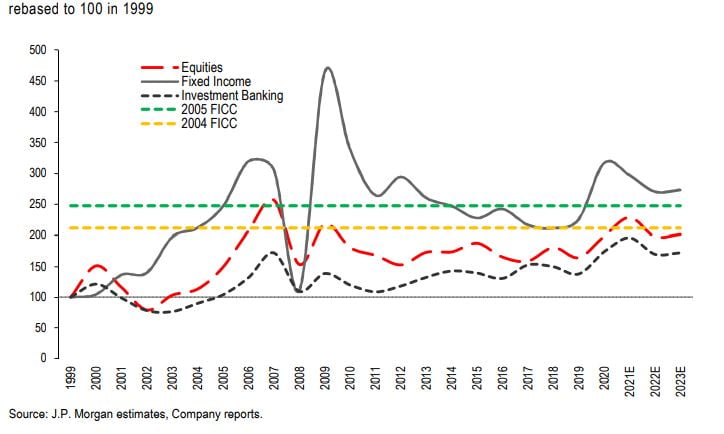

3. The Truth About the Investment Banking Jobs Outlook Now

Data-driven insights on the current state of investment banking jobs

- Exploring the factors that are shaping the industry

4. Top Trends in Investment Banking for 2023

Generative AI, increased regulatory scrutiny, open banking, and fintech competition

- Attrition and talent shortage in the industry

- Employee expectations and the cultural shift in the workplace

5. The Future of Investment Banking: Bank of 2030

Transition to a more specialized service model

- Adapting to changing consumer expectations, emerging technologies, and new business models

- Strategies for driving bold transformation in the industry

6. Preparing for Tomorrow’s Investment Banking Jobs

The importance of technology and data skills

- How to stand out in the competitive job market

- The future of investment banking and the skills you need to succeed

7. Building a Career in Investment Banking: Essential Skills and Techniques

A comprehensive guide to landing a job in investment banking

- The essential skills and techniques needed for success in the industry

- Navigating the job search and application process

8. Investment Banking Salaries: How to Negotiate Your Salary and Compensation Package

A guide to understanding and maximizing your earning potential

- The average salary and compensation for investment bankers

- Tips for negotiating your salary and benefits

9. Investment Banking Resume Tips and Tricks: How to Stand Out in the Competitive Job Market

A comprehensive guide to creating a winning investment banking resume

- The key skills, experiences, and achievements to highlight

- Formatting and presentation tips for a professional and impactful resume

10. The Role of Investment Banking in Economic Growth

How investment banks contribute to economic growth and development

- The various roles and responsibilities of investment banks in the economy

- The impact of investment banking on job creation and business expansion

Investment banking candidates should possess a combination of tangible and intangible skills to succeed in the industry. Some of the most important qualities for investment banking candidates to have include:

what are the most important qualities for investment banking candidates to have

what are the most important qualities for investment banking candidates to have

- Intellectual Abilities: Candidates should demonstrate the ability to deal with unfamiliar situations and maintain healthy client relationships[1].

- Management and Leadership Potential: Investment banking roles often require candidates to have strong leadership skills and the ability to manage teams[1].

- Entrepreneurial Skills: Candidates should be able to identify business opportunities in new and unusual areas, which may involve funding a team of enthusiasts to help build a business from scratch or spotting growth potential in an existing business[1].

- Networking Skills: Strong interpersonal skills are essential for attracting and retaining clients, and candidates should be adept at dealing with different personalities in stressful situations[3].

- Analytical Skills: Investment bankers are often required to analyze complex financial data and make informed decisions based on their findings[1].

- Resilience: Investment banking is a high-pressure job, with long hours and demanding conditions, so candidates should be resilient and adaptable[3].

- Communication and Interpersonal Skills: Candidates should have excellent communication skills and be able to connect with people from various backgrounds[2].

- Teamwork and Collaboration Skills: The ability to work well with others and contribute to a team’s success is crucial in investment banking[4].

- Project and Time Management Ability: Candidates should be able to manage multiple projects and meet deadlines effectively[4].

- Technology Skills: Proficiency in data analysis, programming, and financial modeling is highly valued in the industry[5].

By possessing these qualities, candidates can increase their chances of success in the competitive investment banking job market.

Here are some frequently asked questions (FAQs) related to investment banking jobs:

1. How to Prepare for Investment Banking Fit Questions?

- You can efficiently prepare for common fit questions in investment banking by focusing on developing a few short stories, strengths, and weaknesses. This approach can help you answer almost any qualitative question without having to memorize a large number of questions and answers[1].

2. What are Common Questions Asked During Investment Banking Graduate Scheme Interviews?

- Common questions asked during investment banking graduate scheme interviews include:

- Why did you choose to pursue a career in investment banking?

- What makes you stand out among other candidates for this graduate scheme?

- Describe a recent financial news story that caught your attention and its potential implications[2].

3. What Questions to Ask Investment Bankers?

- When interacting with investment bankers, it’s important to focus on areas that can help you secure a job offer. You might want to ask about the kind of experiences and skills that are valued in the industry[3].

4. How to Ace Interview Questions for a Job in Investment Banking?

- To excel in an investment banking interview, it’s essential to prepare for both technical and behavioral questions. Additionally, being able to answer guesstimate questions and articulating your motivation for working in investment banking are crucial for standing out in the interview process[5].

These FAQs cover a range of common inquiries related to preparing for investment banking interviews, including fit questions, graduate scheme interviews, and interacting with investment bankers.