You’ve saved up a substantial amount of money—a lumpsum—and you’re ready to invest it wisely. Your goals are ambitious: you want that investment to grow to ₹3 crore, and eventually, ₹5 crore. With a promising compound annual growth rate (CAGR) of 18%, how long will it take to turn your dreams into reality? explore different scenarios, and equip you with the knowledge to make informed investment decisions. Whether you’re planning for retirement, your child’s education, or simply building wealth, this guide is for you.

Table of Contents

What is a Lumpsum Investment?

A lumpsum investment is when you invest a significant amount of money all at once, rather than spreading it out over time through smaller, periodic contributions (like a Systematic Investment Plan, or SIP). Think of it as planting a big seed and letting it grow, harnessing the power of time and compounding to multiply your wealth. For example, if you’ve received a bonus, sold a property, or saved up a hefty sum, a lumpsum investment could be your ticket to substantial financial growth.

The beauty of this approach? Your entire capital starts working for you immediately, compounding year after year. But how quickly it grows depends on one critical factor: the rate of return, or in this case, the CAGR.

Understanding CAGR: The Engine of Growth

So, what exactly is CAGR? The Compound Annual Growth Rate is the annual rate at which your investment grows, assuming that all profits are reinvested each year. It’s like a steady engine driving your money forward, smoothing out the ups and downs of returns into a single, consistent growth rate.

For instance, if you invest ₹1 lakh and it grows to ₹1.18 lakh in one year, that’s an 18% increase—your CAGR if that growth persists annually. Unlike simple interest, where you earn a fixed amount each year, compounding allows your earnings to generate more earnings, creating an exponential growth curve. At 18% CAGR, we’re talking about a robust, aggressive return that can significantly accelerate your journey to ₹3 crore and ₹5 crore.

But how do we calculate the time it takes to hit those milestones? Let’s get to the math!

The Formula: Cracking the Time Code

To determine how long your lumpsum investment takes to grow to a specific amount, we use the compound interest formula:

[ A = P \left(1 + \frac{r}{100}\right)^t ]

Where:

- A = The target amount (₹3,00,00,000 or ₹5,00,00,000)

- P = The principal, or initial investment

- r = The annual growth rate (18% in this case)

- t = The time in years (what we’re solving for)

Since we need to find t, we rearrange the formula:

[ t = \frac{\log\left(\frac{A}{P}\right)}{\log\left(1 + \frac{r}{100}\right)} ]

This equation tells us how many years it takes for your initial investment (P) to grow to your target amount (A) at an 18% CAGR. But here’s the catch: the query doesn’t specify the initial lumpsum amount. So, to make this practical and insightful, we’ll explore three realistic scenarios—starting with ₹10 lakhs, ₹50 lakhs, and ₹1 crore—and see how long each takes to reach ₹3 crore and ₹5 crore.

Calculating the Time: Real-World Scenarios

Since your starting point influences the journey, let’s calculate the time required for different initial investments at 18% CAGR. We’ll break it down step-by-step, so you can see exactly how your money grows.

Scenario 1: Starting with ₹10 Lakhs

Suppose you invest ₹10,00,000. How long until it becomes ₹3 crore?

- P = ₹10,00,000

- A = ₹3,00,00,000

- r = 18%

Plugging into the formula:

[ t = \frac{\log\left(\frac{3,00,00,000}{10,00,000}\right)}{\log\left(1 + \frac{18}{100}\right)} = \frac{\log(300)}{\log(1.18)} ]

- (\log(300) \approx 2.4771)

- (\log(1.18) \approx 0.0723)

[ t \approx \frac{2.4771}{0.0723} \approx 34.25 \text{ years} ]

Now, for ₹5 crore:

- A = ₹5,00,00,000

[ t = \frac{\log\left(\frac{5,00,00,000}{10,00,000}\right)}{\log(1.18)} = \frac{\log(500)}{\log(1.18)} ]

- (\log(500) \approx 2.6990)

- (\log(1.18) \approx 0.0723)

[ t \approx \frac{2.6990}{0.0723} \approx 37.33 \text{ years} ]

Result: From ₹10 lakhs, it takes 34.25 years to reach ₹3 crore and 37.33 years to reach ₹5 crore.

Scenario 2: Starting with ₹50 Lakhs

Now, let’s up the ante to ₹50,00,000.

For ₹3 crore:

- P = ₹50,00,000

- A = ₹3,00,00,000

[ t = \frac{\log\left(\frac{3,00,00,000}{50,00,000}\right)}{\log(1.18)} = \frac{\log(6)}{\log(1.18)} ]

- (\log(6) \approx 0.7782)

- (\log(1.18) \approx 0.0723)

[ t \approx \frac{0.7782}{0.0723} \approx 10.76 \text{ years} ]

For ₹5 crore:

- A = ₹5,00,00,000

[ t = \frac{\log\left(\frac{5,00,00,000}{50,00,000}\right)}{\log(1.18)} = \frac{\log(10)}{\log(1.18)} ]

- (\log(10) = 1)

- (\log(1.18) \approx 0.0723)

[ t \approx \frac{1}{0.0723} \approx 13.83 \text{ years} ]

Result: From ₹50 lakhs, it’s 10.76 years to ₹3 crore and 13.83 years to ₹5 crore.

Scenario 3: Starting with ₹1 Crore

Finally, if you start with ₹1,00,00,000:

For ₹3 crore:

- P = ₹1,00,00,000

- A = ₹3,00,00,000

[ t = \frac{\log\left(\frac{3,00,00,000}{1,00,00,000}\right)}{\log(1.18)} = \frac{\log(3)}{\log(1.18)} ]

- (\log(3) \approx 0.4771)

- (\log(1.18) \approx 0.0723)

[ t \approx \frac{0.4771}{0.0723} \approx 6.60 \text{ years} ]

For ₹5 crore:

- A = ₹5,00,00,000

[ t = \frac{\log\left(\frac{5,00,00,000}{1,00,00,000}\right)}{\log(1.18)} = \frac{\log(5)}{\log(1.18)} ]

- (\log(5) \approx 0.6990)

- (\log(1.18) \approx 0.0723)

[ t \approx \frac{0.6990}{0.0723} \approx 9.67 \text{ years} ]

Result: From ₹1 crore, it takes 6.60 years to reach ₹3 crore and 9.67 years to reach ₹5 crore.

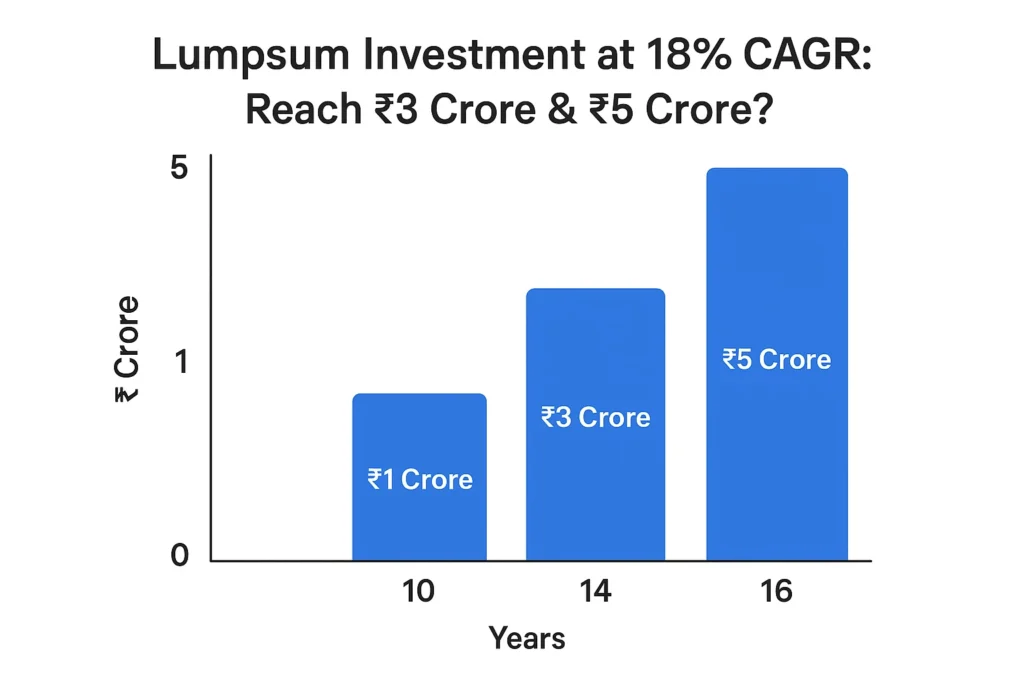

Visualizing the Journey: A Handy Table

Here’s a clear summary of how long it takes to reach your goals based on your starting investment:

| Initial Investment (₹) | Time to ₹3 Crore (Years) | Time to ₹5 Crore (Years) |

|---|---|---|

| 10,00,000 | 34.25 | 37.33 |

| 50,00,000 | 10.76 | 13.83 |

| 1,00,00,000 | 6.60 | 9.67 |

This table reveals a powerful truth: the more you invest upfront, the faster you reach your targets. Starting with ₹1 crore cuts the time dramatically compared to ₹10 lakhs, thanks to the magic of compounding.

The Power of Compounding: Why It Matters

Compounding is often called the eighth wonder of the world, and for good reason. As your investment grows, the returns you earn start generating their own returns, creating a snowball effect. Here’s a famous quote to drive it home:

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

— Albert Einstein (attributed)

Let’s see this in action with ₹50 lakhs:

- Year 5: ₹50,00,000 × (1.18)⁵ ≈ ₹1,14,35,000

- Year 10: ₹50,00,000 × (1.18)¹⁰ ≈ ₹2,61,70,000

- Year 10.76: ≈ ₹3,00,00,000

- Year 13.83: ≈ ₹5,00,00,000

Notice how the growth accelerates in later years? Between years 10 and 13.83, the investment nearly doubles from ₹2.61 crore to ₹5 crore, showcasing compounding’s exponential power.

Case Study: Mr. Sharma’s Investment Journey

Meet Mr. Sharma, a 40-year-old professional with ₹50 lakhs to invest at 18% CAGR. His goals? ₹3 crore for his children’s education in about 10 years and ₹5 crore for retirement in 14 years.

From our calculations:

- ₹3 crore in 10.76 years: Perfectly aligns with his education goal.

- ₹5 crore in 13.83 years: He’ll hit his retirement target just under 14 years.

At age 50, he’ll have ₹3 crore, and by 54, he’ll be sitting on ₹5 crore—assuming the 18% CAGR holds steady. Mr. Sharma’s story shows how a lumpsum investment, paired with a high growth rate, can turn financial dreams into reality.

Is 18% CAGR Realistic? Risks and Rewards

An 18% CAGR is ambitious. Historically, India’s stock market (e.g., Sensex) has delivered around 12-15% CAGR over decades, but certain investments—like small-cap mutual funds, high-growth stocks, or sectoral funds—can exceed this. Here’s the catch: higher returns come with higher risks.

“The stock market is a device for transferring money from the impatient to the patient.”

— Warren Buffett

To aim for 18%, you might consider:

- Equity Mutual Funds: Small-cap or mid-cap funds often target high growth.

- Stocks: Research-driven picks in booming sectors like tech or healthcare.

- Diversification: Spread risk across assets to balance volatility.

But beware—market fluctuations, economic downturns, or poor investment choices could derail your plans. Always consult a financial advisor to tailor your strategy.

How Initial Investment Size Changes the Game

The table earlier showed that a larger lumpsum slashes the time to your goals. Why? Because compounding works harder when there’s more capital to multiply. For instance:

- ₹10 lakhs to ₹50 lakhs: A 5x increase in principal reduces the time to ₹3 crore from 34.25 years to 10.76 years—less than a third!

- ₹50 lakhs to ₹1 crore: Doubling the investment cuts the time from 10.76 years to 6.60 years.

This underscores a key lesson: invest as much as you can, as early as you can.

Building Your Lumpsum: Practical Tips

Don’t have ₹50 lakhs or ₹1 crore lying around? Here’s how to build that initial investment:

- Save Aggressively: Slash unnecessary expenses—ditch that extra coffee subscription!

- Leverage Windfalls: Use bonuses, tax refunds, or inheritances.

- Invest Regularly: Start with SIPs to grow your capital over time.

- Sell Underperformers: Liquidate low-return assets to fund high-growth opportunities.

What About Taxes and Inflation?

Your net returns matter more than gross returns. In India:

- Long-Term Capital Gains (LTCG): Equity investments held over a year are taxed at 10% on gains above ₹1 lakh.

- Short-Term Gains: Taxed at 15% for equities sold within a year.

Inflation also erodes purchasing power. If it’s 6% annually, ₹5 crore in 14 years won’t buy as much as it does today. Plan for real returns (CAGR minus inflation) to set realistic goals.

Key Takeaways: Your Investment Cheat Sheet

Here’s what to remember:

- Compounding Rocks: It’s your wealth-building superpower.

- Start Big, Start Early: Larger sums and longer timelines shrink the wait.

- Risk vs. Reward: 18% CAGR is possible but requires smart, bold choices.

- Stay Patient: Wealth grows slowly at first, then explodes later.

FAQs: Your Questions Answered

1. What does CAGR mean in simple terms?

CAGR is the steady annual growth rate of your investment, factoring in compounding. It’s like your investment’s “average speed” over time.

2. How do I calculate time to reach my financial goals?

Use the formula: ( t = \frac{\log\left(\frac{A}{P}\right)}{\log\left(1 + \frac{r}{100}\right)} ). Plug in your target (A), initial amount (P), and CAGR (r).

3. Is 18% CAGR achievable?

Yes, with high-growth investments like stocks or mutual funds, but it’s risky and not guaranteed. Historically, 12-15% is more common.

4. Should I go for lumpsum or SIP?

Lumpsum shines in rising markets; SIPs smooth out volatility. It depends on your cash flow and risk appetite.

5. What if my returns aren’t constant?

Real-world returns fluctuate. These calculations assume a steady 18%—adjust expectations for market ups and downs.

6. How does tax affect my goals?

Taxes reduce your net returns, extending the time to your target. Factor in LTCG or other taxes when planning.

Conclusion: Your Path to ₹3 Crore and ₹5 Crore

Investing a lumpsum at 18% CAGR can transform your financial future. Whether it’s ₹10 lakhs taking 34 years or ₹1 crore taking under 10 years, the journey to ₹3 crore and ₹5 crore hinges on three things: your starting amount, the growth rate, and time. Start early, pick high-potential investments, manage risks, and let compounding work its magic.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

— Paul Samuelson

Ready to plant your financial seed? The clock’s ticking—start today!

1 Comment