Mastering Forex Trading Basics

Table of Contents

1. Introduction

2. What is Forex Trading?

3. The Importance of Forex Trading

4. Getting Started in Forex Trading

5. Understanding Currency Pairs

6. Forex Market Participants

7. Setting Up a Forex Trading Account

8. How to Read Forex Quotes

9. Analyzing the Forex Market

10. Fundamental Analysis

11. Technical Analysis

12. Risk Management in Forex Trading

13. Strategies for Success

14. Common Forex Trading Mistakes to Avoid

15. Conclusion

Mastering Forex Trading Basics

Forex trading, or foreign exchange trading, is a financial market that’s open 24 hours a day, five days a week. It involves buying and selling currencies from around the world. If you’re new to Forex trading or looking to refine your skills, this article will guide you through the basics of mastering Forex trading.

What is Forex Trading?

Forex trading is the process of exchanging one currency for another, and it’s the largest and most liquid financial market in the world. It’s vital for international trade and investment, making it a crucial component of the global economy. Unlike other financial markets, Forex has no central exchange, and trading takes place electronically over-the-counter (OTC).

The Importance of Forex Trading

Forex trading plays a pivotal role in global finance, enabling businesses, investors, and governments to conduct foreign trade and manage financial risk. It offers opportunities for individuals to participate in the market, diversify their portfolios, and potentially profit from currency movements.

Getting Started in Forex Trading

To get started in Forex trading, you’ll need a computer, a reliable internet connection, and a trading platform. Choose a reputable broker, create an account, and fund it with your desired trading capital.

Understanding Currency Pairs

Forex trading involves trading currency pairs. Each pair consists of two currencies, where one is the base currency, and the other is the quote currency. Understanding these pairs is crucial for success in Forex trading.

Forex Market Participants

The Forex market is composed of various participants, including banks, financial institutions, corporations, governments, and retail traders. Knowing who the major players are can help you make informed decisions.

Setting Up a Forex Trading Account

Setting up a trading account is your first step into the Forex world. Select a broker, provide necessary identification, and choose the account type that suits your needs.

How to Read Forex Quotes

Understanding how to read Forex quotes is essential. You’ll come across currency pairs with two prices – the bid price and the ask price. The difference between these prices is known as the spread.

Analyzing the Forex Market

Two fundamental methods of analysis in Forex trading are fundamental analysis and technical analysis. Each approach helps you predict currency movements and make informed trading decisions.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, news events, and government policies. It helps traders gauge the intrinsic value of a currency and make long-term predictions.

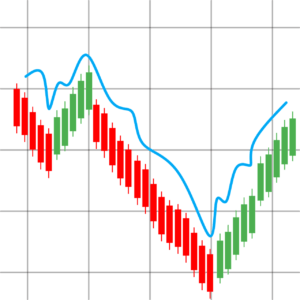

Technical Analysis

Technical analysis involves studying historical price charts and applying various technical indicators. It’s used to forecast short to medium-term price movements.

Risk Management in Forex Trading

Managing risk is paramount in Forex trading. Implementing risk management strategies, such as setting stop-loss orders and managing your position size, can help protect your capital.

Strategies for Success

There are several trading strategies in Forex, including day trading, swing trading, and scalping. Your choice of strategy should align with your risk tolerance and trading style.

Common Forex Trading Mistakes to Avoid

Avoiding common pitfalls, such as overleveraging, ignoring risk management, and not staying updated on market news, is crucial for long-term success in Forex trading.

Conclusion

Mastering the basics of Forex trading is a journey that requires dedication, practice, and continuous learning. It’s a market that offers immense opportunities, but success is not guaranteed. By understanding the fundamentals, applying sound strategies, and managing risk, you can navigate the Forex market effectively and work towards your financial goals.

FAQs

1. Is Forex trading suitable for beginners?

Forex trading can be suitable for beginners, but it’s important to educate yourself, practice with a demo account, and start with a small trading capital.

2. How much money do I need to start Forex trading?

The amount of money needed to start Forex trading varies, but it’s advisable to start with an amount you can afford to lose.

3. What are the most traded currency pairs in Forex?

The most traded currency pairs in Forex include EUR/USD, USD/JPY, and GBP/USD.

4. Can I trade Forex full-time?

While some traders do trade Forex full-time, it’s essential to have a solid strategy, risk management plan, and financial stability before considering it as a full-time profession.

5. Where can I find reliable Forex news and analysis?

You can find reliable Forex news and analysis from financial news websites, Forex brokers, and trading forums. Staying informed is crucial for successful Forex trading.