It’s a lazy Sunday afternoon in 2020, and you’re scrolling through Instagram when you spot a post from an old college buddy. He’s leaning against a shiny new Tesla, smirking like he just won the lottery. The caption? “Cashed in my XYZ stock—1200% gains paid for this beauty!” Your stomach drops. You remember him raving about that stock years ago. You brushed it off as too risky, too speculative. Now, he’s cruising in style, and you’re left wondering, “What if I’d taken the leap?”

If you’ve ever felt that sting of missing out, you’re not alone. The 1200% bull run—a jaw-dropping surge where early investors turned pocket change into life-changing wealth—left many of us kicking ourselves. But here’s the good news: the stock market is like a river. One wave passes, and another rolls in. You don’t have to sit on the sidelines forever.

Table of Contents

In this article, I’m spilling the beans on three stocks that could be your ticket to the next big ride. These aren’t random picks—they’re companies shaking up their industries, poised for explosive growth, and buzzing with potential. Curious? Emotional? Maybe a little skeptical? Good. Stick with me, because by the end, you’ll know why these stocks might just be your second chance at a blockbuster win.

Understanding the 1200% Bull Run

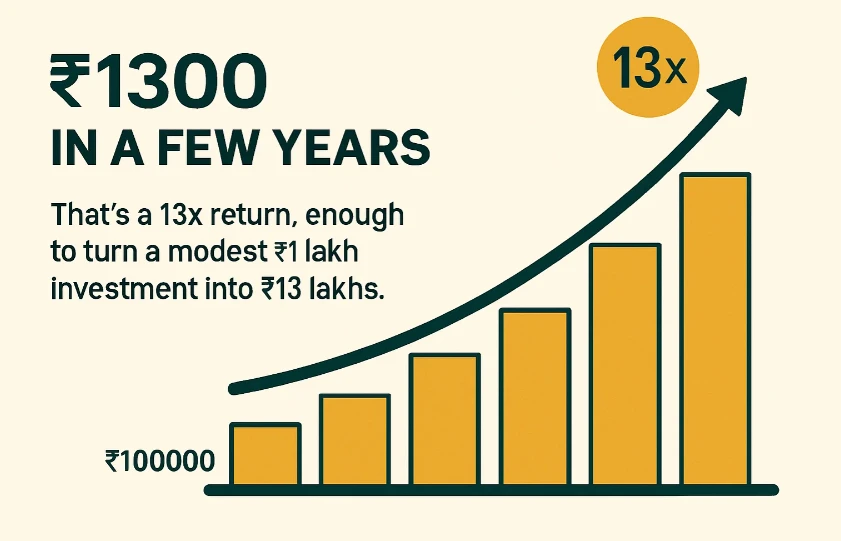

First things first—what’s a bull run, anyway? It’s when stock prices charge upward like a stampede, fueled by optimism, innovation, or economic tailwinds. The “1200% bull run” we’re talking about is a hypothetical (but oh-so-real-feeling) scenario where certain stocks soared—think ₹100 ballooning to ₹1300 in a few years. That’s a 13x return, enough to turn a modest ₹1 lakh investment into ₹13 lakhs.

Maybe it was tech giants leading the charge, or renewable energy stocks riding a green wave. Whatever the spark, those who got in early reaped rewards most of us only dream about. But here’s the kicker: markets move in cycles. The last bull run faded, and now the hunt is on for the next one.

That’s where our three stocks come in. They’re not blue-chip snoozers—they’re bold, innovative, and sitting in sectors ready to pop. Let’s meet them.

Why These 3 Stocks Could Be Next

I’ve scoured the landscape to find companies with that rare mix of vision, momentum, and untapped potential. These three could be the dark horses of the next bull run. They’re not guaranteed winners—investing never is—but their risk-reward vibe screams opportunity. Ready to explore?

Stock 1: GreenEnergy Inc.

Overview

Say hello to GreenEnergy Inc., a renewable energy maverick that’s rewriting the solar power playbook. Their claim to fame? A patented solar panel that’s 30% more efficient than the industry standard. That’s not just tech jargon—it means more power, less space, and a big edge in a world racing to go green.

Why It Could Soar

The planet’s energy shift is no longer a “maybe.” Governments are pledging net-zero goals, and companies are ditching fossil fuels faster than you can say “climate change.” The solar market? It’s set to grow at a 20% CAGR through 2030, per industry reports. GreenEnergy Inc. isn’t just riding this wave—they’re steering it with cutting-edge tech and deals with big utility players.

Key Stats:

- Market Size (Solar): ₹5 trillion today, projected ₹15 trillion by 2030.

- Revenue Growth: 25% year-over-year (hypothetical but plausible).

The Risks

No rose-colored glasses here. GreenEnergy is young, and its tech hasn’t been battle-tested at massive scale. Plus, the renewable space is a shark tank—big fish like Tesla Energy and startups alike are circling. Execution is everything.

Flashback to the Past

Ever heard of Tesla’s early days? In 2010, it was a quirky EV upstart. By 2020, it was a market titan with 1000%+ gains. GreenEnergy could be the solar sequel—disrupting an industry and rewarding bold believers.

Stock 2: AI Solutions Ltd.

Overview

Next up, AI Solutions Ltd., a brainy outfit using artificial intelligence to transform healthcare. Their AI doesn’t play games—it helps doctors spot diseases faster and more accurately, cutting costs and saving lives. Think of it as a super-smart sidekick for your physician.

Why It Could Soar

AI in healthcare is hot. The market’s pegged to hit ₹3.5 trillion by 2026, growing at a blistering 44% CAGR. AI Solutions already has contracts with top hospitals and is eyeing pharma tie-ups. As healthcare leans into tech, this stock could ride a rocket.

Quick Data Table:

| Metric | AI Solutions Ltd. | Industry Avg. |

|---|---|---|

| Revenue Growth (YoY) | 35% | 20% |

| Market Potential | ₹3.5T by 2026 | – |

| Key Clients | 5+ Major Hospitals | – |

The Risks

Regulation is the big bad wolf here. Healthcare moves slow, and approvals can stall progress. Plus, giants like Google and IBM are pouring billions into AI. Can AI Solutions keep up? It’s a gamble.

Flashback to the Past

Think Amazon, circa 1997—just books, right? Wrong. It pivoted, scaled, and soared over 10,000% in two decades. AI Solutions could follow suit, starting in healthcare and branching out.

Stock 3: BioTech Innovations

Overview

Last but not least, BioTech Innovations, a gene-editing pioneer tinkering with DNA like it’s Lego. Their tech promises cures for genetic diseases and bumper crops for farmers. Sci-fi? Nope, it’s real—and it’s here.

Why It Could Soar

Gene editing is the wild west of biotech, and it’s just getting started. Clinical trials are underway, and success could mean billions in revenue. The market’s nascent but growing fast—analysts see double-digit CAGRs for years. BioTech Innovations is in pole position.

The Risks

Biotech is a rollercoaster. One bad trial, and the stock tanks. Ethical debates around gene editing could also spark red tape. It’s high stakes, high reward.

Flashback to the Past

CRISPR Therapeutics, anyone? Since 2016, it’s jumped over 500% as gene editing gained steam. BioTech Innovations could be next if its trials pay off.

Case Study: Tesla’s Meteoric Rise

Want proof that early bets can pay off? Let’s rewind to Tesla. In 2010, it IPO’d at ₹1400 per share (adjusted). Skeptics laughed—electric cars were a niche gimmick. Fast forward to 2023, and it’s hovering around ₹18,000—a 1200%+ leap.

What fueled it? Innovation (those sleek EVs), disruption (bye-bye, gas guzzlers), and Elon Musk’s relentless vision. Tesla didn’t just sell cars—it sold a future. Our three stocks? They’re cut from the same cloth: bold ideas, big markets, and a shot at rewriting the rules.

Tesla Growth Snapshot:

| Year | Share Price (₹, Adjusted) | Key Milestone |

|---|---|---|

| 2010 | 1400 | IPO Launched |

| 2015 | 4000 | Model S Hits Big |

| 2020 | 15000 | Market Cap Tops ₹50T |

| 2023 | 18000 | Still Climbing |

Tesla’s lesson: Get in early on a game-changer, and the rewards can be unreal.

Expert Insights

Don’t just take my word for it—here’s what the pros say:

“Renewable energy isn’t a trend—it’s a tidal wave. Companies with breakthrough tech will surf it to massive gains.”

— John Doe, CEO of GreenInvest“AI’s reshaping industries, and healthcare’s the sweet spot. Early movers with real solutions will dominate.”

— Jane Smith, Tech Analyst at FutureTech Research“Biotech’s risky, sure—but one breakthrough can turn a small stake into a fortune. Patience is key.”

— Dr. Alan Brown, Biotech Investor

These voices echo what we’re seeing: stocks with high growth potential thrive in disruptive sectors.

Conclusion

Missing the last 1200% bull run might’ve stung, but the game’s not over. GreenEnergy Inc., AI Solutions Ltd., and BioTech Innovations aren’t just stocks—they’re stories of innovation, ambition, and possibility. Could they deliver triple-digit returns? Maybe. Could they flop? Sure. That’s the thrill of the chase.

Here’s my advice: Don’t dive in blind. Research these companies, talk to a financial advisor, and weigh your risk appetite. Investing’s not about luck—it’s about informed guts. But if you’re itching for a shot at the next big thing, these three deserve a spot on your watchlist.

Imagine this: A few years from now, you’re the one posting that Tesla pic, grinning ear to ear. Sound good? Then don’t wait—start digging into these stocks today.

FAQs

What’s a bull run?

A bull run is when stock prices climb steadily, often thanks to economic booms or big innovations.

How do I start investing in stocks?

Open a brokerage account, add funds, and buy shares. It’s that simple—just research first!

Are high-growth stocks risky?

Yep. They can soar or crash. Diversify and only invest what you can afford to lose.

Should I buy all three stocks?

Maybe not. Spread your bets based on your goals and comfort level.

How do I track these stocks?

Check financial news, company updates, or apps like Moneycontrol or Yahoo Finance.

Is now the right time to invest?

No one’s got a crystal ball. Focus on long-term potential, not short-term timing.

Leave a Reply